Bottled Water Processing Market Share, Size, Trends, Industry Analysis Report

By Packaging Material (Cans, Plastic, Glass, Other Packaging Materials); By Equipment; By Product Type; By Technology; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4427

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

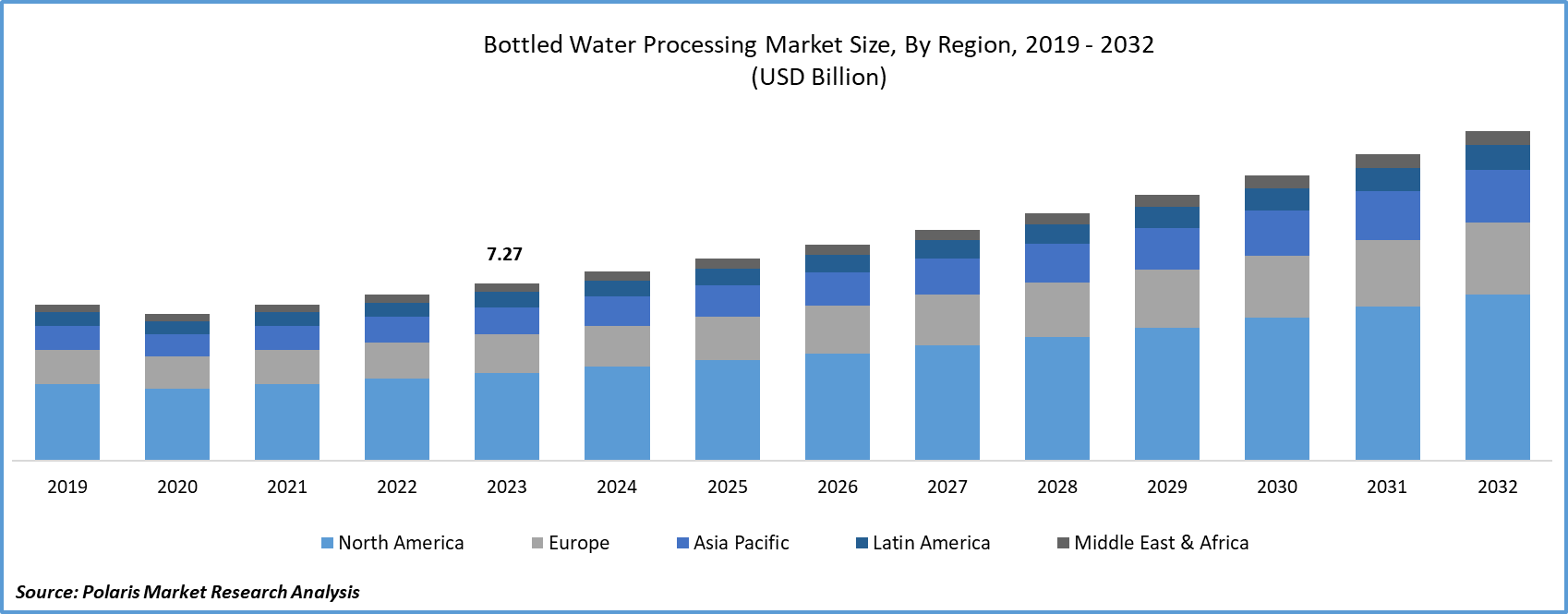

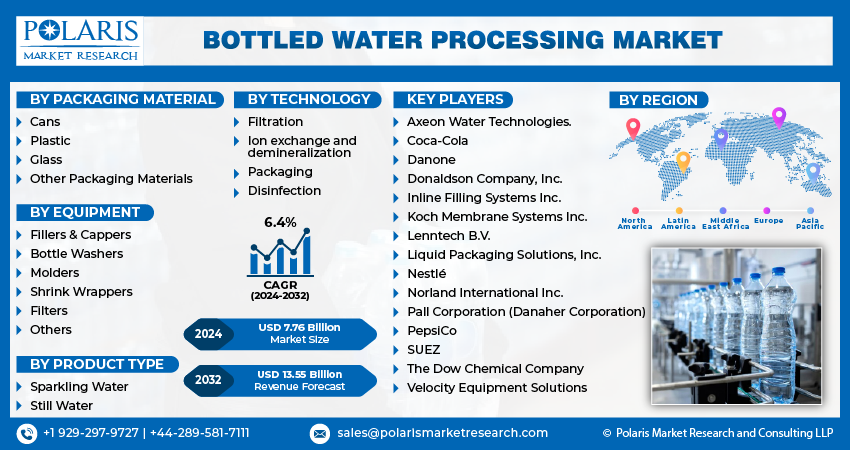

Bottled Water Processing Market size was valued at USD 7.27 billion in 2023. The market is anticipated to grow from USD 7.76 billion in 2024 to USD 13.55 billion by 2032, exhibiting a CAGR of 6.4% during the forecast period.

