Europe Prescription Drugs Market Size, Share, Trends, & Industry Analysis Report

By Ailment (Alzheimer’s, Parkinson’s, Migraine, Chronic Pain, Sleep Disorders, Major Depressive Disorder), and By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6346

- Base Year: 2024

- Historical Data: 2020-2023

Overview

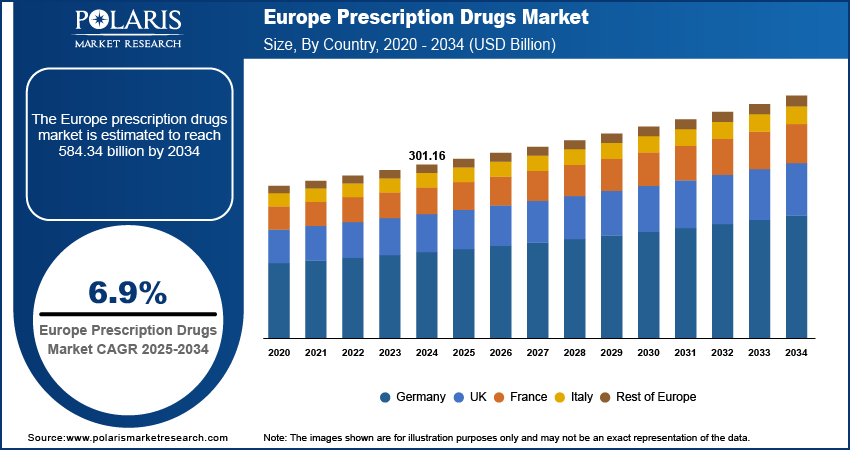

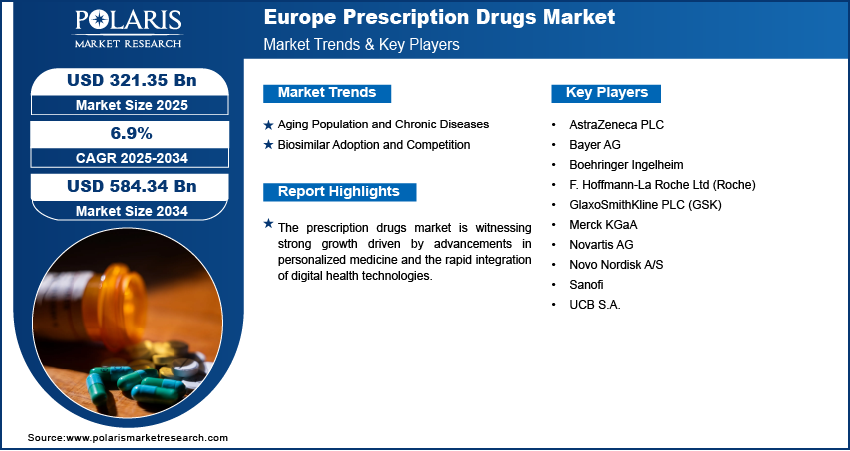

The Europe prescription drugs market size was valued at USD 301.16 billion in 2024, growing at a CAGR of 6.9% from 2025–2034. Key factors driving demand include the central role of the European Medicines Agency (EMA), strong public and political focus on innovation, growing aging population and the rising burden of chronic diseases, rapid adoption of biosimilars and the competitive environment.

Key Insights

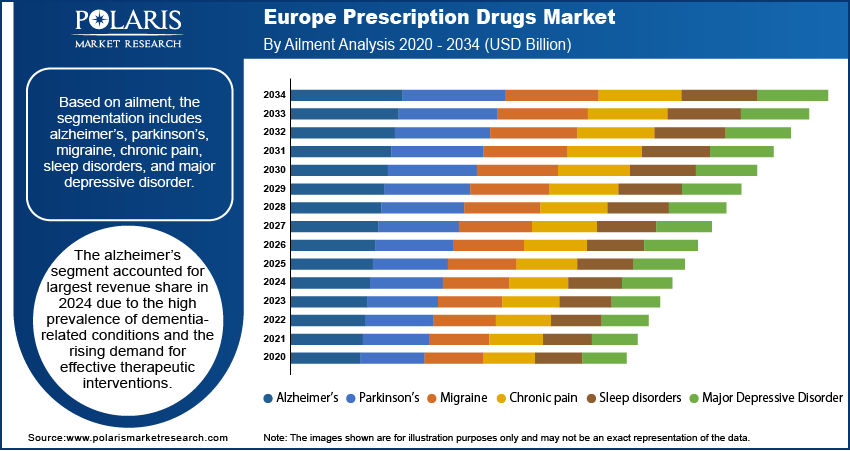

- The alzheimer's segment held the largest revenue share in 2024, fueled by the high and growing global prevalence of dementia and the urgent need for effective treatments.

