Quick Commerce Market Share, Size, Trends, Industry Analysis Report

By Product Category (Clothing, Stationary), By Payment Mode (Cash on Delivery, Online), By Technology, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Dec-2023

- Pages: 117

- Format: PDF

- Report ID: PM4142

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

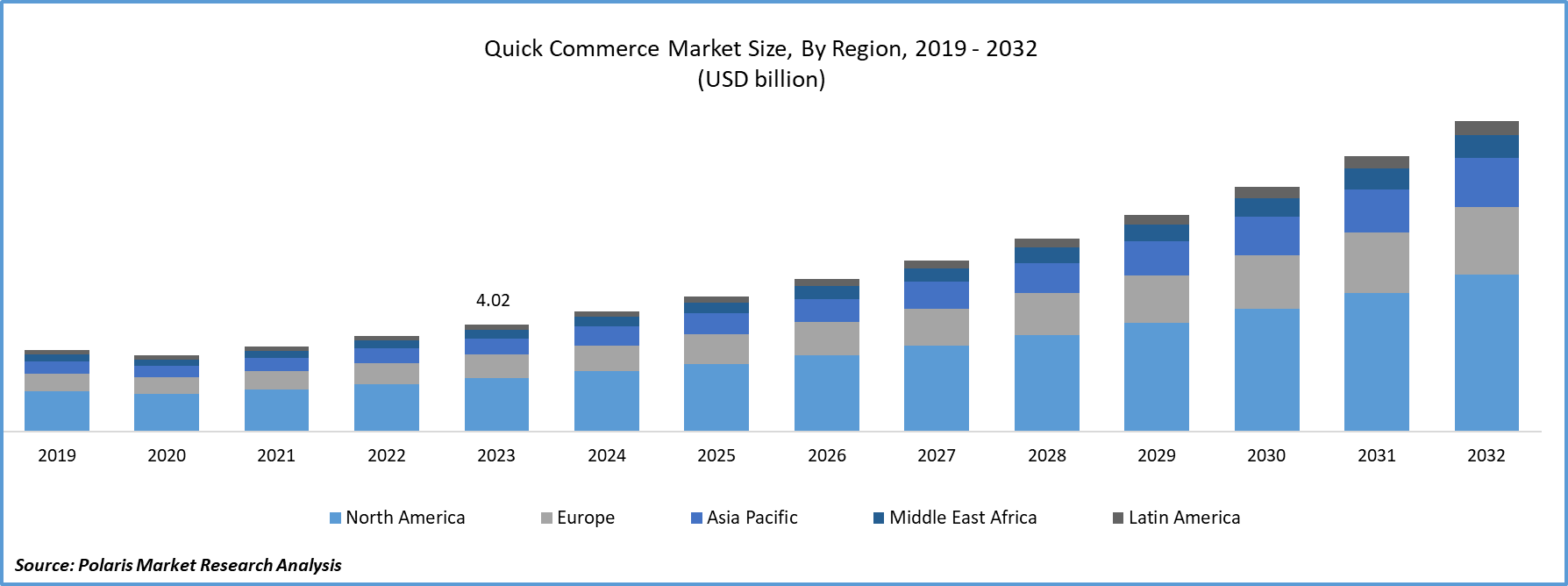

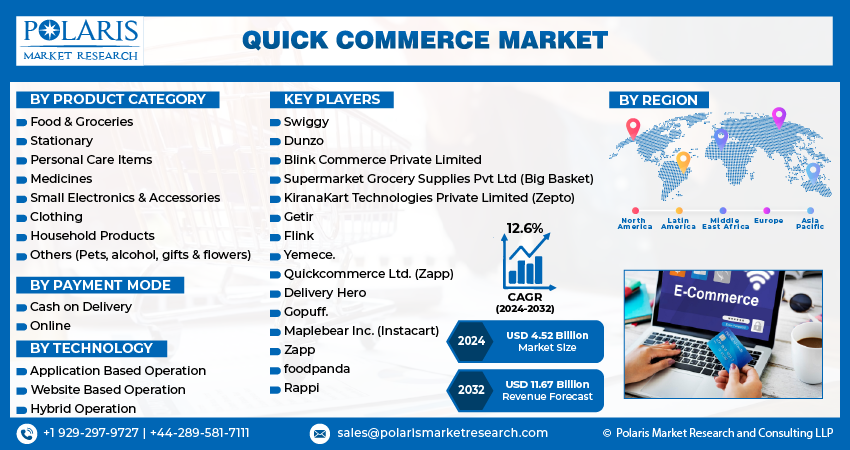

The global quick commerce market was valued at USD 4.02 billion in 2023 and is expected to grow at a CAGR of 12.6% during the forecast period.

The market's expansion is fueled by the increased need for swift delivery of essential items like household necessities. There is a rising preference for on-demand delivery of food, groceries, and household essentials, driven by higher per capita income, extensive industrialization, and rapid urban development. The concept of quick commerce revolves around a highly efficient delivery model, employing well-organized logistics and strategically located dark stores in residential areas. This ensures incredibly fast doorstep deliveries, typically within 10 to 30 minutes.

\

\

To Understand More About this Research: Request a Free Sample Report

The adoption of 5G and 4G technology for payment methods is expected to positively influence quick commerce market growth by providing users with seamless experiences. Additionally, the increasing use of smartphones in developing nations is expanding customers' access to online shopping. Consequently, the rising utilization of consumer devices like laptops, smartphones, and tablets is likely to drive market growth. Furthermore, the increasing presence of small and medium-sized businesses is expected to contribute to the demand for quick commerce in the foreseeable future.

