Drug Testing Market Share, Size, Trends, Industry Analysis Report

By Drug Type; By Sample Type; By Product (Consumables, Instruments, Rapid Testing Devices, Services); By End-Use; By Region; Segment Forecast, 2021 - 2028

- Published Date:Sep-2021

- Pages: 120

- Format: PDF

- Report ID: PM1970

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

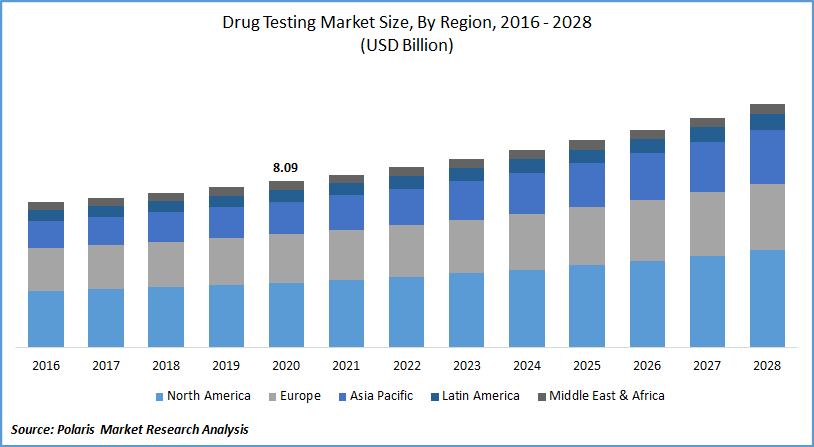

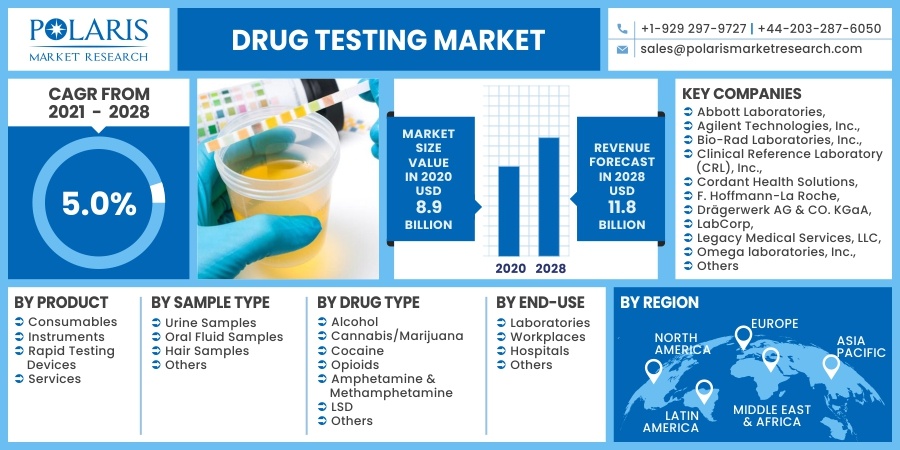

The global drug testing market was valued at USD 8.09 billion in 2020 and is expected to grow at a CAGR of 5.0% during the forecast period. Upsurge in the prevalence of drug addiction and the consumption of illicit medicines has led to the necessity for screening, driving up the demand for the global market. Growing initiatives to combat drug abuse, strict regulations by government agencies, and the advent of advanced tests will further drive market growth.

The research report offers a quantitative and qualitative analysis of the drug testing market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

There is a rapid rise in the number of people consuming illicit medicines and alcohol across the globe. Approximately 270 million people use some form of illegal drug globally, and nearly 35 million people suffer from drug use disorders. 21 million people indulge in drug abuse. Only a few receive treatments in the U.S.

Opioid doses, which are responsible for 33% of drug-related deaths, are used by 53 million people globally. Alcohol consumption is also growing globally, with approximately 2.3 billion people using it currently, and 107 million humans are suffering from alcohol use disorder. All these factors will cumulatively contribute to the growth of the global market.

COVID-19 pandemic is expected to positively influence the growth of the global market due to the economic slowdown and loss of employment due to lockdown imposed in many countries has negatively impacted many people's mental health, and many of them are involved in drug abuse. This will result in the need for more testing for the proper treatment of these people.

