EdTech and Smart Classroom Market Share, Size, Trends, Industry Analysis Report

By Hardware (Interactive Projectors, Interactive Displays, Others); By Education System; By Technology; By End-Use; By Region; Segment Forecast, 2025- 2034

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM2070

- Base Year: 2024

- Historical Data: 2020 - 2023

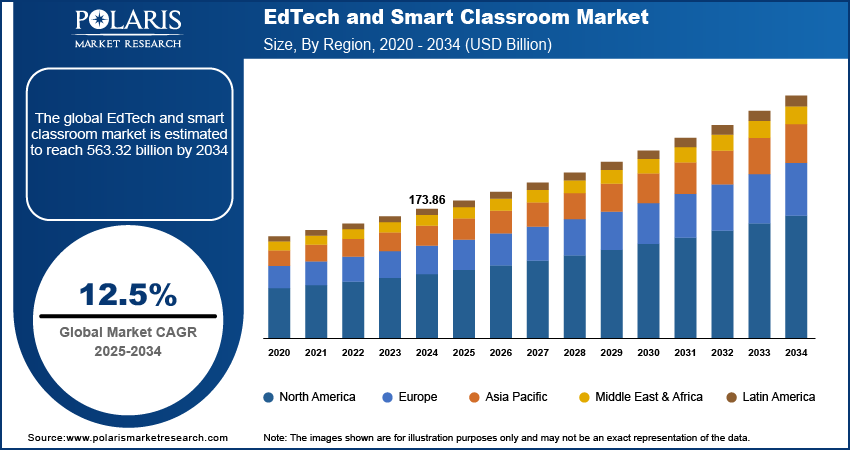

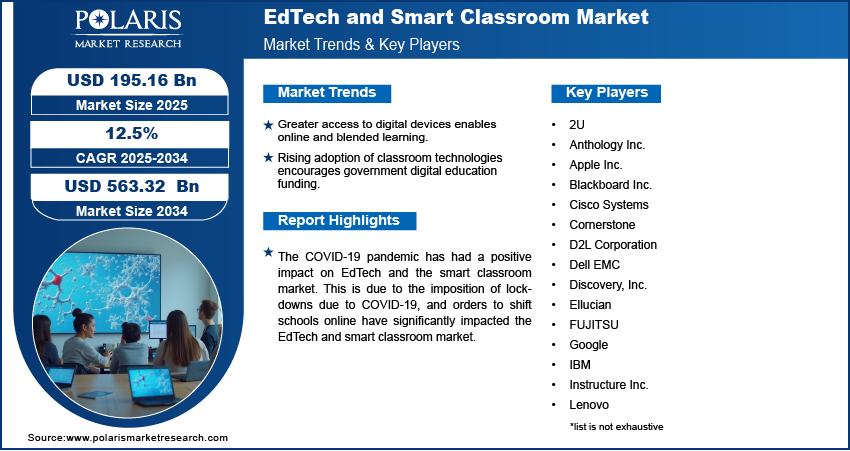

The global EdTech and smart classroom market was valued at USD 173.86 billion in 2024 and is expected to grow at a CAGR of 12.5% during the forecast period. The rapid rise in digitalization in the education industry and the rising proliferation of e-learning solutions are significant factors driving the market demand for EdTech and the smart classroom market. Increasing public-private initiatives promoting online education throughout the world, along with increased availability of online courses by top education institutes, are also accelerating the growth of the global market of EdTech and smart classrooms.

