Household Robots Market Share, Size, Trends, Industry Analysis Report

By Offering (Product, Services); By Type; By Distribution Channel (Online, Offline); By Application; By Region; Segment Forecast, 2022-2030

- Published Date:Nov-2022

- Pages: 117

- Format: PDF

- Report ID: PM2742

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

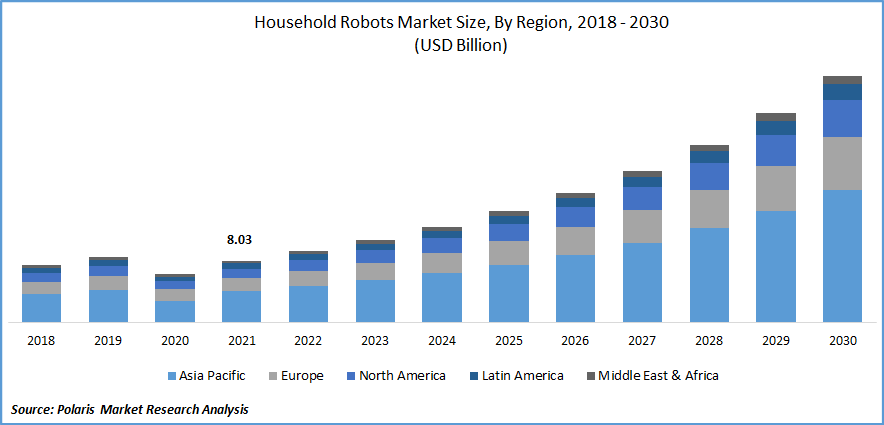

The global household robots market was valued at USD 8.03 billion in 2021 and is expected to grow at a CAGR of 16.8% during the forecast period. The growing demand for household robots is expected to be driven by the increasing cost of labor service, penetration of IoT devices, and reliability and low maintenance of robots.

Know more about this report: Request for sample pages

Household robots are replacing the human labor force owing to their consistency, productivity, and speed of getting the task done. In addition, repetitive work leads to a lack of interest and boredom, resulting in carelessness and unmotivated to do the job, which is avoided in the case of robots as they are programmed to do a specific task, which boosts the market growth.

Moreover, robots don’t require wages and leave while performing the task, which reduces the overhead expense, which is the primary factor driving the market growth.

The COVID-19 pandemic had a negative impact on the growth of the household robots market. Negligible operations in the electronics industry led to delays in the production of robots across the world. In addition, stringent government law has resulted in the closure of international robots, significantly reducing the demand for household robots and their related commodities and hampering the market growth.

With the emerging technologies, manufacturer focus on developing robots with high endurance capability. The robots currently run-on nickel-metal hydride batteries due to less toxic metal and generation of high power, but this helps robots to run only for fewer hours. Most manufacturers are looking forward to switching to Li-ion batteries as they can be charged quickly and run longer.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Global household robots are likely to be driven by the growing adoption of autonomous technology, which reduces human intervention. The rising demand for autonomous robot with voice and remote chat assistance across developing and developed economies are expected to spur market growth.

In addition, autonomous robot vacuums are replacing conventional vacuums, which require manual charging and switching, which are now converted to self-charge and are assisted with voice commands, increasing the sale of household robots.

Moreover, many household robots are now equipped with AI and efficient navigation features. Such robots help work in the dark and can deal with obstacles. Furthermore, this robot could be connected to Wi-Fi and smart devices such as Alexa and google assistant to have two-way communication.

For instance, amazon launched a robot, namely Amazon Astro, which could be connected to smartphones and helps monitor and receive real-time alerts remotely. These robot helps to identify clingers such as mirror, walls, and doors to avoid any obstacles while performing the task; such factors propel the market growth.

Report Segmentation

The market is primarily segmented based on offering, type, distribution channel, by application, and region.

|

By Offering |

By Type |

By Distribution Channel |

By Application |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Product segment accounted for the largest share in 2021

The product segment accounted for the highest revenue share in 2021, owing to the rising consumer demand for robotic technology with less human intervention. In addition, the growing number of working women has resulted in the adoption of autonomous and smart products across developed nations.

