Commercial UAV (Unmanned Aerial Vehicle) Market Size, Share, Trends, & Industry Analysis Report

By Type (Fixed Wing, Rotary Blade, Hybrid), By Application, By End-Use, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 128

- Format: PDF

- Report ID: PM1074

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

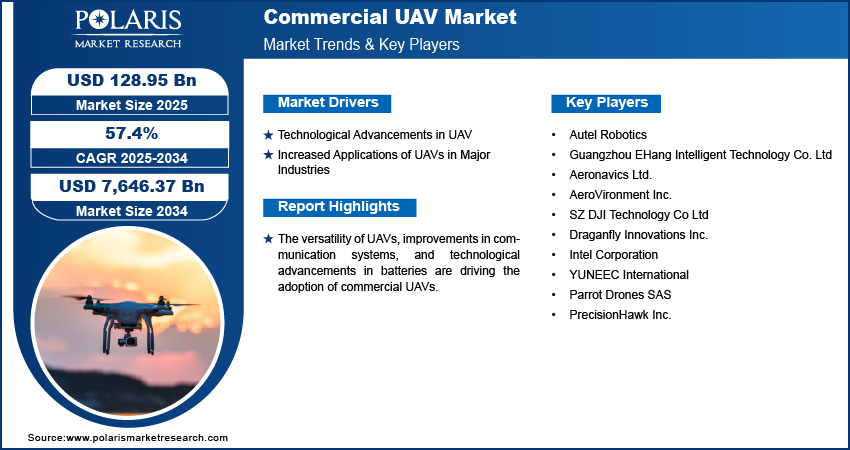

The commercial UAV market was valued at USD 82.00 billion in 2024 and is expected to reach USD 7,646.37 billion by 2034, exhibiting a CAGR of 57.4% from 2025 to 2034. The market is expanding due to growing adoption in agriculture, construction, surveillance, and delivery services. Enhanced drone technology, AI integration, and relaxed regulations are fueling demand. Enterprises are increasingly relying on UAVs for cost-effective operations and real-time data gathering. Commercial unmanned aerial vehicles (UAVs) are airborne vehicles that can fly autonomously. These aircraft make use of an embedded program for their operation or can be controlled remotely from the ground by a pilot. Some commercial drones are designed for specific tasks, whereas others can be used in professional settings and for general consumers. These drones have a diverse range of applications and are used across several industries, including agriculture, construction, public safety, and logistics.

-market.webp)

To Understand More About this Research: Request a Free Sample Report

The versatility of commercial UAVs to perform various functions, including aerial imaging, weather monitoring, traffic control, and green mapping, is driving their adoption. Additionally, improvements in communication systems and the advancement of battery technology contribute to their escalating demand. The increasing integration of emerging technologies such as artificial intelligence (AI) is anticipated to be the key commercial UAV market trend. The introduction of supportive policies by regulatory bodies worldwide to facilitate UAV operations is projected to unlock significant business opportunities and drive innovations in UAV applications during the forecast period.

Trends and Drivers

Technological Advancements in UAVs

Battery life improvements, enhanced sensor capabilities, artificial intelligence (AI) and machine learning (ML) integration, and other technological developments are anticipated to facilitate sophisticated and diverse UAV applications. With advancements in battery technology, batteries can store more energy without an increase in size or weight. This enables UAVs to fly for extended periods and perform tasks that weren’t previously possible due to battery life constraints. Also, the development of advanced sensors such as https://www.polarismarketresearch.com/industry-analysis/lidar-drone-marketLiDAR and multispectral sensors offers UAVs the ability to collect high-quality, accurate data. Besides, AI and ML integration enables the development of UAVs with enhanced features such as autonomous navigation, obstacle detection, and real-time data analysis. Thus, such technological advancements are expected to enhance the performance and usability of UAVs and drive the commercial UAV market expansion during the forecast period.