Key Insights

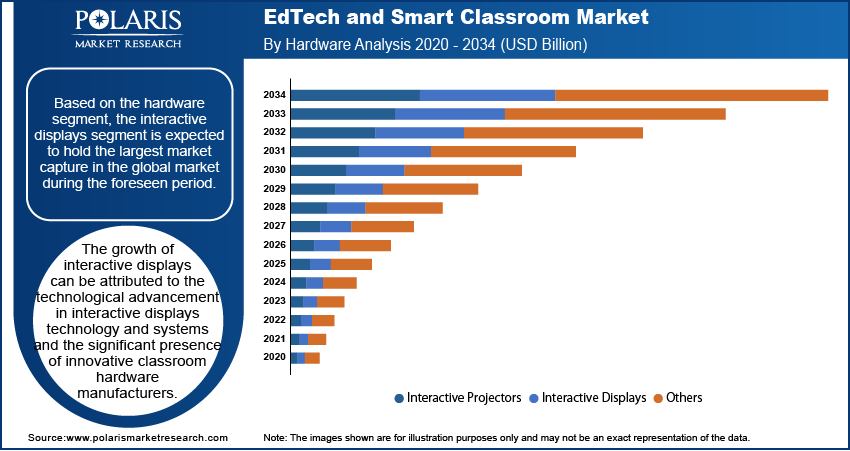

- In hardware, the interactive displays segment held the largest share in 2024. They include interactive flat panels and whiteboards, which are integral components of the contemporary smart classroom.

- By the education system, the learning management system subsystem held the largest share in 2024. This is encouraged by the increased demand for platforms that can offer content, delivery of the content, evaluation, and especially during the rise of online and blended learning.

- By technology, gamification held the largest share in 2024 as it promotes the deep learning of the content by the students.

- By end use, the K-12 segment held the largest share in 2024. This is due to the increased usage of digital learning by teachers and students in kindergarten through 12th grade, which is aimed at equipping students for the future and the march towards a more digital world.

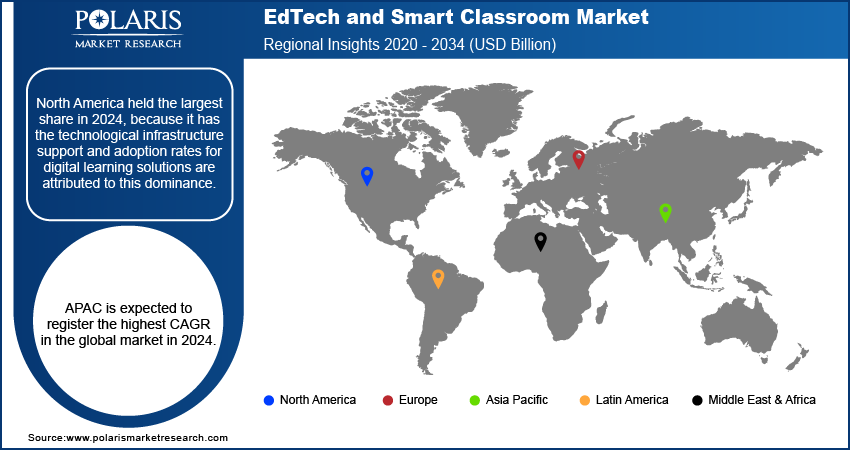

- By region, North America held the largest share in 2024, because it has the technological infrastructure support and adoption rates for digital learning solutions are attributed to this dominance.

Industry Dynamics

- There is an increased access to digital devices, such as smart tablets and smartphones, which has led to increased access to the internet. As a result, this allows for an easier shift towards an online or blended learning system.

- Because of the increased rate of adoption of modern classroom technologies, governments are now more focused on funding digital education projects and improving the technological access available to schools.

- A large number of students are also curious about the new forms of artificial intelligence, virtual reality, and augmented reality. These students are interested in capturing the flag scale learning.

Market Statistics

- 2024 Market Size: USD 173.86 billion

- 2034 Projected Market Size: USD 563.32 billion

- CAGR (2025-2034): 12.5%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on the Market

- Self-paced learning plans are tailored to individual learners with the help of Artificial Intelligence (AI). AI set personalized targets along with content and exercises that match specific needs based on performance data.

- AI may takes over teachers’ tasks that are considered to be more routine, such as assigning grades and tests, preparing lesson plans, and other clerical tasks.

- Access to education has been enhanced due to the introduction of artificial intelligence. AI-based tools can provide features like real-time translation to help those with limited language proficiency.

However, the security concern and data privacy issues related to intelligent schoolrooms and EdTech due to the growing cybercrime incidents are expected to restrain the market growth of EdTech and smart schoolroom. Apart from this, the integration of smart technologies, such as artificial intelligence (AI) and machine learning (ML), in online learning models is expected to create significant growth opportunities in the EdTech and smart classroom market over the forecast period.

