Rolling Stock Market Share, Size, Trends, Industry Analysis Report

By Product (Locomotive, Rapid Transit Vehicle, Wagon); By Type; By Train Type; By Region; Segment Forecast, 2024-2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM3379

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

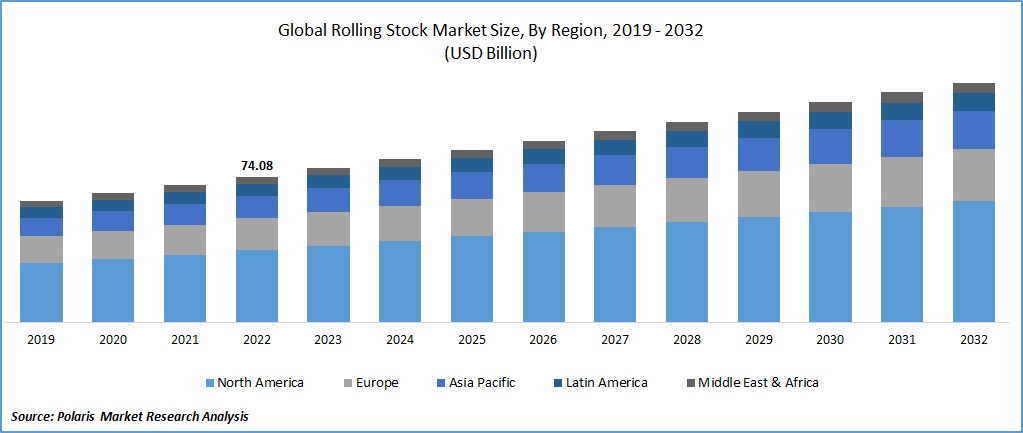

The global rolling stock market size and share was valued at USD 78.52 billion in 2023 and is expected to grow at a CAGR of 4.9% during the forecast period. The growing demand for electric trains is responsible for market expansion. As more countries and cities electrify their rail networks, the demand for electric trains is increasing. The shift to electric trains is driven by environmental concerns, energy security, and the need for more efficient and cost-effective transportation solutions. For Instance, in March 2023, to facilitate the production of 13 electric trains for Czech Railways, Skoda Group stated that it would invest 20.87 million USD in its Sumperk facility. 13 EMU 240 units are now being produced at the Sumperk plant for the Olomouc Region. The newest RegioPanter model from Skoda is the EMU 240. The chassis will be made in Pilsen, while painted and welded cabinets for the new cars will be provided from Skoda's facility in Ostrava.

Rolling stock is a building block of the modern rail transportation system. It refers to engines and carriages that are used on a railway. Rolling stock covers several different types of vehicles used to operate services or for track maintenance. They include both powered and unpowered vehicles, such as freights, locomotives, and passenger cars. This area of discipline can further be categorized into the physical structure of rolling stock, the safety aspects of rolling stock, and power and control issues.

A rolling stock encompasses several components, which include the car body, car body fittings, guidance, power system, propulsion and auxiliary systems, braking systems, communication systems, HVAC, and lighting, amongst others. Rolling stocks come in several types, including diesel, electric, and hybrid models. Each of these locomotive models is designed to meet specific requirements. The growth of intercity and high-speed rail networks drives the need for rolling stock, impacting the rolling stock market growth favorably.

To Understand More About this Research: Request a Free Sample Report

Railway transit can be an inexpensive and environmentally beneficial option to the growing environmental challenges brought on by air and vehicle travel and increasing metropolitan traffic. The growing urban population in developing and developed countries is driving the demand for efficient and reliable rapid transit systems to ease traffic congestion and improve connectivity.

The rolling stock market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Industry Dynamics

Growth Driver

The government regulations and policies are supporting the growth of the Rolling Stock Market. For example, regulations that require the use of more environmentally friendly rolling stock or policies that support domestic production of rolling stock drive the demand for the market. With increasing awareness of the environmental impact of transportation, there is a growing demand for sustainable transportation options. Electric trains and other clean energy solutions are becoming more popular, which is positively influencing the market.

The growth of intercity and high-speed rail networks has created a need for faster and more efficient trains. Electric trains are better suited for high-speed travel as they are more energy-efficient and have faster acceleration than diesel trains. Electric trains can be more cost-effective than diesel trains over the long term as they have lower maintenance costs and require less fuel. This cost savings is attractive to railway operators and governments that want to reduce their transportation budgets which is driving market growth. For instance, in March 2023, the Railway Board was awarded with a USD 3.2 billion project for the delivery and upkeep of electric locomotives for freight transportation in India, which will be carried out by the railways and the worldwide engineering and technology company Siemens.

