Drone Simulator Market Share, Size, Trends, Industry Analysis Report

By Component (Hardware, Software); By System (Fixed, Portable); By Drone; By Application; By Device; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 117

- Format: PDF

- Report ID: PM2680

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

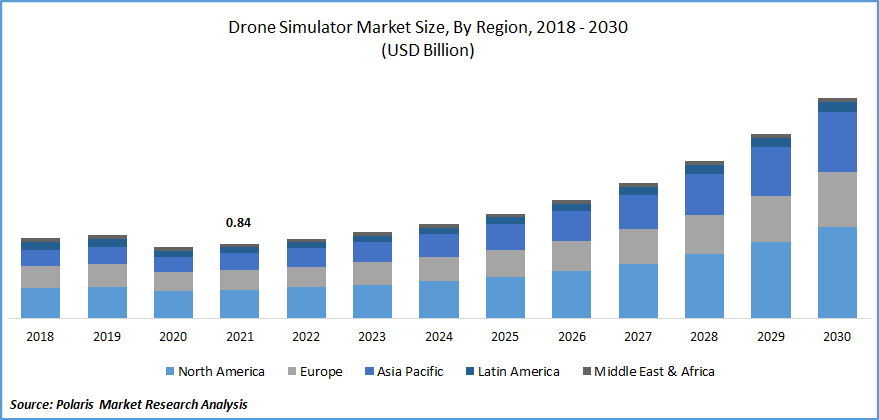

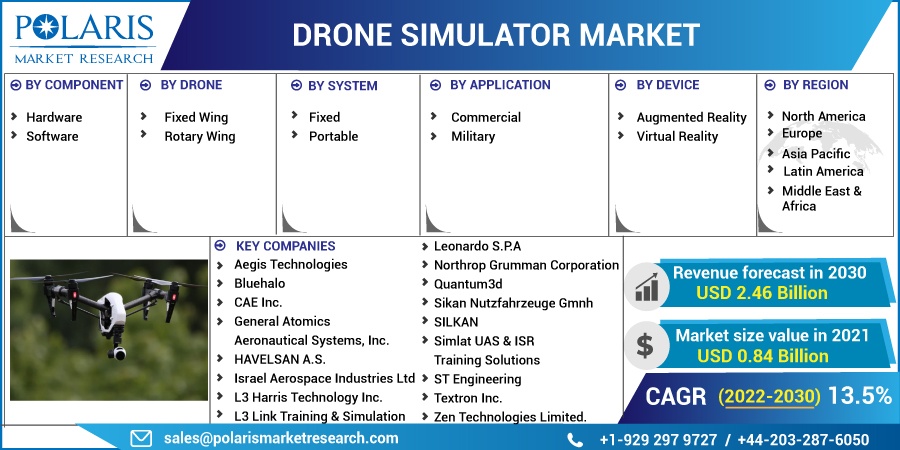

The global drone simulator market was valued at USD 0.84 billion in 2021 and is expected to grow at a CAGR of 13.5% during the forecast period. The growing demand for drone simulator market is expected to be driven by the increasing R&D expenditure for military simulations and the rising demand for unmanned aerial vehicles (UAV) in the commercial and military sectors.

Know more about this report: Request for sample pages

Simulation-based training is replacing the conventional way of training special commanders and pilots as they enhance their experience and polish their skills through virtual reality. Many defense forces and flight schools have switched to simulation-based training as they offer different scenarios imitating real-world combat and allow the trainee to gain expertise in various real-life scenarios, which is expected to positively influence the simulator market growth.

The COVID-19 pandemic had a negative impact on the growth of the drone simulator market. The negligible operation has ceased production, resulting in a shortage of products required to make drones, which haltered the industry market during the Covid-19 period. Moreover, many flight centers were shut down owing to the global pandemic, which resulted in a decrease in skilled pilots, impacting the delayed delivery of simulators; such factors haltered the market growth.

Technological advancement to develop new and innovative UAVs has increased the demand for simulators, but these simulators, when connected with various software and hardware, raise the final price of the drone, which is expected to restrict the UAV market growth. Moreover, fewer training institutes to provide simulation-based training has resulted in a lack of trained professionals is a major reason for restraining the industry growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rapid advancement in simulator technology has led to the development of its components, such as sensors, navigation, high-quality camera, and control increase which has created a huge demand in the commercial & civil, military & defense sectors. In addition, the growing demand in the agriculture sector for mapping lands, in the mining industry to create 3-D maps to improve accuracy as well as in the oil & gas industry for inspection of oil spills and gas emissions are some of the factors influencing the growth of UAV which is likely to complement the UAV simulator market growth.

