Floating Hotel Market Share, Size, Trends, Industry Analysis Report

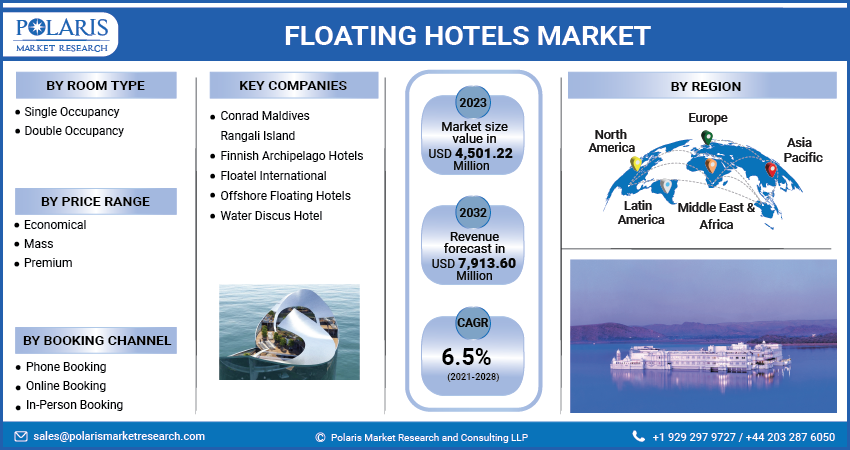

By Room Type (Single Occupancy, Double Occupancy); By Price Range; By Booking Channel; By Region; Segment Forecast, 2023 - 2032

- Published Date:Sep-2023

- Pages: 115

- Format: PDF

- Report ID: PM3745

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

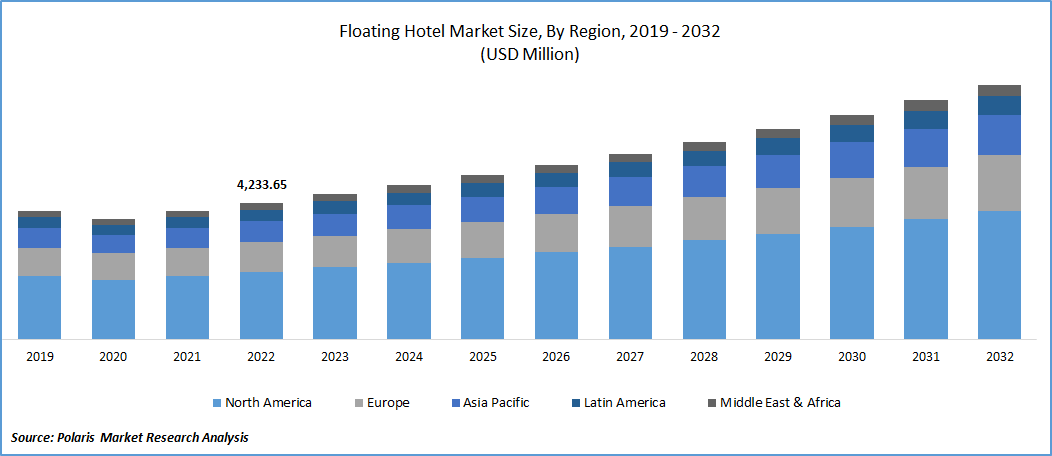

The global floating hotel market was valued at USD 4,233.65 billion in 2022 and is expected to grow at a CAGR of 6.5% during the forecast period.

A floating hotel refers to a hotel built on water, including lakes, rivers, and oceans. These dwellings are to give a pleasant atmosphere to the people, with surroundings filled with water. It offers new experiences ranging from small to luxury complexes. They offer unique experiences compared to traditional land accommodations.

To Understand More About this Research: Request a Free Sample Report

Travelers prefer unique environments in their free time, driving the demand for floating hotel dwellings. Growing offshore operations are fueling demand and the expansion of the floating hotel market. Petrobras tendered five more hotels to meet the rising service demand in 2023. This is done as the Brazilian oil giant refills its fleets due to rising day rates. Floating hotels are a viable option for industries involved in offshore operations, as they exemplify the need to seek onshore accommodation alternatives for their workers.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces floating hotels market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Industry Dynamics

Growth Drivers

Rising consumer interest in recreational activities

A floating hotel serves the same amenities and features as a hotel constructed on land, but along with them, it provides unique experiences as it is floating on water. These hotels are a major option in areas where land is scarce. Rising consumer interest in recreational activities is driving the demand for floating hotels. People are showing interest in tours and entertaining activities. Growing collaborations to establish new floating hotels are driving the expansion of the market.

Meyor Floating Solutions partnered with Hotels & Resorts Investment Maldives to transform the luxury real estate sector in the Maldives. This will introduce innovations into the floating hotel market. This partnership offers a fresh and exclusive way for individuals to experience the stunning beauty of the Maldives while maintaining ecological harmony. This enables hotel management to incorporate new features into their floating hotel services, offering tourists effective and unique experiences.

Business professionals prefer floating hotels for business gatherings as they present a pleasant environment for discussions among business leaders. Floating hotels are following sustainable environmental goals in their operations. For instance, Hayri Atak Architectural Design Studio (HAADS), a Turkish design company, designed an eco-floating hotel in Qatar with 154 rooms. It generates electricity, along with collecting and reusing food waste and rainwater. An increasing number of hotels with sustainable and eco-friendly designs will attract environmental-conscious travelers. This will further create new growth opportunities for the floating hotel market in the coming future.

