Europe Industrial Cooling Systems Market Size, Share, Trends, & Industry Analysis Report

By Product (Hybrid Cooling, Water Cooling, Air Cooling, Evaporative Cooling), By Offering, By Component, By End Use, By Country – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6211

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

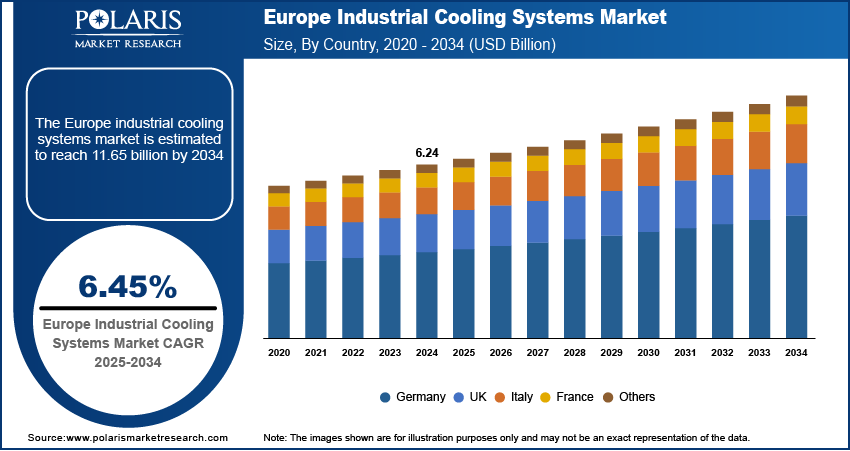

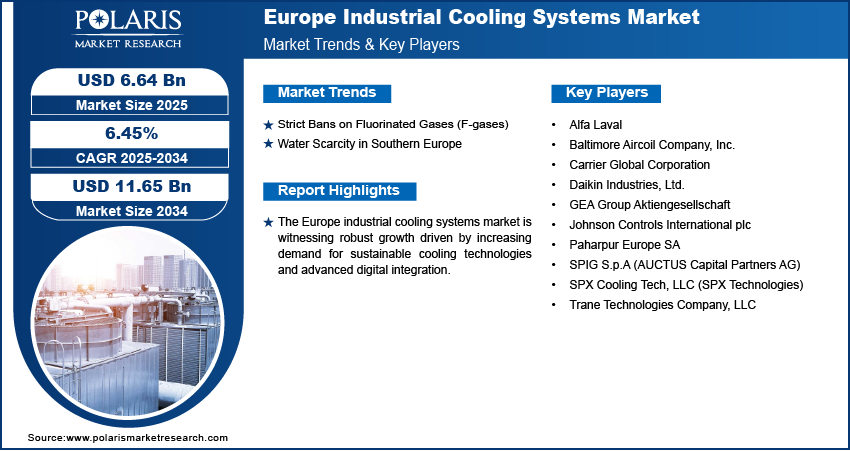

The Europe industrial cooling systems market size was valued at USD 6.24 billion in 2024, growing at a CAGR of 6.45% from 2025 to 2034. Key factors driving demand for Europe industrial cooling systems include the region’s strong commitment to environmental sustainability, enforcement of strict regulations on fluorinated gases (F-gases), and rising water scarcity in Southern Europe.

Key Insights

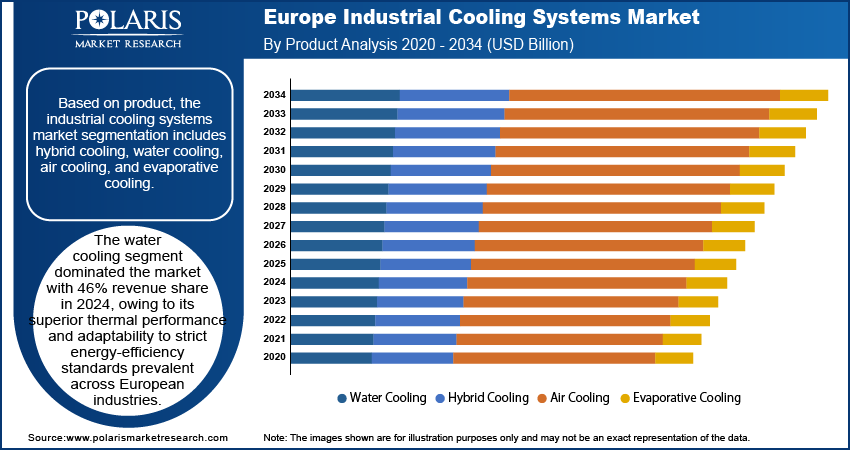

- In 2024, the water cooling segment led the market with a 46% revenue share due to its excellent thermal performance and compliance with Europe's strict energy-efficiency standards.