The COVID-19 pandemic has had a positive impact on EdTech and the smart classroom market. This is due to the imposition of lockdowns due to COVID-19, and orders to shift schools online have significantly impacted the EdTech and smart classroom market. Digital education is the only effective mode of learning amidst the pandemic, and thus, many schools and institutes are moving towards EdTech education. The Jordon School District Board of Education also opted to move six schools online in November 2020 due to the ongoing spread of the COVID-19.

Similarly, in November 2020, the School District of Lancaster also decided to reintroduce online learning and EdTech for elementary schools following a month of its reopening of the traditional classrooms, owing to the surge in COVID-19 cases. This, in turn, is projected to result in the high proliferation of EdTech and smart classrooms as an alternative to conventional education, leading to market growth of EdTech and smart classrooms in recent years.

Industry Dynamics

Growth Drivers

In the current scenario, EdTech and smart classroom is gaining significant prominence worldwide. It typically enhances the learning and teaching process to identify the academic paths and educate the students about the present and future learning opportunities. Growing digitalization in the education sector, coupled with the rise in implementation of connected and smart devices in e-learning, is the significant force that escalates the market demand for the market. Digital education and smart classrooms are also generating new learning opportunities for students' engagement through the online digital environment, boosting the overall quality of education.

In July 2020, Vasta Platform, a Brazilian K-12 EdTech firm, funded more than USD 300 million to provide digital content and administrative technologies, with a customer base that includes 4,100 private schools and more than 1.5 million student accounts across the country. Therefore, the EdTech and smart classroom has observed a significant rise in adoption due to improving the quality of education over the foreseen period.

Additionally, the rise in public-private initiatives promoting online education throughout the world is also driving the growth of the global EdTech and smart classroom market. Nowadays, online learning is also considered a productive alternative to conventional classroom-based education, and therefore, expanding the investment in digital tools from educational institutions. This has also turned the government's focus towards e-learning solutions into the mainstream by framing a policy to include EdTech platforms and certifying curriculums.

Report Segmentation

The market is primarily segmented on the basis of hardware, education system, technology, end-use, and region.

|

By Hardware |

By Education System |

By Technology |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Hardware

Based on the hardware segment, the interactive displays segment is expected to hold the largest market capture in the global market during the foreseen period. The growth of interactive displays can be attributed to the technological advancement in interactive displays technology and systems and the significant presence of innovative classroom hardware manufacturers. Further, the considerable presence of an interactive display can influence learning in many ways as it typically serves to increase the level of learner engagement, encourage students, and promote enthusiasm for learning.

Moreover, most hardware manufacturers have been stepping up in the business of offering interactive display hardware, which facilitates companies to relocate the technology and develop the hardware accordingly. For instance, in August 2021, Singer unveiled a new all-in-one interactive flat panel smartboard that incorporates the feature of TV, projector, computer, and whiteboard.

On the contrary, the interactive projector is expected to be the second-leading segment in the EdTech and smart classroom market, and hence, is witnessing considerable growth throughout the world. An interactive projector is the most ideal solution for classroom and collaborative office meetings.

Insight by End-Use

In 2024, the K-12 segment held the largest revenue in the global market, owing to the extensive implementation of digital education software in education institutes because of the proliferation of digitalization in teaching processes.

Further, EdTech and smart classroom is gaining wide popularity in the K-12 on the back of technological breakthrough in learning and teaching in several countries for better engagement among students and teachers, along with the growing transformation of the conventional education practices. This, in turn, is expected to gain a significant profit share that accelerates the growth of the global market of EdTech and smart classrooms.

Geographic Overview

Geographically, North America leads the global market in 2024 and is estimated for the largest share in revenue due to the surge in trend and popularity of online education and the rising inclination towards digital technologies in the education sector. Additionally, the increasing availability of various online courses and programs offered by schools, colleges, and universities fuels the growth of EdTech and the smart classroom market in the region.

