Electronic Weighing Machines Market Share, Size, Trends, Industry Analysis Report

By Type (Laboratory Scale, Gem & Jewelry Scale, Retail Scale, Health Scale, Kitchen Scale, Others), By Distribution Channel; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 132

- Format: PDF

- Report ID: PM2052

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

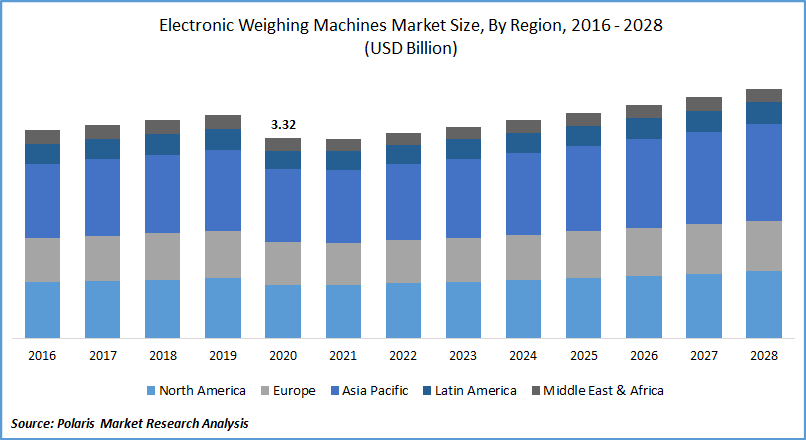

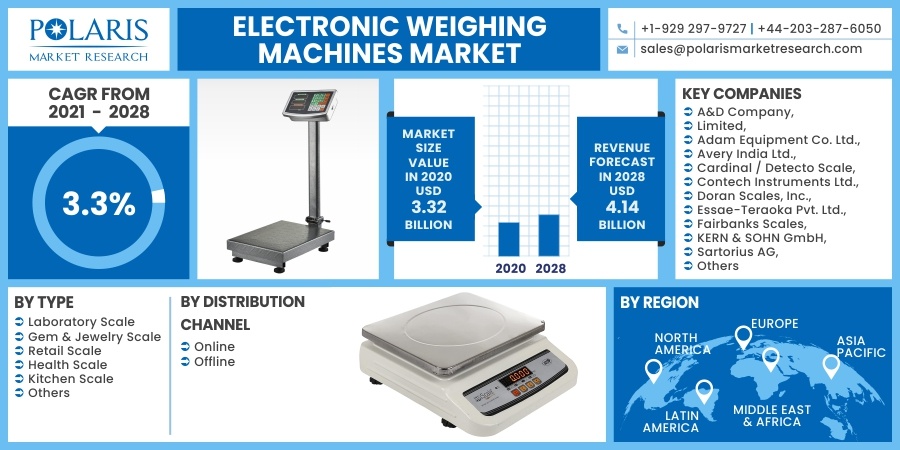

The global electronic weighing machines market was valued at USD 3.32 billion in 2020 and is expected to grow at a CAGR of 3.3% during the forecast period. The growth of the electronic weighing machines industry is attributed to the growing demand for the electronic weighing machine from the retail sector, surging demand from the commercial & residential sector, and favorable initiatives such as product launch & acquisition taken by market players.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The electronic weighing machines market comprise various properties & advantages, including flexibility in measuring multiple loads, compact size, precision, and efficient delivery of online processing. Therefore, electronic weighing machines are gaining potential demand from the retail sector, E-commerce market, along jewelry outlets. The abrupt outbreak of COVID-19 has wreaked havoc on the electronic weighing machine business, affecting a variety of industries.

The pandemic has a favorable impact on the life science business, which has to focus on worldwide collaboration, rapid medical information exchange, and dynamic production capabilities. However, other industries, such as industrial production, semiconductor manufacturing, and others, have suffered setback. Several governments throughout the world have declared nationwide lockdowns and temporary closures of a variety of businesses, resulting in a drop in demand for electronic weighing machines in the market.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The electronic weighing machines aids in determining the weight of a product in retail shops in the market. The fundamental load cell, appropriate signal conditioners, and output recorders/indicators make the electronic weighing system an essential machine in retail shops. It has high reliability, precision, durability, portability, and ease of calibration features which stimulates the demand for electronic weighing machines in retail stores in the market.

