U.S. Transparent Plastics Market Size, Share, Trends, & Industry Analysis Report

By Polymer Type, By Form, By Application, and By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6342

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

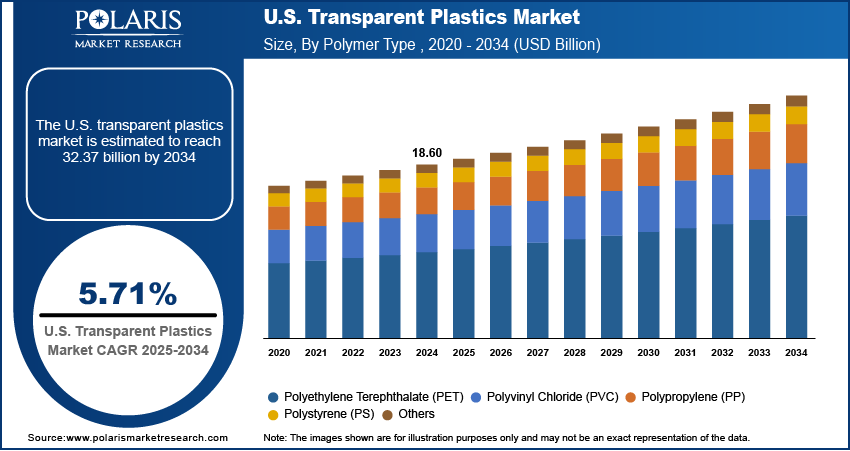

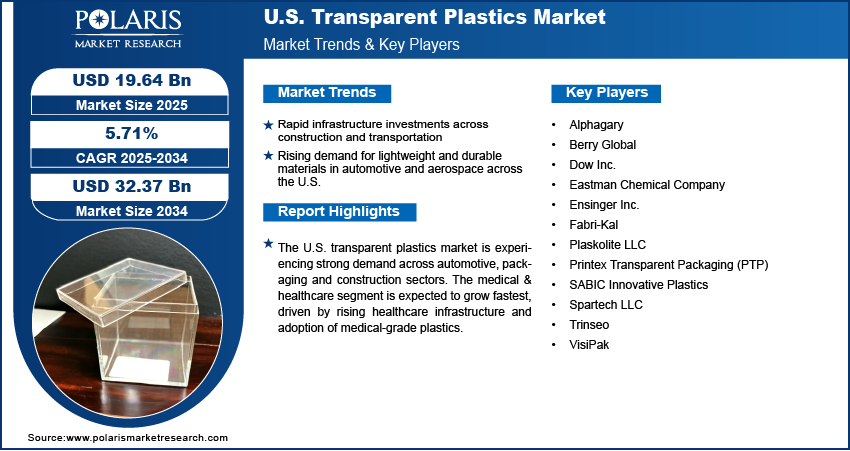

The U.S. transparent plastics market size was valued at USD 18.60 billion in 2024, growing at a CAGR of 5.71% during 2025–2034. This industry is growing due to rapid infrastructure investments in construction and transportation along with rising demand for lightweight and durable materials in automotive and aerospace.

Key Insights

- Packaging segment dominated the U.S. transparent plastics market in 2024 driven by strong demand for food & beverage, pharmaceutical and personal care packaging for lightweight and recyclable materials.

- Medical & healthcare segment will grow at the highest CAGR during the forecast period driven by growing demand for sterile and high-clarity plastics in surgical instruments and pharmaceutical packaging.

Industry Dynamics

- Rapid infrastructure investments in construction and transportation is driving demand for transparent plastics in panels, glazing and lightweight structural applications.

- Increased need for light and strong materials in automotive and aerospace industry throughout the nation is driving the adoption of transparent plastics.

- Growing emphasis on recyclable and bio-based clear plastics is opening up possibilities for achieving sustainability and regulatory needs.

- Petrochemical feedstock price volatility and competition from glass and metals is inhibiting cost stability and widespread take-up.