Bottled Water Processing Market Overview

The main purpose of bottled water processing is to treat and purify water. The market has experienced significant growth in recent years due to the rising prevalence of water-borne diseases. Water processing technology plays a crucial role in eliminating harmful bacteria from water, ensuring its safety for human consumption. Increasing consumer awareness regarding the quality and hygiene of consumed products is contributing to the growing demand for packaged drinking water. Moreover, the increasing desire for convenient products and higher disposable income are expected to drive the global consumption of bottled water.

In this market, technologies such as blow molding for PET bottles, bottle washing, chemical treatment, filtration, disinfection, and filling & capping have gained widespread popularity.

The global rise in bottled water consumption over the past decade is attributed to heightened health awareness and the recognized benefits of body hydration. Governments and health organizations in both developed and developing nations are actively promoting policies and regulations to encourage the adoption of national guidelines for water intake and healthy hydration practices. Recognizing water as a crucial macronutrient, education on nutritional policies plays a pivotal role in shaping public behavior.

The European Food Safety Authority (EFSA) emphasizes that maintaining appropriate water consumption contributes to sustaining cognitive functions, normal physical activities, and body thermoregulation. The EFSA recommends a daily water intake of 1.6 liters for women and 2 liters for men to ensure optimal health.

To Understand More About this Research: Request a Free Sample Report

Sometimes utilities or government agencies may need temporary water treatment plans, whether for emergency backup, water quality testing, testing new projects or Consequences comes to pass that the water treatment equipment rental service is increasingly used as a reduction of capital investment policies as a responsibility of the leasing companies.

Bottled Water Processing Market Dynamics

Market Drivers

Rise in the Consumption of Bottled Water Bolstering the Growth of the Intumescent Coatings Market

Water stands as one of the most vital substances on Earth. Bottled water, recognized as the healthiest packaged beverage, is in good sized demand while compared to carbonated drinks. It is seen as a convenient manner to stay hydrated and make contributions to a healthy eating regimen. According to the U.N. University's Institute for Water, Environment, and Health, the bottled water market experienced 73% growth from 2010 to 2020. Consumption is projected to grow from around 350 billion liters in 2021 to 460 billion liters by means of 2030.

The bottled water segment within the US beverage industry is in growth due to its convenience, health advantages, safety assurances, and high-quality attributes. Many consumers favor the flavor of bottled water, and its consistent safety is closely monitored by the Food and Drug Administration (FDA). Manufacturers are leveraging this appeal by introducing new flavored options with eye-catching packaging. The escalating demand, driven by both quantity and quality considerations influenced by government regulations, contributes to the expansion of the bottled water processing market.

In Asia Pacific region, notably in countries like India, Thailand, Indonesia, Vietnam, China, South Korea, and Malaysia, substantial growth is anticipated in the bottled water industry. China's market, in particular, exhibits robust development attributed to trends favoring premiumization, heightened consumption, and increased disposable income. Factors such as bulk water purchases and evolving drinking habits also play pivotal roles in propelling the bottled water market in these nations.

Market Restraints

Significant Initial Capital Investments in the Establishment of Bottled Water Processing Facilities Likely to Hamper the Growth of the Market

The substantial financial outlay needed to establish new water processing facilities is a key restraint factor to the growth of the bottled water processing market. Companies within this industry are anticipated to make significant investments in the installation of modern and advanced water processing machinery. Additionally, these machines necessitate regular maintenance to ensure efficient and safe operations, leading to elevated costs for the processing companies.

Report Segmentation

The market is primarily segmented based on packaging material, equipment, product type, technology, and region.

|

By Packaging Material |

By Equipment |

By Product Type |

By Technology |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Bottled Water Processing Market Segmental Analysis

By Packaging Material Analysis

Plastic segment dominates the market in forecast period, with PET (polyethylene terephthalate) being the most commonly used material for packaging. PET is favored for its lightweight, durable, and cost-effective properties, making it a popular choice for bottling beverages. Additionally, other types of plastic, including HDPE (high-density polyethylene) and PVC (polyvinyl chloride), are utilized in specific cases. The convenience, portability, and lightweight nature of plastic make it the preferred option for on-the-go hydration.