Therefore, the presence of large retail stores across the developed and developing economies is driving the growth of the electronic weighing machines market over the forecast years. For instance, according to Census Bureau data, retail stores in the U.S. increased by a net amount in 2018. In the fourth quarter of 2018, over 3,100 more stores than in the fourth quarter of 2017. Similarly, the number of stores with less than five employees increased by 4,569 in the first quarter of 2018 compared to the first quarter of 2017 in the machines market. Similarly, as per Statista, both local and international shoppers flock to London's West End.

As a result, it is the UK's most populous shopping district in terms of store count. With 1,590 and 1,559 retailers, respectively, Manchester and Glasgow City Center were ranked second and third in the global machines market. Therefore, the presence of a significant number of retail stores worldwide is leveraging the demand for electronic weighing machines globally.

Report Segmentation

The market is primarily segmented on the basis of type, distribution channel, and region.

|

By Type |

By Distribution channel |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Type

Of all, the retail scale segment held the largest share in the global electronic weighing machines industry in 2020 due to the growing urbanization and rising retail stores, whereas the laboratory scale category is projected to gain tremendous growth in the upcoming period owing to the surging research projects in the pharmaceutical & biotech companies.

Insight by Distribution Channel

The most popular distribution methods are brick and mortar retail locations, which include distributors, specialty stores, hypermarkets, and supermarkets. The majority of customers prefer to purchase an electronic weighing machine from an offline store since they can see the product's quality and operation before purchasing it. In addition, offline stores provide after-sales help for product-related difficulties. Furthermore, communicating with these stores to claim guarantees or warranties is easier.

As a result, the characteristics entice customers to shop at brick-and-mortar stores, whereas online distribution channel is projected to capture healthy machines market share in the upcoming period due to the significant rise in e-commerce sector in developing economies.

Geographic Overview

Geographically, in 2020 Asia Pacific dominated the global electronic weighing machines industry with a considerable share. The high presence of regional businesses is a fundamental driver of the machines market expansion. Electronic weighing machines are in high demand in the region due to a large number of retail establishments and laboratories. The two largest shareholders and contributors to the regional electronic machines market growth are China and India.

The presence of regional players and the availability of low-cost raw materials are major factors contributing to the health penetration and tremendous dominance of the Asia Pacific region in the electronic weighing machines industry globally. For instance, as per Statista, the entire retail chain store in China was over 236,103, in 2017 which increased to 252,656 by 2019. Also, the Indian retail machines market is projected to grow substantially in the forthcoming period amounting to over 883 billion in 2020 and is expected to rise to USD 1.7 trillion by 2026.

Additionally, the popularity of automated electronic measuring equipment for testing and measuring materials in small and medium businesses as automation has spread across several market verticals. This feature is propelling the global electronic weighing machines market in North America to new heights of profitability. Weighing machine technology is rapidly evolving in North America for improved commercial applications like shipping and recycling.

Furthermore, in Europe, self-weighing devices connected with barcode and receipt printers, which imply the price of the material by assessing its weight, have been introduced to customers as part of the rise of modern retail across with the rapid expansion of huge convenience and departmental stores. Modernization of retail businesses resulted in printer scales for improved stock management in stores, ensuring consumer convenience, particularly when purchasing unpackaged commodities like fruits and vegetables.

Competitive Landscape

Some of the major Market Players operating the global electronic weighing machines industry include A&D Company, Limited, Adam Equipment Co. Ltd., Avery India Ltd., Cardinal / Detecto Scale, Contech Instruments Ltd., Doran Scales, Inc., Essae-Teraoka Pvt. Ltd., Fairbanks Scales, KERN & SOHN GmbH, Mettler-Toledo International, Inc., Rice Lake Weighing Systems India Ltd., Sartorius AG, Shimadzu Corporation, and Tanita.

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 3.32 billion |

|

Revenue forecast in 2028 |

USD 4.14 billion |

|

CAGR |

3.3% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

A&D Company, Limited, Adam Equipment Co. Ltd., Avery India Ltd., Cardinal / Detecto Scale, Contech Instruments Ltd., Doran Scales, Inc., Essae-Teraoka Pvt. Ltd., Fairbanks Scales, KERN & SOHN GmbH, Mettler-Toledo International, Inc., Rice Lake Weighing Systems India Ltd., Sartorius AG, Shimadzu Corporation, and Tanita |