Report Segmentation

The market is primarily segmented based on product, type, train type, and region.

|

By Product |

By Type |

By Train Type |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Rapid Transit Vehicle Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Rapid transit vehicle segment is anticipated to grow at the highest CAGR during the upcoming period. The rapid transit vehicle industry is witnessing significant technological advancements, such as the development of lightweight materials, advanced propulsion systems, and automated train control systems in addition to factors such as passengers seeking comfortable and safe travel experiences which is responsible for market growth. Rapid transit vehicles that offer improved ride quality, safety, and accessibility are likely to gain more traction in the market.

The growing urban population in developing and developed countries is driving the demand for efficient and reliable rapid transit systems to ease traffic congestion and improve connectivity. By making it simpler and less expensive for large numbers of workers and customers to arrive and depart, high-quality mass transit that serves dense employment and retail districts can contribute to the economic prosperity of those places. These factors are responsible for the market growth during the forecast period.

Diesel Train Segment Dominated the Market in 2022

Diesel Train segment dominated the market in 2022. Diesel engines are not only more dependable, but they can also move more weight while using less fuel. Diesel trains are often seen as a cost-effective option for railway operators, particularly in areas where electrification is not yet feasible or cost-prohibitive. Diesel fuel is widely available and has a lower upfront cost compared to electric trains. Thus, the economic efficiency of diesel trains is driving the market expansion.

Electric train segment is anticipated to grow at the fastest CAGR during the forecast period. The falling battery prices, rising energy densities, and easy availability to reasonably priced renewable electricity are factors contributing to the market growth. The shift to electric trains is driven by environmental concerns, energy security, and the need for more efficient and cost-effective transportation solutions. In February 2023, the first battery-electric train will go to the USA, according to Swiss train manufacturer Stadler. ASPIRE Engineering Research Center and Utah State University (USU) have signed a development agreement according to the company. The Flirt Akku train model will be used as the basis for the tests.

Asia Pacific Region is Expected to Exhibit the Highest CAGR During the Forecast Period

Asia Pacific is anticipated to grow at the highest CAGR during the forecast period which can be attributed to increasing spending on metro and electric train systems in nations with economies like China, India, Taiwan, and others. Asia Pacific is home to some of the fastest-growing economies in the world. The region's population is expected to continue growing rapidly, driving the demand for transportation infrastructure, including railways and rolling stock. The region is also seeing rapid technological advancements in rolling stock, such as high-speed trains and electric trains, which are augmenting the market demand.

In March 2023, Rolling Stocks (Metro Trains) for Pune Metro Project-3 have officially begun to be produced by Alstom Transport India Limited at its Andhra Pradesh plant at Sri City. India would launch its first metro project in accordance with the new Metro Rail Policy with a 23.3-kilometer route and 23 stops. 66 Metropolis trains with three carriages will be constructed by Alstom for this project.

MEA region is expected to grow at a significant rate during the forecast period. The demand for rolling stock is being fueled by the government's investments in the modernization and extension of the rail network in this region. Additionally, the economy of the area is expanding, and with it, so is the need for commodities to be transported by train. The need for rolling stock to move commodities to various destinations is being driven by the expansion of businesses including manufacturing, construction, and retail.

Competitive Insight

Some of the major players in the global market include CRRC Corporation, Trinity Rail, GE Transportation, Siemens Mobility, Alstom, Wabtec Corporation, Kawasaki Heavy, Greenbrier, Hyundai Rotem, Stadler Rail & Hitachi Rail System.

Recent Developments

- In March 2023, the leading Russian manufacturer of rolling stock, CISC Transmashholding (TMH), was granted a 12-year maintenance contract by the Egyptian Ministry of Transportation, valued at 430 million euros. According to the contract, TMH will offer technical assistance for shipping automobiles for a period of 12 years. In the suburbs of Cairo, TMH will also construct a specialized rail depot, outfit it, educate local laborers, maintain the rolling stock, and provide replacement parts.

- In February 2023, the Solapur Division of the Indian Central Railway completely electrified all 976 Km of its train lines. Solapur Division will reduce the Kurduwadi-Latur section's carbon impact by 8,268 tonnes per year by saving 3,116 Kl of fuel, which is approximately INR 35.50 crore yearly.

Rolling Stock Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 83.08 billion |

|

Revenue Forecast in 2032 |

USD 121.80 billion |

|

CAGR |

4.9% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024- 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Type, By Train Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

CRRC Corporation Limited, Trinity Rail, GE Transportation, Siemens Mobility, Alstom SA, Wabtec Corporation, Kawasaki Heavy Industries Ltd., The Greenbrier Co., Hyundai Rotem, Stadler Rail AG and Hitachi Rail System |

We provide our clients the option to personalize the rolling stock market report to suit their needs. By customizing the report, you can get data as per your format and definition. Also, the customization option allows you to gain a deeper dive into a specific segment, region, customer, or market competitor. Report Customization

FAQ's

The Rolling Stock Market report covering key segments are product, type, train type, and region.

Rolling Stock Market Size Worth $ 121.80 Billion By 2032.

The global Rolling Stock Market expected to grow at a CAGR of 5.0% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in Rolling Stock Market are Increase in allocation of budget for development of railways.