Baking Ingredients Market Size, Share, Trends, Industry Analysis Report

: By Product, By End Use (Bread, Cakes and Pastries, Cookies and Biscuits, Rolls and Pies, and Others), and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 125

- Format: PDF

- Report ID: PM1977

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

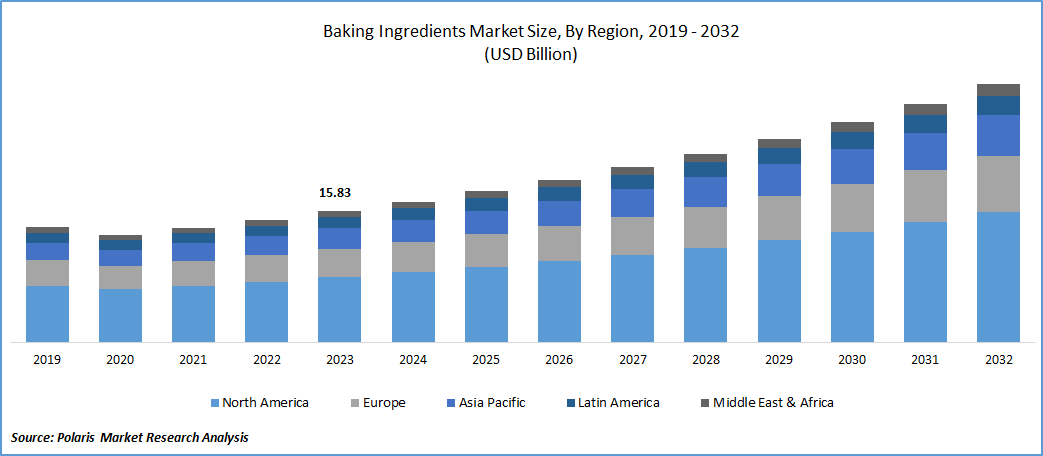

The global baking ingredients market size was valued at USD 17.79 billion in 2024. It is projected to grow from USD 18.90 billion in 2025 to USD 33.05 billion by 2034, exhibiting a CAGR of 6.4% during 2025–2034.

Baking ingredients are the essential components used to make baked goods such as bread, cakes, cookies, and pastries. They include items such as flour, sugar, eggs, butter, leavening agents, and flavorings. Each ingredient plays a specific role in the texture, taste, and structure of the final product.

The rising demand for multi-cuisine bakery products and the escalating need for baking ingredients that accelerate fermentation are driving the demand for bakery ingredients. Vital baking components such as enzymes, emulsifiers, baking powders, and yeast play a major role in crafting a variety of bakery products such as bread, cakes, pastries, rolls, pies, and tarts.

To Understand More About this Research: Request a Free Sample Report

Rising urbanization and fast-paced lifestyles are leaving people with less time to cook, leading to a growing demand for ready meals and easy-to-prepare food. According to the World Bank, 57% of the world's population lives in urban settings. Consequently, food and beverage companies are introducing a wide range of baked products that are perfect for quick breakfasts and convenient snacks. This is boosting the need for high-quality bakery ingredients that improve flavor, texture, and shelf life. Additionally, the availability of baked goods with longer shelf life and the convenience of freezer-friendly options in retail bakeries are encouraging single-purchase buying habits, thereby driving the market growth.

Market Dynamics

Expansion of Bakery Industry

The bakery industry is expanding rapidly as the consumption of bakery products, including bread, pastries, cakes, cookies, and other baked goods, is on the rise. According to the US Bureau of Labor Statistics, in 2023, the US bakery industry employed 243,400 people. This expanding industry is driving the demand for bakery ingredients. Additionally, factors such as population growth, urbanization, and changing consumer preferences contribute to the heightened demand for bakery products, further fueling the baking ingredients market expansion.

Expansion of Retail Channels and Quick Commerce

The global expansion of retail channels and smart retail outlets into underdeveloped and previously underserved areas is significantly boosting the availability and visibility of bakery products. According to the Government of Canada, global retail sales of baked goods reached USD 407,164.2 million in 2021, showcasing the expansion of retail channels. More people now have access to modern retail outlets, leading to a rising demand for convenient and affordable baked goods. This increase in demand is directly fueling the need for high-quality bakery ingredients used in the production of bread, pastries, cookies, and other baked items. Additionally, the emergence of quick commerce platforms in major cities and developing regions is further playing a major role by enabling faster delivery of fresh bakery products. These combined factors are driving the baking ingredients market demand.