Market Statistics

- 2024 Market Size: USD 18.60 Billion

- 2034 Projected Market Size: USD 32.37 Billion

- CAGR (2025–2034): 5.71%

The transparent plastics market is expanding with uses in construction packaging automotive and electronics. Acrylic polycarbonate PET and PVC are still commonly utilized for clarity and strength. For instance, in November 2023 Tipa launched home compostable laminate manufacturing in the U.S. for green packaging with makers developing new recipes to improve durability stability and resistance to UV.

Sustainable adoption of plastics is speeding up driven by regulation and customer need. Technical developments in bio based PET and recycled resins enable compliance and reduced emissions. Design freedom in automotive glazing and medical applications is provided by transparent plastics and new high clarity and anti-fog grades extend application in electronics packaging and healthcare.

Government initiatives for manufacturing and infrastructure renewal are propelling demand for clear plastics utilized in lightweight energy-efficient building glazing and hard-wearing aesthetically pleasing packaging.

Drivers & Opportunities

Rapid infrastructure investments across construction and transportation: Global infrastructure growth is increasing the demand for transparent plastics in transport and construction activities. Their light weight makes them suitable for skylights panels safety glazing and noise barriers while enhancing energy efficiency as well as the longevity of the structure. Government policies, such as the USD 400 billion funding via Bipartisan Infrastructure Law of 2023, as well as investment in green infrastructure, are also contributing to the utilization of high-performance reusable transparent plastics.

Rising demand for lightweight and durable materials in automotive and aerospace across the U.S.: American automotive and aerospace industries are using transparent plastics to lower their weight and increase performance. OICA reports that vehicle production increased from 9.15 million in 2021 to 10.56 million in 2024, a 15.4% growth. The plastics enhance toughness in cabin windows cockpit canopies and illumination parts, and growing investment in electric vehicles and next-generation aircraft will likely further fuel their application.

Segmental Insights

Polymer Type Analysis

On the basis of polymer type, it comprises polyethylene terephthalate (PET), polyvinyl chloride (PVC), polypropylene (PP), polystyrene (PS), polycarbonate (PC), polymethyl methacrylate (PMMA) and others. The PET segment dominated in 2024 as a result of its strength transparency and ease of recycling, thus the perfect choice for food beverage personal care and pharmaceutical packaging.

The PC segment is expected to register the highest CAGR owing to its impact resistance transparency and thermal stability. It is used in automotive glazing sunroofs aerospace interiors and electronics for protective enclosures and screens. Its resistance to adverse environmental conditions is also promoting use in construction glazing systems.

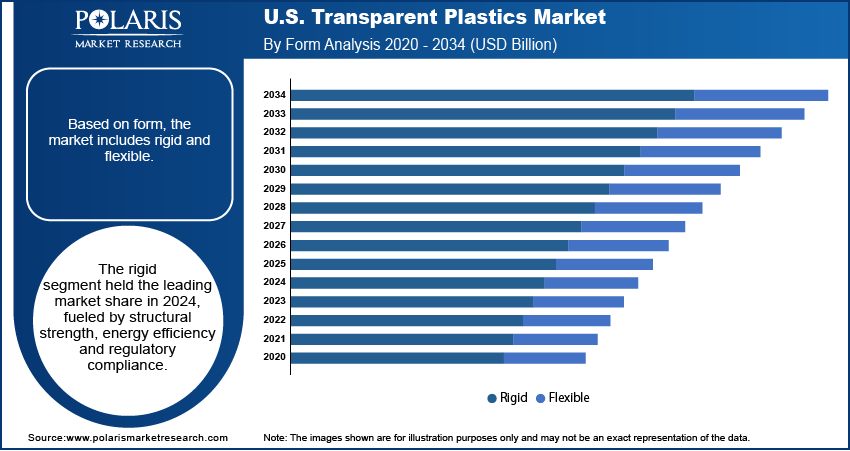

Form Analysis

Based on form, the segmentation includes rigid and flexible. The rigid segment dominated the U.S. transparent plastics market in 2024 due to its universal use in packaging, automotive and building. Rigid transparent plastics possess excellent durability, impact resistance and clarity and are therefore ideal for bottles, containers, panels and glazing applications. They also improve product shelf life in food and beverage packaging while ensuring product safety.

