Medical Device Outsourcing Market Share, Size, Trends, Industry Analysis Report

By Application (Cardiology, Diagnostic Imaging, Orthopedic, IVD, Ophthalmic, General and Plastic Surgery, Drug Delivery, Dental, Endoscopy, Diabetes Care, Others); By Service; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 119

- Format: PDF

- Report ID: PM1387

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

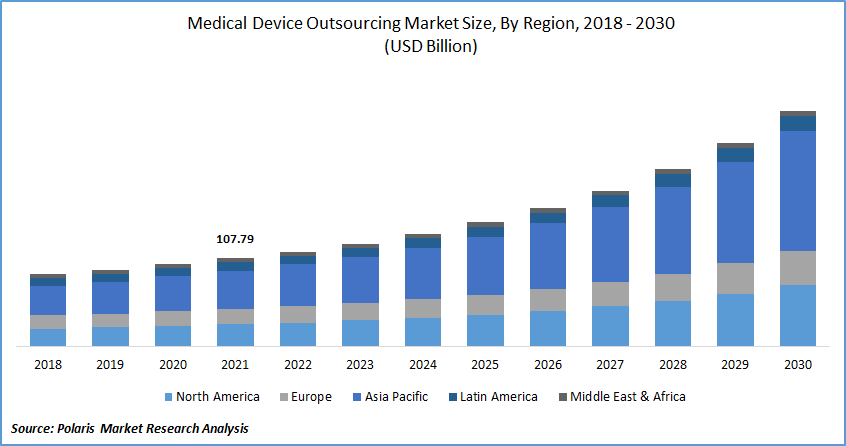

The global medical device outsourcing market was valued at USD 107.79 billion in 2021 and is expected to grow at a CAGR of 12.0% during the forecast period. Medical equipment outsourcing is becoming increasingly popular among original equipment suppliers. Market growth is being driven by additional pressure on producers to minimize operational costs while sustaining the quality of their healthcare services.

Know more about this report: Request for sample pages

Medical equipment firms can use sourcing to handle routine manufacturing and gain from cost savings, a streamlined supply chain, and logistical synchronization. These features all assist them in bringing competitive items to market while making sure all requirements for the sector are met. Furthermore, benefits such as decreased production period, which guarantees early product introduction into the market, as well as the have enough to meet regulatory standards, drive industry growth.

The demand for the medical device outsourcing market is also being driven by a few general healthcare trends. In several regions of the world, the rising demand for medical equipment in minimally invasive treatments for chronic diseases is creating attractive prospects for outsourcing businesses.

Additionally, there is a sizable need for high-quality healthcare services in emerging countries, which has benefited the growth of the medical device outsourcing market. Medical devices outsourcing companies help medical devices get speedy approval and a timely launch, which has some positive effects, including market saturation in emerging nations. This characteristic is anticipated to accelerate the industry for medical equipment outsourcing.

Medical device outsourcing market participants now have new opportunities owing to the rise of robotics among medical technology producers. The production of medical equipment is increasingly using specialized robotic arms, which is another factor driving the industry growth. To have their products licensed for sale on the international market, medical device makers frequently work with a range of regulatory compliance outsourcing companies.

The medical device outsourcing market will expand as OEMs of ophthalmology, cardiovascular, oncology, and dentistry equipment, as well as among suppliers of medical equipment design engineering, testing, and simulation tools, become more accepting of outsourcing.

Medical hardware makers are resorting to outsourced network operators to reduce costs as a result of large reductions in public investment in the US and other important EU countries. As businesses strive to acquire an advantage over rivals, the length of time it takes for products to become commercially viable will continue to decrease, which will fuel long-term growth.

The COVID-19 pandemic has impacted healthcare industry workflows. Numerous companies, including parts of the healthcare industry, have been forced to immediately close their doors due to the disease. The interest in product sterilization services has increased as a result, nevertheless.

Due to a sharp rise of COVID-19 cases worldwide, countries were forced to close their production facilities and create quarantine zones to control the spread, which had a detrimental effect on the businesses that make medical devices. The worldwide supply chain has never before experienced a disturbance like the COVID-19 epidemic, and with disruption comes heightened risk. More than ever before, businesses have reduced and simplified their processes, which may affect quality assurance. As a result, the market for outsourcing medical equipment sales suffers.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

It is anticipated that the prevalence of chronic diseases will fuel the expansion of the industry for medical equipment outsourcing. Chronic diseases are ailments that last for a year or longer and necessitate continuing medical care, restricting daily activities, or both. The industry for outsourced medical devices is expanding as a result of the rise in chronic diseases, which increases the need for new, high-quality medical goods with shorter launch times.

For instance, the worldwide burden of chronic diseases is predicted to reach roughly 56% by 2030, according to the UN Chronicles, a digital magazine published by the United Nations. As a result, the industry for medical equipment outsourcing will expand due to the rise of chronic disorders.

