Allergy Diagnostics and Therapeutics Market Size, Share, Trends, Industry Analysis Report

: By Type (Diagnostics and Therapeutics), Allergen Type, Test Type, Product, Drug Class, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 119

- Format: PDF

- Report ID: PM1334

- Base Year: 2024

- Historical Data: 2020-2023

Allergy Diagnostics and Therapeutics Market Overview

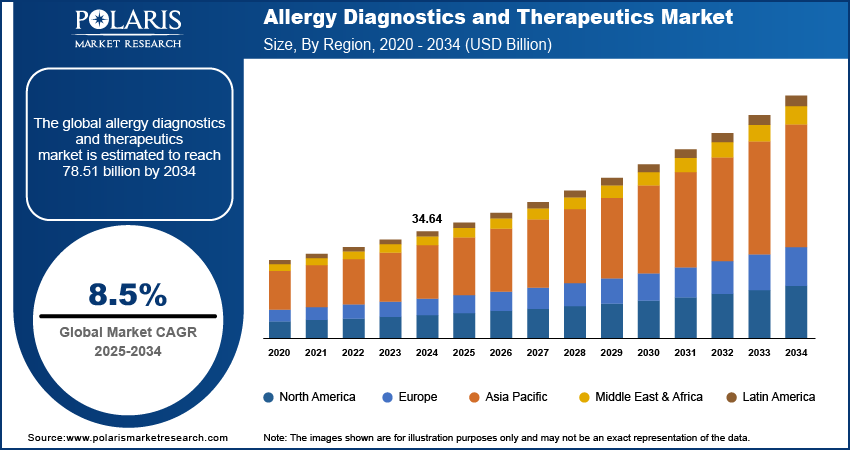

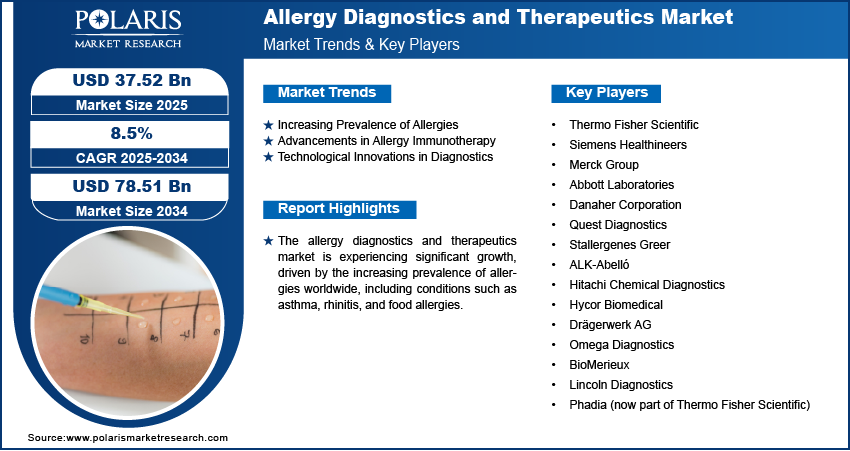

The allergy diagnostics and therapeutics market size was valued at USD 34.64 billion in 2024. The market is projected to grow from USD 37.52 billion in 2025 to USD 78.51 billion by 2034, exhibiting a CAGR of 8.5% during the forecast period.

The allergy diagnostics and therapeutics market focuses on the development and provision of diagnostic tools and treatments for various allergic conditions. The market includes products such as allergy testing kits, immunotherapy, and pharmaceuticals designed to alleviate symptoms of allergies. Key drivers of market growth include the increasing prevalence of allergic conditions, such as asthma and rhinitis, due to environmental changes, pollution, and genetic factors. The growing demand for personalized treatments and advancements in immunotherapy are also contributing to allergy diagnostics and therapeutics market expansion. Additionally, technological innovations in diagnostic techniques and a rising awareness of allergic disorders are influencing market trends, creating opportunities for new product developments and therapeutic approaches.

To Understand More About this Research: Request a Free Sample Report

Allergy Diagnostics and Therapeutics Market Dynamics

Increasing Prevalence of Allergies

The rising prevalence of allergies globally is a significant driver of allergy diagnostics and therapeutics market growth. Environmental factors such as climate change, urbanization, and pollution contribute to a higher incidence of allergic conditions such as asthma, allergic rhinitis, and food allergies. According to the 2019 World Health Organization (WHO) report, asthma affects over 260 million people worldwide, and the prevalence of allergic rhinitis has been steadily increasing in developed countries. This growing patient base has led to an increased demand for both diagnostic tools and therapeutic interventions. Additionally, the increased use of air conditioning, which circulates allergens, and the higher exposure to environmental pollutants are expected to continue influencing the rising rates of allergies.