The flexible segment is expected to grow at the fastest CAGR during the forecast period due to growing usage in packaging and medical applications. These plastics are lightweight, versatile and design flexible that makes them ideal for use in films, wraps and pouches. Flexible transparent plastics also enhance food and beverage packaging convenience as well as sustained shelf life.

Application Analysis

Based on application, the segmentation includes medical & healthcare, automotive, consumer goods, packaging, building & construction, electrical & electronics and other applications. The packaging segment led the market for transparent plastics in the U.S. in 2024 due to increasing demand in food, beverage, pharmaceutical and personal care sectors. In January 2022, the U.S. Department of Energy invested USD 13.4 million to support seven projects researching ways to decrease energy consumption and greenhouse gas emissions from single-use plastics while developing recycling and upcycling technologies.

The medical and healthcare segment is projected to grow at the fastest CAGR during the forecast period fueled by rising demand for sterile and durable materials. These plastics are applicable in diagnostic equipment, medical instruments, syringes and drug packaging for their transparency, biocompatibility and resistance to sterilization treatments. They also enhance safety in hospitals by allowing visibility and minimizing the risk of contamination.

Key Players & Competitive Analysis Report

The U.S. transparent plastics market is moderately competitive driven by rising demand in packaging construction automotive healthcare and electronics. Leading companies focus on advanced polymer formulations biodegradable and recyclable plastics and integrated supply networks for diverse end-use sectors. Investments in new processing technologies quality monitoring and cost-efficient recycling are enhancing performance and economics.

Major players in the U.S. transparent plastics industry includes Eastman Chemical Company, Dow Inc., SABIC Innovative Plastics, Trinseo, Plaskolite LLC, Spartech LLC, Ensinger Inc., Berry Global, Printex Transparent Packaging (PTP), Alphagary, VisiPak, and Fabri-Kal.

Key Players

- Alphagary

- Berry Global

- Dow Inc.

- Eastman Chemical Company

- Ensinger Inc.

- Fabri-Kal

- Plaskolite LLC

- Printex Transparent Packaging (PTP)

- SABIC Innovative Plastics

- Spartech LLC

- Trinseo

- VisiPak

Industry Developments

February 2025: IPG introduced its U.S. brand Plastic Sheeting in Ultra and Performance formats to provide tough and clear surface protection for automotive, construction, transportation and marine uses.

November 2024: VisiPak launched Recyclapak, a 100% recyclable clear tube made from PET by a patented molding procedure without adhesives that provides affordability and sustainability.

U.S. Transparent Plastics Market Segmentation

By Polymer Type Outlook (Revenue, USD Billion, 2020–2034)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polystyrene (PS)

- Polycarbonate (PC)

- Polymethyl Methacrylate (PMMA)

- Other Polymers

By Form Outlook (Revenue, USD Billion, 2020–2034)

- Rigid

- Flexible

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Medical & Healthcare

- Automotive

- Consumer Goods

- Packaging

- Building & Construction

- Electrical & Electronics

- Other Applications

U.S. Transparent Plastics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 18.60 Billion |

|

Market Size in 2025 |

USD 19.64 Billion |

|

Revenue Forecast by 2034 |

USD 32.37 Billion |

|

CAGR |

5.71% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 18.60 billion in 2024 and is projected to grow to USD 32.37 billion by 2034.

The U.S. market is projected to register a CAGR of 5.71% during the forecast period.

A few of the key players in the market are Eastman Chemical Company, Dow Inc., SABIC Innovative Plastics, Trinseo, Plaskolite LLC, Spartech LLC, Ensinger Inc., Berry Global, Printex Transparent Packaging (PTP), Alphagary, VisiPak, and Fabri-Kal.

The rigid segment dominated the market in 2024, driven by high durability, impact resistance, and widespread use in packaging, construction, and automotive applications.

The medical & healthcare segment is projected to grow at the fastest CAGR, fueled by rising demand for sterile, durable, and high-clarity materials in diagnostic devices, surgical instruments, and pharmaceutical packaging.