Food Service Disposables Market Share, Size, Trends & Industry Analysis Report

By Packaging(Rigid and Flexible); By Material; By Application; By End-Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 115

- Format: PDF

- Report ID: PM2167

- Base Year: 2024

- Historical Data: 2020-2023

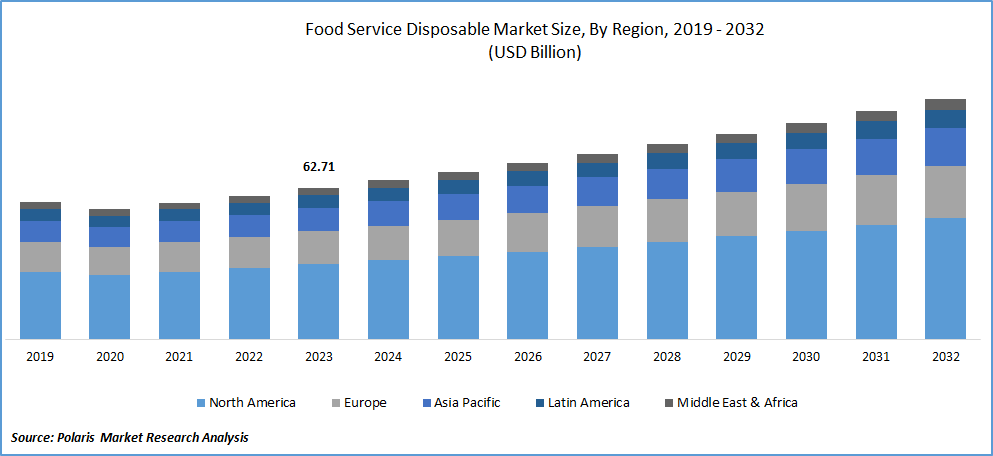

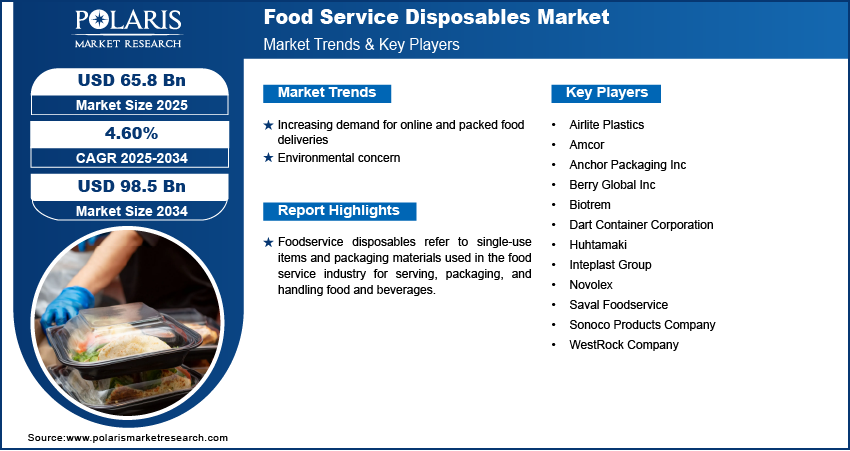

The global Food Service Disposables Market was valued at USD 62.30 billion in 2024 and is projected to grow at a CAGR of 4.6% from 2025 to 2034. Rising demand for convenient packaging in the growing food delivery sector is sustaining market growth.

Industry Trends

Foodservice disposables refer to single-use items and packaging materials used in the food service industry for serving, packaging, and handling food and beverages. These disposable products are designed to be convenient, hygienic, and often used for one-time purposes.

Deliveries of food via a wide range of online and offline platforms have become one of the e-commerce industry's fastest-growing offerings. The availability of various online tools and apps gave the food business access to a new platform. The ability to accept cash on delivery and a wide range of payment methods, including digital wallets and online banking, have all improved customer appeal. Hence the increasing demand for food service disposable shows the significant growth in the market share.

