Asphalt Pavers Market Share, Size, Trends, Industry Analysis Report

By Product Type (Tracked Pavers, Wheeled Pavers); By Screed Type; By Operating Weight; By Paving Width; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 116

- Format: PDF

- Report ID: PM1745

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

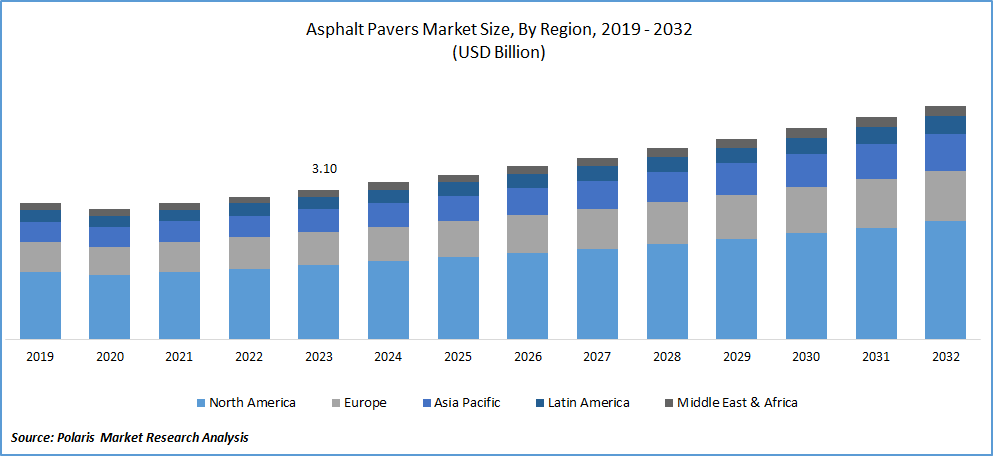

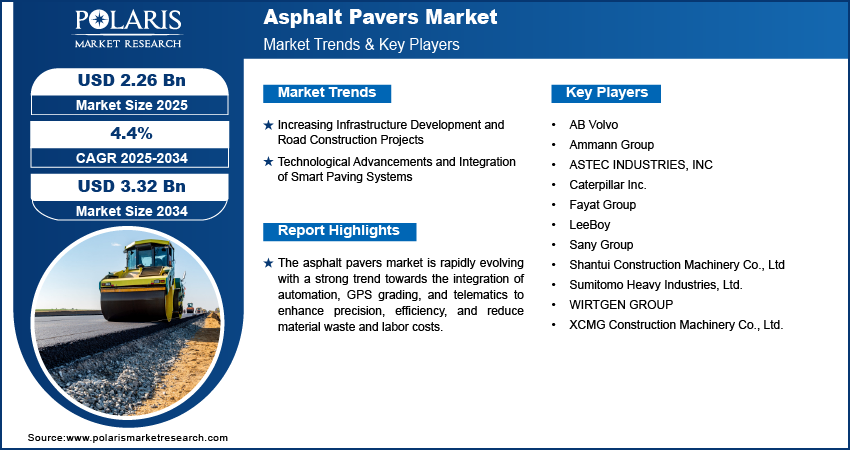

The global asphalt pavers market was valued at USD 2.4 billion in 2024 and is expected to grow at a CAGR of 3.70% from 2025 to 2034. Rising road construction and infrastructure development activities support market growth.

Key Insights

- In 2024, the tracked pavers segment accounted for the highest revenue share, driven by their enhanced traction and stability, making them ideal for large-scale highway and airport projects across uneven and soft terrains.

- The 2.5–5 meter paving width segment is expected to witness the highest growth during the forecast period, as it caters to increasing demand for compact, versatile pavers suited for urban roadwork and municipal infrastructure.

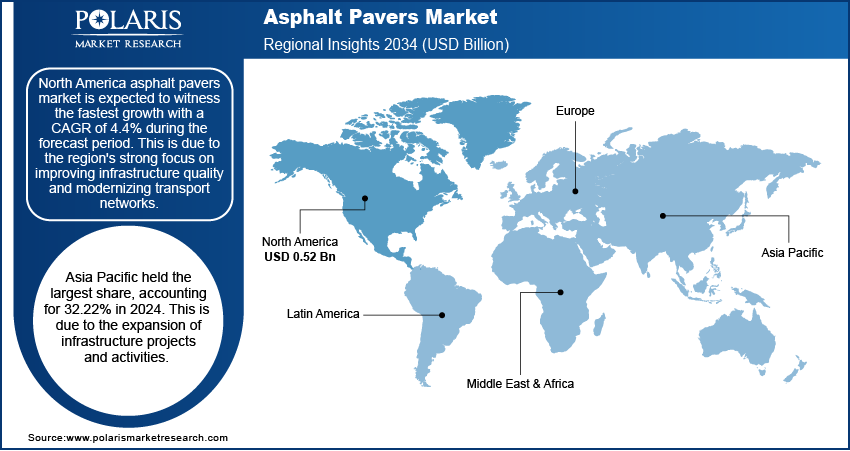

- In 2024, Asia Pacific accounted for the largest market share, supported by rapid infrastructure development, government-funded road construction projects, and growing urbanization in countries like China, India, and Southeast Asian nations.

