Drip Irrigation Market Share, Size, Trends, Industry Analysis Report

By Component (Emitters/Drippers, Drip Tubes/Drip Lines, Pressure Pumps, Valves, Filters, Fittings & Accessories); By Crop Type; By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 118

- Format: PDF

- Report ID: PM2463

- Base Year: 2024

- Historical Data: 2020-2023

What is the Market Size of the Drip Irrigation Market?

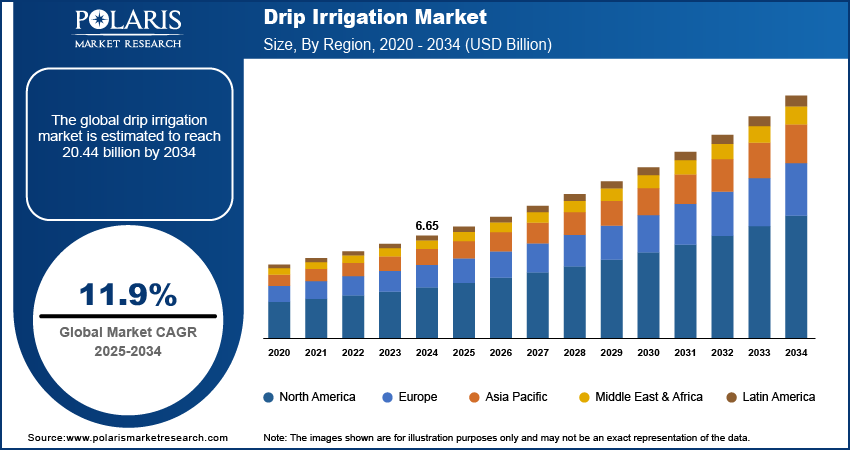

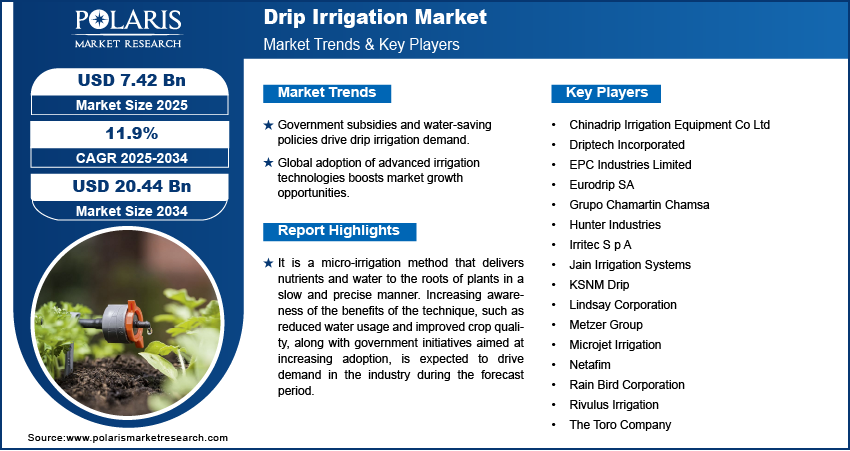

The global drip irrigation market was valued at USD 6.65 billion in 2024 and is expected to grow at a CAGR of 11.9% during the forecast period. Key factors driving the demand includes rising government initiatives and the increasing popularity of drip irrigation among crop growers.

Key Insights

- In 2024, the field crop segment dominated the global market. This is due to its numerous advantages, such as helping to increase profit percentages and requiring fewer fertilizers and water.

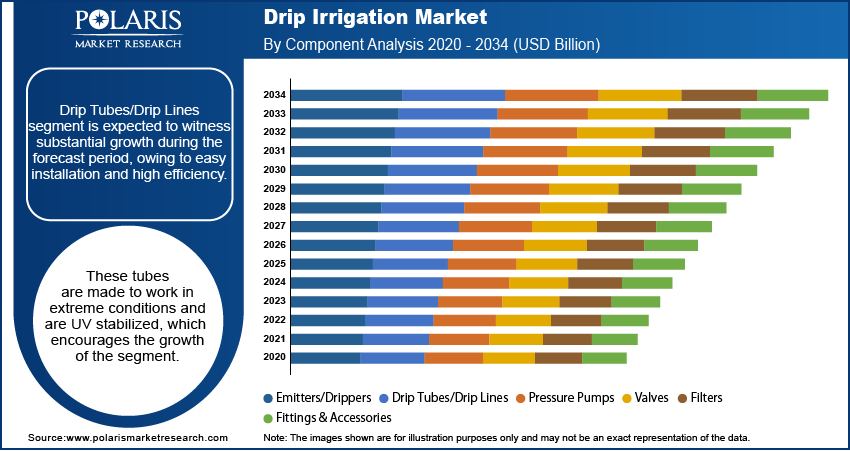

- The drip Tubes/Drip Lines segment is expected to witness substantial growth during the forecast period. This is due to easy installation and high efficiency.

