Ammunition Market Share, Size, Trends, Industry Analysis Report

By Product (Bullets, Aerial Bombs, Grenades); By Component; By Caliber; By Guidance Mechanism; By Application; By Lethality; By Region; Segment Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 149

- Format: PDF

- Report ID: PM1201

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

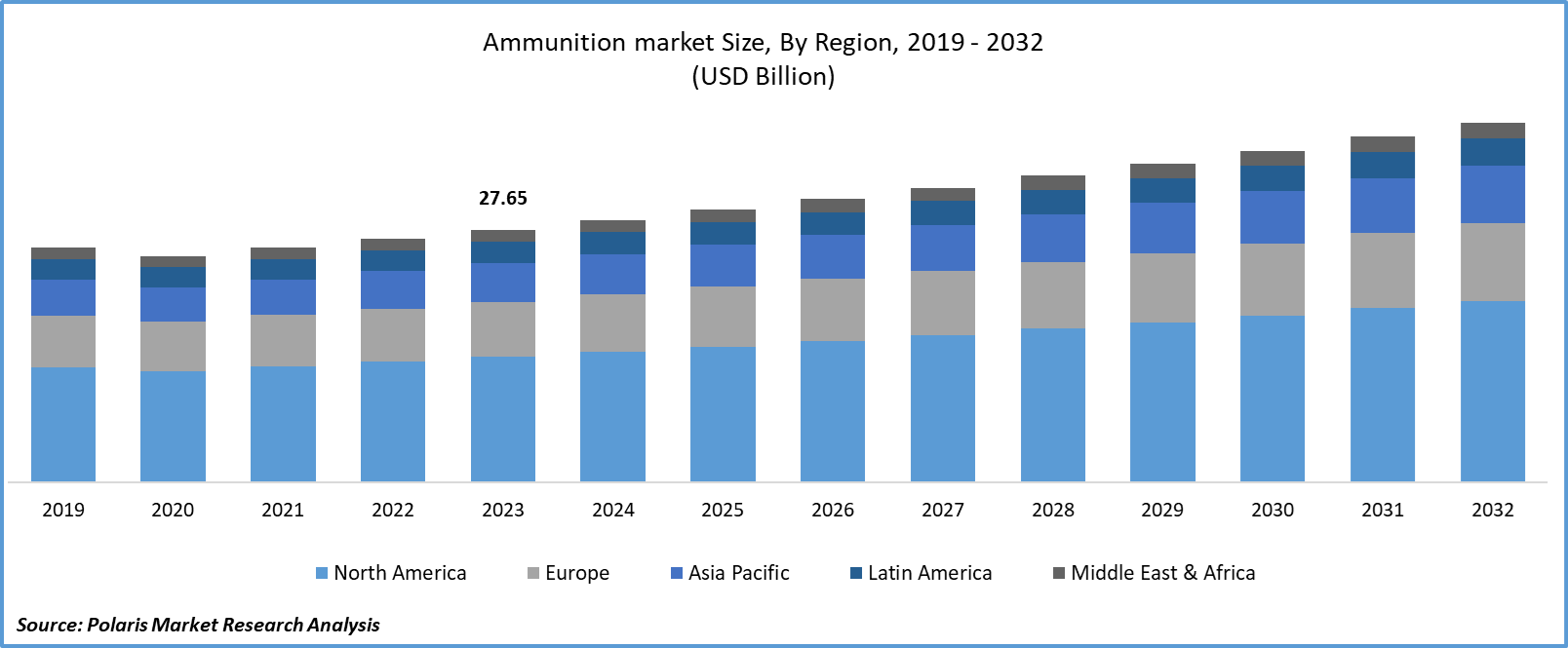

The global ammunition market was valued at USD 22 billion in 2024 and is expected to grow at a CAGR of 3.50% from 2025 to 2034. The market growth is driven by rising defense spending and increasing demand for firearms across military and law enforcement sectors. Increasing participation in shooting sports and self-defense training drives demand for ammunition in the civilian segment.

Key Insights

- The bullets segment is projected to register the highest CAGR during the forecast period. It is driven by the rising global threats and the increasing introduction of new defense tools.

- In 2024, the projectiles and warheads segment held the largest revenue share. The growing conflicts in space are stimulating the demand for effective projectiles and warheads by countries.

- The small-caliber ammunition segment held a significant share in 2024. The dominance is attributed to its superior performance and accuracy.

- Asia Pacific held the largest revenue share in 2024. This is due to the increasing defense expenditures among the nations with growing border conflicts in the region, specifically India and China.

- The European market will grow rapidly in the coming years. The growth is fueled by the growing government initiatives to enhance defense equipment production and drive technological advancements.

Industry Dynamics

- Rising bilateral agreements between countries to stimulate defense equipment manufacturing drive the demand for ammunition.

- Military modernization initiatives, aimed at upgrading weaponry and enhancing combat capabilities, fuel the demand for advanced systems.

- High costs of advanced ammunition systems hinder the growth of the market.

- Growing demand for ammunition systems is expected to boost the industry growth in the coming years.

Market Statistics

2024 Market Size: USD 22 billion

2034 Projected Market Size: USD 31 billion

CAGR (2025–2034): 3.50%

Asia Pacific: Largest market in 2024

AI Impact on Ammunition Market

- Artificial intelligence technology helps enhance targeting accuracy in jammed or GPS-denied environments.

- Real-time sensor data analysis facilitates autonomous decision-making during flight.

- AI systems monitor equipment health for predictive maintenance, which minimizes downtime.

- The technology improves demand prediction and logistics routing.

- AI models simulate environmental conditions to optimize performance and projectile trajectory.

To Understand More About this Research:Request a Free Sample Report

The growing global conflicts, specifically among neighboring countries, are boosting the need for effective defense tools, such as bullets, grenades, and mortars. The increasing support from government and non-government organizations to assist countries in equipping effective defense tools is showcasing enormous growth potential for the ammunition market. For instance, in January 2024, the North Atlantic Treaty Organization Support and Procurement Agency (NATO SPA) settled to acquire 55-mm artillery shells worth 220,000, valued at USD 1.2 billion.

Furthermore, rising investments in ammunition manufacturing along with rising concerns about nation safety are anticipated to bolster the industry expansion over the forecast period.

For instance, in April 2024, Winchester received the contract to construct a manufacturing facility for Next Generation Squad Weapon – Ammunition (NGSW-A) in the United States at Lake City Army Ammunition Plant (LCAAP).

Moreover, growing bilateral agreements to boost support from the countries aiming to build advanced ammunition for their nations is likely to facilitate new growth opportunities in the coming years. Government expenditure on defense and military modernization programs is a primary driver of the industry. As countries invest in enhancing their defense capabilities to address evolving security threats, there is a continuous demand for ammunition to equip armed forces with the necessary firepower.

Military modernization initiatives, aimed at upgrading weaponry, enhancing combat capabilities, and improving operational effectiveness, fuel the demand for advanced systems. This includes investments in precision-guided munitions, smart ammunition, and next-generation small caliber ammunition. Apart from military and law enforcement agencies, there is a significant civilian market, including recreational shooters, hunters, sports enthusiasts, and firearms collectors. Factors such as growing participation in shooting sports, hunting activities, and self-defense training drive demand for ammunition in the civilian market.

Growth Drivers

Rising Bilateral Agreements to Stimulate Defense Equipment Manufacturing

Bilateral agreements between countries often involve collaboration in defense and security matters, such as joint military exercises, intelligence sharing, and defense procurement. Such agreements facilitate closer ties between nations and create opportunities for defense equipment manufacturers to supply ammunition and other military hardware.

Many countries seek to strengthen their indigenous defense manufacturing capabilities as part of national security strategies. Bilateral agreements may include provisions for technology transfer, co-production, or joint development of defense equipment, including ammunition. This encourages investment in domestic defense industries and fosters innovation and self-reliance.

Bilateral agreements can open up new markets for defense equipment manufacturers by providing access to foreign defense industry. Export opportunities arise from agreements with partner countries seeking to modernize their armed forces, replace outdated equipment, or enhance their defense capabilities. This expands the customer base for manufacturers and supports revenue growth.

Growing Demand for Ammunition Systems

The significant uptick in ammunition system demand is significantly driving the production of these systems in the global marketplace. For instance, in October 2023, Northrop Grumman Corporation announced its plan to develop a guided-ammunition system, high explosive 57mm ammunition, for the United States Navy.