Market Segment Analysis

Market Assessment by End Use

The market assessment, based on end use, includes bread, cakes and pastries, cookies and biscuits, rolls and pies, and others. The bread segment is expected to witness significant growth during the forecast period. Bread is acknowledged as a staple food in numerous countries globally, with its consistent demand growth attributed to affordability and nutritional value. Evolving consumer preferences have prompted manufacturers to focus on innovation, aiming to offer baked goods that cater to diverse tastes. Owing to the rising health consciousness among consumers, manufacturers are focusing on creating bread with well-balanced nutritional content and flavors.

Market Evaluation by Product

The baking ingredients market segmentation, based on product, includes oils, fats, and shortenings; enzymes; preservatives; colors & flavors; starch; baking powder & mixes; yeast; emulsifiers; and others. The baking powder & mixes segment dominated the baking ingredients market share in 2024. Baking powder functions as a vital ingredient in bakery products, acting as a leavening agent and a provider of essential nutrients such as proteins, vitamins, and carbohydrates. It plays a crucial role in helping baked goods rise and achieve a light, fluffy texture. Baking powder is widely used in the production of cakes, cookies, muffins, and breads. Additionally, the growing consumer awareness of health and wellness is also driving interest in organic and natural ingredients. Wheat-based baking powder, in particular, is gaining popularity due to its lower levels of saturated fat and cholesterol, aligning with healthier dietary preferences.

Regional Analysis

The study provides the baking ingredients market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the global market. The trend of on-the-go food lifestyles in countries such as Canada and the US is driving the demand for bakery products in the region. According to The Auguste Escoffier School of Culinary Arts, 6 out of 10 US citizens prefer on-the-go food instead of dine in. Bakery manufacturers are offering convenient and portable options, such as pocket wraps and rolls, which are further fueling the industry growth in the region. The prevalence of gluten-free food is a prominent trend in the industry, and it is expected to persist during the projected period.

Asia Pacific is expected to record the highest CAGR during the forecast period. China and India, as the most populous countries globally, are expected to see further population growth. As the urban population in the region increasingly adopts Western food preferences, many businesses are inclined to enhance their production volume and employ new production techniques to deliver high-quality products. This shift presents growth opportunities for baking ingredient manufacturers to supply emulsifiers, enzymes, baking powders, oils, and fats to baking mixes manufacturers in China, Japan, and India.

The demand for baking mix ingredients is growing rapidly in India, driven by increasing urbanization, changing food habits, and a rising preference for convenience foods. The demand for high-quality baking mixes in India is on the rise as more people in cities and even smaller towns embrace Western-style bakery products such as cakes, cookies, and breads. These mixes are especially appealing to young consumers and working professionals who want convenience without compromising on taste. The expansion of retail chains and e-commerce platforms has made Indian baking mix ingredients more accessible than ever.

Key Players and Competitive Analysis

The market ecosystem is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. The competitive trend is amplified by continuous progress in product offerings. A few major players in the market are Aryzta AG, Associated British Foods plc, Bread Talk Co. Ltd, Britannia Industries Ltd, Finsbury Food Group, Flower Foods Inc, General Mills Inc, George Weston Ltd, Goodman Fielder, Grupo Bimbo S.A.B. de C.V, Hostess Brands LLC, Koninklijke DSM V.V, Mckee Foods Corporation, Mondelez International, Monginis Food Pvt. Ltd., Nestle SA, Tiger Brands Company, Uniferm GmbH & Co., and Yamazaki Baking Co. Ltd.

Nestle SA (Nestle), headquartered in Vevey, Waadt, Switzerland, is a manufacturer and marketer of food products and beverages. The company's product portfolio comprises baby foods, bottled water, cereals, chocolates and confectionery, coffee, culinary products, chilled and frozen foods, dairy products, nutritional products, ice cream, and pet products. It also offers nutritional products, sausages, and direct-to-consumer meal delivery services. Its major brands include Aero, Alpo, Milkybar, Nestle Ice Cream, Cerelac, Nescafe, Nespresso, Nestea, Milo, Maggi, Buitoni, Cailler, Movenpick, Freshly, Purina, Boost, Gerber, and Kit Kat. The company has a business presence in Asia, Oceania, sub-Saharan Africa, the Americas, Europe, the Middle East, and North Africa.

