Europe MRO Distribution Market Share, Size, Trends, Industry Analysis Report

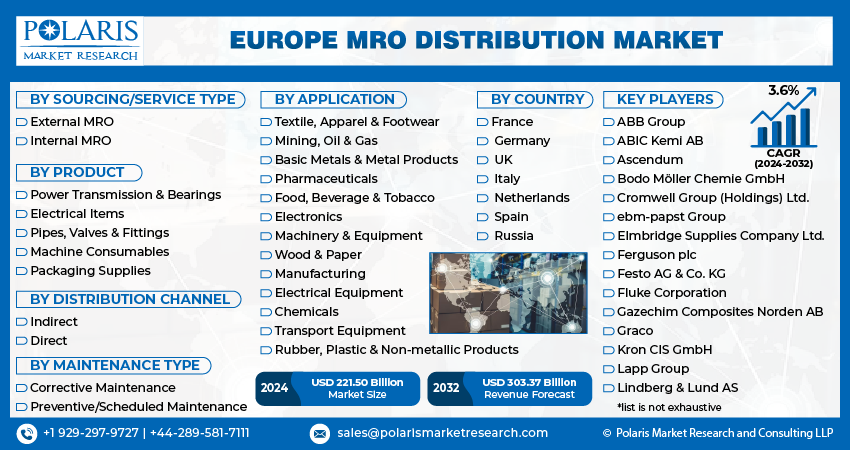

By Sourcing/Service Type (External MRO, Internal MRO); By Product; By Distribution Channel; By Maintenance Type; By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 119

- Format: PDF

- Report ID: PM4550

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

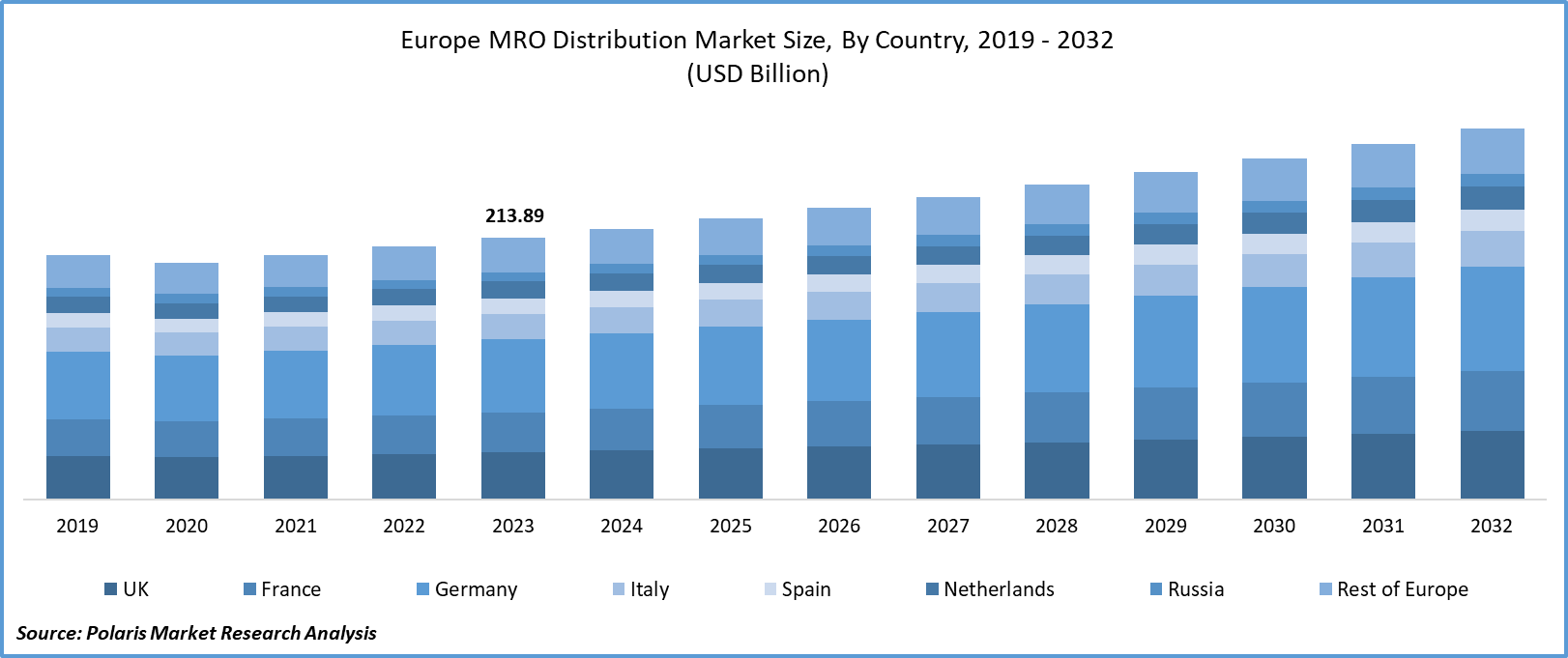

Europe MRO Distribution Market size was valued at USD 213.89 billion in 2023. The market is anticipated to grow from USD 221.50 billion in 2024 to USD 303.37 billion by 2032, exhibiting the CAGR of 3.6% during the forecast period

Europe MRO Distribution Market Overview

The anticipated growth in the demand for Maintenance, Repair, and Operations (MRO) distribution in Europe is driven by the increasing requirements for the development, maintenance, and repair of industrial equipment and services within the region.