Industry Dynamics

- Rapid growth in road construction and infrastructure projects is driving demand for asphalt pavers, as governments and private developers invest heavily in modernizing highways, urban roads, and transportation networks globally.

- Increasing adoption of tracked pavers is contributing to market growth due to their superior traction, stability, and ability to perform efficiently on uneven surfaces and large-scale paving applications like highways and airports.

- Rising urbanization and smart city initiatives are creating a need for compact and mid-sized pavers, especially in densely populated areas, where maneuverability and precision paving are crucial for roadwork and maintenance.

- High capital and maintenance costs of advanced asphalt pavers may restrain market growth, particularly for small contractors and municipalities operating under tight budget constraints.

- Environmental regulations and demand for sustainable construction are pushing manufacturers to innovate with cleaner engines and efficient paving technologies, impacting product development and influencing buyer preferences.

Market Statistics

- 2024 Market Size: USD 2.4 Billion

- 2034 Projected Market Size: USD 3.5 Billion

- CAGR (2025-2034): 3.70%

- Asia Pacific: Largest Market Share

AI Impact on Asphalt Pavers Market

- AI is transforming asphalt paving operations by enabling predictive maintenance, real-time diagnostics, and automated adjustments to machine settings for optimal performance and material usage.

- It improves construction efficiency by analyzing project data to forecast delays, optimize paving schedules, and ensure consistent compaction quality across varying surface and weather conditions.

- AI enhances machine automation by enabling semi-autonomous or fully autonomous pavers that adjust speed, screed width, and material flow with minimal human intervention.

- AI-powered systems support remote monitoring and data-driven decision-making, allowing contractors to improve job site productivity, reduce fuel consumption, and lower operational costs.

To Understand More About this Research: Request a Free Sample Report

Asphalt pavers are heavy construction equipment for laying asphalt on roads, parking lots, and other surfaces. They are designed to evenly distribute and compact asphalt material, creating a smooth and durable pavement surface. Asphalt pavers typically consist of a tractor unit with a hopper for holding the asphalt mix, a conveyor system for delivering the material to the rear, and a screed unit for spreading and leveling the asphalt. The screed can be adjusted to achieve the desired thickness and surface texture. Asphalt pavers play a crucial role in road construction projects, ensuring asphalt's efficient and accurate placement to create high-quality road surfaces.

Several key factors primarily drive the market growth in the asphalt paver industry, that increase in infrastructural development due to a rise in paved roads. Additionally, emerging economies actively develop their road networks, further contributing to market growth. Strong government support and investment, often in collaboration with the private sector, are also significant drivers. Finally, there is a growing demand for energy-efficient construction equipment, including asphalt pavers.

The Asia-Pacific region is poised for significant adoption of asphalt pavers over an extended forecast period. The region presents substantial potential due to substantial public and private investments, coupled with an array of ongoing road construction projects.

- For instance, in April 2022, the Chinese government, as part of its strategic initiatives, expressed intentions to expand its influence in Bangladesh through the extension of the Belt and Road projects. Beijing has allocated RMB 7.26 million for a road development project aimed at enhancing Bangladeshi road infrastructure. The escalating demand for road traffic necessitates ongoing construction and enhancement of roads in both urban and rural areas, likely fueling global market demand.

Manufacturers offer attractive financing options with flexible payment terms to make ownership more feasible for contractors. These financing options have become increasingly available, allowing contractors to purchase asphalt pavers without significant strain on their budgets. For example, companies like Deere & Co. provide financing solutions that include loans, leasing, and installment options for construction equipment, including compactors. Such offerings by manufacturers are expected to drive the sales of asphalt pavers in the future.

Additionally, producers are introducing innovative pavement materials such as Open Graded Friction Course (OGFC), Superpave, and Stone Matrix Asphalt (SMA). These advancements improve working conditions for the workforce at the pavement site, resulting in enhanced efficiency. Consequently, the demand for asphalt finishers is expected to impact market growth positively.

Industry Dynamics

- Growth Drivers

- Rise in the construction and infrastructure sector

The construction sector's growth is poised to create significant opportunities for asphalt pavers. The ongoing surge in construction and infrastructure projects, particularly in emerging economies like India, Brazil, and China, is fueling the demand for various construction equipment. Additionally, government initiatives and infrastructure planning efforts bolstered the construction sector's expansion in these countries. Urban and rural infrastructure projects encompassing roads, highways, dams, railways, metros, and power infrastructure development are expected to offer favorable prospects for the asphalt pavers market in the coming years.