- The parkinson's segment is anticipated to be the fastest-growing, propelled by its increasing incidence and a robust pipeline of novel therapies addressing a wide range of symptoms.

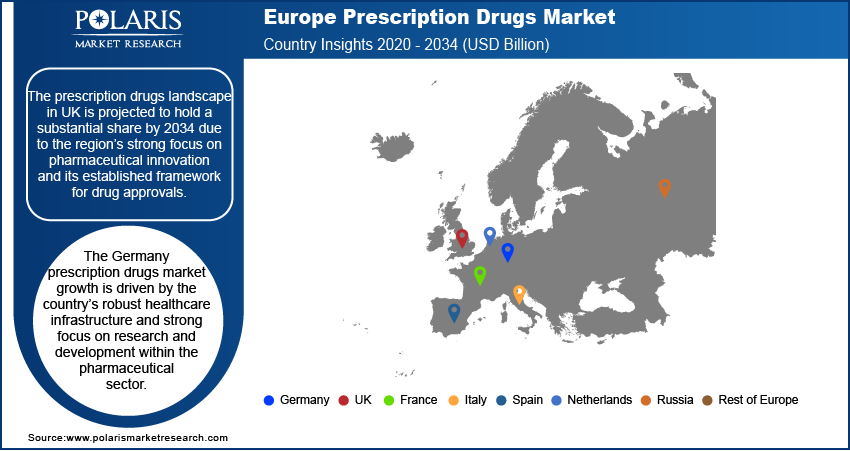

- The UK's prescription drugs landscape is expected to hold a substantial share by 2034, supported by its strong commitment to pharmaceutical innovation and a well-established regulatory approval framework.

- Germany's prescription drug market growth is driven by its advanced healthcare infrastructure and a deep-seated national emphasis on pharmaceutical research and development.

Industry Dynamics

- Europe's aging population and high rate of chronic diseases are primary drivers of demand for long-term and advanced prescription drug therapies.

- Europe's robust biosimilar adoption, driven by strong regulation and cost-containment policies, creates a highly competitive environment and expands treatment access.

- Strict government price controls and complex health technology assessments consistently pressure profit margins and limit market access for new, innovative drugs.

- Leading adoption of biosimilars and digital health integration creates efficiency, freeing budgets to fund and reimburse next-generation precision medicines and advanced therapies.

Market Statistics

- 2024 Market Size: USD 301.16 billion

- 2034 Projected Market Size: USD 584.34 billion

- CAGR (2025-2034): 6.9%

- Germany: Significant market share in 2024

AI Impact on Europe Prescription Drugs Market

- AI rapidly analyzes complex biological data to identify new drug candidates and predict their success, drastically cutting development time and cost.

- AI improves trial design by selecting ideal participants, predicting outcomes, and monitoring safety, leading to faster, more efficient, and successful studies.

- AI analyzes patient genetics and data to predict individual drug responses, allowing for tailored, more effective therapies and improved outcomes.

- AI forecasts demand, optimizes production processes, and manages inventory to increase efficiency, reduce costs, and prevent drug shortages.

Prescription drugs are regulated medications that require authorization from a licensed healthcare professional to ensure safe and effective use. In Europe, the European Medicines Agency (EMA) plays a central role in shaping the prescription drugs market, as it establishes a suitable regulatory framework across member states. The EMA ensures consistency in drug quality and efficacy while reducing regulatory fragmentation by heading scientific evaluation, safety monitoring, and approval processes. This adaptation accelerates market access for innovative drugs and also enhances patient trust across the region. The EMA’s structured post-marketing surveillance and pharmacovigilance further safeguard public health, positioning them as cornerstones of the European prescription drug ecosystem.