Advancements in Allergy Immunotherapy

A key trend in the allergy diagnostics and therapeutics market is the growing adoption of allergy immunotherapy (AIT), including sublingual and subcutaneous treatments. These therapies are designed to reduce the severity of allergic reactions over time by desensitizing patients to specific allergens. Immunotherapy has gained popularity due to its long-term effectiveness compared to traditional symptom-management treatments such as antihistamines. According to the American College of Allergy, Asthma, and Immunology (ACAAI), immunotherapy can provide relief for patients suffering from allergic rhinitis and asthma, with clinical studies showing significant improvements in symptom management after a few years of treatment. As more patients seek alternatives to lifelong medication use, AIT is expected to continue growing as a preferred treatment option.

Technological Innovations in Diagnostics

Technological advancements in diagnostic tools are significantly reshaping the allergy diagnostics and therapeutics market. New developments in in-vitro diagnostic (IVD) tests and molecular techniques are enhancing the precision of allergy testing, enabling quicker, more accurate results. The ability to detect specific allergens at a molecular level helps in personalizing treatments, making them more effective. For instance, multiplex testing, which allows for the simultaneous testing of multiple allergens in a single sample, is gaining traction. The global demand for these advanced diagnostic tools is expected to increase as patients seek more efficient, less invasive ways to identify allergens.

Allergy Diagnostics and Therapeutics Market Segment Insights

Allergy Diagnostics and Therapeutics Market Assessment by Type

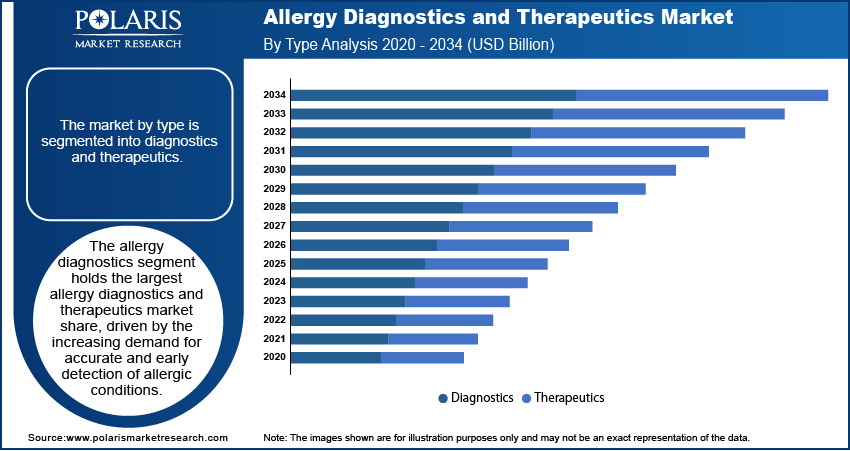

The market by type is segmented into diagnostics and therapeutics. The diagnostics segment holds the largest allergy diagnostics and therapeutics market share, driven by the increasing demand for accurate and early detection of allergic conditions. The segment includes a variety of diagnostic tools such as skin prick tests, blood tests, and newer technologies such as multiplex testing and molecular diagnostics. The adoption of these advanced diagnostic methods is expanding due to their ability to provide quick, reliable results, which are essential for effective treatment planning. The growth in the diagnostics segment is also influenced by the rising awareness of allergies and the growing prevalence of allergic diseases globally, prompting patients to seek more accurate testing solutions. Additionally, technological innovations in diagnostics are enhancing the precision and speed of allergy identification, further contributing to the segment's growth.

In contrast, the therapeutics segment is also experiencing the fastest growth rate, primarily fueled by advancements in immunotherapy treatments and the increasing demand for long-term, sustainable allergy management solutions. This segment includes allergy medications, such as antihistamines and corticosteroids, as well as allergy immunotherapy products such as sublingual tablets and injectable vaccines. The rising preference for immunotherapy, particularly sublingual immunotherapy (SLIT), is driving significant growth as it offers a less invasive, more patient-friendly alternative to traditional allergy shots. Moreover, the increasing emphasis on personalized medicine is expected to accelerate the development and adoption of tailored therapeutic options, thus contributing to the segment's rapid expansion.