The rising logistics expenses pose a challenge for suppliers, impacting the overall cost of Maintenance, Repair, and Operations (MRO) operations. Given the diverse sizes, shapes, and dimensions of components used in MRO operations, dedicated transportation is essential. Additionally, certain MRO components, due to their fragile nature, necessitate specialized logistic services, leading to increased logistics costs. However, logistics companies are securing contracts within the supply chain to transport components from manufacturers to distributors or directly to Original Equipment Manufacturers (OEMs), thereby mitigating the overall operational costs.

The increasing need for repair, maintenance, and service operations in manufacturing and industrial activities, especially in Norway, Sweden, Germany, and Finland, has created numerous opportunities. The ready availability of Maintenance, Repair, and Operations (MRO) goods and a skilled labor force in the region has paved the way for the development of industrial and manufacturing activities. This, in turn, has boosted sales for major players in European economies. Furthermore, the expected growth in industrial output is likely to escalate MRO activities in Germany, Italy, France, and the United Kingdom.

To Understand More About this Research: Request a Free Sample Report

The research and innovation programs of the European Union have robustly backed the advancement of industrial technologies, empowering the European manufacturing sector to harness cutting-edge advancements fully. This support fosters the integration of smart technologies into Maintenance, Repair, and Operations (MRO) solutions, creating additional opportunities within the United Kingdom market.

The UK Government's initiation of the 'Made Smarter' review, aimed at advancing the industry and providing recommendations for the UK to become a significant player in the 4th industrial revolution by 2030, underscores a commitment to smart industry development. Such a governmental support trend enhances the growth of the MRO market.

Moreover, companies like Groupe Roux-Jourfier facilitate the integration of "collaborative robotics" in manufacturing plants, enabling fully automated processes and collaborative work with human operators for more intricate tasks. This becomes particularly crucial for the Aerospace industry, where Original Equipment Manufacturers (OEMs) face constant time pressures and transfer these demands to suppliers.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces Europe MRO distribution market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Europe MRO Distribution Market Dynamics

Market Drivers

Thriving Manufacturing Sector, bolstering the growth of the European MRO Distribution market.

The thriving manufacturing industry is poised to drive the demand for machinery and equipment in both the early and later stages of production and procurement within the European MRO distribution market. This surge is anticipated to be a significant factor in propelling market growth. For instance, Germany, renowned for its automobile industry and home to leading companies such as Porsche, BMW, Volkswagen, and Mercedes-Benz, among others, is expected to witness a substantial increase in the demand for MRO services due to the growing automobile production during the forecast period.

Market Restraints

High Labor and Material Costs are likely to hamper the growth of the market.

The labor workforce plays a crucial role in the MRO distribution channel in Europe, and the rising cost of labor due to economic inflation may present a constraint for the European MRO distribution market. Skilled and educated maintenance technicians are essential for this market. Compliance with minimum wage laws in various countries adds another layer of cost, with organizations obligated to pay staff based on their workforce size. Currently set at a minimum of USD 70 in Europe, this wage is anticipated to increase over time.

Report Segmentation

The market is primarily segmented based on sourcing/service type, product, distribution channel, maintenance type, application, and region.

|

By Sourcing/Service Type |

By Product |

By Distribution Channel |

By Maintenance type |

By Application |

By Country |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Europe MRO Distribution Market Segmental Analysis

By Product Analysis

- In 2023, machine consumables emerged as the largest market share holder. The service providers of MRO are placing a growing emphasis on installing advanced quality machinery to improve performance and extend the lifecycle of installed machinery. However, some crucial parts in specific machinery necessitate replacement due to wear and a decline in performance over time. The growing manufacturing industry in Europe is expected to drive the demand for specialized technology machines, subsequently propelling the need for MRO operations related to the consumables of machines.

- Bearings find extensive use in mobile mechanical devices like steering, wheels, and other rotating components. There are several types of bearings, including ball, cylindrical roller, tapered roller bearings, spherical roller, needle roller, and roller. The machinery and automotive manufacturing industries exhibit a demand for bearings due to their effectiveness in handling excessive loads and the need for minimal maintenance. The anticipated surge for durable and advanced bearings is expected to propel the bearing product segment during the forecast period.