As a result, in May 2020, IBM Corp. has unveiled a new free digital education platform, namely Open P-Tech, which highly emphasized workplace learning and digital skills. This platform equips 14-20 years old learners and educators with foundational technology competencies. Such initiative undertaken by the market vendors in the key countries of the particular region is expected to bolster the region's EdTech and smart schoolroom growth.

Moreover, APAC is expected to register the highest CAGR in the global market in 2024. The market demand for EdTech and smart classrooms in the region is attributed to an increase over the study period, owing to the extensive implementation of EdTech solutions to identify the power of sophisticated learning methodologies and the growing usage of e-learning content in the region. Moreover, government-led initiatives and public-private partnerships are constantly growing in both rural and urban areas are also projected to contribute to the region's EdTech and smart classroom growth.

Which country accounted for the largest share in the Asia Pacific edtech and smart classroom market in 2014?

India held the largest market revenue share in 2024. Rising investment in the education sector and growing penetration of 4G and 5G network across the country boost the industry growth. Further, the increasing disposable income of the aspirational middle-class population propels the demand for personalized learning, exam preparation support, and access to global standards. This factor contributes to the need for digital tutoring, study materials, and test prep platforms. In the past few years, the Indian government has been investing a significant amount in Edtech and smart classroom development. Various initiatives, such as Samagra Shiksha Abhiyan, school transformation efforts, and CSR-funded programs, introduced smart classrooms in the country. The following table provides details on the schools with smart classrooms with digital devices.

|

Sl. No. |

India/State/UT |

Percentage of Schools with Functional Smart Classrooms with Digital Boards/Smart Boards/Virtual Classrooms/Smart TV Availability |