General Mills Inc., established in 1856 and based in Golden Valley, Minnesota, is a multinational food company with a diverse range of brands. Its products are widely available in American households and international markets. The company focuses on producing food items that cater to various consumer preferences. General Mills manages a portfolio of brands, including Gold Medal Flour, Nature Valley, Annie’s, Cascadian Farm, Pillsbury, Betty Crocker, Häagen-Dazs, Old El Paso, and Blue Buffalo pet food. These offerings span various categories, addressing different dietary needs and consumer demands. The company's operations are divided into three primary segments: US Retail, Bakeries and Foodservice, and International. The US Retail segment generates a substantial portion of revenue through the sale of packaged goods via retail chains, cooperatives, membership stores, and wholesalers. This includes baking mixes, cereals, snacks, meals, and dough products. The Bakeries and Foodservice segment provides customized food solutions such as frozen dough and breakfast items to quick-service restaurants and food service operators. The International segment operates in numerous countries, marketing global brands alongside products adapted to local tastes. General Mills maintains a global presence with operations in North America, Latin America, Europe, Asia Pacific, the Middle East, and Africa. Manufacturing facilities are located across these regions to support its markets.

List of Key Companies in Baking Ingredients Market

- Aryzta AG

- Associated British Foods plc

- Bread Talk Co. Ltd

- Britannia Industries Ltd

- Finsbury Food Group

- Flower Foods Inc

- General Mills Inc

- George Weston Ltd

- Goodman Fielder

- Grupo Bimbo S.A.B. de C.V

- Hostess Brands LLC

- Koninklijke DSM V.V

- Mckee Foods Corporation

- Mondelez International

- Monginis Food Pvt. Ltd.

- Nestle SA

- Tiger Brands Company

- Uniferm GmbH & Co.

- Yamazaki Baking Co. Ltd

Baking Ingredients Industry Developments

In April 2025, CSM Ingredients Group launched Egg ‘n Easy Plus, an advanced egg reduction solution, designed to reduce costs and maintain quality, and was introduced as part of their Value-Added Solutions strategy.

In May 2024, New bakery ingredients were launched by Dawn Foods, Puratos, and others, including aromatic sourdough starters, high-protein flours, and on-trend flavored inclusions, enhancing innovation in the baking industry.

Baking Ingredients Market Segmentation

By Product Outlook (Revenue USD Billion, 2020–2034)

- Oils, Fats, and Shortenings

- Enzymes

- Preservatives

- Colors & Flavors

- Starch

- Baking Powder & Mixes

- Yeast

- Emulsifiers

- Others

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Bread

- Cakes and Pastries

- Cookies and Biscuits

- Rolls and Pies

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Baking Ingredients Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 17.79 billion |

|

Market Size Value in 2025 |

USD 18.90 billion |

|

Revenue Forecast in 2034 |

USD 33.05 billion |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 17.79 billion in 2024 and is projected to grow to USD 33.05 billion by 2034.

The global market is projected to record a CAGR of 6.4% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are Aryzta AG, Associated British Foods plc, Bread Talk Co. Ltd, Britannia Industries Ltd, Finsbury Food Group, Flower Foods Inc, General Mills Inc, George Weston Ltd, Goodman Fielder, Grupo Bimbo S.A.B. de C.V, Hostess Brands LLC, Koninklijke DSM V.V, Mckee Foods Corporation, Mondelez International, Monginis Food Pvt. Ltd., Nestle SA, Tiger Brands Company, Uniferm GmbH & Co., and Yamazaki Baking Co. Ltd.

The baking powder & mixes segment dominated the market share in 2024, as it is widely employed as a fundamental component in bakery products worldwide.

The bread segment is expected to witness significant growth during the forecast period as it is used as a staple food in numerous countries globally, with its consistent demand growth attributed to affordability and nutritional value.