Clean Label Mold Inhibitors Market Share, Size, Trends, Industry Analysis Report

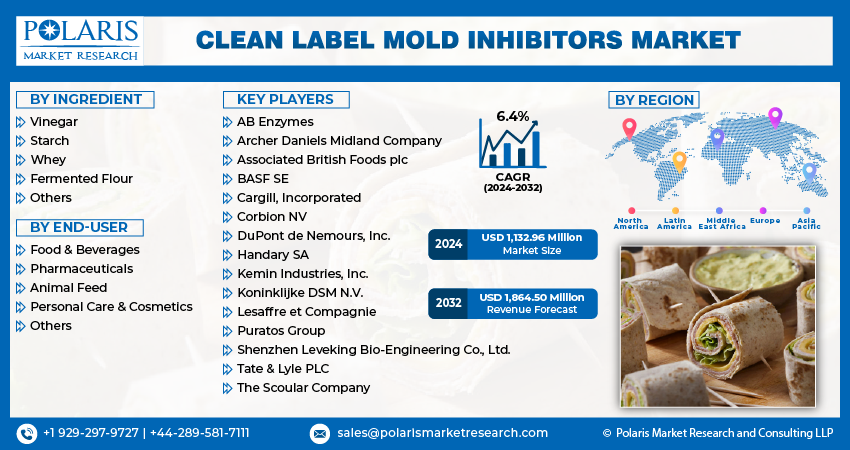

By Ingredient (Vinegar, Starch, Whey, Fermented Flour, Others); By End-User; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4622