Plastic bottled water is widely available in various sizes and formats. This accessibility ensures that consumers can easily find and purchase bottled water in diverse locations, ranging from convenience stores to vending machines. Plastic bottles offer a secure and hygienic packaging solution, with sealed bottles contributing to the safety and purity of the water inside. This sealing process protects the water from contaminants, maintaining its quality throughout the distribution chain.

By Product Type Analysis

Sparkling water exhibits the highest growth rate segment in 2023. The upswing in popularity is a result of the convenience element, as sparkling water is now presented in streamlined and portable formats that effortlessly fit into the fast-paced lifestyles of consumers. This change in packaging has transformed the way individuals consider hydration, positioning sparkling water as the preferred beverage for a variety of activities, spanning from gym workouts to informal social gatherings.

In addition to serving as a standalone beverage, sparkling water has integrated itself into the expanding culture of mocktails and cocktails. Its effervescence and neutral flavor make it an excellent mixer, expanding its appeal to various consumption occasions. Innovations in packaging have played a vital role in enhancing the allure of sparkling water. The introduction of convenient, on-the-go formats has notably boosted its popularity, establishing it as a lifestyle beverage. This shift in consumer behavior has firmly established sparkling water as the preferred choice for a spectrum of occasions, including fitness routines and social gatherings.

Bottled Water Processing Market Regional Insights

The Asia Pacific Region Dominated the Global Market with the Largest Market Share in 2023

A factor behind the increased demand for bottled water in the Asia Pacific region is the growing apprehension about the quality of tap water in certain areas. With a heightened awareness of water safety and purity, consumers are increasingly choosing bottled water as a perceived safer and more dependable source of drinking water. The bottled water industry has strategically addressed these concerns by positioning its products as a reliable alternative that adheres to rigorous quality standards. This heightened consciousness regarding water quality serves as a significant driving force, shaping consumer preferences and contributing to the continued growth of the bottled water processing market.

Advancements in distribution and retail channels have played a crucial role in driving the expansion of the bottled water processing market share in the Asia Pacific region. The increased presence of bottled water in diverse retail settings, such as supermarkets and convenience stores, has significantly broadened consumer access. Additionally, the integration of online platforms for buying bottled water has provided consumers with convenient and efficient ways to obtain their preferred products. This improved accessibility has not only expanded the market's reach but has also heightened the overall convenience associated with selecting bottled water over other beverage options.

The growing demand for safe and hygienic bottled water is driving the increased consumption of bottled water in North America, contributing to the regional market's expansion.

In Europe, substantial growth is anticipated due to rising consumer apprehensions regarding the consumption of contaminated tap water, particularly in the UK, Germany, and France. Additionally, the rapidly expanding travel and tourism industry in Europe has generated a significant demand for bottled water, further fueling the market's growth in this region.

Competitive Landscape

The Bottled Water Processing market size is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Axeon Water Technologies.

- Coca-Cola

- Danone

- Donaldson Company, Inc.

- Inline Filling Systems Inc.

- Koch Membrane Systems Inc.

- Lenntech B.V.

- Liquid Packaging Solutions, Inc.

- Nestlé

- Norland International Inc.

- Pall Corporation (Danaher Corporation)

- PepsiCo

- SUEZ

- The Dow Chemical Company

- Velocity Equipment Solutions

Recent Developments

- In September 2022, GEA Group Aktiengesellschaft has lauched the smart software solution GEA Smart Filtration designed for membrane filtration plants. This technology enables remote monitoring of the plant status through a dedicated app. Representing a significant addition to GEA's software portfolio, this tool harnesses the capabilities of cloud connectivity and real-time analytics to enhance plant availability and performance.

- In March 2021, DuPont (US) has entered into a collaborative partnership with Waterise AS to advance sustainable subsea desalination technology. This joint effort aims to offer seawater reverse osmosis membranes and expertise for Waterise's subsea desalination plants. The collaboration is in line with DuPont's steadfast commitment to innovation and sustainability, addressing worldwide water challenges and further solidifying the company's leadership in water purification and separation technologies.

Report Coverage

The Bottled Water Processing market report forecast emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, packaging material, equipment, product type, technology, and their futuristic growth opportunities.

Bottled Water Processing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.76 billion |

|

Revenue forecast in 2032 |

USD 13.55 billion |

|

CAGR |

6.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Packaging Material, By Equipment, By Product Type, By Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The Bottled Water Processing Market report covering key segments are packaging material, equipment, product type, technology, and region.

Bottled Water Processing Market Size Worth $13.55 Billion By 2032

Bottled Water Processing Market exhibiting the CAGR of 6.4% during the forecast period.

Asia Pacific is leading the global market

key driving factors in Bottled Water Processing Market are Rise in the consumption of bottled water bolstering