Developing robust public infrastructure is crucial for sustainable growth and economic advancement worldwide. By 2028, global roadway expenditure is projected to triple the current spending, covering approximately 80% of the existing road network. China and India alone accounted for about 50% of paved roads and are anticipated to contribute further in the forecast period.

Report Segmentation

The market is primarily segmented based on product type, screed type, operating weight, paving width, and region.

|

By Product Type |

By Screed Type

|

By Operating Weight

|

By Paving Width |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Analysis

- The tracked pavers segment accounted for the highest revenue share in 2024

In 2024, the tracked paver segment accounted for the highest revenue share due to its superior efficiency compared to wheeled pavers. Tracked pavers are preferred due to their excellent traction and flotation, which enhance stability and maneuverability, particularly in tight spaces. Tracked pavers are well-suited for hilly and mountainous regions with steep terrain. They can operate without slipping and possess the capability to push trucks uphill or prevent them from rolling downhill, further highlighting their advantages over wheeled counterparts.

By Paving Width Analysis

- The 2.5-5 segment is expected to witness the highest growth during the forecast period.

The 2.5-5 segment is expected to witness the highest growth during the forecast period. These asphalt pavers are versatile and suitable for various road sizes and purposes, offering flexibility in asphalt spreading. They are the most commonly used type, especially in locations where the road dimensions remain relatively consistent. Pavers with widths less than 2.5 meters are anticipated to demonstrate a steady growth trajectory, primarily serving applications such as parking lots, parks, and rural areas. Additionally, those exceeding 5 meters are expected to exhibit moderate growth. This trend is attributed to the increasing preference for concrete in paving wider roads, especially in emerging economies where concrete is favored for such applications.

Regional Analysis

- Asia Pacific accounted for the largest market share in 2024

In 2024, Asia Pacific accounted for the largest market share, primarily driven by the growing demand for highway and road construction projects and rising residential development. These pavers, known for improving base, density, and appearance, are preferred in the region, further fueling their demand. Key players in the asphalt pavers market have been expanding existing facilities and establishing corporate offices in Southeast Asia to benefit from economies of scale and increase their global market shares.

In particular, China will require approximately USD 150 billion over the next ten years to develop and maintain roads. Given the substantial capital demand, the government and bank loans alone cannot meet these requirements due to the country's economic slowdown and sluggish growth.

The governance of India introduced the Bharatmala Pariyojana, a roadway infrastructure plan aimed at developing 24,800 km of highways with a total investment of approximately USD 72.0 billion. The National Highways Authority of India (NHAI) presented Infrastructure Investment Trusts to monetize assets and attract additional funds to support such infrastructure projects.

Competitive Insight

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies, such as research and development, mergers and acquisitions, and technological innovations, to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include

- Ammann

- Astec Industry

- Caterpillar

- Fayat Group

- Sany

- Shantui

- Sumitomo

- Volvo CE

- VT Leeboy

- Wirtgen Group

- XCMG

- Zoomlion

Recent Developments

- In April 2025, Kraton Corporation launched the CirKular+™ Paving Circularity Series, enabling up to 50% reclaimed asphalt reuse. The innovation improved asphalt performance, supported circularity goals, and reduced greenhouse gas emissions in line with evolving industry sustainability standards.

- In April 2022, Dynapac introduced its latest addition to the highway pavers market in the United States. The new model, the 8-foot tracked paver D25T, was unveiled to cater to the growing demand for advanced paving equipment. This development coincided with the United States federal government's commitment to allocate a substantial budget of USD 1 trillion towards road and highway development initiatives.

- In February 2022, Wirtgen launched its latest innovation in the market: the SP 102i concrete pavers. These modular concrete pavers allow customers to adapt and customize the machine according to their specific requirements.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 2.49 billion |

|

Revenue forecast in 2034 |

USD 3.5 billion |

|

CAGR |

3.70% from 2025–2034 |

|

Base year |

2024 |

|

Historical data |

2020–2023 |

|

Forecast period |

2025–2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Product Type, By Screed Type, By Operating Weight, By Paving Width, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Asphalt Pavers Market Size Worth $ 3.5 Billion By 2034

The global key market players include Wirtgen Group, Ammann, Sumitomo, Sany, Zoomlion, Fayat Group

Asia Pacific IS contribute notably towards the Asphalt Pavers Market.

The global asphalt pavers market is expected to grow at a CAGR of 3.70% during the forecast period.

Asphalt Pavers Market report covering key segments are product type, screed type, operating weight, paving width, and region.