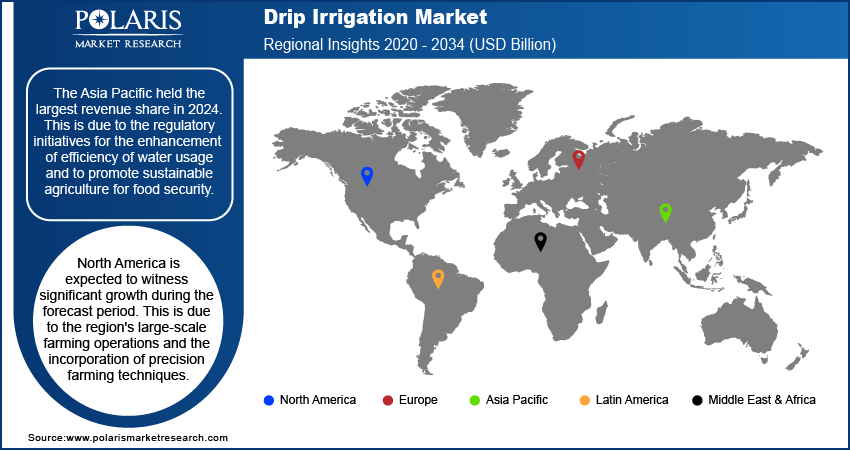

- The Asia Pacific held the largest revenue share in 2024. This is due to the regulatory initiatives for the enhancement of efficiency of water usage and to promote sustainable agriculture for food security.

- North America is expected to witness significant growth during the forecast period. This is due to the region's large-scale farming operations and the incorporation of precision farming techniques.

Industry Dynamics

- The popularity of these technologies in farmland and fields worldwide has boosted the growth opportunities, as these systems are used in landscapes and surroundings with unusual shapes.

- Subsidies and the promotion of water-saving policies by the government drive market growth, as these initiatives make drip irrigation systems more affordable.

- The installation of equipment requires high investments, which creates challenges for small-scale farmers.

- The demand for efficient irrigation systems creates growth opportunities to expand due to global water scarcity.

Market Statistics

- 2024 Market Size: USD 6.65 billion

- 2034 Projected Market Size: USD 20.44 billion

- CAGR (2025-2034): 11.9%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on Drip Irrigation Market

- Data analysis enables precision farming by delivering water whenever needed.

- Forecasting weather and soil data automates watering for perfect growth.

- Monitors leakage and clogs to instantly identify and locate issues.

- Water optimization and nutrient use for healthy and productive plants enhance crop yields and overall health.

What Does the Current Landscape Look for Drip Irrigation Industry?

It is a micro-irrigation method that delivers nutrients and water to the roots of plants in a slow and precise manner. Increasing awareness of the benefits of the technique, such as reduced water usage and improved crop quality, along with government initiatives aimed at increasing adoption, is expected to drive demand in the industry during the forecast period. It entails laying tubes with emitters next to the crops in the soil. The injectors gently trickle moisture into the surrounding soil. It is 90% effective in enabling crops to utilize the water delivered, contrasting with other methods, including sprinklers, which are approximately 65-75% effective. It also reduces waste and evaporation. It progressively delivers water to the bottom of the plant, where it is vitally required.

Industry Dynamics

Growth Drivers

How Increasing Popularity of Drip Irrigation Among Crop Growers is Driving the Market Expansion?

The popularity of these technologies in farmland and fields worldwide has remained at an all-time high due to the numerous benefits. Consequently, the industry worldwide has been growing at a similar rate, and this trend is likely to persist during the projection period. These systems are used in landscapes and surroundings with unusual shapes, as well as areas with irregular terrain or soil characteristics. Such methods are more adaptable, allowing farmers and gardeners to design a network as required. This often results in improved system performance.

Furthermore, a rise in awareness of these benefits, with the adoption of modern techniques, is expected to boost the expansion opportunities.

Report Segmentation

The market is primarily segmented based on component, crop type, application, and region.

|

By Component |

By Crop Type |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Segmental Insights

Crop Type Analysis

Why Crop Segment Dominated the Market in 2024?

In 2024, the field crop segment held the largest share of the global market, as it has many advantages, including increasing profit percentages as it requires less fertilizer and water. Additionally, with a growing population due to urbanization, farmers are now growing sugarcane and corn, which will further grow the segment during the forecast period. Drip systems can scale, allowing for the possibility of large monoculture farming of these staple crops, which again addresses the need for maximizing yield per hectare while saving an essential resource, water. The adoption of the irrigation method for field crops evolves from efficiency measures to a need for sustainable or profitable agriculture as the global demand for food becomes stronger. This trend is supported further by progressive agricultural policies fostering water-saving technology.

