Antibody Fragments Market Share, Size, Trends, Industry Analysis Report

By Specificity (Monoclonal, Polyclonal); By Type (FAB, scFv); By Therapy; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 114

- Format: PDF

- Report ID: PM2578

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

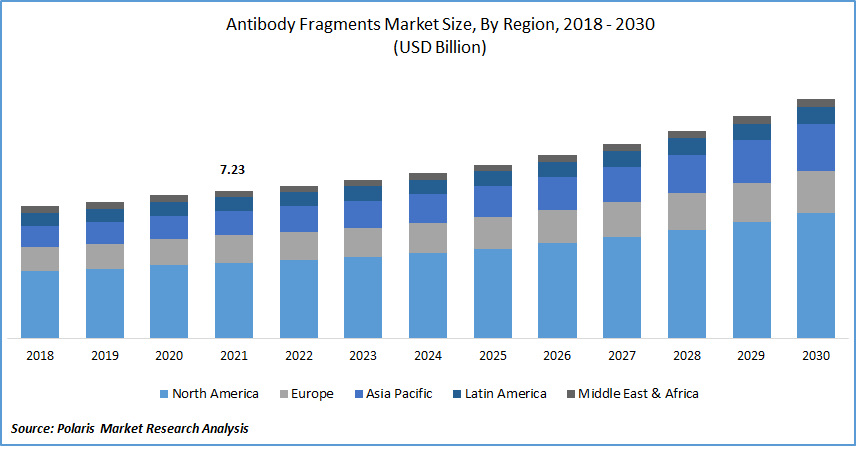

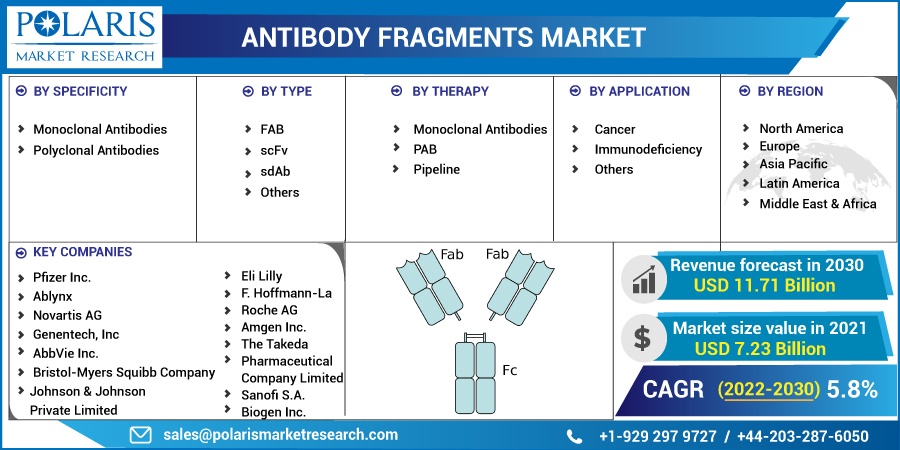

The global antibody fragments market was valued at USD 7.23 billion in 2021 and is expected to grow at a CAGR of 5.8% during the forecast period. The growing demand for the antibody fragments market is expected to be driven by the increasing diseases across the globe and targeting the disorders with the help of antibody fragments as they cost less and are accurate.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

With the recent advancements in R&D, it will soon replace the full-length antibody. The key driver for the growth of the antibody fragment is increasing with the increase in diseases such as cancer. Many diseases face difficulties while treatment, as full-length antibodies cannot be attached at the targeted point because of their larger size. But now, with the smaller antibody size, it is possible. These fragments are easy to target and have low manufacturing costs and high yield production.

The antibody fragments market was positively impacted during the COVID-19 pandemic and is expected to grow post-COVID-19. The antibody fragments were also used for the treatment of COVID-19. With the increasing cases of COVID-19, the research for developing the antibody against it has also increased. In a recent study, antibody fragments were used for the treatment of COVID-19 with the proper development and targeted antigen.

As the geriatric population is increasing with an increasing prevalence of immunodeficiency, the growth of the industry post-pandemic will grow steadily in countries such as North America, Japan, and India, among others. In addition, growing research centers in the Asia Pacific are likely to expand over the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The global pharmaceutical industry is expected to grow with the increasing prevalence of immunodeficiency and the treatment of such diseases. These fragments being smaller in size target, are designed to be more specific, stable, and potent than the traditional full-length antibody.

The increasing number of cancer cases can be crucial as it cannot penetrate tumors with full-length antibodies. So, these fragments can be used as they are minor in size and easily penetrated and cured. These fragments contain specific sequences for the target site and can be designed without the fragment crystallizable region.