Furthermore, the demand to complete tasks remotely is a growing trend that has created various product lines for household robots. For instance, iRobot collaborated with google and integrated Google’s AI assistant to control the robots with voice commands and improve the functioning of daily work.

Moreover, many companies are heavily investing in developing bots with AI and cognitive learning to fulfill the requirement of the urban population. For instance, Samsung and LG electronics are heavily investing in launching new household robotic products; such factors are expected to drive segment growth.

Domestic robots are expected to hold largest market share

The most common use of domestic robots the smart vacuum. This type of household robot can operate around a room floor, cleaning carpeting, hardwood, and other sorts of floors. These robots are used in home security networks as well.

The demand for domestic robots is driven by the changing lifestyles with emerging trends across developed and developing nations. In addition, domestic robots have wide applications in household chores such as mowing, washing floors and windows, and many more, which are done efficiently.

Furthermore, these robots provide company for kids and older age groups and remind them to take their medicines on time and monitor their activities, increasing global demand and ultimately boosting the market growth.

Online channel is expected to witness faster growth

The demand for household robots through online distribution channels is expected to see a significant surge over the forecast period owing to easy access to the market and a reduction in overhead expenses. Moreover, household robot sales through online channels were boosted during the pandemic owing to the temporary termination of retail shops and shopping marts.

In addition, many businesses offer product setup and make installation easier, encouraging people to purchase products from e-commerce than offline, which is expected to drive market growth.

Vacuuming segment is expected to account for the largest share in 2030

Vacuuming robot is expected to dominate the market over the forecast period owing to the increasing global population and growing geriatric population across developing nation. These robots are helpful in the deployment of cleaning purposes for an aging group of people. They are heavily used in countries like China and Japan due to their affordability which is expected to propel the segment growth.

Moreover, the increasing sales of vacuum robots are due to their self-sufficient and self-operating nature, which copes with the busy lifestyles of consumers; such factors bolstered the market growth.

Asia Pacific is expected to dominate and witness fastest growth over the forecast period

Asia Pacific is the largest region for household robots and is expected to witness faster growth over the forecast period owing to the rising adoption of innovative technology and rising disposable income. In addition, the increasing development of cleaning robots across China is also supporting segment growth. Countries like China & India revamp their education systems and invest in innovation to support human and robotic workforces.

According to International Monetary Fund (IMF), In Asia, China is now the single biggest user of these robots, with an estimated 50 percent of the region’s total industrial robot usage, followed by Korea and Japan.

Furthermore, the growing demand for household cleaning, home security, and monitoring across China, Japan, South Korea, and India are essential factors driving the market’s demand.

Competitive Insight

Some of the major players operating in the global market include AIRROBO, Alfred Karcher, SE & Co.KG, Blue Grog Robotics, Inc., Bobsweep Inc., BSH Hausgerate, Dyson Ltd, Ecovacs Robotics, Inc, Husqvarna Group, iLIFE Innovation Ltd, Intuitive Surgical Inc., iRobot Corporation, John Deere, Lego, LG Electronics Inc., Maytronics Ltd., Miele, Neato Robotics, Inc., Panasonic Corporation, Robomow, Roborock Technology Co. Ltd, Samsung Electronics Co. Ltd, and SharkNinja Operating LLC.

Recent Developments

In August 2022, Amazon merged with iRobot corporation to acquire iRobot and to create innovative cleaning products to make customer lives easier.

In October 2021, AIRROBO launched their new product named the Robot vacuum T10+ which has the ability of self-emptying dustbin and also provides 45 days of hands-free cleaning service.

Household Robots Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 9.25 billion |

|

Revenue forecast in 2030 |

USD 31.99 billion |

|

CAGR |

16.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Offering, By Type, By Distribution Channel, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Alfred Karcher, SE & Co.KG, Blue Grog Robotics, Inc., Bobsweep Inc., BSH Hausgerate, Dyson Ltd, Ecovacs Robotics, Inc, Husqvarna Group, iLIFE Innovation Ltd, Intuitive Surgical Inc., iRobot Corporation, John Deere, Lego, LG Electronics Inc., Maytronics Ltd., Miele, Neato Robotics, Inc., Panasonic Corporation, Robomow, Roborock Technology Co. Ltd, Samsung Electronics Co. Ltd, and SharkNinja Operating LLC. |