By Sourcing/Service Type Analysis

- In the forecast period, external MROs claimed the largest market share. The external MRO distribution operations are poised to grow significantly in Europe, driven by the escalating contracts with third-party service providers of MRO. Many companies are streamlining their internal MRO operations by outsourcing skilled workforce tasks to external service providers. The growth of manufacturing industries, the rising demand for technological advancements, and precise manufacturing activities have introduced advanced machinery in production facilities. Companies that offer External MRO services in Europe are prioritizing the provision of precise solutions tailored to the latest technology machinery.

- Internal MRO services are primarily employed to prevent disruptions arising from unforeseen issues during production. Management conducts these operations for maintenance and prompt repair when a machine breaks down due to faults.

Europe MRO Distribution Market Country Insights

Germany dominated the market with the largest market share in 2023

Industries playing a pivotal role in the economic growth of the country encompass machine tools, pharmaceuticals, chemicals, high precision equipment, textiles, metal, optics, shipbuilding, plastic goods, automotive, electrical equipment, and coal. Germany predominantly exports products like spacecraft and aircraft, motor vehicles and their parts, and packaged medicaments. The expansion of these industries is expected to amplify the requirement for the maintenance and repair of machines, consequently driving the growth of MRO in the forthcoming years.

The mining, automotive, and chemical industries play significant roles in the industrial advancements of the Czech Republic. The presence of natural resources, limestone, and black coal mines in the country is creating opportunities for the growth of the mining industry. Additionally, the Czech Republic is a key hub for automotive manufacturing, hosting multinational players such as Hyundai Motor Manufacturing Czech, Toyota, and Skoda Auto, with over 50% of the country's exports comprising automotive products. Reforms aimed at developing manufacturing facilities and expanding production quantities are anticipated to stimulate the demand for MRO services over the forecast period.

Competitive Landscape

The Europe MRO Distribution market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the market include:

- ABB Group

- ABIC Kemi AB

- Ascendum

- BENNING Elektrotechnik und Elektronik GmbH & Co. KG

- Bodo Möller Chemie GmbH

- Cromwell Group (Holdings) Ltd.

- ebm-papst Group

- Elmbridge Supplies Company Ltd.

- Ferguson plc

- Festo AG & Co. KG

- Fluke Corporation

- Gazechim Composites Norden AB

- Graco

- Kron CIS GmbH

- Lapp Group

- Lindberg & Lund AS

- Mates Italiana SRL

- MCtechnics

- Mento AS

- Neumo-Egmo Spain SL

- Norwegian Oilfield Supply AS

- Panasonic Industry Europe GmbH

- Pepperl+Fuchs

- Phoenix Contact

- Plastorgomma Srl

- Premier Farnell Limited

- Rittal GmbH & Co. KG

- Rohde & Schwarz

- RS Components

- Schneider Electric

- Sonepar

- Testo SE & Co. KGaA

- Transfer Multisort Elektronik Sp. z.o.o.

- Valeo Service

- WABCO

- WAGO Kontakttechnik GmbH & Co. KG

- Weidmüller Interface GmbH & Co. KG

- Wera Werkzeuge GmbH

- Wurth Group

Recent Developments

- In February 2023, Bodo Möller Chemie GmbH extended its presence in the West Africa market by establishing a warehouse in the Nigerian metropolitan area. This facility will serve as a distribution point for adhesives, fillers, resins, and additives, aiding the company in streamlining the supply chain of its products.

- In October 2022, Premier Farnell Limited reinforced its investments in industrial products to bolster support for predictive maintenance services for manufacturers. This involves the acquisition of Industrial Internet of Things (IIoT) technologies to assist manufacturers in reducing the time, cost, and effort required for implementing scheduled maintenance.

Report Coverage

The Europe MRO Distribution market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, sourcing/service type, product, distribution channel, maintenance type, application, and their futuristic growth opportunities.

Europe MRO Distribution Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 221.50 billion |

|

Revenue Forecast in 2032 |

USD 303.37 billion |

|

CAGR |

3.6% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Sourcing/Service Type, By Product, By Distribution Channel, By Maintenance Type, By Application, By Country |

|

Country Scope |

France, Germany, UK, Italy, Netherlands, Spain, Russia |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Navigate through the intricacies of the 2024 Europe MRO Distribution Market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

FAQ's

key companies in Europe MRO Distribution Market are ABB Group, ABIC Kemi AB, Ascendum, BENNING Elektrotechnik und Elektronik GmbH & Co. KG

Europe MRO Distribution Market exhibiting the CAGR of 3.6% during the forecast period

The Europe MRO Distribution Market report covering key segments are sourcing/service type, product, distribution channel, maintenance type, application, and region.

key driving factors in Europe MRO Distribution Market are Digital Transformation in the MRO Industry

The Europe MRO Distribution market size is expected to reach USD 303.37 billion by 2032