Chocolate Market Size, Share, Trends, Industry Analysis Report

: By Product (Artificial and Traditional), Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Oct-2025

- Pages: 128

- Format: PDF

- Report ID: PM1144

- Base Year: 2024

- Historical Data: 2020-2023

What is the Current Market Size?

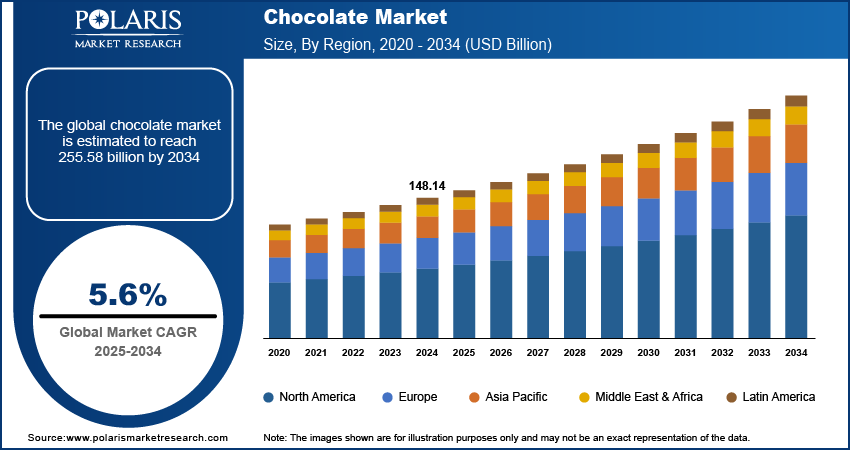

The global chocolate market size was USD 148.14 billion in 2024 and is projected to increase to USD 156.26 billion in 2025, reaching USD 255.58 billion by 2034, at an annual growth rate of 5.6% during the forecast period. Key Factors driving the demand includes utilization of high-quality or nutritious ingredients in chocolate items, growing awareness of the health benefits of dark chocolate consumption, and changing consumer preferences and innovative product offerings.

Key Insights

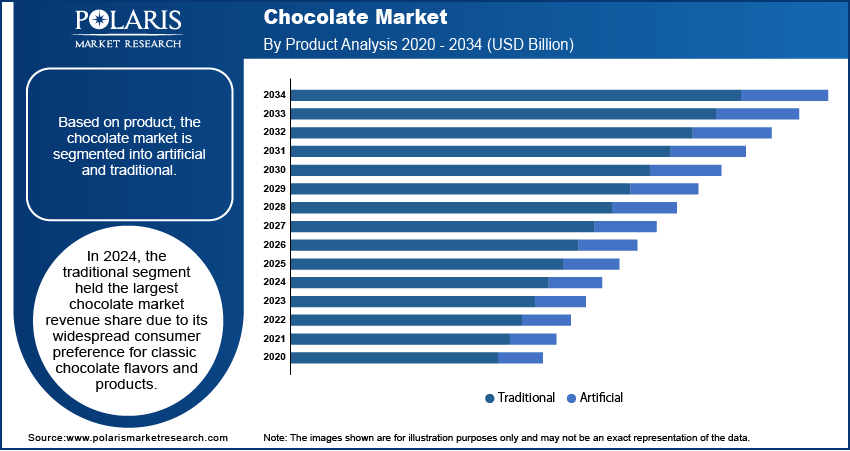

- By product, traditional chocolate held the largest share in 2024 due to established consumer preference for authentic cocoa taste and premium/quality positioning keeps traditional chocolate as the primary revenue driver.

- By distribution channel, supermarkets & hypermarkets held the largest share in 2024 because they offer wide product assortments, in-store visibility, promotions and impulse-buy placement.