To Understand More About this Research:Request a Free Sample Report

Growing environmental concerns have led to an increased focus on sustainability. Many businesses were adopting eco-friendly and biodegradable disposable products to reduce their environmental impact. Ongoing research and development in materials science led to innovations in the types of materials used for disposable products. Manufacturers were exploring alternatives to traditional plastics, such as plant-based materials and compostable options. Some companies were engaging in partnerships or acquisitions to strengthen their positions in the market, expand their product portfolios, or gain access to new technologies.

- For instance, on March 23, 2022, Mondi, in packaging and paper, spent €280 million in corrugated packaging facilities across four countries to boost production and improve customer service.

Eco-friendly and biodegradable disposables have gained popularity as environmental concerns have increased. Manufacturers are developing products that are compostable and made from sustainable materials. Busy lifestyles and the rise of takeout and delivery services have increased the demand for disposable packaging.

Moreover, The COVID-19 pandemic has influenced the market with increased demand for single-use items to meet hygiene and safety standards. However, there is also a growing emphasis on sustainable disposables in the post-pandemic era. Furthermore, the market is anticipated to grow during the forecast period.

Key Takeaways

- Asia Pacific dominated the largest market and contributed to more than 37% of the share in 2023.

- North America is expected to grow at the fastest CAGR during the forecast period.

- By packaging category, rigid segment is expected to grow at the fastest CAGR during the forecast period.

- By application category, online delivery segment accounted for the largest market share in 2024.

What are the market drivers driving the demand for Food Service Disposable market?

Increasing demand for online and packed food deliveries

Increasing demand for online and packed food deliveries is projected to spur product demand and facilitate market growth. Customers' increasing exposure to the Western lifestyle is aided by the phenomenal rise of the meal delivery industries worldwide. This scenario is further complicated by the fact that digital food businesses provide a wide range of services, including marketplace, concierge, cloud kitchen, thin layer, full-stack, on-demand delivery, restaurant and food discovery, and home-cooked food models.

Disposable products offer convenience in terms of quick service and reduced cleanup times. This aligns with the busy lifestyles of consumers who often prefer the convenience of single-use items in the food service industry. The growth of the food delivery and takeout market has significantly increased the demand for disposable packaging. Consumers often prefer the convenience of receiving their meals in disposable containers. Consumer preferences for on-the-go meals, outdoor dining, and casual dining experiences have influenced the demand for disposable products that provide these preferences. These show the significant growth of the Food Service Disposable market.

Furthermore, the increasing population and growth in the online food industry, growth in the number of strategic partnerships among prominent companies, and recent technical advancements, like eco-friendly materials, which reduce the production cost of the product while developing beneficial opportunities for the market, will further create scope to the growth opportunities in the forecast period.

Which factor is restraining the demand for Food Service Disposable?

Environmental concern

One of the significant restraints is the environmental impact of disposable products. The use of non-biodegradable materials, especially traditional plastics, contributes to pollution and waste issues. This has led to increased scrutiny and demand for more sustainable and eco-friendly alternatives. Stringent regulations related to single-use plastics and packaging materials pose challenges for manufacturers and businesses in the food service disposable market. Compliance with evolving regulations can be costly and may require significant changes in product offerings.

Report Segmentation

The market is primarily segmented based on packaging, material, application, end use, and region.

|

By Packaging |

By Material |

By Application |

By End Use |

By Region |

|

|

|

|

|

Category Wise Insights

By Packaging Insights

Based on packaging analysis, the market is segmented on the basis of rigid and flexible. The rigid segment is projected to grow at the highest CAGR during the projected period, mainly driven by its wide range of beneficial characteristics and features such as cost-effectiveness, easy availability, high flexibility, and lightweight. Moreover, heightened environmental awareness and the increasing commitment of numerous companies to minimize their environmental impact have led to a significant surge in the global demand for recyclable plastic materials. This, in turn, is driving the growth of the segment market.