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

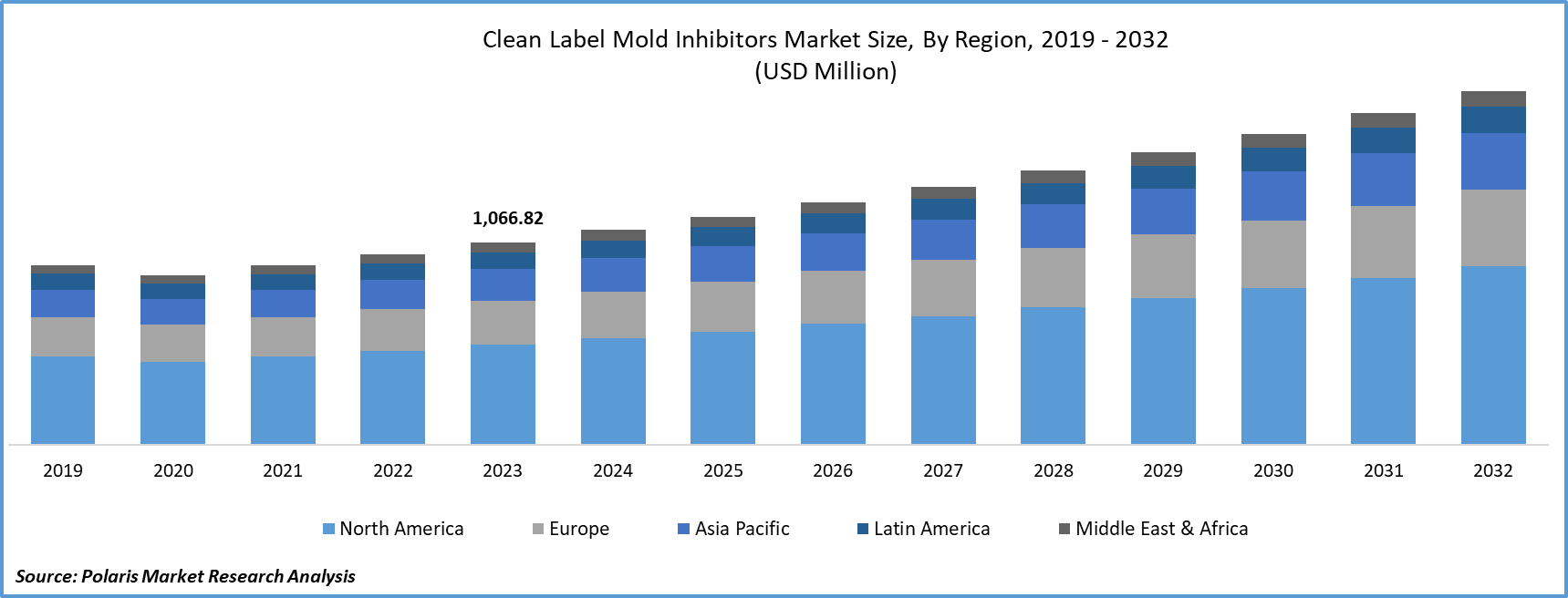

- Clean Label Mold Inhibitors Market size was valued at USD 1,066.82 Million in 2023.

- The market is anticipated to grow from USD 1,132.96 Million in 2024 to USD 1,864.50 Million by 2032, exhibiting the CAGR of 6.4% during the forecast period.

Market Introduction

Consumers are increasingly prioritizing clean-label products, seeking transparency in ingredient lists, and avoiding artificial additives. This shift in consumer preferences has a direct impact on the clean-label mold inhibitors market trends. Manufacturers are responding by reformulating products to replace traditional mold inhibitors with cleaner alternatives.

Manufacturers are exploring innovative preservation techniques to extend the shelf life of products without compromising on the clean label status. Advanced technologies, such as high-pressure processing and modified atmosphere packaging, are being employed to inhibit mold growth while meeting clean label criteria.

To Understand More About this Research: Request a Free Sample Report

The global food and beverage industry's continuous growth provides a fertile ground for the clean label mold inhibitors market research. As food manufacturers strive to meet clean-label demands, there is a growing need for effective mold inhibitors that meet both regulatory requirements and consumer expectations.

For instance, in July 2023, Kemin Industries showcased its comprehensive range of clean-label ingredient solutions at the Institute of Food Technologists 2023 Annual Meeting and Exposition (IFT FIRST) in Chicago, IL.

The market for clean-label mold inhibitors is expanding due to the surge in demand for products featuring natural ingredients, offering a harmonious blend of excellent flavor and sustainable attributes, propelling the growth of the clean-label mold inhibitors Market trends. Industry demand The widespread application of these mold inhibitors as natural stabilizers in the food industry, enhancing shelf life, emerges as a significant driver fueling their consumption.

Industry Growth Drivers

Increasing demand for clean label products is projected to spur the product demand.

The clean-label mold inhibitors market growth is greatly aided by increasing demand for clean-label products. Consumer preferences are shifting towards clean-label products, characterized by transparency in ingredient sourcing and processing. The clean-label mold inhibitors market report benefits from this trend, as manufacturers seek natural and clean alternatives to traditional mold inhibitors, aligning with the demand for cleaner food labels.

Growing health and wellness awareness is expected to drive clean label mold inhibitors market growth.

With a heightened awareness of health and wellness, consumers are seeking food products that not only taste good but also contribute positively to their health. Clean-label mold inhibitors, often derived from natural sources, resonate with health-conscious consumers, providing a growth impetus to the market.

Industry Challenges

Regulatory compliance and certification is likely to impede the clean label mold inhibitors market growth opportunities.

Regulatory compliance and certification stand as a prominent factor hindering the growth of the clean label mold inhibitors market industry. Meeting stringent regulatory standards and obtaining clean label certifications can pose challenges for manufacturers. Navigating through complex regulatory landscapes and ensuring compliance with various certification programs can be time-consuming and resource-intensive, acting as a restraint on market growth.

However, challenges related to formulation complexities, cost considerations, regulatory compliance, and the limited shelf life of natural ingredients act as restraints. Successfully navigating these drivers and restraints will be crucial for stakeholders to capitalize on the opportunities in this dynamic market.

Report Segmentation

The market is primarily segmented based on ingredient, end-user, and region.

|

By Ingredient |

By End-User |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Ingredient Analysis

Fermented flour segment is expected to witness highest growth during forecast period

The fermented flour segment is projected to grow at a CAGR during the projected period in the market. This surge is driven by the dual advantages it offers—serving as a clean-label mold inhibitor while enhancing the flavor and texture of food products naturally. Manufacturers are increasingly turning to fermented flour as a versatile solution to meet the rising demand for clean and natural alternatives. The fermentation process not only imparts unique and desirable sensory attributes to the products but also provides effective mold inhibition, aligning with the clean label trend.

