Electronic Wet Chemicals Market Share, Size, Trends & Industry Analysis Report

By Type (Acids, Solvents, Bases, Others); By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM4283

- Base Year: 2024

- Historical Data: 2020-2023

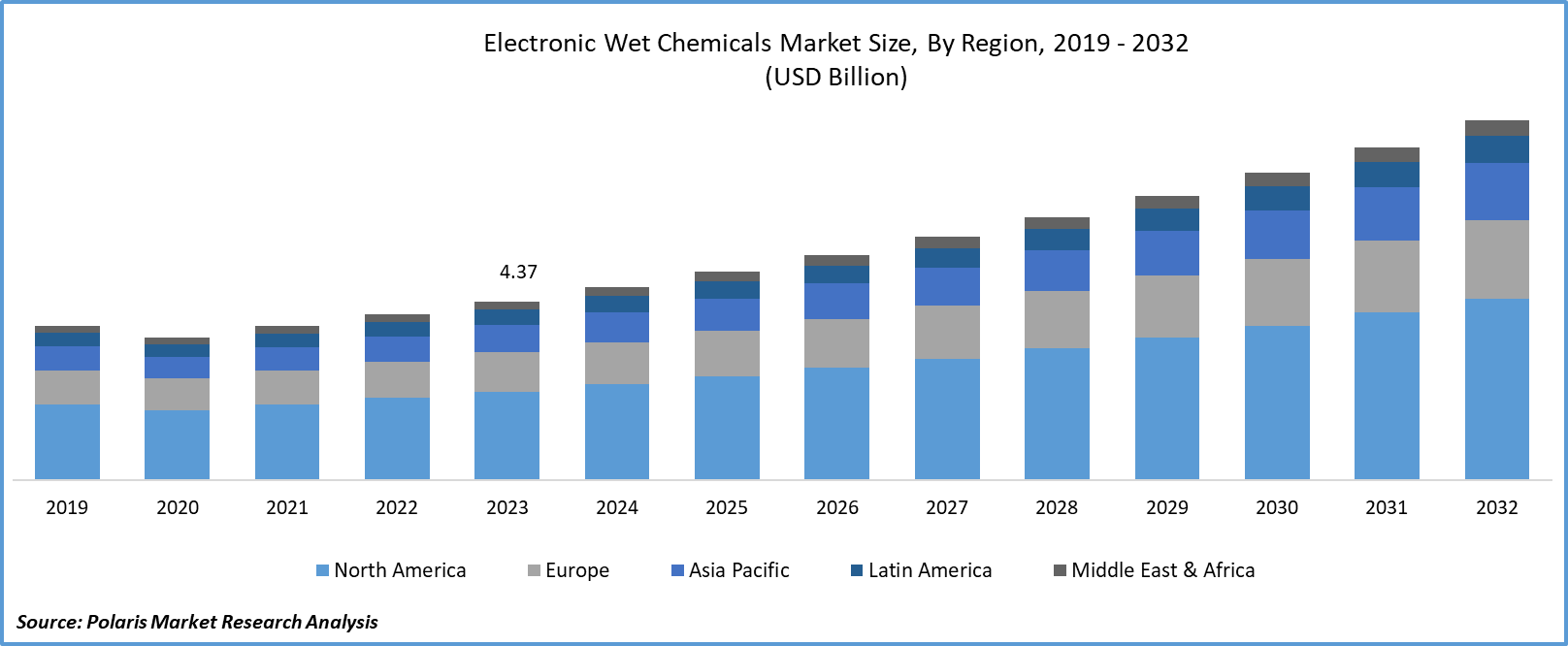

The global Electronic Wet Chemicals Market was valued at USD 4.84 billion in 2024 and is forecasted to grow at a CAGR of 7.50% from 2025 to 2034. Expansion in semiconductor manufacturing, flat panel displays, and printed circuit board production is fueling demand for high-purity chemicals.

Industry Trends

Electronic wet chemicals refer to chemicals or solutions used in processes related to the fabrication, maintenance, or treatment of electronic components. This might include cleaning solutions, etchants, or other chemicals used in the manufacturing or maintenance of electronic devices. The creation of a broad variety of electronic components, such as semiconductors, printed circuit boards (PCBs), displays, and others, is included in the electronic manufacturing sector. Specialized wet chemicals are becoming more and more necessary as the world grows more networked and dependent on electronics.

The production of semiconductors is a perfect illustration of this phenomenon. It is a fundamental component of contemporary electronics, powering everything from computers and automobile systems to cell phones. Due to the intricate nature of semiconductor manufacture, wet chemicals are used for etching, cleaning, and doping, all of which require precise and hygienic processing. Modern wet chemicals that can withstand the rigorous requirements of these processes are needed, and the semiconductor industry is always innovating to fulfill the growing need for smaller, quicker, and more energy-efficient devices.