- The aftermarket services segment is projected to grow the fastest during the forecast period, driven by regulatory focus on energy audits, maintenance, and system efficiency.

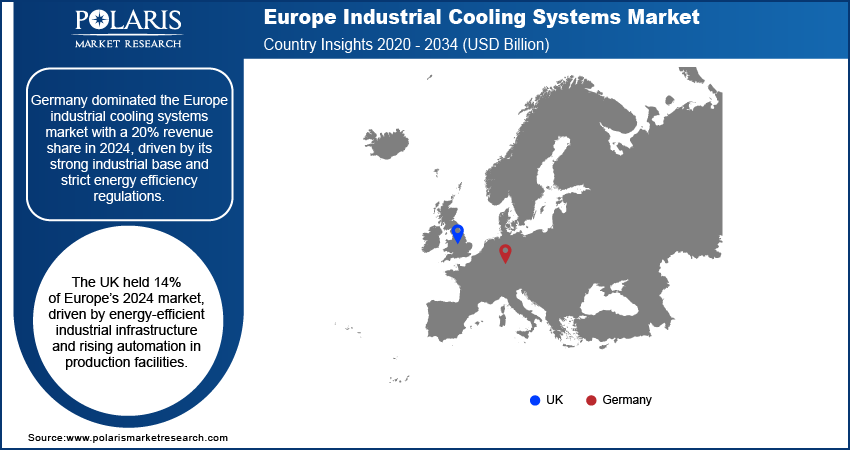

- Germany dominated the Europe industrial cooling systems market with a 20% revenue share in 2024, supported by its robust industrial sector and stringent energy regulations.

- The UK held a 14% market share in 2024, fueled by a growing focus on energy efficiency and increased automation in industrial facilities.

Industry Dynamics

- Strict EU F-gas regulations are pushing the industrial cooling market toward eco-friendly refrigerants and sustainable designs.

- Water scarcity in Southern Europe is driving demand for efficient cooling systems that minimize water use, boosting adoption of hybrid and air-cooled technologies.

- High upfront costs of advanced cooling systems limit their adoption, especially among small and medium-sized industries with tight budgets. Retrofitting old facilities also adds complexity and expense.

- Growing demand for energy-efficient solutions driven by strict EU regulations creates a strong market for eco-friendly and smart cooling technologies. Rising industrial automation boosts this potential.

Market Statistics

- 2024 Market Size: USD 6.24 billion

- 2034 Projected Market Size: USD 11.65 billion

- CAGR (2025–2034): 6.45%

To Understand More About this Research: Request a Free Sample Report

AI Impact on Industrial Cooling Systems Market Overview

- AI-powered industrial cooling systems are expected to revolutionize the industrial cooling landscape in the coming years by harnessing machine learning, advanced algorithms, and data analytics to enhance energy efficiency and optimize performance.

- AI systems integrate and analyze real-time and historical data from various sources, which helps businesses make informed decisions about their cooling operations.

- Since industries face increasing demands for energy efficiency and sustainability, AI-driven tools play an essential role in modern industrial cooling systems.

Market Overview

Industrial cooling systems are specialized solutions designed to remove excess heat from industrial equipment and processes to ensure optimal performance, safety, and efficiency. In Europe, the market for industrial cooling systems is witnessing a strong transformation, driven by the region’s strong commitment to environmental sustainability. The European Union’s Green Deal and carbon neutrality goals are pushing industries to adopt cleaner, energy-efficient cooling technologies that align with regulatory mandates. This shift is encouraging manufacturers and process industries to transition away from conventional cooling systems toward low-emission, high-efficiency alternatives that support both operational reliability and environmental compliance. Additionally, the focus on reducing greenhouse gas emissions and improving energy efficiency across industrial infrastructure has propelled the demand for sustainable cooling solutions. Cooling systems integrated with smart monitoring, water-saving designs, and hybrid configurations are gaining traction as industries strive to meet EU climate targets. This evolving regulatory landscape is reshaping product development strategies and also accelerating innovation in next-generation cooling technologies across the region.

