Ball Valves Market Share, Size, Trends, Industry Analysis Report

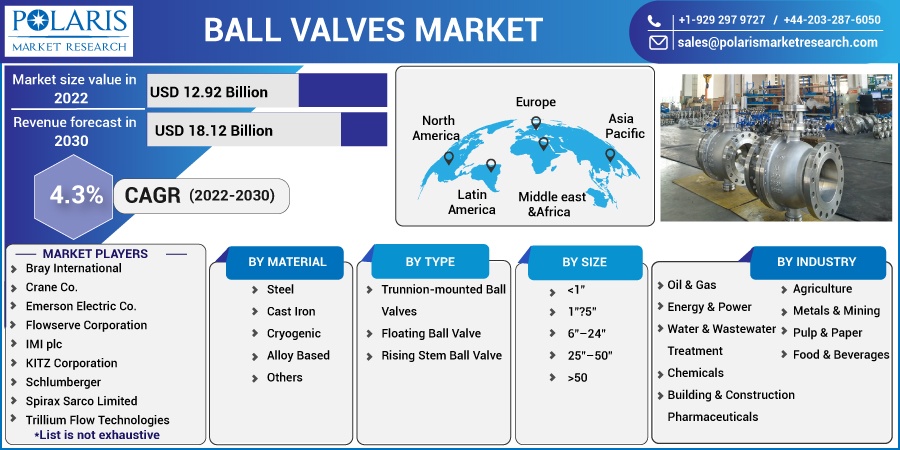

By Material (Mild Ball Valves, Medium Ball Valves, Extreme Ball Valves); By Type; By Size; By Industry; By Region; Segment Forecast, 2022-2030

- Published Date:Dec-2022

- Pages: 118

- Format: PDF

- Report ID: PM2905

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

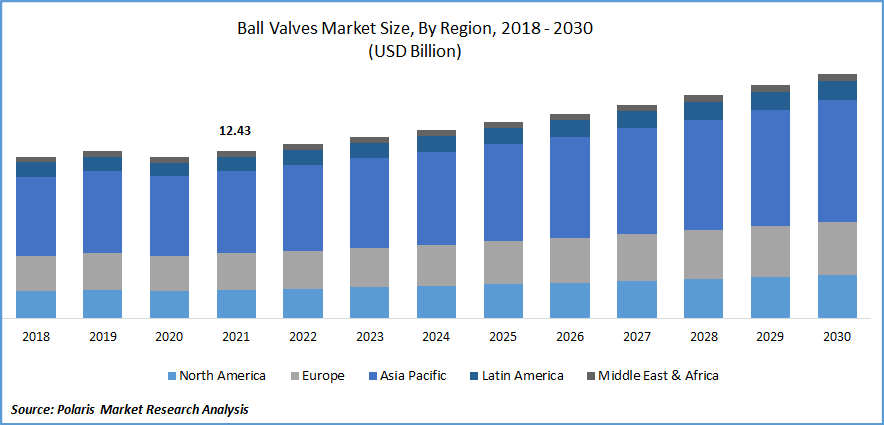

The global ball valve market was valued at USD 12.43 billion in 2021 and is expected to grow at a CAGR of 4.3% during the forecast period.

The rising demand for ball valves in new and upgraded nuclear power reactors is primarily responsible for market growth. Implementation of 3D printing technologies for ball valve manufacture, as well as digital transformation in industrial facilities, are driving the market forward.

Know more about this report: Request for sample pages

However, high pricing pressure and a lack of uniformity are limiting industry expansion. With a fast-rising population and urbanization, industrial infrastructure is quickly expanding. Several cities can respond quickly and correctly to crises in energy, transportation, and natural catastrophes by integrating the necessary technology and the know-how to regulate them.

Cities are beginning to incorporate technology dynamism into municipal operations, ranging from transportation to infrastructure maintenance and beyond. Smart cities use data to better manage resources. Valves are essential components of a wide range of industrial machinery. Valve failure might cause problems in industrial processes which might hinder market growth.

The Internet of Things enables valve professionals to remotely monitor the health of valves in a facility and measure their efficiency, life cycle, and propensity for failure. As a result, IIoT improves valve performance and safeguards the work environment. Sensor-equipped valves linked through IIoT can assist to decrease maintenance and shutdown expenses. The valve industry is extremely fragmented. Mergers and acquisitions are intended to assist enterprises in expanding their product ranges and increasing their market share. As oil prices fell, major industry players purchased small businesses to assure long-term development and profitability.

