Caps & Closures Market Share, Size, Trends, Industry Analysis Report

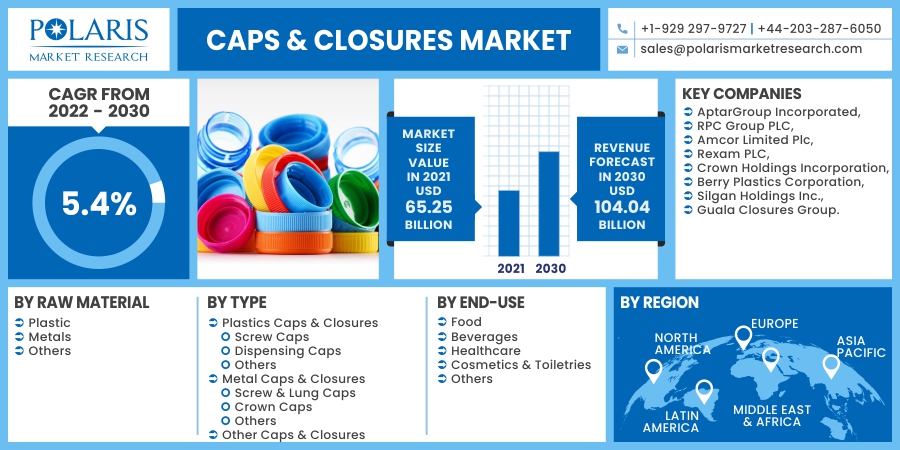

By Raw Material (Plastic, Metals, Others); By End-Use (Food, Beverage, Healthcare, Cosmetics & Toiletries, Others); By Type; By Region; Segment Forecast, 2022 - 2030

- Published Date:Apr-2022

- Pages: 126

- Format: PDF

- Report ID: PM2364

- Base Year: 2021

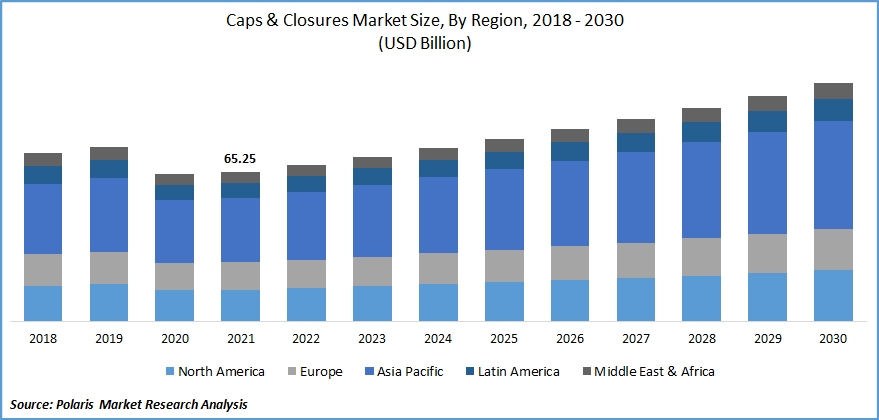

- Historical Data: 2018 - 2020

Report Outlook

The global caps & closures market was valued at USD 65.25 billion in 2021 and is expected to grow at a CAGR of 5.4% during the forecast period. The increasing demand for the various types of packed food products, non-alcoholic and alcoholic beverages, and the growing need for easy-to-open and sustainable packages are the major factors fostering the market demand across the globe.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Caps & closures act as a vital role in packaging as it acts as a barrier and averts the chances of contamination of the product, thereby boosting the shelf-life of the products. The growing awareness for health and wellness, increasing disposable income, and the rising application of caps & closures across various end-use industries like pharmaceutical, personal care, home care, food & beverages, and automotive are further spurring the caps & closures market demand over the coming years.

The outbreak of the COVID-19 has shown a significant impact on the various sector of the economy. The caps & closures market was also negatively affected due to the regulatory bodies' imposition of stringent lockdown across several regions. Caps & closures are primarily adopted in pharmaceuticals, cosmetic products, food & beverages, household goods, etc. They are the final constituent for the packaging of goods and for maintaining the reliability of the product packing.