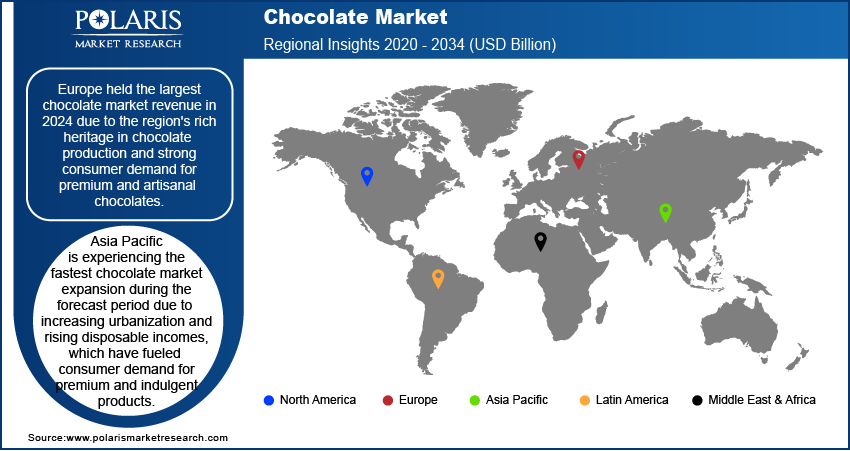

- By region, Europe was the largest regional market held the largest share in 2024, led by mature consumption, strong premium chocolate demand, and well-established confectionery manufacturers across Western Europe.

Industry Dynamics

- Rising consumer inclination toward premium and artisanal products is fueling demand for high-quality, ethically sourced, and single-origin varieties.

- Expanding retail infrastructure, coupled with the growing influence of organized supermarkets and online grocery platforms, is improving accessibility and product visibility.

- Continuous innovation in flavor profiles, textures, and functional ingredients, such as added proteins, antioxidants, or reduced sugar is attracting health-conscious consumers.

Market Statistics

- 2024 Market Size: USD 148.14 billion

- 2034 Projected Market Size: USD 255.58 billion

- CAGR (2025-2034): 5.6%

- Europe: Largest market in 2024

What Does the Current Market Landscape Look for Chocolate Industry?

Chocolate is a sweet, rich food product made from roasted and ground cacao beans, often combined with sugar and milk, used in confectionery, baking, and beverages. The global chocolate market is a dynamic and rapidly evolving industry driven by changing consumer preferences and innovative product offerings. Chocolate remains one of the most popular confectionery items, with demand fueled by its versatile applications across food, beverages, and desserts. Rising health consciousness among consumers has led to a surge in demand for premium, organic, sugar-free, vegan, and gluten-free chocolate products. For instance, in June 2021, Nestlé launched KitKat V, a vegan version of the iconic chocolate bar, available in particular countries. Made with a rice-based milk alternative and 100% sustainable cocoa, it caters to the growing demand for plant-based options and is certified vegan.

Trends such as bean-to-bar manufacturing and single-origin cocoa derivatives are shaping the chocolate market landscape, offering unique and high-quality products to cater to discerning consumers. The pandemic further highlighted the emotional appeal of chocolate, as consumers turned to it for comfort and stress relief. Innovations in packaging and sustainable sourcing, coupled with expanding distribution channels, have enhanced accessibility and appeal. The market is poised for substantial growth in the coming years with increasing demand from emerging economies and growing awareness of the health benefits of moderate chocolate consumption.

To Understand More About this Research: Request a Free Sample Report

Market Dynamics

What are the Factors Driving the Market Expansion?

Utilization of High-Quality or Nutritious Ingredients in Chocolate Items

There is a growing preference for chocolates that are made with premium ingredients, such as organic cocoa, nuts, and superfoods, as consumers become more health-conscious. For instance, in March 2020, Endangered Species Chocolate (ESC) launched a new plant-based oat milk chocolate bar line, offering three flavors exclusively at Whole Foods Market. The vegan, gluten-free bars feature 55% cocoa, sustainably sourced ingredients, and support ESC's mission of ethical trade and habitat conservation. These ingredients such as cocoa and others enhance the flavor and texture of chocolates and offer additional nutritional benefits, such as higher antioxidant content and lower sugar levels. Consequently, brands focusing on the inclusion of high-quality ingredients cater to the evolving preferences of health-conscious consumers, boosting market growth.

Growing Awareness of Health Benefits of Dark Chocolate Consumption

The growing awareness of the health benefits of dark chocolate consumption is driving the chocolate market growth as consumers increasingly prioritize wellness in their dietary choices. Dark chocolate, rich in antioxidants, flavonoids, and essential minerals, is linked to improved heart health, reduced stress, and enhanced cognitive function. For instance, a December 2024 report by NPR highlighted that individuals who consume approximately one ounce of dark chocolate daily have a 21% lower risk of developing Type 2 diabetes compared to those who do not include it in their diet. These health advantages make it a popular choice among health-conscious individuals seeking indulgence without guilt. Additionally, the perception of dark chocolate as a functional food has led to its inclusion in premium and specialty product lines, further boosting its demand and driving growth in the overall market.

Segment Insights

Product Analysis

Which Segment by Product Dominated the Market in 2024?