Consumers seeking healthier and more transparent ingredient lists find fermented flour appealing, creating opportunities for its integration into various food applications. As a result, fermented flour contributes significantly to the expanding landscape of clean-label mold inhibitors, where its multifunctionality positions it as a favored choice for manufacturers striving to balance effectiveness, naturalness, and consumer preferences. This growth underscores the pivotal role of fermented flour in addressing the clean-label demands of modern consumers while offering functional benefits in mold inhibition and product enhancement.

By End-User Analysis

Pharmaceutical segment is expected to dominate the market during forecast period

In 2023, the market share was predominantly influenced by pharmaceuticals, commanding a significant market share. By adding clean-label mold inhibitors to its applications, the pharmaceutical industry is addressing customer expectations for transparency and natural alternatives. These inhibitors are essential for successfully preventing mold growth, which protects pharmaceutical safety and integrity. In line with the larger clean labeling movement, pharmaceutical companies are progressively implementing natural source-derived clean-label mold inhibitors. Manufacturers are investigating clean-label alternatives, such as mold inhibitors, in response to the increased customer preference for pharmaceutical products with transparent and unambiguous chemical disclosures.

Regional Insights

North America region dominated the global market in 2023

North America dominated the global market in 2023 and is expected to continue to do so. The region's prominence can be attributed to the increasing consumer demand for clean-label products and a growing awareness of natural and transparent ingredients. The stringent regulatory landscape and a robust focus on health and wellness in North America further propel the adoption of clean-label mold inhibitors. With consumers seeking cleaner and safer food options, North America's influence in driving the growth of the market remains unparalleled on the global stage.

In the meanwhile, with consumers becoming more interested in organic foods and natural food preservatives, the Asia-Pacific region is the most lucrative in the market. A substantial population, rising disposable income, and increased consciousness of food safety and quality make the area ideal for the industry's expansion. The use of mold inhibitors is being driven mostly by the need for clean-label products in Asia-Pacific, which is a reflection of the region's changing tastes for healthier and more transparent food options.

Key Market Players & Competitive Insights

The clean label mold inhibitors market industry players is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- AB Enzymes

- Archer Daniels Midland Company

- Associated British Foods plc

- BASF SE

- Cargill, Incorporated

- Corbion NV

- DuPont de Nemours, Inc.

- Handary SA

- Kemin Industries, Inc.

- Koninklijke DSM N.V.

- Lesaffre et Compagnie

- Puratos Group

- Shenzhen Leveking Bio-Engineering Co., Ltd.

- Tate & Lyle PLC

- The Scoular Company

Recent Developments

- In October 2023, SK Capital Partners, LP, a private investment firm specializing in the specialty materials, ingredients, and life sciences sectors, revealed the execution of an agreement for the acquisition of J&K Ingredients, Inc.

- In July 2023, BioVeritas, LLC, a food technology company, introduced an innovative clean label mold inhibitor derived from vegetable oil extracts using a proprietary upcycling process. This product serves as a viable substitute for calcium propionate in bakery applications, ensuring a similar flavor and texture while adhering to clean label standards.

Report Coverage

The clean label mold inhibitors market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, ingredient, end-user, and their futuristic growth opportunities.

Clean Label Mold Inhibitors Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1,132.96 Million |

|

Revenue forecast in 2032 |

USD 1,864.50 Million |

|

CAGR |

6.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Clean Label Mold Inhibitors Market report covering key segments are ingredient, end-user, and region.

Clean Label Mold Inhibitors Market Size Worth $1,864.50 Million By 2032

Clean Label Mold Inhibitors Market exhibiting the CAGR of 6.4% during the forecast period.

North America is leading the global market

key driving factors in Clean Label Mold Inhibitors Market are Increasing demand for clean label products is projected to spur the product demand