Investing in the semiconductor industry allows companies to tap into the production and development of semiconductor devices, which are integral components in electronic devices such as computers, smartphones, and various other electronic systems. These devices are crucial to the functioning of modern technology. This strategic approach allows companies to align their interests with the growing demand for semiconductors and related wet chemical processes.

To Understand More About this Research: Request a Free Sample Report

For instance, in June 2019, Kanto Chemical Co. Inc. made a substantial investment of approximately USD 63.7 million to enhance and enlarge its production facility in Taiwan. This strategic initiative was aimed at addressing the escalating demand from key local clients in the semiconductor industry. As a result of this expansion, the annual output of semiconductor products from the facility is projected to rise significantly, increasing from 120,000 tons to an impressive 200,000 tons.

Furthermore, the need for wet chemicals is further increased by the widespread use of electronic devices in a variety of industries, such as consumer electronics, automotive, aerospace, and healthcare. The introduction of cutting-edge technologies such as 5G, the Internet of Things (IoT), and artificial intelligence supports this trend by encouraging the creation of sophisticated electronic systems and components, which in turn supports the expansion of the electronic wet chemicals market.

Also, the increased demand for hydrogen peroxide in semiconductor manufacturing acts as a crucial driver for the electronic wet chemicals market. Due to its versatile properties, hydrogen peroxide plays a vital role in cleaning and etching procedures, efficiently removing both organic and inorganic contaminants from semiconductor wafers.

Key Takeaways

- North America accounted for the largest market contributed to more than 40% share in 2024

- Asia-Pacific (APAC) region is projected to grow at a fastest CAGR during the forecast period

- By type category, the hydrochloric acid segment held the largest revenue share in 2024

- By end-use category, the consumer goods segment expected to witness the fastest CAGR during the forecast period

What are the Market Drivers Driving the Demand for Electronic Wet Chemicals Market?

Increasing Demands for Electronic Devices

The expanding consumer electronics market, coupled with the rising demand for smartphones, tablets, wearables, and other electronic devices, is fueling the need for efficient wet chemical processes in electronic manufacturing. Innovative technology and research and development (R&D) initiatives have been instrumental in reshaping the market environment. In the global market for electronic wet chemicals, research and development efforts have grown quickly. To create cutting-edge wet chemicals, major businesses, including equipment suppliers, semiconductor firms, and chemical producers, make significant R&D investments.

In addition to adhering to strict quality and environmental standards, the growing emphasis on environmentally sustainable practices is driving the adoption of eco-friendly wet chemical formulations that comply with environmental standards, appealing to environmentally conscious manufacturers. Increased investments in research and development activities by industry players are foremost to the formulation of advanced and efficient wet chemical solutions, contributing to electronic wet chemicals market growth.

Which Factor is Restraining the Demand for Electronic Wet Chemicals?

Volatility In Raw Material Prices Might Restrict Growth

Volatility in raw material prices can present challenges and potentially restrict the growth of the electronic wet chemicals market. The unpredictable and significant fluctuations in production costs for electronic wet chemicals. Sudden price increases can strain the profit margins of manufacturers and potentially result in higher prices for end-users.

Manufacturers in the electronic wet chemicals market m ay experience pressure on their profitability due to increased costs associated with raw materials. If the prices of essential chemicals rise substantially, companies may find it challenging to maintain competitive pricing while preserving their profit margins. Also, rapid fluctuations in raw material prices can limit the ability of companies to invest in research and development or adopt new technologies. This, in turn, may hinder innovation and the development of more cost-effective or sustainable manufacturing processes.

Report Segmentation

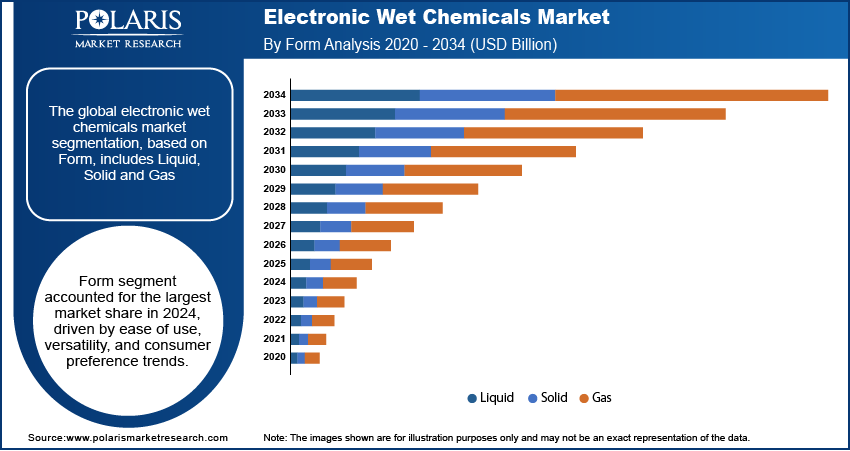

The market is primarily segmented based on form, type, application, end-use, and region.

|

By Form |

By Type |

By application |

By End-Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Type Insights

Based on type analysis, the market is segmented on the basis of isopropyl alcohol, hydrogen peroxide, ammonium hydroxide, hydrofluoric acid, nitric acid, sulfuric acid, hydrochloric acid, acetic acid, phosphoric acid, and others. In 2024, the hydrochloric acid segment held the largest revenue share due to the increasing use of electronic devices and electric vehicles dominating the electronic wet chemicals market growth. In semiconductor manufacturing operations, strong acids such as sulfuric and hydrochloric acid are essential for cleaning and etching silicon wafers. One major factor driving the demand for acids is the ongoing expansion of the semiconductor sector.

