Enzymes Market Share, Size, Trends, Industry Analysis Report

By Formulation (Liquid, Dry); By Type; By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 152

- Format: PDF

- Report ID: PM1059

- Base Year: 2024

- Historical Data: 2020-2023

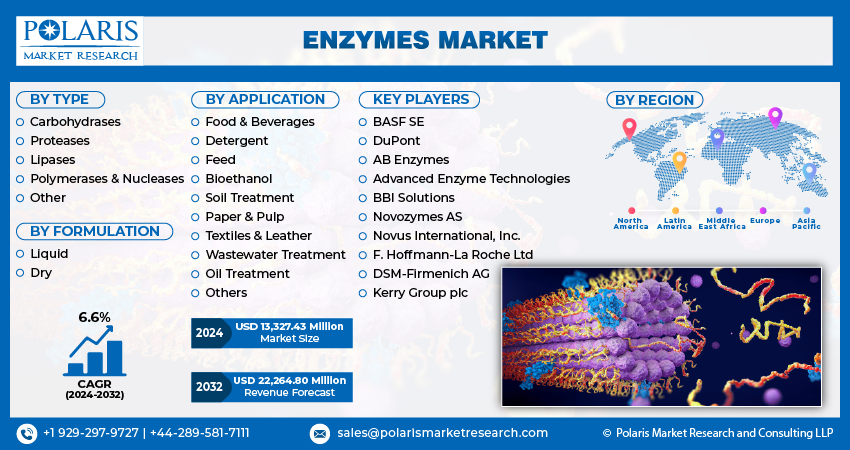

The global enzymes market was valued at USD 14.9 billion in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2034. Key drivers include the expanding applications of enzymes in pharmaceuticals, food & beverage, and biofuel industries, coupled with advancements in enzyme engineering technologies.

Industry Trends

The enzyme market is experiencing robust growth, fueled by the increasing demand across various industries like food and beverages, pharmaceuticals, and biofuels. Enzymes help to improve process efficiency, reduce energy consumption, and enhance product quality, providing significant advantages to businesses. In the food and beverage sector, these are widely used for different applications like baking, brewing, dairy food, and fruit juice clarification, among others. The growing consumer awareness about health and nutrition has further boosted the demand in food products, especially for their role in improving digestion and nutrient absorption.

To Understand More About this Research:Request a Free Sample Report

The pharmaceutical industry represents another key segment driving the enzyme market, where these are utilized in drug manufacturing processes, diagnostics, and therapeutic applications. Enzyme-based drugs, also known as biologics, have gained prominence due to their specificity, efficacy, and reduced side effects compared to traditional chemical-based drugs.

- For instance, In December 2022, Ginkgo Bioworks introduced Ginkgo Enzyme Services, leveraging high-throughput screening and machine learning for enzyme development across pharmaceuticals, diagnostics, food, and agriculture.

Additionally, advancements in biotechnology have facilitated the development of novel enzyme-based therapies for various diseases, including cancer, metabolic disorders, and autoimmune conditions, thereby expanding the market opportunities for manufacturers. Furthermore, the increasing focus on sustainability and environmental conservation has led to a surge in demand for enzymes in the biofuel and renewable energy sectors. These play a vital role in the production of biofuels such as ethanol and biodiesel from renewable feedstocks such as corn, sugarcane, and algae.

Key Takeaways

- North America dominated the market and contributed over 40% market share in 2024

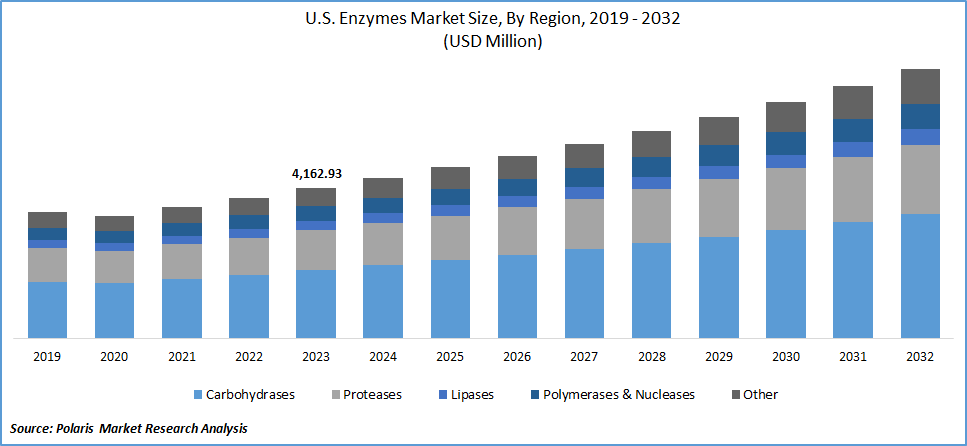

- By type category, the carbohydrases segment dominated the global enzymes market size in 2024

- By application category, the food & beverages segment is projected to grow with a significant CAGR over the forecast period

What are the Industry Drivers Driving the Demand for the Enzymes Market?