||||

|

All Management |

Government |

Government Aided |

Private Unaided |

Others |

||

|

India |

India |

20.8 |

17.2 |

27.9 |

31.9 |

9.7 |

|

1 |

Andaman and Nicobar Islands |

44.2 |

44.2 |

50 |

44.3 |

0 |

|

2 |

Andhra Pradesh |

38.9 |

34 |

14.8 |

55.9 |

18.5 |

|

3 |

Arunachal Pradesh |

17.9 |

13.2 |

42.3 |

41.4 |

21.3 |

|

4 |

Assam |

4.7 |

4.5 |

0.5 |

12.7 |

0.2 |

|

5 |

Bihar |

10.3 |

7.1 |

7.9 |

33.8 |

17.9 |

|

6 |

Chandigarh |

83 |

84.9 |

100 |

85.7 |

63 |

|

7 |

Chhattisgarh |

16.6 |

15.6 |

7.5 |

24.3 |

1.5 |

|

8 |

Dadra and Nagar Haveli and Daman and Diu |

57.5 |

56.3 |

87.5 |

61.9 |

0 |

|

9 |

Delhi |

59.7 |

53.8 |

30.6 |

68.6 |

0 |

|

10 |

Goa |

21.1 |

6.7 |

36.6 |

42.1 |

0 |

|

11 |

Gujarat |

55.1 |

54.7 |

57.8 |

55.1 |

66.7 |

|

12 |

Haryana |

40.5 |

30.6 |

33.3 |

57.8 |

39 |

|

13 |

Himachal Pradesh |

22.7 |

18.6 |

0 |

47 |

0 |

|

14 |

Jammu and Kashmir |

12.3 |

8.7 |

0 |

24.7 |

8.2 |

|

15 |

Jharkhand |

9 |

6.2 |

6.7 |

41.4 |

18 |

|

16 |

Karnataka |

18.4 |

11.1 |

17.6 |

37.5 |

10 |

|

17 |

Kerala |

54.9 |

59.6 |

48.3 |

68.4 |

34.7 |

|

18 |

Ladakh |

22.6 |

20.9 |

3.7 |

39.6 |

0 |

|

19 |

Lakshadweep |

51.4 |

51.4 |

0 |

0 |

0 |

|

20 |

Madhya Pradesh |

15.3 |

9.3 |

12.7 |

35.6 |

7.7 |

|

21 |

Maharashtra |

56.3 |

62 |

43 |

53.8 |

40.5 |

|

22 |

Manipur |

11 |

3.2 |

0.9 |

39.4 |

14.3 |

|

23 |

Meghalaya |

3.2 |

0.9 |

5.4 |

6.8 |

6.4 |

|

24 |

Mizoram |

3.6 |

2.3 |

4.3 |

6.6 |

4.2 |

|

25 |

Nagaland |

26.2 |

24.7 |

0 |

30.2 |

100 |

|

26 |

Odisha |

21.7 |

19.7 |

31.5 |

29 |

21 |

|

27 |

Puducherry |

57.2 |

50.7 |

66.7 |

66.1 |

0 |

|

28 |

Punjab |

74.5 |

84.5 |

24.4 |

53 |

7.1 |

|

29 |

Rajasthan |

14.8 |

9.6 |

0 |

26 |

3.3 |

|

30 |

Sikkim |

38.1 |

40.7 |

27.8 |

32.3 |

0 |

|

31 |

Tamil Nadu |

7.9 |

1 |

0 |

35 |

0.8 |

|

32 |

Telangana |

19.3 |

12 |

12.5 |

38.8 |

2 |

|

33 |

Tripura |

6.8 |

5.2 |

14 |

25.9 |

3.5 |

|

34 |

Uttar Pradesh |

11 |

8.2 |

15.6 |

16.2 |

2.4 |

|

35 |

Uttarakhand |

21.2 |

18.3 |

17 |

32.4 |

5.4 |

|

36 |

West Bengal |

3.8 |

2.8 |

21.5 |

12.2 |

8.8 |

Source: Open Government Data (OGD) Platform India

The table shows that a few states have schools with few or no smart classroom installations. However, governments and private educational organizations are taking efforts and investing in providing access to digitalized education to every child, regardless of the location. Such initiatives are expected to fuel the adoption of edtech and smart classrooms in the country during the forecast period.

Competitive Insight

Some of the major market players operating in the global market of EdTech and smart classrooms include 2U, Anthology Inc., Apple Inc., Blackboard Inc., Cisco Systems, Cornerstone, D2L Corporation, Dell EMC, Discovery, Inc., Ellucian, FUJITSU, Google, IBM, Instructure Inc., Lenovo, Microsoft Corporation, Oracle Corporation, PROMETHEAN LIMITED, SAP SE, Smart Technologies ULC and Workday Inc.

Industry Dynamics

In June 2025, Google Cloud and Pearson announced a multi-year strategic partnership to leverage Google’s advanced AI models, including Gemini and LearnLM, to transform education.

In October 2024, Anthology partnered with Obrizum to integrate advanced AI and analytics into the Blackboard Learning Management System. This collaboration is designed to provide hyper-personalized and adaptive learning experiences for millions of users.

EdTech and Smart Classroom Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 173.86 billion |

| Market size value in 2025 | USD 195.16 billion |

|

Revenue forecast in 2034 |

USD 563.32 billion |

|

CAGR |

12.5% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Hardware, By Education System, By Technology, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

2U, Anthology Inc., Apple Inc., Blackboard Inc., Cisco Systems, Cornerstone, D2L Corporation, Dell EMC, Discovery, Inc., Ellucian, FUJITSU, Google, IBM, Instructure Inc., Lenovo, Microsoft Corporation, Oracle Corporation, PROMETHEAN LIMITED, SAP SE, Smart Technologies ULC and Workday Inc. |

FAQ's

? The global market size was valued at USD 173.86 million in 2024 and is projected to grow to USD 563.32 million by 2034.

? The global market is projected to register a CAGR of 12.5% during the forecast period.

? North America dominated the share in 2024.

? A few key players include 2U, Anthology Inc., Apple Inc., Blackboard Inc., Cisco Systems, Cornerstone, D2L Corporation, Dell EMC, Discovery, Inc., Ellucian, FUJITSU, Google, IBM, Instructure Inc., Lenovo, Microsoft Corporation, Oracle Corporation, PROMETHEAN LIMITED, SAP SE, Smart Technologies ULC and Workday Inc.

? The K-12 segment accounted for the largest share of the market in 2024.

? The gamification segment dominated the market in 2024.