The global chocolate market segmentation, based on product, includes artificial and traditional. In 2024, the traditional segment held the largest revenue share in the global market due to its widespread consumer preference for classic chocolate flavors and products. Traditional chocolates, often associated with nostalgia and comfort, continue to dominate demand, particularly in regions where heritage brands and artisanal offerings hold cultural significance. Additionally, the use of natural ingredients and traditional processing methods in these products aligns with the growing consumer inclination toward authenticity and quality. This strong consumer loyalty, coupled with the segment’s broad appeal across age groups and markets, has solidified its position as the leading revenue contributor.

Distribution Channel Analysis

Why the Online Segment Held the Highest Market Share?

The global chocolate market segmentation, based on distribution channel, includes convenience store, supermarket & hypermarket, and online. The online segment accounts for the highest market share during the forecast period due to the increasing adoption of e-commerce platforms and the convenience they offer. Online channels provide consumers with a wide variety of chocolate options, including premium and niche brands, that may not be available in physical stores. Features such as home delivery, exclusive discounts, and customizable gifting options further drive consumer preference for online shopping. Additionally, the rise of digital marketing and social media promotions has enhanced brand visibility and consumer engagement, boosting sales through online platforms. This shift aligns with changing consumer lifestyles and the growing reliance on digital solutions.

Regional Insights

By region, the study provides chocolate market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Which Region Held the Largest Revenue Share in 2024?

Europe held the largest market revenue in 2024 due to the region's rich heritage in chocolate production and strong consumer demand for premium and artisanal chocolates. Countries such as Switzerland, Belgium, and Germany are globally renowned for their high-quality chocolate, attracting both local and international consumers. Additionally, the widespread culture of gifting chocolates during festivals and special occasions has sustained robust market growth. The presence of leading chocolate manufacturers, continuous product innovation, and the popularity of organic and sustainable offerings further contributed to Europe's dominance in the global chocolate market. For instance, in September 2024, Nutella expanded its product range by introducing two new offerings- Nutella Ice Cream, combining layers of Nutella and hazelnut-flavored ice cream, and Nutella Plant-Based, a milk-free variant made with rice syrup and chickpea. These launches cater to the rising demand for plant-based options, reflecting a shift toward dietary and lifestyle preferences. Both products align with sustainability goals, featuring responsibly sourced ingredients such as certified cocoa and palm oil and eco-friendly packaging, including recyclable glass jars and lids.

Why Asia Pacific is Expected to Witness the Fastest Growth?

Asia Pacific is experiencing the fastest chocolate market expansion during the forecast period due to increasing urbanization and rising disposable incomes, which have fueled consumer demand for premium and indulgent products. The region's growing middle-class population, coupled with the influence of Western food culture, has boosted chocolate consumption. Additionally, rapid growth in e-commerce platforms and innovative marketing strategies by global and regional brands have enhanced product accessibility and appeal. Expanding retail networks and the introduction of unique flavors tailored to local preferences further drive market growth in Asia Pacific.

Chocolate Market – Key Players and Competitive Analysis Report

The competitive landscape of the chocolate market features a mix of global giants and regional players aiming to gain market share through product innovation, sustainability initiatives, and strategic expansions. Leading companies such as Nestlé, Mars, Barry Callebaut, and Ferrero leverage their extensive R&D capabilities and global distribution networks to introduce premium, sustainably sourced, and health-focused chocolate products. Market trends reveal growing consumer demand for organic, vegan, and functional chocolates, reflecting heightened health consciousness and ethical considerations. The market is poised for substantial growth, driven by increasing consumption in emerging markets and a rising preference for premium and artisanal options. Regional players cater to localized tastes and cost sensitivities, particularly in Asia Pacific, which is projected to register at the highest CAGR due to its expanding middle-class population and evolving consumption patterns. Competitive strategies include mergers and acquisitions, partnerships with cocoa-producing communities, and the launch of innovative offerings such as clean-label and low-sugar chocolates. These developments highlight the importance of sustainability, consumer-centric innovation, and regional market dynamics in shaping the future of the chocolate industry. A few key major players are Arcor; Barry Callebaut; Chocoladefabriken Lindt & Sprüngli AG; Ferrero; Mars, Incorporated; Meiji Holdings Co., Ltd.; Mondelēz International, Inc.; Nestlé; The Australian Carob Co.; and The Hershey Company