Component Analysis

What is the Reason Behind the Drip Tubes/Drip Lines Segment's Substantial Growth?

Drip Tubes/Drip Lines segment is expected to witness substantial growth during the forecast period, owing to easy installation and high efficiency. These tubes are made to work in extreme conditions and are UV stabilized, which encourages the growth of the segment. In addition, the flexibility of the drip tube designs allows for various field layouts and cropping designs, including orchards and row crops. The maintenance requirements of drip tubing are relatively low with long operational life, providing a clear cost management advantage to farming. Recent advances in manufacturing are also materializing more durable emitters that resist clogging, enabling greater reliability of the whole irrigation system. Here is the backdrop of practicality, durability, and value settings that quickly enhances their growth in the market.

Geographic Overview

Why Asia Pacific Held the Largest Revenue Share in 2024?

In 2024, the Asia Pacific held the largest revenue share. The increasing upgradation of technology, coupled with the rising adoption of micro-irrigation in emerging economies such as China and India, is expected to boost market demand throughout the forecast period. This growth is further boosted by the regulatory initiatives for the enhancement of efficiency of water usage and to promote sustainable agriculture for food security. The presence of large agricultural lands, combined with the rising need to address water scarcity, creates opportunities for expansion.

Furthermore, the regulatory effort to encourage such systems through subsidies, foreign investments, and low-interest rates boost the opportunities to expand. For instance, in August 2024, Jain Irrigation collaborated with the Central Potato Research Institute (CPRI) to launch the innovative Kufri FryoM potato variety. The aim is to revolutionize potato farming in India.

What are the factors for North America's Significant Growth?

North America is expected to witness significant growth during the forecast period. This is due to the progress of agriculture and increased environmental reasons. The region's operation of large-scale farming have benefited from the incorporation of precision farming techniques to optimize the use of resources and improve crop resilience. Regulatory support and subsidized transitions have helped adapt efficient water systems, providing technology to modern agricultural infrastructure. Furthermore, a more sophisticated production agriculture sector with a high degree of awareness and acceptance of high-end technology in irrigation methods has led to the adoption of advanced drip solutions. Therefore, the widespread incorporation of technology has led to an increased adoption of drip irrigation in prominent row crops and high-value agriculture.

Competitive Insight

Major market players operating in the global drip irrigation market include Chinadrip Irrigation Equipment Co., Ltd., Driptech Incorporated, EPC Industries Limited, Eurodrip S.A, Grupo Chamartin Chamsa, Hunter Industries, Irritec S. p. A, Jain Irrigation Systems, KSNM Drip, Lidsay Corporation, Metzer Group, Microjet Irrigation, Netafim, Rain Bird Corporation, Rivulus Irrigation, and The Toro Company. These players are adopting organic and inorganic tactics such as new product releases, collaborations & acquisitions, partnerships & mergers in order to increase their market presence and compete in the global market.

Industry Developments

November 2024: Netafim Italia acquired Tecnir S.r.l. The acquisition aims to improve precision irrigation, providing advanced and tailored solutions for Italian farmers.

July 2024: Rivulis and Phytech collaborated on sustainable farming, combining Rivulis’ global presence and leadership in micro-irrigation products and solutions with Phytech’s cutting-edge real-time plant health, hydraulic monitoring, and automation technology.

Drip Irrigation Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.65 Billion |

| Market size value in 2025 | USD 7.42 Billion |

|

Revenue forecast in 2034 |

USD 20.44 Billion |

|

CAGR |

11.9% from 2020 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Component, By Crop Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Chinadrip Irrigation Equipment Co., Ltd., Driptech Incorporated, EPC Industries Limited, Eurodrip S.A, Grupo Chamartin Chamsa, Hunter Industries, Irritec S. p. A, Jain Irrigation Systems, KSNM Drip, Lidsay Corporation, Metzer Group, Microjet Irrigation, Netafim, Rain Bird Corporation, Rivulus Irrigation, and The Toro Company. |

FAQ's

• The global market size was valued at USD 6.65 billion in 2024 and is projected to grow to USD 20.44 billion by 2034.

• The global market is projected to register a CAGR of 11.9% during the forecast period.

• Asia Pacific dominated the market in 2024.

• A few of the key players in the market are Chinadrip Irrigation Equipment Co., Ltd., Driptech Incorporated, EPC Industries Limited, Eurodrip S.A, Grupo Chamartin Chamsa, Hunter Industries, Irritec S. p. A, Jain Irrigation Systems, KSNM Drip, Lidsay Corporation, Metzer Group, Microjet Irrigation, Netafim, Rain Bird Corporation, Rivulus Irrigation, and The Toro Company.

• In 2024, the field crop segment dominated the global market.

• The drip Tubes/Drip Lines segment is expected to witness substantial growth during the forecast period.