During this period, the growth of the food & beverage sector, both offline and online food chains, declined because of the apprehension of the virus spreading. However, the availability of safe and hygienic products is propelling the market demand. Additionally, the gradual opening of the lockdowns also presents various growth prospects for the closures market growth over the upcoming years.

Industry Dynamics

Growth Drivers

The surging demand for bottled water worldwide is one of the chief driving factors for the global market growth. Bottled water is gaining massive traction among the population and is one of the fastest-growing beverage categories. The changing lifestyles and increasing per capita are the foremost factors propelling the growth of the bottled water sector.

The bottled water manufacturers are more inclined towards selling their products as superior and high-quality, thus, in turn, propelling the demand for the caps & closures. The rise in income levels of the population is accelerating the sales of premium bottled water and encouraging producers to introduce premium bottled water products with appealing capping & closures solutions.

As per the International Bottled Water Association, the escalating population pool of high-net-worth individuals (HNWI) is playing a significant role in influencing the demand for premium bottled water. Moreover, technological developments in packaging solutions also foster the demand for caps and closures. This technology facilitates companies to integrate innovation into products rather than the traditional methods of sticking company’s labels for better product identification.

Therefore, this factor resulted in high investments in the R&D activities for launching technically advanced products with characteristics such as extended shelf life, reusability, better sealing capabilities, and leakage proof. Accordingly, these features proficiently preserve the quality and consistency of the product and boost their shelf life. Hence these factors augment the market growth over the forecast period.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented on the basis of raw material, type, end-use, and region.

|

By Raw Material |

By Type |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Insight by Raw Material

The plastic market segment is recorded to hold the largest revenue share. Plastic is the most consumable material in the production of caps & closures because of its characteristics like durability and cost-effectiveness compared to other materials. Plastic caps & closures are manufactured from a variety of polymers such as polyethylene terephthalate (PET), polypropylene (PP), polyethylene (PE), and polyvinyl chloride (PVC).

It is majorly adopted across various end-use industries as it can be molded into the desired shape by applying heat or pressure. Therefore, the introduction of a wide range of packaging forms is fueling the demand for the plastic segment, thus, in turn, leading the market segment dominance in the forecasting period.

The metal segment is projected to exhibit a progressive growth rate in the forecasting years. The metal caps and closures offer stability and rigidity while portraying superior goods in the market. The rising demand for effective packaging solutions like metal caps and closures to ensure the longer shelf-life of food and beverage products is fostering segment market growth.

Moreover, the growing usage of tamper-evident and child-resistant metal caps & closures is gaining immense popularity, leading the producer to manufacture high-quality metal caps & closures, which is expected to fuel the segment demand over the coming years.

Geographic Overview

Geographically, North America accounted for the largest revenue share in the global market. The rapid technological advancements in packaging solutions coupled with the changing lifestyle of the population are the significant factors that may accelerate the market demand across the region. In addition, the growth of the food industry and escalating demand for packed food are further offering various lucrative opportunities for the market demand. The millennial population is more inclined to the packed food because of a huge working population, which may accelerate the market demand across the region.

Moreover, the Asia Pacific market is anticipated to exhibit the highest CAGR due to the increasing disposable income and increased consumption of processed and packaged food and beverage items. Additionally, the rising number of exports from these countries and technologically advanced packaging solutions are presenting various growth opportunities for the market. Furthermore, India is one of the leading nations with large consumer bases worldwide, which further surges the demand for caps and closures in the packaging industry.

Competitive Insight

Some of the major players operating in the global market include AptarGroup Incorporated, RPC Group PLC, Amcor Limited Plc, Rexam PLC, Crown Holdings Incorporation, Berry Plastics Corporation, Silgan Holdings Inc., and Guala Closures Group.

In February 2022, AptarGroup, Inc. announced the construction of a new facility in Mumbai, India. The growing demand in the Asia Pacific from the pharmaceutical industry is expected to be the major factor for production expansion by the company in the Asia and Southeast Asia market.

Caps & Closures Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 65.25 billion |

|

Revenue forecast in 2030 |

USD 104.04 billion |

|

CAGR |

5.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Raw Material, By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

AptarGroup Incorporated, RPC Group PLC, Amcor Limited Plc, Rexam PLC, Crown Holdings Incorporation, Berry Plastics Corporation, Silgan Holdings Inc., and Guala Closures Group. |