Allergy Diagnostics and Therapeutics Market Evaluation by Allergen Type

The allergy diagnostics and therapeutics market segmentation, based on allergen type, includes food, inhaled, drug, and others. The food segment holds the largest market share during the forecast period. This growth is driven by the rising global prevalence of food allergies, particularly in developed countries, where allergies to foods such as peanuts, shellfish, and dairy products have become more common. As awareness of food allergies increases, both diagnostic tests and therapeutic treatments tailored to food allergens are in high demand. Food allergen testing, which includes skin tests and specific IgE blood tests is essential for identifying triggers and formulating personalized treatment plans. The increasing number of food allergy diagnoses has further contributed to the growth of this segment, with regulatory support for more advanced testing and treatment options enhancing market opportunities.

The inhaled segment is also registering the fastest growth due to the increasing rates of respiratory allergies such as asthma, rhinitis, and allergic conjunctivitis. The rising levels of air pollution, climate change, and pollen exposure are contributing to the growing prevalence of inhaled allergies. These factors have spurred the demand for effective diagnostic and therapeutic solutions for inhalant allergens such as dust mites, mold, pollen, and pet dander. The availability of more efficient allergen immunotherapy treatments, including both sublingual and subcutaneous immunotherapy options, is accelerating the growth in this segment. As patients seek longer-lasting and more personalized treatments for inhaled allergies, the segment is expected to continue growing rapidly in the coming years.

Allergy Diagnostics and Therapeutics Market Assessment by Test Type -Based Insights

The allergy diagnostics and therapeutics market segmentation, based on test type, includes in-vivo test and in-vitro test. The in-vitro test segment holds the largest market share. This is largely due to the increasing preference for non-invasive, highly accurate diagnostic methods. In-vitro tests, such as specific IgE blood tests and allergen-specific antibody assays, are gaining traction due to their ability to provide precise results without the need for skin exposure, making them suitable for patients with severe allergic reactions. The growing demand for personalized medicine, where diagnostic tests help tailor treatment plans for individuals, is also driving the expansion of this segment. The ability to detect a wide range of allergens through blood testing further adds to the appeal of in-vitro diagnostics.

The in-vivo test segment is also registering the highest growth, fueled by the rising adoption of skin prick tests and patch tests, which offer fast, reliable results for diagnosing specific allergens. In-vivo tests are particularly valued for their direct approach to detecting immediate allergic responses and are widely used in clinical settings for initial allergy diagnosis. The growth in this segment is also supported by the increasing awareness of allergy-related conditions and the desire for quick, on-site diagnostic solutions. As more individuals seek immediate results for allergic reactions, the demand for in-vivo testing methods, especially in allergy clinics and hospitals, is expected to continue to rise.

Allergy Diagnostics and Therapeutics Market Regional Insights

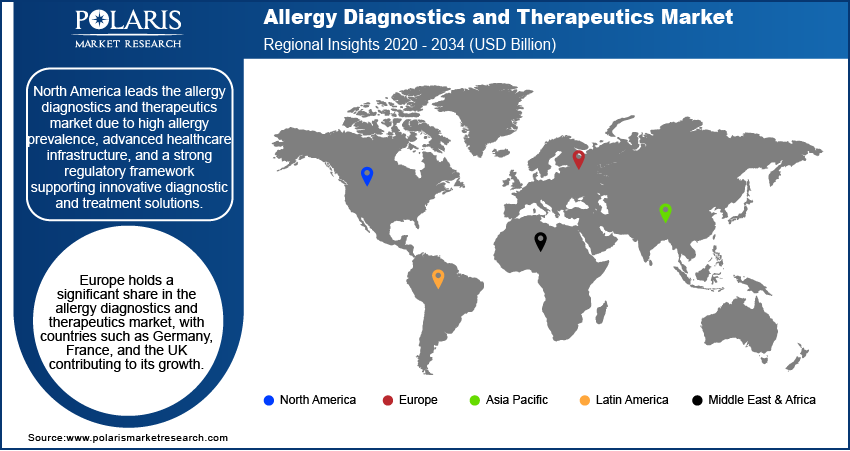

The allergy diagnostics and therapeutics market segmentation, based on region, includes North America, Europe, Asia Pacific, Latin America, and Middle East Africa. North America holds the largest allergy diagnostics and therapeutics market share, driven by factors such as the high prevalence of allergic conditions, advanced healthcare infrastructure, and a well-established regulatory environment that supports the development of innovative diagnostic and therapeutic solutions. The US, in particular, has a large patient population with conditions such as allergic rhinitis, asthma, and food allergies, which has spurred demand for both diagnostic testing and immunotherapy treatments. Additionally, increasing healthcare awareness, the availability of advanced allergy testing technologies, and the presence of key market players in the region further contribute to North America's dominance. The strong research and development activities in the region also play a crucial role in expanding the market.