Mondelēz International, Inc. is a prominent American multinational company specializing in confectionery, food, and snack products, headquartered in Chicago, Illinois. Established in 2012, Mondelēz has positioned itself as a leader in the global snack industry, reflecting its commitment to providing tasty snacks worldwide. Mondelēz operates in about 160 countries and employs around 91,000 people globally. The company's extensive portfolio includes some of the most recognized chocolate brands, such as Cadbury Dairy Milk, Toblerone, Milka, and Côte d'Or. These brands contribute significantly to Mondelēz's strong position in the chocolate market, where it ranks second globally. In addition to chocolate, Mondelēz offers a diverse range of products, including cookies (Oreo, Chips Ahoy!), crackers (Ritz), and gum (Trident), making it one of the largest snack companies worldwide. Mondelēz focuses on innovation and sustainability within its operations. The company has implemented various strategies to enhance its product offerings while addressing consumer trends toward healthier snacking options. That includes expanding its portfolio to include organic and better-for-you snacks. Furthermore, Mondelēz emphasizes responsible sourcing practices for its cocoa and other ingredients to ensure ethical production processes. Overall, Mondelēz International stands out not only for its iconic brands but also for its commitment to adapting to changing consumer preferences and promoting sustainable practices in the food industry.

Nestlé, specializes in the food and beverage industry, has a history in chocolate manufacturing that dates back to the late 19th century. The company was established in 1866 through the merger of two Swiss firms, which laid the groundwork for its extensive product portfolio, including chocolate. Nestlé's contributions to the chocolate industry began with the invention of milk chocolate by Daniel Peter in 1875, which was later commercialized under the Nestlé brand. The company played a pivotal role in shaping the chocolate landscape, particularly in Switzerland, where it merged with other chocolate makers such as Cailler and Kohler to expand its offerings. Nestlé operates over 50 chocolate manufacturing facilities globally, producing popular brands such as KitKat, Smarties, and Aero. The company focuses on diverse consumer preferences, from traditional bars to healthier confections, and emphasizes quality control using advanced technologies to ensure product safety and authenticity. Nestlé's focus on research and development has led to healthier chocolate options, meeting consumer demand for nutritious snacks. Innovations such as aeration and extrusion have created lighter chocolates with lower calories while preserving taste and texture. This commitment to health-conscious products aligns with the company's strategy to adapt to consumer preferences while maintaining its legacy in the chocolate industry. Overall, Nestlé's ongoing presence in the market showcases its ability to innovate and respond to consumer needs.

Key Companies in Chocolate Market

- Arcor

- Barry Callebaut

- Chocoladefabriken Lindt & Sprüngli AG

- Ferrero

- Mars, Incorporated

- Meiji Holdings Co., Ltd.

- Mondelēz International, Inc.

- Nestlé

- The Australian Carob Co.

- The Hershey Company

Chocolate Market Developments

May 2024: The Hershey Company showcased innovative products such as Reese’s Medals and KIT KAT Pink Lemonade at the Sweets & Snacks Expo. The company highlighted advancements in augmented reality for merchandising, foodservice strategies for growing demand, and optimized checkout experiences to boost sales and customer engagement.

June 2024: Nestlé Travel Retail launched the Nestlé Sustainably Sourced chocolate range, reflecting its commitment to responsible cocoa sourcing through the Nestlé Cocoa Plan and Rainforest Alliance certification. The range offers personalized packaging and recyclable pouches, emphasizing sustainability, supporting cocoa-farming families, and promoting transparency in production practices.

Chocolate Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Artificial

- Traditional

- Milk

- Dark

- White

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Convenience Store

- Supermarket & Hypermarket

- Online

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Chocolate Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 148.14 billion |

|

Market Size Value in 2025 |

USD 156.26 billion |

|

Revenue Forecast by 2034 |

USD 255.58 billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global chocolate market size was valued at USD 148.14 billion in 2024 and is projected to grow to USD 255.58 billion by 2034.

• The global market is projected to register a CAGR of 5.6% during the forecast period.

• Europe held the largest chocolate market revenue in 2024.

• A few key players in the market are Arcor; Barry Callebaut; Chocoladefabriken Lindt & Sprüngli AG; Ferrero; Mars, Incorporated; Meiji Holdings Co., Ltd.; Mondel?z International, Inc.; Nestlé; The Australian Carob Co.; and The Hershey Company.

• In 2024, the traditional segment held the largest chocolate market revenue share globally.

• The online segment accounted for the highest market share during the forecast period.