The rising investment in the development of artificial intelligence to gather and utilize visual and environmental data to increase accessibility and make operations easier is expected to drive UAV simulator market growth. Moreover, the growing demand for virtual reality in training programs and drone racing is also a significant factor supporting the UAV simulator market growth.

Report Segmentation

The market is primarily segmented based on component, drone, system, application, device, and region.

|

By Component |

By Drone |

By System |

By Application |

By Device |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

Software segment accounted for the largest share in 2021

The software segment accounted for the highest revenue share in 2021 owing to its programs which imitates the UAV flying experience and enact real-life condition which is essential to train military pilots or civilian. For instance, Microsoft partnered with Ansys and MathWorks and launched an AI-based simulation software Project AirSim where the platform offers customers to create 3-D environments according to their specific location; such factors are influencing the segment growth.

The simulator is a replica of an actual training system, and with technological advancement in sensor, GPS navigation, 360-degree view, and several flight modes enhance simulation to create a real-life environment that is used to train commanders and commercial pilots, which complements the UAV simulator market growth over the forecast period.

Fixed wing is expected to witness the highest growth

The demand for the fixed wing is driven by the rising demand from the military and defense industry. The growing demand for this type is due to the ability to cover a large distance and higher altitudes in a single flight which is the requirement of many armed forces. In addition, these drones continue flying and land safely even after complete power loss; such ability to recover quickly increases its demand in the defense sector, which is likely to complement UAV simulator market growth.

Moreover, extensive use of these drones in the military due to their high payload capabilities and their ability to withstand weather conditions is also a significant factor contributing to the segment growth.

Portable system is expected to witness faster growth

The demand for portable systems is expected to see a significant surge over the forecast period owing to the several commercial applications such as filmmaking, mapping & surveying, firefighting, and many more. In addition, the rising demand for aerial mapping, police surveillance, and emergency response due to its cost-effectiveness is expected to drive market growth.

Military segment is expected to account for the largest share

The military segment is expected to dominate the market over the forecast period, led by inexpensive drone simulators for training the air force, pilots, and operators. The growing adoption of military simulators is due to high-quality graphics and immersive training environments to gain experience and face challenges in a real field.

Moreover, the rising investments of defense agencies for long endurance and the unmanned aerial vehicle is likely to have a positive impact on the revenue growth over the forecast period.

Augmented reality is expected to spreadhead the revenue growth

Augmented reality (AR) devices are expected to dominate the market over the forecast period owing to their affordability and application in many end-use industries. AR offers high resolution and screen frames with quick system response, which helps commercial pilots to remember emergency checklists during flight. The AR simulators are extensively used for military training as actual vehicles, tanks, and equipment are expensive and involve risk; the scalability of AR influences segment growth.

Asia Pacific is expected to witness the fastest growth over the forecast period

Asia Pacific is expected to witness fastest CAGR growth over the forecast period owing to increasing military expenditure and rising R&D investment in drone technology to meet current and future requirements. In addition, several companies have collaborated to develop drones with artificial intelligence and machine learning which is helpful in many end-use industries; such factors are expected to drive demand over the forecast period.

Competitive Insight

Some of the major players operating in the global drone simulator market include Aegis Technologies, Bluehalo, CAE Inc., General Atomics Aeronautical Systems, Inc., HAVELSAN A.S., Israel Aerospace Industries Ltd, L3 Harris Technology Inc., L3 Link Training & Simulation, Leonardo S.P.A, Northrop Grumman Corporation, Quantum3d, Sikan Nutzfahrzeuge GmbH, SILKAN, Simlat UAS & ISR Training Solutions, Singapore Technologies Electronic Limited, ST Engineering, Textron Inc., and Zen Technologies Limited.

Recent Developments

In July 2021, Indra developed a multi-purpose and inter-operable virtual-based simulation system to train military pilots and prepare them for higher-risk flights which require half time than the original training.

In June 2020, Israel Aerospace Industries collaborated with Iron drone to develop intercepting drones that could be launched simultaneously to target several swarms during day and night.

Drone Simulator Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 0.89 billion |

|

Revenue forecast in 2030 |

USD 2.46 million |

|

CAGR |

13.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Drone, By System, By Application, By Device, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Aegis Technologies, Bluehalo, CAE Inc., General Atomics Aeronautical Systems, Inc., HAVELSAN A.S., Israel Aerospace Industries Ltd, L3 Harris Technology Inc., L3 Link Training & Simulation, Leonardo S.P.A, Northrop Grumman Corporation, Quantum3d, Sikan Nutzfahrzeuge Gmnh, SILKAN, Simlat UAS & ISR Training Solutions, Singapore Technologies Electronic Limited, ST Engineering, Textron Inc., And Zen Technologies Limited. |