The main factor causing items to be produced at lower and more reasonable prices is increasing competition between medical equipment makers. This element is having a beneficial effect on the expansion of the medical device outsourcing market. The purpose of expressing and preference for outsourcing services, including quality control, installment, and regulatory consultancy, as well as ongoing regulatory landscape change, is anticipated to boost the industry during the projected period.

Report Segmentation

The market is primarily segmented based on application, services, and region.

|

By Application |

By Services |

By Region |

|

|

|

Know more about this report: Request for sample pages

Contract Manufacturing Segment is Expected to Witness the Fastest Growth

The increased emphasis on lowering production costs is boosting the growth of this segment. Furthermore, rising manufacturing complexity is fueling market expansion. Medical device manufacturers prioritize the development of high-quality safety gadgets for patient care. Furthermore, the high level of inspection used in the development of medical devices has resulted in multiple layers of regulations and standards. As a result, demand for manufacturing services is increasing.

The quality assurance services segment is expected to have a sizable revenue share. The maintenance of an efficient quality control system is an essential part of the manufacturing of any medical device. ISO 13485 is, however, one quality management system that includes the development, application, and preservation of products that are used by medical device suppliers and producers.

To enforce consistency as well as provide high-quality elements alongside safe and efficient finished medical devices, device manufacturers have been outsourcing quality management solutions to medical equipment consulting firms.

General & Plastic Surgery Sector is Expected to Hold the Significant Revenue Share

The expansion of this market is anticipated to be aided by both the availability of reputable outsourcing companies that abide by legal and regulatory regulations, as well as the expanding popularity of cosmetic procedures. Global demand for cosmetic surgery has surged as a result of the enormous increase in knowledge and consciousness about physical looks in recent times.

The need for this surgical equipment is increased by the need for specific molding and machining procedures for items like fixation devices, extremities splints, and depilatory creams. The number of surgeries performed each year has increased as a result of the development of minimally invasive and noninvasive procedures. This necessitates the use of novel, method-specific gadgets.

The Demand in North America is Expected to Witness Significant Growth

North American market is growing as a result of the enormously rising demand for health-related services and the rising capital expenditure on healthcare. Because product lifespans are brief, medical device makers rely heavily on innovation and cutting-edge techniques to expand in the very popular sector.

Among the developments in the market are medical device outsourced R&D, portable medical equipment, patient-centric approaches, robotic check-ups, and robotic surgery. These innovations frequently result in increased performance, increase in production, improved quality, and reduced WIP (work in progress), as well as decreased production dangers and accelerated product market access.

Medical device manufacturers can use supply chain management partners to complete recurring industrial production and gain from cost savings, a streamlined supply chain, logistics activities alignment, and many other advantages that guarantee that all industry requirements are met while enabling them to release commercial products into the marketplace.

Additionally, there is a lot of market potential for pharmaceuticals in Asian countries such as China, Japan, and India. Asia Pacific region is growing owing to the rising demand for healthcare devices as a result of an aging patient group experiencing chronic and infectious illnesses is fueling this region's market expansion. Prominent firms with a Korean base, like Nissha Co., Ltd., place a strong emphasis on flexibility and customer-centered service. These aforementioned elements are projected to accelerate the industry's expansion for medical device production outsourcing.

Competitive Insight

Some of the major players operating in the global market include American Preclinical Services., Benchmark Electronic Inc., Celestica Inc., Charles River Laboratories International, Inc., Cadence Inc., Eurofins Scientific, IQVIA, Accellent Inc., Intertek Group PLC, North American Science Associates, Inc., Pace Analytical Services LLC., Providien LLC, and Thermo Fischer Scientific Inc.

Recent Developments

- In August 2021, to treat patients with aortic dissection arches (TAA) and penetrate atherosclerosis ulcers, Terumo Aortic acquired FDA approval for the Relay Pro Thoracic Transcatheter System.

- In December 2021, the MODULAR ATP clinical trial was started by Boston Scientific Corporation to assess the reliability, efficiency, and efficacy of the mCRM modular treatment system.

- In December 2021 Labcorp purchased Toxikon Inc. to broaden its product line and add testing facilities for the biopharmaceutical, medical product, and other sectors. Additionally, since the start of COVID-19, gamers have worked hard to support the industry throughout the epidemic.

Medical Device Outsourcing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 107.79 billion |

|

Revenue forecast in 2030 |

USD 287.03 billion |

|

CAGR |

12.0% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Application, By Service, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

American Preclinical Services., Benchmark Electronic Inc., Celestica Inc., Charles River Laboratories International, Inc., Cadence Inc., Eurofins Scientific, IQVIA, Accellent Inc., Intertek Group PLC, North American Science Associates, Inc., Pace Analytical Services LLC., Providien LLC, and Thermo Fischer Scientific Inc. |