The Europe prescription drugs market is further shaped by the strong public and political focus on innovation, which promotes the adoption of advanced therapeutic solutions. European governments and policymakers consistently highlight research in biologics, precision medicine, and novel drug delivery systems, creating a favorable environment for pharmaceutical advancements. For instance, in October 2023, the European Partnership for Personalised Medicine (EP PerMed) was launched to advance precision medicine research, promote innovation, and support its integration into European health systems, involving 49 partners. This commitment to innovation is supported by collaborative frameworks involving academia, healthcare institutions, and industry, ensuring that cutting-edge treatments reach patients efficiently. Furthermore, policies that encourage innovation maintain a balance between accessibility and affordability, thereby strengthening the region’s healthcare systems. Together, this focus on progressive drug development and supportive policy measures reinforces Europe’s position as a leader in advancing next-generation prescription therapies.

Drivers & Opportunities

Aging Population and Chronic Diseases: The growing aging population and the rising burden of chronic diseases are driving the Europe prescription drugs market, as they directly influence the demand for long-term treatments and advanced therapies. Europe has one of the highest proportions of elderly citizens globally, and with aging comes a higher prevalence of conditions such as cardiovascular diseases, diabetes, neurodegenerative disorders, and cancer. A January 2024 EU report stated the population was 449.3 million, with 21.6% aged 65 or over. That year, 35.3% of people reported having a longstanding chronic health condition. This demographic shift increases the reliance on prescription medicines to manage complex health conditions, enhance quality of life, and decrease hospitalization rates. Consequently, pharmaceutical companies in Europe are increasingly focused on developing tailored therapies that address the evolving healthcare needs of older patients, thereby fueling continuous growth in the prescription drugs market.

Biosimilar Adoption and Competition: The rapid adoption of biosimilars and the competitive environment also contribute to the growth opportunities. Europe has been at the forefront of biosimilar approvals and growth, supported by strong regulatory frameworks and cost-containment strategies across national healthcare systems. For instance, in February 2025, Biocon Biologics received European Commission marketing authorization for YESINTEK, a biosimilar of Ustekinumab. It is indicated for treating plaque psoriasis, psoriatic arthritis, and Crohn’s disease, demonstrating comparable safety and efficacy to the reference product. The growing use of these types of biosimilars enhances accessibility to biologic therapies by reducing treatment costs, which in turn supports broader patient coverage under public healthcare. At the same time, the increased competition boosts innovation among pharmaceutical manufacturers, encouraging them to improve existing therapies and invest in next-generation biologics. This balance of affordability and innovation sustains market growth and also ensures Europe remains a leader in integrating biosimilars into mainstream therapeutic care.

Segmental Insights

Ailment Analysis

Based on product, the segmentation includes alzheimer’s, parkinson’s, migraine, chronic pain, sleep disorders, and major depressive disorder. The alzheimer’s segment accounted for largest revenue share in 2024 due to the high prevalence of dementia-related conditions and the rising demand for effective therapeutic interventions. The need for prescription drugs that slow progression, manage symptoms, and improve cognitive function has become increasingly critical with Alzheimer’s disease being one of the leading causes of disability among the aging population. Additionally, continuous research in novel drug classes, along with the growing focus on early diagnosis, has further reinforced the dominance of this segment. Therefore, as healthcare systems across Europe prioritize dementia care strategies, Alzheimer’s drugs are expected to remain central to the region’s prescription drug market.

The parkinson’s segment is expected to witness fastest growth during the forecast period driven by the rising incidence of the disease and the growing pipeline of advanced therapies targeting motor and non-motor symptoms. The demand for long-term treatment solutions is steadily rising among Europe’s aging population, with parkinson’s being a progressive neurological disorder. Advances in drug formulations, including extended-release therapies and novel mechanisms of action, are broadening treatment options and improving patient outcomes. This strong innovation pipeline, combined with greater healthcare investments in neurodegenerative disease management, positions the parkinson’s segment for rapid expansion in the years ahead.

Country Analysis

UK Prescription Drugs Market

The prescription drugs landscape in UK is projected to hold a substantial share by 2034 due to the region’s strong focus on pharmaceutical innovation and its established framework for drug approvals. The UK continues to promote an environment that supports research, particularly in precision medicine, biologics, and advanced therapies. Additionally, collaborative efforts between public health authorities and private industry support the acceleration of drug development and market access, ensuring that innovative treatments are delivered efficiently to patients. This blend of innovation-driven growth and supportive regulatory systems highlights the UK’s role in shaping the Europe prescription drugs market.