Increased Applications of UAVs in Major Industries

The applications of UAVs have expanded significantly across various industries over the past few years. They are being increasingly used in the construction and real estate sectors owing to their ability to carry out property surveys, provide real-time alerts, and improve safety on construction sites. Also, UAVs are particularly important for the inspection of locations that are difficult to access or located in contaminated surroundings. The use of UAVs has transformed telecommunication tower scrutiny as these airborne vehicles can carry out tower inspections cost-effectively and in less time. Besides, they can help improve the productivity of solar power plants by detecting hotspots on solar plates. For instance, the Lockheed Martin Indago quadrotor unmanned aerial system (UAS), which comes with quick deployment and long-endurance imaging capability, can be used for inspection near energy generation plants. Such industry applications of UAVs drive the commercial unmanned aerial vehicle market growth.

Segmental Insights

Insights by Type

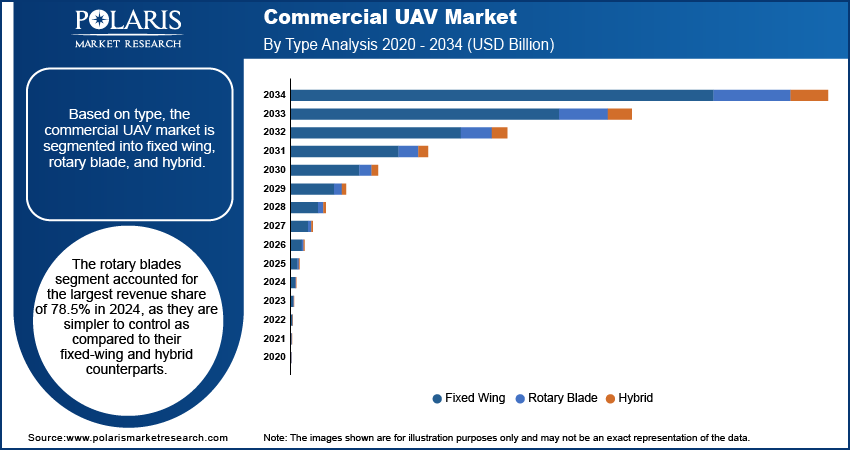

The commercial unmanned aerial vehicle market segmentation, based on type, includes fixed wing, rotary blade, and hybrid. The rotary blades segment accounted for the largest revenue share of 78.5% in 2024. Rotary blades UAVs, which include one to eight rotors to generate the required thrust, are easier to control as compared to their fixed-wing and hybrid counterparts. Also, they can hover and maneuver while maintaining a visual on a specific target for prolonged periods, making them a popular option for inspection tasks. Besides, the sensor stability and vertical takeoff and landing capabilities of rotary blade UAVs make them the apt choice for several professional uses, including photography, filmmaking, surveillance, and monitoring.

Insights by End-Use

The commercial UAV market, based on end-use, is segmented into agriculture, energy and public utilities, delivery & logistics, construction, media and entertainment, government, and others. The delivery & logistics segment is anticipated to register the highest CAGR from 2025 to 2034 owing to the expansion of the e-commerce sector across the globe. With the increased demand for quick delivery of goods, companies are increasingly exploring new methods, including UAVs, for product warehousing and delivery. Besides, warehouses worldwide are making significant investments to increase the adoption of automation. In that regard, UAVs find an important usage in operations, including inventory audit, cycle counting, and stock finding, that demand more person-hours.

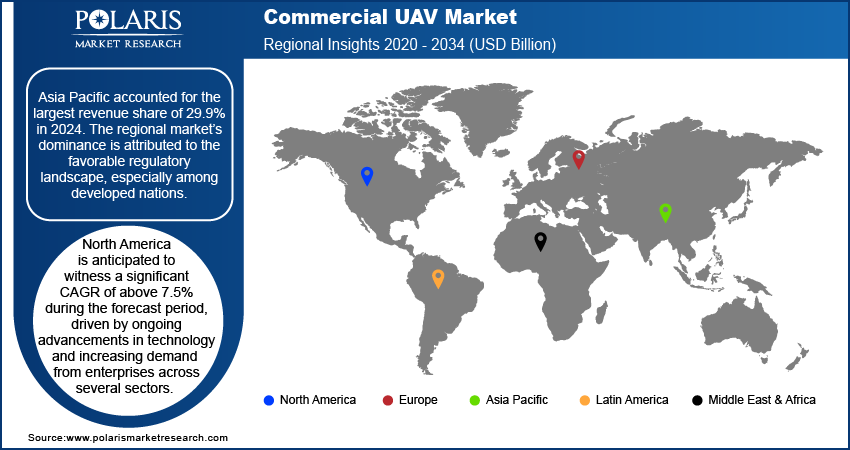

Regional Insights

Asia Pacific commercial UAV market accounted for the largest revenue share of 29.9% in 2024. The regional market’s dominance can be attributed to the favorable regulatory landscape, especially among developed nations. Various governments across the region are continually working on the development of new regulations for commercial drone applications. Also, several startups and small and medium-sized businesses in Asia Pacific are testing new applications and working on improving the safety of UAVs, impacting the regional market demand favorably.