By Application Insights

Based on application analysis, the market has been segmented on the basis of food service and online deliveries. The online delivery segment accounted for the largest market share in 2023 and is likely to retain its market position throughout the forecast period. The growth of online food delivery platforms, such as Uber Eats, DoorDash, Grubhub, and others, has played a crucial role in driving the demand for disposable packaging. These platforms facilitate the ordering and delivery of meals from a variety of restaurants, creating a need for efficient and hygienic packaging solutions. Online food delivery services rely heavily on disposable packaging to ensure that food remains fresh, hot and well-presented during transportation. This has contributed to increased demand for disposable containers, utensils, and packaging materials these major key factors influencing the growth of the segment market.

Regional Insights

Asia Pacific

The Asia Pacific region dominated the global market with the largest share in 2023 and is expected to maintain its prominence over the anticipated period. The expansion of the Food Service Disposable Market in the region is primarily driven by the rapid growth of the online food delivery sector, exemplified by platforms like Zomato and Swiggy. The evolving lifestyles of individuals, characterized by an increasing focus on aesthetics and convenience, have significantly contributed to the surge in online food delivery services. The expanding adult population plays a pivotal role in driving the demand for food service disposables in the market.

North America

The North American region is anticipated to experience the fastest CAGR during the projection period. The COVID-19 pandemic has had a good impact on the online food delivery industry, contributing to the continued development in popularity of online meal delivery, which has experienced exponential growth in recent years. Online meal delivery is becoming more and more popular, and one of the main reasons for this is convenience. This increasing demand for food service disposables anticipates the market to grow during the forecast period.

Competitive Landscape

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Airlite Plastics

- Amcor

- Anchor Packaging Inc

- Berry Global Inc

- Biotrem

- Dart Container Corporation

- Huhtamaki

- Inteplast Group

- Novolex

- Saval Foodservice

- Sonoco Products Company

- WestRock Company

Recent Developments

-

June 2025: Airlite Plastics Co. revealed its acquisition of plastics manufacturing company IML PlastX. Airlite stated that the acquisition marks its first operational presence outside the U.S.

- December 2024: Novolex entered into a definitive agreement with Pactiv Evergreen Inc. According to Novolex, the partnership focuses on creating a leading manufacturer in food and specialty packaging products.

- In March 2023, Hinojosa launched Foodservice, a 100% recyclable and compostable packaging line for beverages, dairy, and prepared foods, enhancing sustainability in QSR and food sectors with certified, food-safe paper solutions.

- In January 2022, Amcor, a renowned global company in the creation of sustainable packaging solutions, introduced a novel line of paper-based packaging products. The AmFiber innovations are designed to revolutionize the capabilities of conventional paper packaging, offering an expanded array of features and functional benefits to align with consumers' evolving needs.

- In October 2021, Placon, a North American provider of thermoformed sustainable plastic packaging, announced an expansion in its production and workforce through the acquisition of a former Sonoco packaging operation.

Report Coverage

The food service disposable market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with

the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, packaging, material, applications, end use, and their futuristic growth opportunities.

Food Service Disposable Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 65.8 billion |

|

Revenue forecast in 2034 |

USD 98.5 billion |

|

CAGR |

4.60% from 2025–2034 |

|

Base year |

2024 |

|

Historical data |

2020– 2023 |

|

Forecast period |

2025– 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Packaging, By Material, By Application, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The key companies in Food Service Disposable Market Airlite Plastics, Amcor, Anchor Packaging Inc, Berry Global Inc, Biotrem, Dart Container Corporation

Food Service Disposable Market exhibiting the CAGR of 4.60% during the forecast period.

Food Service Disposable Market report covering key segments are packaging, material, application, end use, and region.

The key driving factors in Food Service Disposable Market are 1. Increasing demand for online and packed food deliveries.

Food Service Disposable Market Size Worth $ 98.5 Billion By 2034