Germany Prescription Drugs Market

The Germany prescription drugs market accounted for significant share in 2024 driven by the country’s robust healthcare infrastructure and strong focus on research and development within the pharmaceutical sector. Germany has one of the largest pharmaceutical industries in Europe, supported by extensive clinical research networks and manufacturing capabilities. The country’s healthcare policies prioritize both accessibility and affordability, encouraging continuous adoption of innovative treatments. Furthermore, Germany’s leadership in biosimilar development and uptake strengthens its role in shaping competitive dynamics within the region. These factors collectively make Germany a central driver of growth in the European prescription drugs market.

Key Players & Competitive Analysis Report

The European prescription drugs landscape is characterized by intense competition among established players, with competitive intelligence and strategy centered on navigating stringent pricing controls and demonstrating superior therapeutic value. Technological advancement in biologics, gene therapy, and personalized medicine represents a critical revenue opportunity, though economic and geopolitical shifts and complex regulatory pathways pose significant challenges. Expert's insight emphasizes that future development strategies must prioritize sustainable value chains and robust clinical differentiation to secure reimbursement. Strategic developments include increased strategic investments in high-growth areas like oncology and immunology, while pricing insights reveal continued pressure from biosimilar adoption. Success hinges on competitive positioning through innovation and efficient market access execution.

Major companies operating in the prescription drugs industry include AstraZeneca PLC, Bayer AG, Boehringer Ingelheim, F. Hoffmann-La Roche Ltd, GlaxoSmithKline PLC, Merck KGaA, Novartis AG, Novo Nordisk A/S, Sanofi, and UCB S.A.

Key Players

- AstraZeneca PLC

- Bayer AG

- Boehringer Ingelheim

- F. Hoffmann-La Roche Ltd (Roche)

- GlaxoSmithKline PLC (GSK)

- Merck KGaA

- Novartis AG

- Novo Nordisk A/S

- Sanofi

- UCB S.A.

Industry Developments

- July 2025: The EU approved AstraZeneca’s Imfinzi, in combination with chemotherapy, for resectable muscle-invasive bladder cancer. The approval was based on Phase III results showing a significant reduction in risk of recurrence and death.

- March 2025: Roche and Zealand Pharma entered an exclusive collaboration to co-develop and co-commercialize petrelintide, a standalone amylin analog therapy, and a fixed-dose combination with Roche’s incretin compound CT-388.

Europe Prescription Drugs Market Segmentation

By Ailment Outlook (Revenue, USD Billion, 2020–2034)

- Alzheimer’s

- Parkinson’s

- Migraine

- Chronic pain

- Arthritic Pain

- Neuropathic Pain

- Cancer Pain

- Chronic Back Pain

- Post-Operative Pain

- Fibromyalgia

- Bone Fracture

- Muscle Pain

- Acute Appendicitis

- Sleep disorders

- Insomnia

- Hypersomnia

- Sleep Apnea

- Sleep Breathing Disorder

- Circadian Rhythm Disorders

- Parasomnia

- Sleep Movement Disorders

- Major Depressive Disorder

By Country Outlook (Revenue, USD Billion, 2020–2034)

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Prescription Drugs Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 301.16 Billion |

|

Market Size in 2025 |

USD 321.35 Billion |

|

Revenue Forecast by 2034 |

USD 584.34 Billion |

|

CAGR |

6.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 301.16 billion in 2024 and is projected to grow to USD 584.34 billion by 2034.

The global market is projected to register a CAGR of 6.9% during the forecast period.

The Germany prescription drugs market accounted for significant global market share in 2024.

A few of the key players in the market are AstraZeneca PLC, Bayer AG, Boehringer Ingelheim, F. Hoffmann-La Roche Ltd, GlaxoSmithKline PLC, Merck KGaA, Novartis AG, Novo Nordisk A/S, Sanofi, and UCB S.A.

The alzheimer’s segment accounted for largest revenue share in 2024.

The parkinson’s segment is expected to witness fastest growth during the forecast period.