Flexitank Market Share, Size, Trends, Industry Analysis Report

By Product (Single Trip, Multi-trip), By Application (Foodstuffs, Chemicals, Oils, Wine & Spirits, Pharmaceutical Goods, Others), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM4387

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

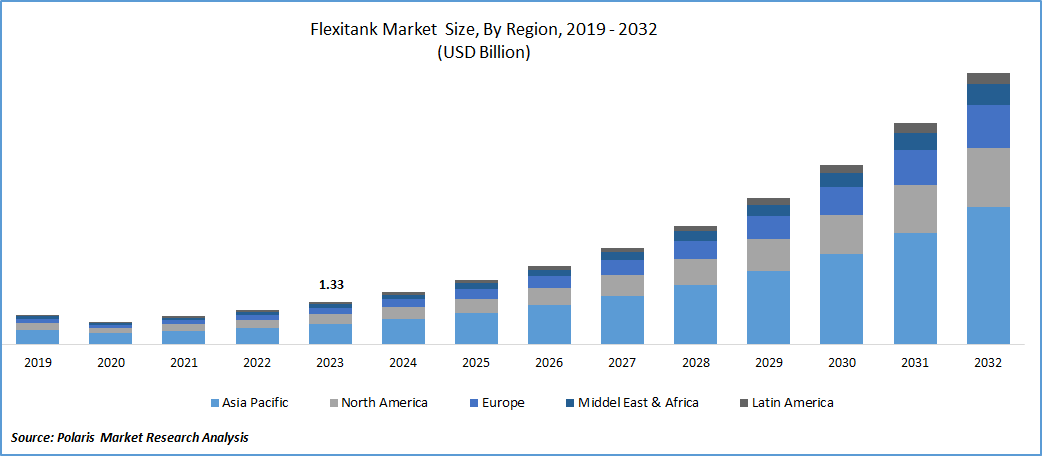

The global flexitank market was valued at USD 1.33 billion in 2023 and is expected to grow at a CAGR of 22.9% during the forecast period.

Growth is attributed to the increasing volume of global trade activities and the competitive advantages offered by flexitanks compared to traditional alternatives like ISO containers, drums, barrels, and IBCs. Flexitanks typically come in capacities ranging from 12,000 to 26,000 liters and find extensive use in shipping various liquid products, including wines, concentrates, edible oils, lubricants, non-hazardous chemicals, fertilizers, & pharmaceuticals.

Flexitanks have emerged as a cost-effective packaging solution compared to ISO tanks and drums, making them a primary alternative for companies seeking to reduce transportation expenses for liquids such as wines, juice concentrates, liquid latex, agricultural oils, biofuels, & glycerin. With advantages like minimal labor and loading costs and the absence of repositioning expenses, flexitanks prove to be the optimal choice for efficiently transporting bulk liquids, especially to remote destinations.

To Understand More About this Research:Request a Free Sample Report

The United States is home to some of the globe's largest pharmaceutical firms. These companies favor single-trip flexitanks for transporting temperature-sensitive liquids, creating substantial growth opportunities for the industry in the U.S. Flexitanks are notably more cost-effective compared to ISO containers and drums, and they can carry about 15% more payload than Intermediate Bulk Containers (IBCs) and 44% more than drums, making them economically preferable as bulk packaging solutions. Additionally, flexitanks are primarily designed for single use, contributing to a reduction in contamination risks.

Industry Dynamics

Growth Drivers

Flexitanks are Often Considered a Cost-Effective Alternative for Bulk Liquid Transportation

The market benefits from the growing volume of commodity trade and the cost-effectiveness of these tanks compared to their counterparts. Disparities in production and consumption rates across different geographical areas necessitate commodity trade. The significant expansion of international trade in recent decades has been a key driver of globalization. As a result, consumers worldwide have access to a broader range of products than they would if limited to locally produced items, highlighting the impact of increasing international trade. To address the ongoing surge in the flow of services, goods, and capital, various government organizations and international institutions have been established to manage these rapidly evolving trends.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Analysis

Single Trip Segment Accounted for the Largest Market Share in 2023

Single trip segment held the largest revenue share. This is primarily due to the combination of low cost and widespread availability associated with single-trip products. The economic advantage of single-trip flexitanks makes them a preferred choice for many industries engaged in liquid transportation. Moreover, the low risk of product contamination linked to single-trip flexitanks is a significant factor contributing to their sustained demand. Since these flexitanks are designed for one time use, there is a reduced likelihood of cross-contamination or residual product issues. This characteristic enhances the appeal of single-trip flexitanks, particularly for industries where maintaining product integrity during transportation is critical.

Typically, these products incorporate 1mm thick polyethylene (PE) as the inner material to improve the barrier properties of the packaging. Single-trip products prove to be well-suited for transporting a variety of substances, including polymers, lubricating and transformer oils, surfactants, liquid malt, cement and construction additives, edible oils, & specialty chemicals.