The COVID-19 epidemic had a significant influence on the global market for ball valves. The market for Ball Valves is not particularly consolidated due to its relatively modern production technique. The consumption of ball & butterfly valves is determined by the downstream industries.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising demand of valves from several industries is a vital factor that is likely to augment the market in the projected forecast. On the other hand, the increasing use of 3D printing technology in valve manufacturing, the use of industrial internet of things (IIoT) and digital transformation in industrial plants, as well as increased investment in water and wastewater treatment plants to address sanitation-related issues, will all contribute to the growth of the global market.

Valves are vital components of a wide range of industrial machines. Plant operations may be disrupted if valves are operated incorrectly. When traditional schedule-based maintenance procedures fail to notify industrial companies about potential valve failures, unplanned downtime ensues. Recent advances in communications, data science, and computing power, on the other hand, have enabled firms to leverage Industrial Internet of Things (IIoT) technologies to reduce unexpected downtime caused by valve failure.

Report Segmentation

The market is primarily segmented based on material, type, size, industry and region.

|

By Material |

By Type |

By Size |

By Industry |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Stainless Steel Valves segment is expected to witness the fastest growth

In situations where corrosion resistance is critical, stainless steel is favored over carbon steel. Stainless steel ball valves are often used in the pharmaceutical, chemical, oil and gas, and food and beverage sectors. Due to the corrosive environment inherent in chemical processing, valves in the chemical industry must withstand demanding circumstances ranging from high toxicity to mild to aggressive chemical compound ingression.

Trunnion- Mounted Ball Valves accounted for a significant market share in 2021

During the projection period, the market for trunnion valves accounted for the largest share in 2021. The trunnion-mounted stem absorbs line pressure force, reducing friction between the ball & seats. As a result, in many situations, trunnion-mounted ball valves are favored over floating and rising stem ball valves. This, in turn, is likely to boost the market growth.

Energy And Power Industry accounted for a significant market share in 2021

The power industry is the world's largest consumer of ball valves. Ball valves are used in the energy and power industries to ensure safety in essential applications. Coal is the most major energy source, accounting for 37% of total primary power output worldwide. However, industry concerns about hazardous emissions from coal-fired electricity generation are growing, and as a result, the sector is transitioning toward renewable or clean and healthy energy. Ball valves are used to stop & start the flow of the media, increase & controlling flow, and regulate flow or processing pressure, from a specific pressure, among other things. Increased investment in power plants is propelling the ball valve market in the energy and power industry.

The demand in the Asia-Pacific region is expected to witness significant growth

China has a strong industrial basis and is one of the most important economies in the Asia Pacific. The principal industries in the country include the process industries such as chemical manufacturers, & public utilities such as electric power generating. Control valves are used in these sectors to provide complete control and monitoring. Japan's mineral and energy shortages had a significant impact on the country's energy and power industries. During the projected period, new investments in the energy and power industries will boost the ball valve market in Japan. The increased need for power in varied end-use sectors such as oil and gas, electricity, and petrochemicals are driving the expansion of the market in India. In India, there is a high need for ball valves in the oil and gas industry.

Competitive Insight

Some of the major players operating in the global market include Bray international, Crane Co., Emerson Electric Co., Flowserve Corporation, IMI plc, KITZ Corporation, Schlumberger, Spirax Sarco Limited, Trillium Flow Technologies, Valmet (Neles Corporation), and Velan, Inc.

Recent Developments

- In 2019 Emerson bought CIRCOR International's Spence and Nicholson product lines to enhance its range of steam system solutions for industrial industries and commercial buildings.

- In 2019 PBM, a maker of valves and specialty valves for both sanitary and industrial uses, was purchased by IMI plc. All of these purchases would raise competition in the ball valves industry.

- In April 2022, Neles combined with Valmet, a producer of automation systems, to become Valmet's flow control business line.

Ball Valves market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 12.92 billion |

|

Revenue forecast in 2030 |

USD 18.12 billion |

|

CAGR |

4.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Material, By Type, By Size, By Industry and By Region. |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Bray International, Crane Co., Emerson Electric Co., Flowserve Corporation, IMI plc, KITZ Corporation, Schlumberger, Spirax Sarco Limited, Trillium Flow Technologies, Valmet (Neles Corporation), and Velan, Inc. |