North America commercial UAV market is anticipated to witness a significant CAGR of above 7.5% during the forecast period. The growth in the region is supported by ongoing advancements in technology, increasing demand from enterprises across several sectors, and the presence of favorable government policy and regulations. For instance, the Federal Administration Association (FAA) issued new regulations and guidelines for commercial UAV operations, including beyond-visual-line-of-sight (BVLOS) and remote identification. These guidelines are expected to reduce entry barriers and increase the usage of UAVs in the region.

Key Players and Competitive Insights

The leading industry players are emphasizing research and development to improve their products and services offerings and drive market demand. Besides, they are adopting several strategic initiatives, including collaborations, new product launches, and increased investments, to enhance their global footprint. To expand and survive in a more competitive environment, the market players must offer innovative solutions.

In recent years, the commercial UAV market has witnessed several technological and innovation breakthroughs, with key players seeking to provide advanced solutions that help meet sustainability goals. A few leading players in the industry include Autel Robotics, Guangzhou EHang Intelligent Technology Co. Ltd, Aeronavics Ltd., AeroVironment Inc., SZ DJI Technology Co Ltd, Draganfly Innovations Inc., Intel Corporation, YUNEEC International, Parrot Drones SAS, and PrecisionHawk Inc.

List of Key Players

- Autel Robotics

- Guangzhou EHang Intelligent Technology Co. Ltd

- Aeronavics Ltd.

- AeroVironment Inc.

- SZ DJI Technology Co Ltd

- Draganfly Innovations Inc.

- Intel Corporation

- YUNEEC International

- Parrot Drones SAS

- PrecisionHawk Inc.

Industry Developments

May 2023: Parrot and Tinamu announced a technology alliance for automated indoor monitoring solutions. According to Parrot, the new partnership will focus on incorporating Tinamu’s software capabilities into Parrot UAVs to offer advanced, completely automated robotic solutions.

November 2022: DJI announced the introduction of the Mavic 3, making its top-tier UAV more accessible. With the launch, DJI aims to provide creators with a fresh way to experience the impressive flight performance and outstanding Hasselblad camera of the Mavic 3 Series.

Commercial UAV Market Segmentation

By Type Outlook

- Fixed Wing

- Rotary Blade

- Hybrid

By Application Outlook

- Commercial

- Filming & Photography

- Inspection & Maintenance

- Mapping & Surveying

- Precision Agriculture

- Surveillance & Monitoring

- Others

- Government & Law Enforcement

- Firefighting & Disaster Management

- Search & Rescue

- Maritime Security

- Border Patrol

- Police Operations

- Traffic Monitoring

- Others

By End-Use Outlook

- Agriculture

- Energy and Public Utilities

- Delivery & Logistics

- Construction

- Media and Entertainment

- Government

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Commercial UAV Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 82.00 billion |

|

Market Size Value in 2025 |

USD 128.95 billion |

|

Revenue Forecast by 2034 |

USD 7,646.37 billion |

|

CAGR |

57.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The commercial UAV market size was valued at USD 82.00 billion in 2024 and is projected to grow to USD 7,646.37 billion by 2034.

The market is projected to register a CAGR of 57.4% from 2025 to 2032.

Asia Pacific accounted for the largest commercial UAV market share in 2024.

A few key players in the market are Autel Robotics, Guangzhou EHang Intelligent Technology Co. Ltd, Aeronavics Ltd., AeroVironment Inc., SZ DJI Technology Co Ltd, Draganfly Innovations Inc., Intel Corporation, YUNEEC International, Parrot Drones SAS, and PrecisionHawk Inc.

The rotary blade segment dominated the market in 2024.

The delivery & logistics segment is projected to witness the fastest growth during the forecast period.