Capsule Endoscopy Market Share, Size, Trends, Industry Analysis Report, By End-Use (Hospitals, Ambulatory Surgery Centers, Others); By Product (Capsule Endoscopes, Systems); By Type; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Mar-2022

- Pages: 116

- Format: PDF

- Report ID: PM2326

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

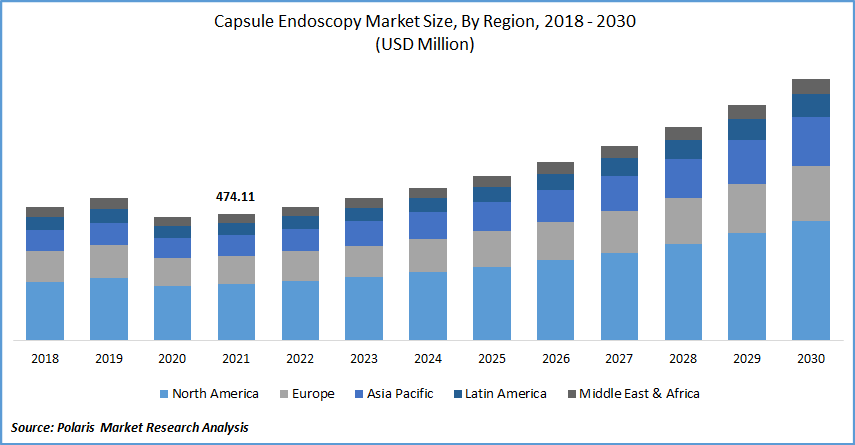

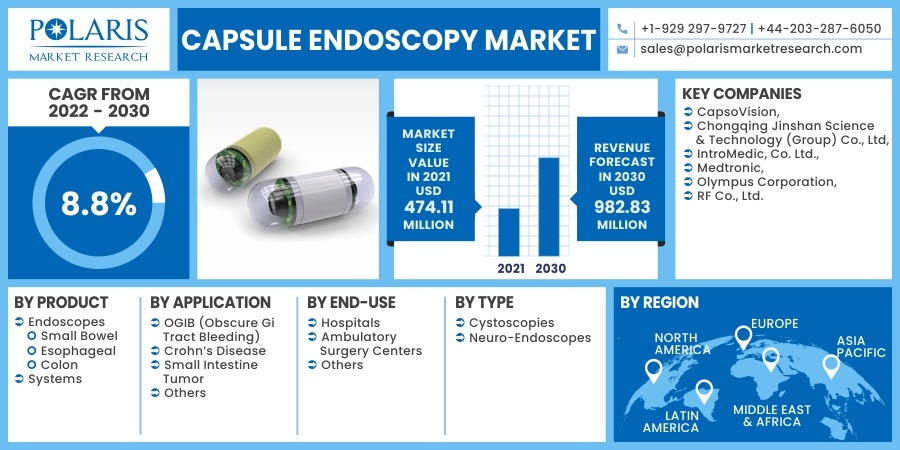

The global capsule endoscopy market was valued at USD 474.11 million in 2021 and is expected to grow at a CAGR of 8.8% during the forecast period. The growing worldwide geriatric population base and technologically sophisticated capsules are the primary drivers driving this endoscopy market expansion. For instance, as per the United Nations, in 2019, 703 million people worldwide were 65 or older. The number of older adults is expected to grow to 1.5 billion by 2050.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Also, the risk of gastrointestinal illnesses such as inflammatory bowel disease, Crohn's disease, colorectal cancer, and appendicitis increases considerably with age. Capsule endoscopy has gained popularity in recent years because of its advantages: easy visualization of gastrointestinal tract pictures, exact diagnosis, and speedier findings. The emergence of technologically advanced wireless capsules with additional features such as longer battery life, increased data storage capacity, Wi-Fi-enabled devices, intuitive designs, easy transmission, bigger frame rate, 360-degree perspective, and improved image quality are driving market growth over the forecast period.

Furthermore, increased public awareness of the availability of painless and MI visualization techniques for treating such disorders is propelling capsule endoscopy market expansion. Video Capsule Endoscopy (VCE) has revolutionized small bowel imaging since it is a non-invasive, well-tolerated technology with great diagnostic methods. Another common treatment and one of the most recent innovations in wireless-capsule endoscopy.