Multi-trip segment will grow rapidly. Multi-trip flexitanks are particularly noteworthy for their sustainability, as they can be reused multiple times, leading to an optimization of the Total Cost of Ownership (TCO). The ability to reuse these flexitanks enhances their overall efficiency throughout the logistical circuit. Unlike single-trip flexitanks, which are designed for one-time use, multi-trip flexitanks are constructed with durability in mind. Their robust design allows them to withstand multiple uses without compromising their functionality or integrity. This reusability not only contributes to a reduction in waste but also offers cost savings over time.

The optimization of Total Cost of Ownership is a crucial aspect, as it considers not only the initial purchase cost but also factors in maintenance, repairs, and the lifespan of the product. In the case of multi-trip flexitanks, the ability to reuse the product multiple times translates into long-term cost efficiency, making them a preferred choice for industries looking for sustainable and cost-effective bulk packaging solutions throughout the logistics process.

By Application Analysis

Foodstuffs Segment Held the Significant Market Share in 2023

Foodstuffs segment held the significant flexitank market share. Segment’s growth is fueled by the rapid expansion of retail chains and increasing food needs resulting from the expanding population in emerging economies. This trend is expected to continue to drive product demand in the foodstuff’s application segment in the foreseeable future.

Ordinary shipping boxes pose a risk of spoilage for wine products. To address this concern, wine producers worldwide are increasingly turning to polyethylene-based flexitanks as a replacement for insulated pouches or shipping containers. Among the most utilized materials for wine packaging, double- and multi-layered polyethylene offer effective solutions to safeguard against spoilage during transportation.

Flexitanks find common use in the transportation of various oil products, including base oils, lubricants, and transformer oils. The demand for industrial lubricants, such as metalworking fluids, greases, and process oils, has increased due to an overall push for innovation and production in various industries. These lubricants play a crucial role in ensuring the smooth functioning of machinery by reducing friction, dissipating heat, and providing protection against wear and corrosion. The use of flexitanks in oil transportation offers a flexible and efficient solution for moving these vital lubricating substances, contributing to the seamless operation of machinery in different industrial applications.

Regional Insights

Asia Pacific Dominated the Global Market in 2023

Asia pacific dominated the global market. Regional dominance can be attributed to the presence of two major agricultural-producing and consuming nations. The substantial agricultural activities in these countries contribute significantly to the demand for flexitanks, particularly in the transportation of various liquid goods.

Furthermore, the high production levels and the export of palm oil from major contributors like Indonesia and Malaysia play a crucial role in driving market growth in the region. The use of flexitanks is prevalent in the transportation of palm oil, and the robust agricultural and export activities in these countries further enhance the regional market's prominence. The combination of extensive agricultural operations and active export markets positions region as a key player in the flexitank industry.

Europe will grow with substantial pace. Regional expansion is likely to be supported by the rising rate of production and export of temperature-sensitive pharmaceuticals in the region. The pharmaceutical industry, particularly in Europe, has witnessed an increased focus on the manufacturing and export of medications that require temperature-controlled transportation to maintain their efficacy. Flexitanks provide a reliable and efficient solution for transporting temperature-sensitive pharmaceuticals, ensuring that these products reach their destination without compromising their quality.

Key Market Players & Competitive Insights

The global market exhibits a high degree of fragmentation, characterized by the substantial presence of numerous companies. Market players are adopting strategies such as competitive pricing, technological advancements, and the introduction of innovative packaging solutions to establish a competitive edge.

Some of the major players operating in the global market include:

- Qingdao BLT Packing Industrial

- Braid Logistics UK Ltd.

- Bulk Liquid Solutions Pvt.

- Büscherhoff Packaging Solutions

- Environmental Packaging Technologies,

- Full-Pak

- HOYER GmbH

- K Tank Supply Ltd.

- Mak & Williams Flexitank Supply

- MY FlexiTank (MYF)

- KriCon Group BV

- Qingdao LAF Packaging

- SIA FLEXITANKS

- Yunjet Plastics Packaging

- Trans Ocean Bulk Logistics

- TRUST Flexitanks

Recent Developments

- In November 2023, ASF, has revealed the expansion of its flexitank portfolio. This expansion aims to offer highly efficient and environmentally friendly shipping options for the transportation of non-hazardous bulk liquid cargo.

Flexitank Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.63 billion |

|

Revenue forecast in 2032 |

USD 8.47 billion |

|

CAGR |

22.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Flexitank Market report covering key segments are product, application, and region.

Flexitank Market Size Worth $ 8.47 Billion By 2032

The global flexitank market is expected to grow at a CAGR of 22.9% during the forecast period.

Asia Pacific is leading the global market.

The key driving factors in Flexitank Market are Flexitanks can enhance supply chain efficiency