Drivers & Opportunities

Strict Bans on Fluorinated Gases (F-gases): The enforcement of strict regulations on fluorinated gases (F-gases) in Europe is driving the industrial cooling systems market, as it necessitates a shift toward environmentally responsible refrigerants and system designs. A European Commission report stated that the EU F-gas Regulation 2024/573 (effective March 2024) phases out HFCs by 2050 through stricter quotas, bans on high-GWP products, and enhanced reporting. Supporting the Green Deal, it accelerates the adoption of climate-friendly alternatives in refrigeration and HVAC systems by 2030–2050. These gases, known for their high global warming potential, are being phased down under EU climate policies, prompting industries to adopt alternative low-GWP (global warming potential) refrigerants and advanced cooling technologies. This regulatory push is boosting innovation in natural refrigerant-based and non-F-gas systems, thereby accelerating the replacement and retrofitting of outdated cooling infrastructure. As a result, manufacturers are prioritizing compliance through sustainable system upgrades, supporting the overall growth of the market.

Water Scarcity in Southern Europe: Rising water scarcity concerns in Southern Europe contribute to the demand for efficient industrial cooling systems that operate under constrained water availability. A January 2025 EEA report stated that 30% of southern Europe's population faces permanent water stress, rising to 70% during summer. The focus has shifted toward technologies such as hybrid and air-based cooling systems that offer reduced water dependency without compromising thermal performance as industries face increasing pressure to reduce water usage. This has boosted the need for innovative cooling solutions designed to balance energy efficiency with water conservation. The challenge of maintaining operational continuity in water-stressed regions is prompting industrial stakeholders to adopt adaptive cooling strategies, positioning water-efficient systems as a critical component of long-term industrial resilience.

Segmental Insights

Product Analysis

Based on product, the segmentation includes hybrid cooling, water cooling, air cooling, and evaporative cooling. The water cooling segment dominated the market with 46% revenue share in 2024, owing to its superior thermal performance and adaptability to strict energy-efficiency standards prevalent across European industries. In sectors such as power generation, food processing, and pharmaceuticals, where operational stability and precision are paramount, water-based cooling systems deliver consistent heat dissipation with enhanced reliability. Moreover, the region's focus on sustainable industrial operations has increased the adoption of advanced closed-loop and hybrid water cooling technologies, which minimize water consumption and thermal pollution. These innovations are reinforcing the preference for water cooling systems as a dependable and environmentally compliant solution.

Offering Analysis

Based on offering, the segmentation includes equipment and aftermarket services. The aftermarket services segment is expected to witness the fastest growth during the forecast period, primarily due to the region's regulatory focus on energy audits, maintenance protocols, and system efficiency. The demand for services such as routine inspections, system retrofitting, and performance monitoring is on the rise with increasing adoption of smart industrial systems and EU-backed energy transition initiatives. European industries are prioritizing lifecycle optimization and predictive maintenance to comply with environmental standards while reducing operational costs. This shift is facilitating a service-centric approach, where ongoing technical support and digital diagnostics play a critical role in maintaining system uptime and efficiency.

Country Analysis

Germany Industrial Cooling Systems Market Analysis

Germany dominated the European market in 2024, driven by its strong industrial base and strict energy efficiency regulations. The country’s extensive manufacturing sector, particularly in automotive, chemicals, and heavy engineering, requires reliable and high-performance cooling solutions to ensure operational stability and energy optimization. Additionally, Germany’s proactive viewpoint on climate policies and adoption of advanced process technologies have accelerated the transition toward eco-friendly and smart cooling systems. These factors collectively position Germany as a major contributor to the growth across the region.

UK Industrial Cooling Systems Market Assessment

The UK accounted for 14% share of the European market in 2024, supported by the growing focus on energy efficiency in industrial infrastructure and the increasing integration of automation across production facilities. The growing need for low-emission and water-efficient technologies, along with investments in upgrading older systems to modern, intelligent cooling solutions, has further increased market penetration. The UK's evolving industrial landscape, supported by innovation and regulatory alignment, continues to create demand for next-generation cooling systems.