The rising initiatives by governments to promote their defense manufacturing capacity are positively affecting global market growth over the study period. For instance, in March 2024, the US army partnered with the Canadian Commercial Corporation to fuel production capacity in Canada.

Restraining Factors

Huge Cost of Advanced Ammunition Systems

The higher investment in ammunition is expected to limit its adoption in the global marketplace. The huge costs of developing these systems are anticipated to lower the demand for the systems in the coming years.

Report Segmentation

The market is primarily segmented based on product, component, caliber, guidance mechanism, application, lethality, and region.

|

By Product |

By Component |

By Caliber |

By Guidance Mechanism |

By Application |

By Lethality |

By Region |

|

|

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Analysis

The bullets segment is projected to grow at the highest CAGR during the forecast period, mainly driven by the rising prevalence of global threats. The increasing number of new defense tools is encouraging nations to acquire advanced technologies earlier to promote their army performance. For instance, in February 2024, the Indian government unveiled a missile barge, ammunition, and torpedo.

By Component Analysis

In 2024, the projectiles and warheads segment held the largest revenue share. The growing conflicts in space are stimulating the demand for effective projectiles and warheads by the countries. As more countries witness the prevalence of air-based wars, there will be a huge demand for warheads and projectiles in the years to come.

By Caliber Analysis

The small-caliber ammunition segment held a significant market share in revenue in 2024, which was positively accelerated due to its superior performance and accuracy. Rising terrorism activities among nations are creating a significant need for small-caliber , driven by its potential to travel faster than medium-caliber ammunition. Additionally, people use small-caliber for hunting, shooting, and enhancing personal safety, driving higher adoption worldwide.

Regional Insights

The Asia Pacific region held the largest market share in 2024. This is due to the increasing defense expenditures among the nations with growing border conflicts in the region, specifically India and China. The Indian Ministry of Defence increased the allocation of the defense budget by one lakh crore, accounting for an 18.5% rise in 2023-24 from 2022-23. The rising investments in defense showcase government efforts to promote the nation's security. This trend is likely to facilitate new growth opportunities for the ammunition market.

The European region will grow rapidly, owing to the growing government initiatives to enhance defense equipment production and drive technological advancements. For instance, in March 2024, the European Commission announced the allotment of EUR 500 million in the future to support the Ammunition Production Act. This is expected to enable the region to produce 2 million shells annually by the end of 2025.

Key Market Players & Competitive Insights

Strategic partnerships to drive the competition

The market needs to be more cohesive. The growing investments in designing new defense equipment are positively impacting the global market. The ongoing expansion initiatives, including partnerships, acquisitions, and collaborations, are fueling competition in the marketplace. For instance, in November 2023, Belgium and FN Herstal entered into a partnership agreement to boost its defense sector by fueling ammunition supply and small arms.

Some of the major players operating in the global market include:

- BAE Systems

- CBC Global Ammunition

- Elbit Systems

- General Dynamics Corporation

- Nammo AS

- Nexter KNDS group

- Northrop Grumman Corporation

- Olin Corporation

- Rheinmetall AG

- Ruag Ammotec

- ST Engineering

- Thales Group

Recent Developments in the Industry

- In January 2025, a European consortium led by FN Herstal launched the SAAT project, uniting partners from nine countries to standardize small arms ammunition and strengthen Europe’s defence interoperability, innovation, and strategic autonomy.

- In June 2023, NIOA, a defence contracting company, announced its plan to expand its partnership to supply 155mm ammunition to the Australian army.

Report Coverage

The ammunition market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, component, caliber, guidance mechanism, application, lethality, and their futuristic growth opportunities.

Ammunition Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 22.77 billion |

|

Revenue forecast in 2034 |

USD 31 billion |

|

CAGR |

3.50% from 2024 – 2032 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Ammunition Market report covering key segments are product, component, caliber, guidance mechanism, application, lethality, and region.

Ammunition Market Size Worth USD 31 Billion By 2034

Ammunition Market exhibiting the CAGR of 3.50% during the forecast period.

Asia Pacific is leading the global market.

The key driving factors in Ammunition Market are rising bilateral agreements to stimulate defense equipment manufacturing