For Specific Research Requirements, Request for a Customized Report

Report Segmentation

The market is primarily segmented based on room type, price range, booking channel and region.

|

By Room Type |

By Price Range |

By Booking Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Room Type Analysis

Double Occupancy segment is expected to witness the fastest growth during forecast period

Double Occupancy segment is expected to have faster growth for the market. This type of occupancy is preferable for friends, couples, and families. It enables the dwellers to share costs equally, making it a cost-effective option for travelers. Furthermore, this enhances space optimization by floating hotel agencies, increasing the variety of room types to consumer preferences. This uplifts social interaction among visitors, driving the demand for iteration on their visit to floating hotels. By offering a variety of double occupancy room types, such as suites, cabins, or villas, floating hotels can cater to different preferences and budgets, expanding their appeal. This will further propel the growth of the market in the coming years.

By Price Range Analysis

Premium segment accounted for the largest market share in 2022

The premium segment held the largest market share during the study period. This pricing enables unique experiences and amenities, including gourmet dining, private pools, and customized services. Forming the premium model by floating hotels enables brand awareness among consumers as it offers a more enjoyable environment to the visitors, driving through word-of-mouth by travelers. Special occasions like destination weddings and celebrations prefer premium models due to their luxury compared to other models. Premium pricing ensures the hotel increases its revenue from customers willing to pay more for additional entertainment and breathtaking views. This will enhance the earning capacity of floating hotels, along with the willingness of consumers to spend more for memorable experiences.

By Booking Channel Analysis

Online booking channel is expected to hold the larger revenue share during forecast period

The online segment will witness a larger revenue share in the coming years. This booking channel permits global access to the floating hotel, allowing foreigners to plan their visit around accommodation in floating hotels. According to Thriphilia, the online booking channel in India is expected to grow by 500% in the next two years. Furthermore, online booking channels facilitate visitors to access information through reviews, ratings, and the ability to streamline the booking process.

Instant online booking services enable travelers to plan tours early in exchange for their plans on weekends and summer holidays, resulting in higher occupancy rates for floating hotels. This booking enables travelers to get an immediate response on their booking status, decreasing uncertainty and stress relief for their trip. The presence of exclusive discounts and offers drives tourists to take trips and plan accommodations, driving the growth of tourists staying in floating hotels. This is a convenient option for customers and businesses, as it is easier to manage remotely than huge paperwork for the booking process. It also allows management to supervise revenue efficiently with growing technology.

By Regional Analysis

Europe registered the highest growth rate in the study period

Europe is projected to witness a higher growth rate for the market. This region is known for its vast presence of coastal and waterfront areas, making it an ideal location for establishing floating hotels. This is popular for tourist places due to its diverse range of cultures and attractions, driving tourists from domestic and international countries to this region, which drives higher demand for floating hotels due to its diversity and unique experiences. Furthermore, In the middle of the housing crisis, the government of Ireland is looking for flotels (floating hotels) to accommodate migrants. The growing migrant population is creating a lack of housing infrastructure in this region. This is creating demand for temporary or short-term accommodations through floating hotels.

North America is projected to experience a larger revenue share for the market. The growing demand for floating hotels is not only limited to tourist visits and celebrations but also due to offshore operations. Bridgemans acquired a retrofitted 650-resident floating hotel to provide accommodation to Industrial workers. It provides lounges, dining rooms, fast wifi, office clinics, and others for crew members in floating hotels. This is leading hotel management to add additional features to their floating hotels.

Moreover, Floating hotels recreate cities with waterfront areas and empower the city development process due to the rise in economic transactions in the region. People in the region prefer luxurious experiences in their free time. The ability to book online tickets instantly fuels the demand for floating hotels in the region.

Competitive Insight

The floating hotel market is fragmented and is anticipated to witness competition due to several players' presence. Major key players in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Conrad Maldives Rangali Island

- Finnish Archipelago Hotels

- Floatel International

- Offshore Floating Hotels

- Water Discus Hotel

Recent Developments

In May 2023, Diu Smart City Limited, the UT administration, and DVS Global joined forces to establish a floating hotel with a public-private partnership (PPP) in Diu. As part of the agreement, DVS Global owns and operates the venture while sharing a part of the revenue with UT.

In December 2023, Petrobras, a Brazilian State-controlled oil company, launched an international tender to contract for another floating hotel. This was done to increase flight accommodation and maintenance units to eight.

Floating Hotel Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 4,501.22 million |

|

Revenue forecast in 2032 |

USD 7,913.60 million |

|

CAGR |

6.5% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Room Type, By Price Range, By Booking Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation |

Explore the market dynamics of the 2024 floating hotels market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Research Industry Reports.

FAQ's

Floating Hotel Market Size Worth $ 7,913.60 Million By 2032.

is top market players in the market.

Europe region contribute notably towards the global Floating Hotels Market.

The global floating hotel market is expected to grow at a CAGR of 6.5% during the forecast period.

room type, price range, booking channel and region key segments in the Floating Hotels Market.