Key Players & Competitive Analysis

Strategic investments in energy-efficient technologies and emerging market segments such as hydrogen and carbon capture are reshaping the European industrial cooling landscape. Competitive intelligence and strategy reveal that major players are leveraging technological advancements in hybrid cooling and IoT technology integration to address latent demand and opportunities across developed markets, particularly in Germany and Scandinavia. Industry trends highlight a growing preference for modular solutions among small and medium-sized businesses, while large operators prioritize sustainable value chains to meet strict EU emissions standards. Revenue growth remains robust, driven by economic and geopolitical shifts and accelerating energy transition investments. Disruptions and trends in supply chains are pushing vendors to localize production, creating expansion opportunities for agile providers. Expert's insight on the sector highlights rising competition in data center cooling, while traditional industries such as pharmaceuticals and chemicals continue driving demand for precision thermal management. Future development strategies must balance growth projections with circular economy principles, as macroeconomic trends such as the EU Green Deal reshape industry ecosystems.

A few major companies operating in the Europe industrial cooling systems market include Alfa Laval; Baltimore Aircoil Company, Inc.; Carrier Global Corporation; Daikin Industries, Ltd.; GEA Group Aktiengesellschaft; Johnson Controls International plc; Paharpur Europe SA (Paharpur Cooling Towers Ltd.); SPIG S.p.A (AUCTUS Capital Partners AG); SPX Cooling Tech, LLC (SPX Technologies); and Trane Technologies Company, LLC.

Key Players

- Alfa Laval

- Baltimore Aircoil Company, Inc.

- Carrier Global Corporation

- Daikin Industries, Ltd.

- GEA Group Aktiengesellschaft

- Johnson Controls International plc

- Paharpur Europe SA (Paharpur Cooling Towers Ltd.)

- SPIG S.p.A (AUCTUS Capital Partners AG)

- SPX Cooling Tech, LLC (SPX Technologies)

- Trane Technologies Company, LLC

Europe Industrial Cooling Systems Industry Developments

- July 2025: Alfa Laval acquired Fives Energy Cryogenics, enhancing its cryogenic heat transfer and pump capabilities for LNG, hydrogen, and industrial gases. The deal strengthens its position in clean energy infrastructure.

- March 2025: Johnson Controls expanded its YORK YVAM magnetic bearing chiller availability to Europe, addressing rising data center demand driven by AI growth. The energy-efficient chillers support compliance with EU sustainability regulations for hyperscale facilities.

Europe Industrial Cooling Systems Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Hybrid Cooling

- Water Cooling

- Air Cooling

- Evaporative Cooling

By Offering (Revenue, USD Billion, 2020–2034)

- Equipment

- Aftermarket Services

- Installation

- Service

- Maintenance

By Component (Revenue, USD Billion, 2020–2034)

- Chillers

- Heat Exchangers

- Heat Pumps

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Utility & Power

- Chemical

- Food & Beverage

- Pharmaceutical

- Oil & Gas

- Others

By Country Outlook (Revenue, USD Billion, 2020–2034)

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Industrial Cooling Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.24 Billion |

|

Market Size in 2025 |

USD 6.64 Billion |

|

Revenue Forecast by 2034 |

USD 11.65 Billion |

|

CAGR |

6.45% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 6.24 billion in 2024 and is projected to grow to USD 11.65 billion by 2034.

The market is projected to register a CAGR of 6.45% during the forecast period.

Germany dominated the revenue share with 20% in 2024.

A few of the key players in the market are Alfa Laval; Baltimore Aircoil Company, Inc.; Carrier Global Corporation; Daikin Industries, Ltd.; GEA Group Aktiengesellschaft; Johnson Controls International plc; Paharpur Europe SA (Paharpur Cooling Towers Ltd.); SPIG S.p.A (AUCTUS Capital Partners AG); SPX Cooling Tech, LLC (SPX Technologies); and Trane Technologies Company, LLC.

The water cooling segment dominated the market with 46% revenue share in 2024.

The aftermarket services segment is expected to witness fastest growth during the forecast period.