Europe holds a significant share in the market, with countries such as Germany, France, and the UK contributing to its growth. The increasing prevalence of allergies, particularly in urban areas, has led to a rising demand for both diagnostic tests and treatments. The region benefits from advanced healthcare infrastructure, high awareness levels about allergic conditions, and access to advanced diagnostic technologies. Additionally, the regulatory environment in Europe supports the development and commercialization of innovative allergy solutions, which further boosts market growth. The growing emphasis on personalized medicine and immunotherapy treatments, including sublingual immunotherapy, is expected to continue driving the allergy diagnostics and therapeutics market in Europe.

Asia Pacific is witnessing rapid growth in the allergy diagnostics and therapeutics market, driven by the rising incidence of allergic conditions, particularly in countries such as China, India, and Japan. Urbanization, environmental pollution, and changes in lifestyle are contributing to an increasing prevalence of allergies in the region. Despite the rising demand, there is still a significant gap in access to advanced diagnostic tools and therapeutic options in some countries. However, improvements in healthcare infrastructure and a rising middle-class population are expected to enhance market growth. The increasing adoption of allergy testing and immunotherapy, along with greater awareness and healthcare reforms, is contributing to the accelerated expansion of the market in Asia Pacific.

Allergy Diagnostics and Therapeutics Market – Key Market Players and Competitive Insights

Allergy diagnostics and therapeutics market key players include Thermo Fisher Scientific, Siemens Healthineers, Merck Group, Abbott Laboratories, Danaher Corporation, and Quest Diagnostics. Other prominent players are Stallergenes Greer, ALK-Abelló, Hitachi Chemical Diagnostics, Hycor Biomedical, Drägerwerk AG, Omega Diagnostics, BioMerieux, Lincoln Diagnostics, Phadia (now part of Thermo Fisher), and HOB Biotech. These companies are actively involved in the development of diagnostic tests and therapies for various allergic conditions. Some of these players are involved in the research and development of new allergen-specific immunotherapies, while others provide advanced diagnostic tools such as blood tests, skin tests, and molecular diagnostic solutions.

In terms of competitive dynamics, companies are focusing on expanding their portfolios through technological innovations, product launches, and strategic partnerships. For instance, several players are working on enhancing the precision and speed of allergy testing methods, with some introducing multiplex testing platforms that allow the simultaneous analysis of multiple allergens. There is also a growing emphasis on personalized treatment options, such as targeted immunotherapy, to address the diverse needs of patients. Companies are also increasingly investing in the expansion of their research and development capabilities to create more effective and patient-friendly solutions.

The market's competitive landscape is influenced by both established companies and emerging players. Established firms leverage their strong distribution networks, brand recognition, and financial resources to maintain their market position. However, smaller companies with innovative solutions are gaining traction, especially in regions with growing demand for allergy diagnostics and therapeutics. As the market evolves, there is a focus on improving access to allergy testing and treatment options, particularly in emerging economies, where healthcare systems are expanding and awareness of allergies is rising.

Thermo Fisher Scientific is a prominent player in the allergy diagnostics and therapeutics market. The company focuses on providing comprehensive diagnostic solutions. It offers a wide range of products for allergy testing, including blood tests and molecular diagnostic tools. Their solutions help healthcare providers accurately identify allergens and tailor treatments to patients.

Siemens Healthineers is another key player in the market. It specializes in diagnostic imaging and laboratory diagnostics. The company provides allergy testing solutions such as blood-based allergy tests, which are designed to detect IgE antibodies to specific allergens. Their diagnostic products are used in both clinical settings and research.

Key Companies in Allergy Diagnostics and Therapeutics Market

- Thermo Fisher Scientific

- Siemens Healthineers

- Merck Group

- Abbott Laboratories

- Danaher Corporation

- Quest Diagnostics

- Stallergenes Greer

- ALK-Abelló

- Hitachi Chemical Diagnostics

- Hycor Biomedical

- Drägerwerk AG

- Omega Diagnostics

- BioMerieux

- Lincoln Diagnostics

- Phadia (now part of Thermo Fisher Scientific)

Allergy Diagnostics and Therapeutics Market Developments

- August 2024: Thermo Fisher Scientific announced the launch of a new allergy testing platform aimed at improving the speed and accuracy of allergy diagnoses. This move is part of their continued efforts to enhance diagnostic capabilities and meet the growing demand for reliable allergy testing.