Industry Dynamics

Growth Drivers

The global market growth is driven by factors such as the growing number of people consuming illicit drugs and alcohol and technological advancements in testing solutions. The stringent regulation imposed by governments in most parts of the world is expected further to propel the market's growth over the projected period.

Many sporting organizations worldwide have strict regulations on drug abuse since many sportspeople take illicit drugs to enhance their performance. Hence many sporting organizations such as the International Olympic Committee (IOC), International sports federation (ISF), and other major sporting bodies have introduced mandatory drug testing for participants before taking part in the sporting event which in turn is expected to boost the growth of the global market.

Many new drug testing products have been launched in recent years, and many are in the developmental stage. For instance, 908 Devices launched a new software update for MX908 in late 2018 that will have a new mission mode feature known as Drug Hunter, including a wide range of opioids, fentanyl, and amphetamines.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented on the basis of product, sample type, drug type, end-use, and region.

|

By Product |

By Sample Type |

By Drug Type |

By End-use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

The consumables segment dominated the market and generated the highest revenue in 2020, owing to the recent surge of consumables for testing. The rising introduction of innovative consumables that offer enhanced solutions to make testing simple, precise, and speedy will further boost the segment's growth.

The services segment occupied the second-highest share in terms of revenue in 2020. The segment's growth has been fueled by an increase in strategic activities made by many companies, such as collaborations, acquisitions, and partnerships, to aid the safety of the public and government agencies.

Insight by Sample Type

The urine sample testing segment generated the highest revenue in 2020 and is expected to maintain its share during the forecast timeframe since it is the most often utilized sample type to detect the presence of illicit substances. The lower cost of urine sample testing, the availability of significant sample volume, the presence of greater concentrations of illicit medicines or metabolites, and the obtainability of point-of-care diagnostics will further drive segment growth.

Insight by Drug type

The cannabis/marijuana testing segment dominated the market and generated the highest revenue in 2020 since it is the most used illicit substance in significant markets, thus resulting in a greater need for its testing kits and testing devices.

According to National Survey on Drug Use and Health (NSDUH), marijuana was the most widely used illicit substance in the U.S., with 43.5 million users. The opioids segment occupied the second largest revenue in 2020 due to the increased opioid crises in significant markets, including North America, and novel testing methods.

Geographic Overview

North America testing is expected to be the most significant region for the global market owing to the availability of advanced testing devices in the countries such as the U.S. Furthermore, the increasing approval for new drug abuse screening devices along with funding to develop new devices is anticipated to propel the growth of the market in this region. The presence of significant players undertaking comprehensive growth strategies and supportive reimbursement policies will further fuel the growth of the testing market over the forecast period.

Asia Pacific testing is expected to be the fastest-growing region for the global market during the forecast period due to the increasing number of alcohol users in countries like China and India. China is anticipated to overtake the U.S. for per capita alcohol intake by 2030, and in India, more than 22 million people use opioids. All these factors augment the growth of this testing market in the region.

Competitive Insight

Key players functioning in the drug testing market are investing in research and development to introduce new innovative products in the market. Companies are also involved in raising funds, acquisitions, and collaborations to increase their global presence in the industry.

Some of the major players functioning in the drug testing market include Abbott Laboratories, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Clinical Reference Laboratory (CRL), Inc., Cordant Health Solutions, F. Hoffmann-La Roche, Drägerwerk AG & CO. KGaA, LabCorp, Legacy Medical Services, LLC, Omega laboratories, Inc., Quest Diagnostics Incorporated, Quidel Corporation, Siemens Healthineers, and Thermo Fisher Scientific, Inc.

Drug Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 8.9 billion |

|

Revenue forecast in 2028 |

USD 11.8 billion |

|

CAGR |

5.0% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Product Type, By Sample Type, By Drug Type, By End-Use, By Region |

|

Regional scope |

North America Europe Asia Pacific Latin America; Middle East & Africa |

|

Key Companies |

Abbott Laboratories, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Clinical Reference Laboratory (CRL), Inc., Cordant Health Solutions, F. Hoffmann-La Roche, Drägerwerk AG & CO. KGaA, LabCorp, Legacy Medical Services, LLC, Omega laboratories, Inc., Quest Diagnostics Incorporated, Quidel Corporation, Siemens Healthineers, and Thermo Fisher Scientific, Inc. |

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.