Report Segmentation

The market is primarily segmented based on specificity, type, therapy, application, and region.

|

By Specificity |

By Type |

By Therapy |

By Application |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Monoclonal Antibodies segment accounted for the largest share in 2021

The monoclonal antibodies segment accounted for the highest revenue share in 2021, owing to the low cost with high accuracy. The application of monoclonal antibodies is used for cancer therapy and has gained recognition across the globe. In addition, monoclonal antibodies are homogenous over the batch produced, thus providing the same results. Monoclonal antibodies were also used in the COVID-19 disease cure because of their homogeneous nature.

On the contrary polyclonal antibodies are much more flexible, superior, and have high specificity over monoclonal antibodies. The polyclonal antibody has a low manufacturing cost and takes less time. But, being heterogeneous in nature, it shows different results every time; thus, researchers face more difficulties studying it. Because of such reasons, the growth of the antibody fragments market gets hindered.

FAB type is expected to spearhead the market growth

The FAB segment accounted for the highest revenue share in 2021 in the market and is expected to grow during the forecast period. FAB fragments segments are the first-generation molecules of antibody and are applied to block the endogenous Ig's-immunoglobulins worldwide used in various types of immunodeficiency such as cancer.

The growth of FAB being first-generation can decline over time with the introduction of second and third-generation molecules of antibody. Single chain variable fragments (scFvs) are heterologous production, have low molecular weight, and are expected to grow over the forecast period. With the introduction of second & third-generation molecules of antibodies, it is expected to drive the demand for the scFvs and sdAbs segment of the market.

Monoclonal antibodies therapy is expected to witness faster growth as compared to its counterparts

The monoclonal antibodies segment generated the highest revenue in 2021 and is expected to dominate the market over the forecast period. In the pharmaceutical sector, monoclonal antibodies are also used as injections to treat various diseases. Ranibizumab & Beovu are a few types of monoclonal antibodies that are generally used in the pharmaceutical sector. Many academics and research centers are working on these antibodies, understanding the challenges and uses.

Cancer segment is expected to grow faster over forecast period

The immunodeficiency segment dominates the market with a higher revenue share owing to the increasing prevalence of diseases globally. Furthermore, the rising geriatric population contributes to the disease, thus using fragments for the treatment of those disorders. Many partnerships, collaborations, mergers, and acquisitions can be noticed in developing new therapies for patients using these fragments.

It is expected that the cancer segment will witness the fastest growth during the forecast period. The use of these fragments is used in the treatments of cancers and tumors majorly. The high prevalence of cancer spreading worldwide is one of the critical drivers contributing to the market's growth over the forecast period.

North America dominates the market and witness fastest growth over the forecast period

North America is the largest region for antibody fragments. It is expected to expand the market with a higher revenue share over the forecast period because of major regional players, advanced technology, and infrastructure. Furthermore, the increasing prevalence of immunodeficiency diseases like cancer is spreading globally.

The antibody fragments market in the Asia Pacific is expected to grow faster over the forecast period with the increasing geriatric population, medical tourism market, and research and development in emerging economies, including India and China. Also, the growing government interest and increasing regional healthcare centers contribute to the segment's growth.

Competitive Insight

Some of the major players operating in the global market include Pfizer Inc.; Ablynx; Novartis AG; Genentech, Inc.; AbbVie Inc.; Bristol-Myers Squibb Company; Johnson & Johnson Private Limited; Eli Lilly, F. Hoffmann-La Roche AG; Amgen Inc.; The Takeda Pharmaceutical Company Limited; Sanofi S.A.; Biogen Inc.

Recent Developments

In June 2022, Amgen Inc. antibody RIABNI™ (rituximab-arrx) which is used to treat moderate to severe rheumatoid arthritis in adult was approved by FDA. In August 2022 Amgen Inc. acquired ChemoCentryx, Inc. which include the Tavneos (avacopan) which is used to treat serious autoimmune diseases.

In August 2022, El Lilly Inc. announced that Taltz (ixekizumab) would be available for patients, which is made of citrate-free formulation to reduce pain. In June 2022, they also supplied 150,000 doses of bebtelovimab, which is used for COVID-19 treatment, to the U.S. government.

Polyurea Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 7.23 billion |

|

Revenue forecast in 2030 |

USD 11.71 billion |

|

CAGR |

5.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Specificity, By Type, By Therapy, By Application, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Pfizer Inc.; Ablynx; Novartis AG; Genentech, Inc.; AbbVie Inc.; Bristol-Myers Squibb Company; Johnson & Johnson Private Limited; Eli Lilly, F. Hoffmann-La Roche AG; Amgen Inc.; The Takeda Pharmaceutical Company Limited; Sanofi S.A.; Biogen Inc. |