Increasing Global consumption of Food and Beverages

The increasing global consumption of food and beverages is a key driving factor for the growth of the enzyme market. The growth is fueled by various factors such as population growth, urbanization, changing dietary habits, and increasing disposable incomes. As people become more affluent and urbanized, there is a growing demand for convenience foods, ready-to-eat meals, and processed snacks. Also, rising consumer attention to healthier food options has led to a higher adoption of low-fat and high-protein foods, driving the demand in the food and beverage industry.

The growing need for clean-label products free from artificial additives and preservatives has resulted in the rising incorporation of enzymes in the production of plant-based and alternative protein sources, including pea, soy, and mycoprotein, contributing to the expansion of the market.

The increasing application of enzymes in beverages and the growing popularity of plant-based drinks are also significant factors driving market growth. The rapid rate of urbanization and changing dietary habits have led to higher demand for beverages and dairy products. This trend is further propelling the demand in the production of various beverages, including plant-based drinks, thereby driving the growth of the global enzyme market.

These play a crucial role in the food and beverage industry by catalyzing biochemical reactions, thereby accelerating processes like fermentation, flavor development, dough conditioning, and starch hydrolysis. With consumers becoming increasingly health-conscious, there is also a growing preference for natural and clean-label products, prompting manufacturers to seek enzyme solutions as alternatives to artificial additives and preservatives.

Which Factor is Restraining the Demand for Enzymes?

Stringent Implementation of Regulations Hinders the Industry Growth

The enzymes market is facing a significant challenge due to the complex and stringent regulatory requirements. These are used across diverse industries, but their manufacturers face hurdles in ensuring compliance due to varying regulatory frameworks. As such, manufacturers must comply with regulations imposed by various governing agencies, including the Enzyme Technical Association (ETA) and the Food Chemicals Codex. These regulations often require extensive documentation, testing, and approval processes, adding time and costs to enzyme development and commercialization.

In the food industry, the use of enzymes must adhere to guidelines defined by various regulatory bodies, such as the FDA, EFSA, USDA, and FSANZ. Despite stringent regulations in the UK, Canada, and the European Union, the lack of a uniform regulatory structure for enzymes can limit their widespread adoption, particularly in price-sensitive industries or applications where cost-effectiveness is critical. Moreover, compliance with these regulations demands continuous monitoring and adherence to quality standards, which can further strain resources and limit access for enzyme manufacturers and users.

Report Segmentation

The market is primarily segmented based on type, formulation, application, and region.

|

By Type |

By Formulation |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Type Insights

Based on type analysis, the industry has been segmented on the basis of carbohydrases, proteases, lipases, polymerases & nucleases, and other types. The carbohydrases segment dominated the enzymes market. Carbohydrase is an industrial-grade enzyme mainly derived from a varied range grouped to perform the synthesis and hydrolysis of carbohydrates such as invertases and amylases. The key application of carbohydrase includes production of syrups from sucrose, starch, and β-glucosidase specifically applied during processing of fruit juices and wine. In addition to applications such as flavors enhancement, carbohydrase is also employed to produce oligosaccharide and glucosyltransferases, which are primarily used for synthesis of prebiotics.

Furthermore, the rising demand for energy drinks among individuals and sports enthusiasts is fueling the growth for carbohydrase enzymes market. Additionally, the demand for amylase and cellulase in sectors including pharmaceutical, household, and personal care, among others, is driving the need for carbohydrates.

By Formulation Insights

Based on formulation category analysis, the industry has been segmented on the basis of liquid, and dry. Dry segment accounted for the major share in the market. Dry formulation of enzymes is stated as a condition that allows enzymes to remain active and stable even in a dry form. Dry formulation has an important role in the formation and production of enzyme granules, which are further used in the formulation of food products, animal feeds, washing agents, pharmaceutical products, and rinsing agents. The key factors attributed to the growth of the dry formulation segments are better shelf life, particle size, low residual moisture proportion, and among others.

In addition, dry granules are highly in demand by the commercial form of users, including the processing industry, such as pharmaceuticals, plastics, rubber, and textile, among others. The key advantages offered by dry granules form of enzymes include homogeneous internal structure, ease of metering, high particle density, and others. The process of dry formulation is categorized into spray drying and wet granulation in mixers or fluidized bed agglomeration. Moreover, the spray drying method is effective for producing animal feed, which increases the metabolism in animals and helps in enhancing their health conditions.

By Application Insights

Based on application category analysis, the industry has been segmented on the basis of food & beverages, detergents, feed, bioethanol, soil treatment, paper & pulp, textiles & leather, wastewater treatment, oil treatment, and other applications. The food & beverages segment dominated the enzymes market in 2024. The enzymes play a crucial role in the food and beverage industry, particularly in sectors such as bakery and confectionery, dairy products, and nutraceuticals. Enzymes are biological catalysts that accelerate biochemical reactions, leading to various benefits in food processing and production. These are widely used in bakery and confectionery products to improve dough handling, texture, and shelf life. For example, enzymes such as amylases, lipases, and proteases help break down starches and proteins in the dough, leading to better dough development, increased volume, and improved crumb structure in bread.

Moreover, various dairy products, including cheese, yogurt, and milk-based beverages. Enzymes such as rennet are used in cheese making to coagulate milk proteins and form curds, while proteases help develop flavor and texture during cheese aging. In yogurt production, lactase are used to hydrolyze lactose into glucose and galactose, making yogurt more easily digestible for lactose-intolerant individuals. These are also employed in milk processing to improve the efficiency of processes such as lactose hydrolysis, milk protein modification, and fat reduction.

Regional Insights

North America

The North America region has emerged as the leading market for enzymes globally in 2024. The increasing awareness among North American consumers regarding health has led to a rise in the consumption of functional food items, which is expected to have a positive impact in the foreseeable years. Over the past decade, there has been a growing demand for enzymes in natural flavor and taste, particularly in exotic food products, contributing to market growth. Enzymes find applications in various sectors, including pre-digestion of baby food, germination in breweries, fruit juice clarification, cheese manufacturing, and meat tenderization. Additionally, the expanding awareness of dietary requirements, a growing population, and an emphasis on enhanced food quality are anticipated to contribute positively to the growth in North America.

The significance of the feed enzymes is growing in North America as these enzymes play a crucial role in enhancing energy and nutrient absorption in animals from their feeds. Carbohydrase enzymes, particularly, contribute significantly to the market's expansion by increasing protein, mineral, and lipid intake in animals. Thus, various major players in the region collaborate to innovate their products based on the heightened demand for feed enzymes.

Asia Pacific

The Asia Pacific region is poised for the exponential growth of the enzyme market driven by increasing meat production, especially in China. Protease and carbohydrase demand is witnessing substantial growth in the country, fueled by increased requirements in the pharmaceutical and food & beverage industries. Additionally, the expanding use of polymerase enzymes in biotechnology is expected to contribute significantly to the overall industry growth. India stands as a significant consumer of a diverse range of products, including food and beverages, laundry items, and dietary supplements, creating a burgeoning demand in the country. The consumption of food and beverages in India is high.

Competitive Landscape

The global market is witnessing rapid growth, with several established players and new entrants competing to gain enzymes market share. Players have adopted strategies such as acquisition, launch, collaborations, and partnership. They are engaging in the development of new products with high speed and improved features to enhance their product portfolio and hold a strong position in the market. The companies have strong distribution networks and a reputation for product quality and reliability and often engage in research and development to introduce innovative technologies, making them formidable competitors.

Some of the major players operating in the global market include:

- BASF SE

- DuPont

- AB Enzymes

- Advanced Enzyme Technologies

- BBI Solutions

- Novozymes AS

- Novus International, Inc.

- F. Hoffmann-La Roche Ltd

- DSM-Firmenich AG

- Kerry Group plc

Recent Developments

- In November 2024, VTR Biotech’s next-generation enzyme products, Yiduozyme and Yibeijia Com Series, were launched during a grand event in Zhuhai, showcasing breakthroughs in sustainable biotechnology.

- In October 2023, Novozymes introduced Vertera ProBite, a natural enzyme enhancing texture in plant-based meat, addressing consumer preferences and label transparency.

- In June 2023, Kerry launched Biobake EgR, an enzyme solution reducing egg usage in baking, addressing rising costs and regulatory shifts towards cage-free farming in Europe.

- In December 2021, BASF introduces Natupulse TS, an innovative feed enzyme to unlock valuable nutrients.

Report Coverage

The enzymes market report emphasizes key regions across the globe to provide users with a better understanding of the product. The report also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, formulation, application, and futuristic growth opportunities.

Enzymes Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 15.85 billion |

|

Revenue Forecast in 2034 |

USD 27.71 billion |

|

CAGR |

6.40% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Type, By Formulation, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

Enzymes Market Size Worth USD 27.71 Billion By 2034 .

The top market players in Enzymes Market include BASF SE, DuPont, AB Enzymes, Advanced Enzyme Technologies, BBI Solutions.

North America is contribute notably towards the Enzymes Market.

Enzymes Market exhibiting a CAGR of 6.40% during the forecast period.

Enzymes Market report covering key segments are type, formulation, application, and region.