- June 2024: Siemens Healthineers introduced an advanced allergy diagnostic tool that integrates artificial intelligence to streamline the testing process, providing faster results and improving the overall patient experience. This development reflects their focus on using technology to enhance diagnostic accuracy and efficiency.

Allergy Diagnostics and Therapeutics Market Segmentation

By Type Outlook

- Diagnostics

- Therapeutics

By Allergen Type Outlook

- Food

- Inhaled

- Drug

- Others

By Test Type Outlook

- In-vivo Test

- In-vitro Test

By Product Outlook

- Consumables

- Instruments

- Services

By Drug Class Outlook

- Corticosteroids

- Antihistamines

- Leukotriene Inhibitors

- Decongestants

- Nasal Anticholinergics

- Others

By End User Outlook

- Hospitals

- Diagnostics Labs

- Research & Development Centers

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Allergy Diagnostics and Therapeutics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 34.64 billion |

|

Market Size Value in 2025 |

USD 37.52 billion |

|

Revenue Forecast in 2034 |

USD 78.51 billion |

|

CAGR |

8.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The allergy diagnostics and therapeutics market has been segmented into detailed segments of type, allergen type, test type, product, drug class, and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth and marketing strategy in the allergy diagnostics and therapeutics market focus on expanding product portfolios, enhancing diagnostic accuracy, and increasing accessibility to allergy testing and treatments. Companies are leveraging technological advancements, such as AI and multiplex testing, to improve diagnostic speed and precision. Strategic partnerships with healthcare providers, expanding distribution networks, and increasing awareness through educational campaigns are key approaches. Additionally, there is a focus on expanding in emerging markets where rising allergy prevalence and improving healthcare systems are creating growth opportunities. Investments in research and development of personalized treatments are also central to capturing a larger market share.

FAQ's

? The allergy diagnostics and therapeutics market size was valued at USD 34.64 billion in 2024 and is projected to grow to USD 78.51 billion by 2034.

? The market is projected to register a CAGR of 8.5% during the forecast period, 2025-2034.

? North America had the largest share of the market.

? Key players in the allergy diagnostics and therapeutics market include Thermo Fisher Scientific, Siemens Healthineers, Merck Group, Abbott Laboratories, Danaher Corporation, and Quest Diagnostics. Other prominent players are Stallergenes Greer, ALK-Abelló, Hitachi Chemical Diagnostics, Hycor Biomedical, Drägerwerk AG, Omega Diagnostics, BioMerieux, Lincoln Diagnostics, Phadia (now part of Thermo Fisher), and HOB Biotech.

? The diagnostics segment accounted for the largest share of the market.

? The food segment accounted for the largest share of the market.

? Allergy diagnostics and therapeutics refer to the methods and treatments used to identify and manage allergic reactions in individuals. Allergy diagnostics involve a variety of tests to determine specific allergens that trigger allergic responses, such as skin prick tests, blood tests, and molecular diagnostics. These tests help healthcare providers pinpoint the cause of allergies, whether it be environmental factors, food, or other substances. Allergy therapeutics, on the other hand, include treatments aimed at alleviating or preventing allergic reactions, such as medications (antihistamines, corticosteroids), immunotherapy (allergy shots or sublingual tablets), and other approaches designed to desensitize individuals to allergens over time. Together, they form a comprehensive approach to managing allergic conditions effectively.

? A few key trends in the allergy diagnostics and therapeutics market are described below: Rising Prevalence of Allergies: An increase in allergic conditions like asthma, rhinitis, and food allergies, driven by environmental factors and lifestyle changes. Advancements in Immunotherapy: Growing adoption of allergy immunotherapy (AIT) such as sublingual and subcutaneous treatments, providing long-term relief from allergies. Technological Innovations in Diagnostics: Development of advanced diagnostic tools, including multiplex testing and molecular diagnostics, offering quicker and more accurate results. Personalized Medicine: Increasing focus on tailored treatments based on individual patient profiles, improving effectiveness in managing allergies.

? A new company entering the allergy diagnostics and therapeutics market could focus on innovating in areas such as personalized medicine and advanced diagnostic technologies. By developing tools that offer faster, more accurate, and non-invasive allergy testing, the company can appeal to both healthcare providers and patients seeking more efficient solutions. Additionally, focusing on immunotherapy treatments, especially sublingual or customized therapies, could differentiate the company by addressing the growing demand for long-term, personalized allergy management. Expanding into emerging markets with rising allergy prevalence and improving access to affordable treatments would also provide growth opportunities, helping the company stay ahead of the competition.

? Companies manufacturing, distributing, or purchasing Allergy Diagnostics and Therapeutics and related products, and other consulting firms must buy the report.