The bases section was expected to grow significantly over the projected timeframe. When dissolved in water, bases are compounds that can receive protons (H+). Applications for them include acid neutralization and pH regulation.

In semiconductor manufacturing, certain acids may be used for doping processes to introduce impurities into the semiconductor material and alter its electrical properties. Acids can be involved in various stages of battery production. For instance, they may be used in cleaning processes, surface treatment of battery materials, or as part of the electrolyte formulation in certain battery types. These result in increasing use of electronic devices, resulting in electronic wet chemicals market growth.

By End-Use Insights

Based on end-use analysis, the market is segmented on the basis of consumer good, automotive, aerospace & defense, medical, and others. The consumer goods segment accounted for the fastest CAGR during the forecast period, primarily driven by the increasing number of critical surgeries, including angioplasty, predominantly performed in hospital settings. With a quarter of total revenue, the consumer products segment led the market. It covers a broad variety of commonplace goods, such as detergents, cleaning supplies, personal hygiene products, and more. These products have a steady and broad electronic wet chemicals market demand.

Throughout the projection period, the automotive segment is anticipated to develop at the quickest rate. Wet chemicals are used in the automobile sector for surface treatment, paint and coating procedures, and battery manufacturing. The demand for high-performance electronic devices with advanced features, improved speed, and enhanced functionality requires precise manufacturing processes that often involve the use of specialized electronic wet chemicals.

Moreover, as technology advances, electronic components become more intricate and sophisticated. This complexity often requires specialized chemicals for processes such as etching, cleaning, and coating, driving the demand for electronic wet chemicals. Further, The development and adoption of emerging technologies like 5G, artificial intelligence, and the Internet of Things (IoT) create new demands for electronic components and, consequently, for the chemicals used in their manufacturing processes. As a result, the consumer goods segment is poised for substantial growth during the forecast period.

Regional Insights

North America

In 2024, North America accounted for the largest market contributor in the electronic wet chemicals market, with the United States foremost in revenue. The United States and Canada is a significant hub for electronics manufacturing. The presence of numerous semiconductor fabrication facilities, assembly plants, and research and development centers contribute to a substantial demand for electronic wet chemicals. Furthermore, it has a well-established semiconductor industry, with major players involved in the design and manufacturing of semiconductors. Electronic wet chemicals are critical in various semiconductor fabrication processes, including photolithography, etching, and deposition.

Asia Pacific

The adoption of electronic wet chemicals in the Asia-Pacific (APAC) region is projected to grow at a fastest CAGR during the forecast period, due to the increasing dominance of the growing population in the automobile sector. Countries such as India, Japan, and China are major contributors to the market revenue in APAC. The key drivers of the market in this region are contributing growth to consumer goods like electronic devices, electric vehicles, and others. These countries are expected to dominate the market during the forecast period.

Competitive Landscape

The electronic wet chemicals market is characterized by dynamic competition and the active involvement of key market players. These companies play a pivotal role in shaping the industry, influencing market trends, and driving innovations in electronic wet chemical solutions. As technological advancements continue to evolve in the semiconductor and electronics sectors, the demand for high-performance wet chemicals is on the rise.

Some of the major players operating in the global market include:

- Air Liquid,

- Air Products,

- BASF AG,

- Covestro,

- Hitachi Chemical

- Honeywell International Inc,

- Linde plc,

- Mitsubishi Chemical Corporation

- Shin-Etsu (Japan),

- Solvay A.G.

- Songwon, Cabot Microelectronics,

- T.N.C. Industrial Co.

Recent Developments

- In September 2024, Element Solutions Inc announced a definitive agreement to sell its flexographic printing plate division, MacDermid Graphics Solutions, to XSYS for approximately USD 325 million, allowing the company to sharpen its focus on high-growth specialty chemicals for the electronics sector.

- In July 2019, Solvay declared that it would raise the capacity of its hydrogen peroxide plant in Jemeppe-Sur-Sambre, Belgium, allowing for a rise in H2O2 output. The company also wants to increase the capacity of its Voikkaa and Bernburg plants. These will meet both new and established applications' growing need for products in Europe.

Report Coverage

The electronic wet chemicals market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, form, type, application, end-use, and their futuristic growth opportunities.

Electronic Wet Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 5.2 billion |

|

Revenue forecast in 2034 |

USD 9.98 billion |

|

CAGR |

7.50% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025– 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Form, By Type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |