Prescription Drugs Market Size, Share, Trends, & Industry Analysis Report

By Ailment (Alzheimer’s, Parkinson’s, Migraine, Chronic Pain, Sleep Disorders, Major Depressive Disorder), and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6345

- Base Year: 2024

- Historical Data: 2020-2023

Overview

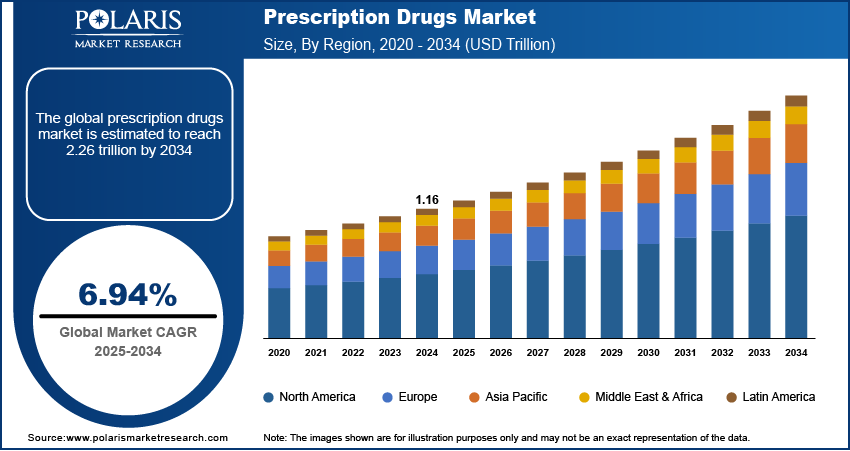

The global prescription drugs market size was valued at USD 1.16 trillion in 2024, growing at a CAGR of 6.94% from 2025–2034. Key factors driving demand include increased healthcare spending and access, technological and scientific innovation, aging global population, and rising prevalence of chronic diseases.

Key Insights

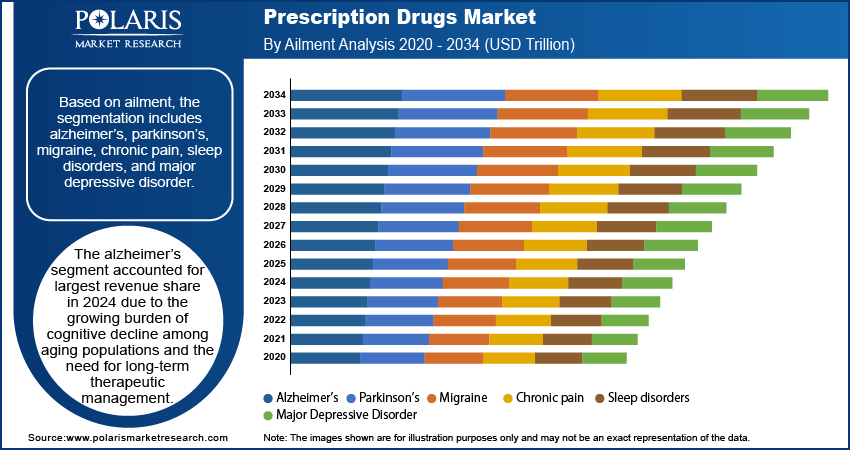

- The alzheimer's segment generated the highest revenue in 2024, driven by the increasing prevalence of cognitive decline in aging populations and the necessity for long-term treatment solutions.

- The parkinson's segment is projected to be the fastest-growing, fueled by a rising global incidence of the disease and the demand for effective, long-term therapeutic management.

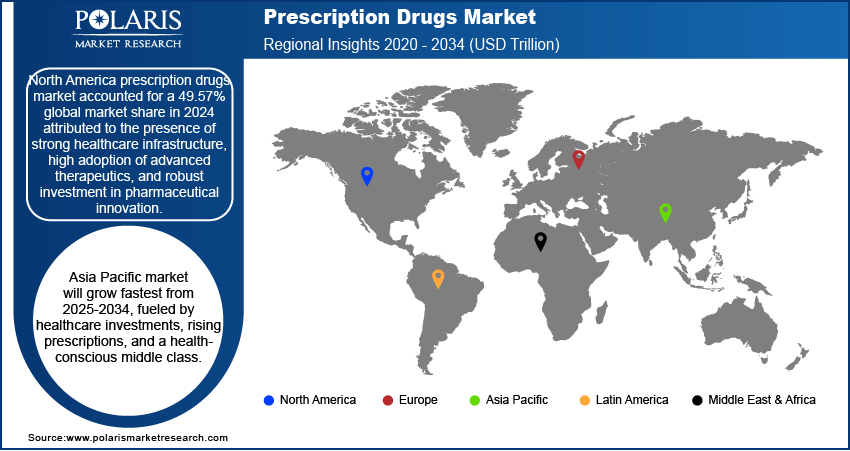

- North America dominated the global market with a 49.57% share in 2024, attributed to its advanced healthcare infrastructure, high adoption of novel therapies, and strong investment in pharmaceutical R&D.

- The U.S. held the largest share of the North American market, a position supported by its sophisticated healthcare system, rapid uptake of new drugs, and a continuous pipeline of pharmaceutical innovation.

- The Asia Pacific region is expected to register the fastest growth rate, propelled by increasing healthcare spending, improved access to prescription drugs, and a growing, health-conscious middle class.

- The market in India is expanding due to rising healthcare investment, improved access to healthcare services, and a large population increasingly seeking modern medical treatments.

Industry Dynamics

- Aging global population increases prescription drug adoption, as older adults require more long-term pharmacological treatments for chronic, age-related conditions.

- The rising global prevalence of chronic diseases, driven by lifestyle and genetic factors, fuels sustained demand for essential long-term prescription drug regimens.

- Rising pricing pressure and cost containment policies, especially in major markets, are severely constraining profitability and return on investment for new therapies.

- Breakthrough innovations in areas such as gene therapy and precision medicine create new, high-value treatment paradigms and address previously untreatable conditions.

Market Statistics

- 2024 Market Size: USD 1.16 trillion

- 2034 Projected Market Size: USD 2.26 trillion

- CAGR (2025-2034): 6.94%

- North America: Largest market in 2024

AI Impact on Prescription Drugs

- AI algorithms analyze vast biological datasets to identify new drug candidates and predict their effectiveness, thereby reducing the time and cost associated with early-stage research.

- AI improves trial design by selecting ideal participants and predicting outcomes. It also enhances monitoring for safety and efficacy, resulting in faster and more successful trials.

- AI analyzes patient data to predict individual responses to medications, enabling more personalized and effective treatment plans and dosing.

- AI forecasts drug demand, optimizes manufacturing processes, and manages inventory, reducing costs and preventing shortages across the pharmaceutical supply chain.

Prescription drugs are pharmaceutical medicines that can only be obtained with a medical prescription and are essential for managing, treating, and preventing various health conditions. The rise in healthcare spending and access, as both public and private investments continue to strengthen healthcare infrastructure globally. According to the 2024 Global Health Expenditure Report, aggregate global health spending in 2022 was USD 9.8 trillion, representing 9.9% of global GDP. Increasing insurance coverage, government initiatives, and expanding access to hospitals and pharmacies are enabling larger sections of the population to access medical treatment and prescribed therapies. This growing accessibility boosts demand and also ensures a higher level of commitment to prescribed regimens, thereby reinforcing the critical role of prescription drugs in improving patient outcomes.

Technological and scientific innovation, which is transforming the development and delivery of drugs, further drives the growth opportunities. Advances in biotechnology, genomics, and precision medicine are creating the way for more targeted therapies, enhancing both the effectiveness and safety of treatments. For instance, in December 2023, the FDA approved two gene therapies, Casgevy and Lyfgenia, for the treatment of sickle cell disease. Casgevy is the first therapy to utilize a novel genome editing technology, representing an important advancement in treatment. The integration of digital health technologies, such as AI-driven drug discovery and smart drug delivery systems, further supports faster development cycles and improved patient compliance. These innovations are expanding the therapeutic potential of prescription drugs while also addressing unmet medical needs, thereby positioning the industry at the forefront of modern healthcare transformation.

Drivers & Opportunities

Aging Global Population: The aging global population is driving the adoption of prescription drugs, as older adults typically require more frequent medical care and long-term treatment for age-related conditions. According to a February 2025 report by the World Health Organization, the worldwide number of individuals aged 60 and older is projected to increase from 1.1 billion to 1.4 billion by 2030. There is a higher incidence of diseases such as arthritis, cardiovascular disorders, neurodegenerative conditions, and other chronic ailments that demand continuous pharmacological intervention with increasing life expectancy. This demographic shift places prescription drugs at the center of healthcare management, ensuring sustained demand across therapeutic categories. Furthermore, advancements in geriatric medicine and the development of tailored formulations specifically designed for older patients continue to enhance the role of prescription drugs in improving quality of life and managing complex health needs among aging populations.

Rising Prevalence of Chronic Diseases: The rising prevalence of chronic diseases is also boosting the demand for prescribed drugs, as conditions such as diabetes, cancer, cardiovascular diseases, and respiratory disorders require long-term treatment regimens. According to a February 2024 report by the U.S. Department of Health and Human Services, an estimated 129 million people in the U.S. have at least one major chronic condition. Lifestyle changes, urbanization, and genetic predispositions have contributed to the increasing global burden of chronic illnesses, making prescription drugs essential in disease management and prevention of complications. Continuous medication is often essential for maintaining patient stability, reducing hospitalizations, and improving survival rates, which highlights the critical role of prescription drugs in modern healthcare. The demand for innovative and effective drug therapies is expected to remain robust across all age groups as chronic diseases increasingly affect younger demographics.

Segmental Insights

Ailment Analysis

Based on product, the segmentation includes alzheimer’s, parkinson’s, migraine, chronic pain, sleep disorders, and major depressive disorder. The alzheimer’s segment accounted for largest revenue share in 2024 due to the growing burden of cognitive decline among aging populations and the need for long-term therapeutic management. Prescription drugs play a vital role in slowing disease progression, managing behavioral symptoms, and improving patient quality of life, making them essential in Alzheimer’s treatment. Additionally, the rising focus on early diagnosis and the development of advanced therapeutic agents have further strengthened this segment. Continuous innovation in neurology-focused pharmaceuticals continues to expand treatment options, thereby sustaining Alzheimer’s as the leading contributor within the ailment-based segmentation.

The parkinson’s segment is expected to witness fastest growth during the forecast period d due to the rising incidence of neurodegenerative disorders and the need for effective long-term treatment regimens. The complexity of Parkinson’s disease treatment, which often requires a combination of medications to manage motor and non-motor symptoms, is driving sustained demand for prescription therapies. Additionally, advances in drug formulations, such as extended-release and combination therapies, are further supporting this growth. Increasing investment in research targeting disease-modifying treatments also positions the Parkinson’s segment as a rapidly expanding area in the prescription drugs market.

Regional Analysis

North America prescription drugs market accounted for a 49.57% global market share in 2024. This dominance is attributed to the presence of strong healthcare infrastructure, high adoption of advanced therapeutics, and robust investment in pharmaceutical innovation. For instance, in January 2025, the Centers for Medicare & Medicaid Services selected 15 more Medicare Part D drugs for price negotiation. These drugs, used by 5.3 million beneficiaries, accounted for USD 41 billion in gross costs over a recent 12-month period. The region also benefits from well-established regulatory frameworks and greater affordability of drugs through insurance coverage, which ensures widespread access. Furthermore, the concentration of major pharmaceutical companies and research institutions fosters continuous innovation, solidifying North America’s leadership position in the global market.

U.S. Prescription Drugs Market Insight

U.S. held largest market share in North America prescription drugs landscape in 2024 due to its advanced healthcare infrastructure, high rate of drug adoption, and continuous pharmaceutical innovation. A strong presence of leading drug manufacturers, vast insurance coverage, and high patient awareness further reinforce the country’s dominant position. Additionally, the U.S. regulatory environment promotes the development and commercialization of new therapies, thereby supporting the country's leadership in the regional market.

Asia Pacific Prescription Drugs Market

The market in Asia Pacific is projected to witness fastest CAGR growth from 2025-2034, driven by rising healthcare investments, increased access to prescription medications, and a growing middle-class population with increased health awareness. The region is witnessing the rapid adoption of modern healthcare practices and the expansion of pharmaceutical distribution networks, which are enabling a wider reach of therapies. Additionally, the increasing prevalence of chronic and lifestyle-related diseases is driving demand for long-term prescription treatments. This evolving healthcare landscape positions the Asia Pacific as one of the most dynamic growth regions for the prescription drugs market.

India Prescription Drugs Market Overview

The market in India is expanding due to rising healthcare expenditure, increasing access to medical facilities, and a rapidly growing population seeking modern treatment options. The expansion of pharmaceutical manufacturing capabilities and a robust generics industry have also made prescription drugs more affordable and widely accessible. Moreover, growing awareness of chronic diseases and government initiatives to improve access to medicines continue to accelerate the adoption of prescription therapies in the country.

Europe Prescription Drugs Market

The prescription drugs landscape in Europe is projected to hold a substantial share in 2034 due to the region’s strong focus on patient safety, quality healthcare standards, and the presence of a robust pharmaceutical industry. The region benefits from coordinated regulations and collaborative research initiatives that accelerate the development and availability of innovative therapies. Widespread healthcare coverage ensures accessibility of prescription medications, further supporting demand across various therapeutic areas. Europe maintains a major position with a growing focus on addressing unmet medical needs and advancing personalized medicine.

Germany Prescription Drugs Market

The Germany prescription drugs market growth is driven by its strong focus on innovation, high healthcare standards, and a robust regulatory framework that ensures patient safety and drug quality. The country’s focus on research and development, particularly in biotechnology and specialty medicines, supports steady market expansion. Additionally, widespread health insurance coverage and a well-structured healthcare system provide broad access to prescription drugs, reinforcing Germany’s role in the European market.

Key Players & Competitive Analysis Report

The prescription drugs industry faces competition, driven by technological advancement in areas like gene editing and biologics. Vendor strategies focus on strategic investments in R&D to target emerging market segments with high unmet needs. Revenue growth is increasingly concentrated in specialty drugs, though economic and geopolitical shifts and supply chain disruptions present ongoing risks. Expert's insight points to a future where sustainable value chains and digital transformation are critical for maintaining a competitive edge. Success hinges on leveraging competitive intelligence to navigate this complex landscape and capitalize on expansion opportunities in both developed and emerging markets.

Major companies operating in the prescription drugs industry include AbbVie, Inc.; AstraZeneca; Bristol-Myers Squibb Company; F. Hoffmann-La Roche Ltd; GlaxoSmithKline plc.; Johnson & Johnson Services, Inc.; Merck & Co., Inc.; Novartis AG; Pfizer, Inc.; and Sanofi.

Key Players

- AbbVie, Inc.

- AstraZeneca

- Bristol-Myers Squibb Company

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline plc.

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Novartis AG

- Pfizer, Inc.

- Sanofi

Industry Developments

- June 2025: Teva and Fosun Pharma announced a strategic partnership to co-develop TEV-56278, an investigational anti-PD1-IL2 therapy for oncology. The therapy utilizes a novel ATTENUKINE technology platform designed to improve efficacy and reduce toxicity.

- January 2023: Amgen announced the U.S. availability of AMJEVITA, a biosimilar to Humira. It is offered at two list prices, one 55% and another 5% below the current Humira list price.

Prescription Drugs Market Segmentation

By Ailment Outlook (Revenue, USD Trillion, 2020–2034)

- Alzheimer’s

- Parkinson’s

- Migraine

- Chronic pain

- Arthritic Pain

- Neuropathic Pain

- Cancer Pain

- Chronic Back Pain

- Post-Operative Pain

- Fibromyalgia

- Bone Fracture

- Muscle Pain

- Acute Appendicitis

- Sleep disorders

- Insomnia

- Hypersomnia

- Sleep Apnea

- Sleep Breathing Disorder

- Circadian Rhythm Disorders

- Parasomnia

- Sleep Movement Disorders

- Major Depressive Disorder

By Regional Outlook (Revenue, USD Trillion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Prescription Drugs Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.16 Trillion |

|

Market Size in 2025 |

USD 1.24 Trillion |

|

Revenue Forecast by 2034 |

USD 2.26 Trillion |

|

CAGR |

6.94% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Trillion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.16 trillion in 2024 and is projected to grow to USD 2.26 trillion by 2034.

The global market is projected to register a CAGR of 6.94% during the forecast period.

North America prescription drugs market accounted for a 49.57% global market share in 2024.

A few of the key players in the market are AbbVie, Inc.; AstraZeneca; Bristol-Myers Squibb Company; F. Hoffmann-La Roche Ltd; GlaxoSmithKline plc.; Johnson & Johnson Services, Inc.; Merck & Co., Inc.; Novartis AG; Pfizer, Inc.; and Sanofi.

The alzheimer’s segment accounted for largest revenue share in 2024.

The parkinson’s segment is expected to witness fastest growth during the forecast period.