It is frequently used in the early evaluation and screening of gastrointestinal bleeding and some bowel diseases. Moreover, rising healthcare expenditure levels, which necessitate effective cancer medical testing and supportive government measures, will likely drive market expansion. National health spending is expected to expand at 5.4 percent per year on average from 2019 to 2028, reaching $6.2 trillion by 2028.

Since national health expenditures are expected to expand 1.1 % faster than Inflation per year on the median between 2019 and 2028, the health share of the economic growth is expected to climb from 17.7 percent in 2018 to 19.7 percent in 2028. However, the high cost of diagnostic methods, insufficient reimbursement regulations, and the risk of capsules retention inside the person's blood are some of the reasons expected to restrict this endoscopy market growth.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The increasing prevalence of small bowel disease, colorectal cancer, and esophageal disease, among others, increases the demand for capsule endoscopy. For instance, as per the American Institute for Cancer Research, Colorectal cancer is the major most frequent cancer in men and the second leading cause of cancer in women. In 2018, there were around 1.8 million new cancer cases. Also, as per Cancer.net, In the United States, in 2021, a projected 19,260 persons (15,310 men and 3,950 women) would be identified with esophageal cancer.

This disease is expected to kill 15,530 people (12,410 men and 3,120 women). Esophageal carcinoma is the sixth leading cause of mortality from cancer in men. Further, endoscopy for the esophagus, small bowel, and colon are widely used in hospitals and other healthcare settings for prompt diagnosis and enhanced patient care. Following this, the growing senior population, which is more vulnerable to inflammatory bowel disease, Obscure Gastrointestinal Bleeding (OGIB), and appendicitis, is fueling capsule endoscopy market expansion.

The risk of GI diseases rises with age. As a result, the growing global elderly population is also provided with a solid growth platform. According to the WHO, the world population base of 65 and projected to reach 16% by 2050. This is expected to increase the patient base, hence accelerating development.

Report Segmentation

The market is primarily segmented based on product, application, end-use, type, and region.

|

By Product |

By Application |

By End-Use |

By Type |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Application

OGIB market segment is expected to be the most significant revenue contributor in the global market. The segment is expanding due to the multiple benefits of this endoscopy in diagnosing and detecting OGIB. Furthermore, advantages such as real-time vision, image capture, analysis of the whole small intestine, and reliable and precise results aid in using this endoscope for OGIB. Furthermore, the shift in the pattern toward using capsule-based endoscopy screening for OGIB instead of traditional approaches such as double-balloon enteroscopy is helping the segment's growth.

Geographic Overview

North America accounted for the largest revenue share. This dominance can be attributed to a growing preference for minimally invasive procedures and product innovations, coupled with awareness among individuals about the early diagnosis of cancer. For instance, as per the CDC, In 2018, 1,708,921 new cancer cases were reported in the United States, and 599,265 people died from cancer. There were 436 cancer cases registered for every 100,000 individuals, and 149 people died from cancer.

Also, enhanced healthcare infrastructure and spending are other factors driving the capsule endoscopy market growth. For instance, as per the National Health Expenditure Accounts (NHEA), in 2020, healthcare expense in the U.S was expected to rise 9.7 percent to USD 4.1 trillion, or USD 12,530 per capita. Health spending contributed to 19.7% of the nation's Gross National Product.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market. It is due to the increased demand in this region for capsule-based endoscopy technology for screening operations. Furthermore, the region's strong economic development is one of the pioneering aspects responsible for drawing worldwide investors. The existence of big competitors, combined with a continually evolving start-up scene, is fueling capsule endoscopy market expansion.

Competitive Insight

Some of the major players operating in the global market include CapsoVision, Chongqing Jinshan Science & Technology (Group) Co., Ltd, IntroMedic, Co. Ltd., Medtronic, Olympus Corporation, and RF Co., Ltd.

Capsule Endoscopy Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 474.11 million |

|

Revenue forecast in 2030 |

USD 982.83 million |

|

CAGR |

8.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Application, By End-Use, By Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

CapsoVision, Chongqing Jinshan Science & Technology (Group) Co., Ltd, IntroMedic, Co. Ltd., Medtronic, Olympus Corporation, and RF Co., Ltd. |