Analytics plays a crucial role in ensuring efficient services and a seamless experience for quick commerce customers. In the face of increasing competition, rapid commerce enterprises face challenges in optimizing their product assortment, which is vital for their success. To achieve the best assortment for quick commerce retailers, it is essential to analyze how demand varies based on demographics and store locations. Given the need for both packaged and fresh products for speedy delivery, tailoring the product range for each store becomes even more critical. Data analytics helps Q-Commerce enterprises identify products that are popular in specific stores. Assortment analytics also aid in recognizing shifts in consumer behavior concerning both short-term and long-term demands across different stores.

The rapid growth of the quick e-commerce market is hindered by the substantial expenses associated with hub operations, including the maintenance of dark stores and last-mile delivery fleets. For instance, in June 2023, Getir, decided to withdraw from the French market. The company attributed its exit to factors such as the exorbitant costs of managing dark stores, reduced profitability in the country, and the intricate legal landscape, leading to the cessation of its operations.

For Specific Research Requirements, Request for a Customized Research Report

Growth Drivers

- Mobile and E-commerce Growth

In regions like Asia and Western Europe, quick commerce gained rapid popularity among individuals aged 20-35. This shift in behavior among the younger demographic can be attributed to factors like competitive pricing, diverse product options, and convenience. Additionally, the increasing internet penetration in developing nations, coupled with the entry of e-commerce players into the market, is opening new avenues for market growth.

The adoption of quick commerce is opening new growth avenues for major market players, enabling them to diversify their services beyond food delivery to include electronics, pet care products, flowers, books, stationery, and cosmetics. According to Glovo, the company experienced a 120% increase in non-food retail orders and a 76% increase in supermarket orders in 2022, indicating significant growth opportunities for quick commerce vendors to expand their offerings. This expansion of product offerings is facilitating quick commerce in reaching a broader customer base, providing essential exposure to the business.

Report Segmentation

The market is primarily segmented based on product category, payment mode, technology, and region.

|

By Product Category |

By Payment Mode |

By Technology |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Category Analysis

- Food and groceries segment garnered the largest share

Food & groceries segment dominated the market. Many prominent quick commerce companies have noted a significant surge in orders for food items, including beverages, ready-to-eat meals, and snacks, surpassing those for non-food items. This trend has led supermarkets and grocery store proprietors to diversify their offerings, incorporating a broader selection of imported food and grocery items to meet the demands of the expanding consumer base.

Personal care items segment will grow at significant pace. With the rise in quick commerce services for groceries and food, market players have identified opportunities to diversify their offerings by including personal care and wellness products. Brands are utilizing quick commerce platforms to promote their top-selling products, employing strategies like dedicated brand pages to showcase their offerings and introduce new items. To engage customers seeking personal care products, quick commerce businesses are utilizing focused marketing and advertising efforts, aiming to connect with their clients through websites, social media, and mobile applications.

By Payment Mode Analysis

- Cash on Delivery segment accounted for the largest market share in 2022

Cash on Delivery segment accounted for the largest market share. Providing a cash-on-delivery option ensures customer satisfaction and encourages purchases. Handling cash-on-delivery payments is also more convenient and secure for delivery staff, enhancing overall efficiency and job satisfaction. These factors contribute significantly to market growth.

Online segment will exhibit robust growth rate. Choices like UPI, net banking, digital wallets, credit cards, debit cards, and buy now pay later models are integral to the streamlined consumer experience that quick commerce endeavors to offer, fueling the growth of this segment. Additionally, discounts and cashback incentives on online transactions encourage customers to use these methods, enhancing the overall appeal of online payments in quick commerce transactions.

By Technology Analysis

- Application based segment accounted for the largest market share in 2022

Application based segment accounted for the largest market share. The convenience of accessing the application via mobile devices like smartphones and tablets empowers customers to use it anytime, anywhere. The app's ability to save user locations enables ordering products even when they are in a different place. Furthermore, the segmental growth is driven by factors such as user-friendly design, seamless navigation within the app, easy addition of payment methods, and effortless browsing experience.

Website based segment will exhibit robust growth rate. Websites offer a holistic view of the homepage and related pages, with the ease of navigation and usage being pivotal factors propelling the segmental growth. Q-commerce websites feature affiliate programs enabling companies to collaborate and expand their reach to a wider demographic audience through the platform. Additionally, websites are compatible with various browsers, enhancing their usability across different search engines.

Regional Insights

- North America accounted for the largest share of global market in 2022

North America garnered the largest share. The rapid adoption of quick commerce is attributed to its swift delivery of various goods like consumables, personal care items, electronics, & pet care products, offering consumers the convenience of ordering anything they need at any time. Quick commerce companies focus on densely populated cities and areas, contributing to market expansion. Apart from user-friendly websites and mobile apps, these companies prioritize customer experience by offering services like real-time order tracking, timely deliveries, and customer support.

APAC will grow at the substantial pace. The region is experiencing rapid market expansion, with startups like Dropezy (USD 2.5 million) & Astro (from Indonesia) securing substantial funding for their operational expansion. With a significant portion of the population belonging to the working class, quick commerce enables households to conveniently order groceries either for the entire week or just in time, eliminating the need to visit physical stores. Moreover, in countries like India, quick commerce has gained prevalence in metro cities and is making its mark in tier 2 and tier 3 cities as well.

Key Market Players & Competitive Insights

To stay competitive in the market, companies focus on factors like convenient payment and ordering options, competitive pricing, attractive discounts, a diverse range of products, and swift delivery schedules.

Some of the major players operating in the global market include:

- Swiggy

- Dunzo

- Blink Commerce Private Limited

- Supermarket Grocery Supplies Pvt Ltd (Big Basket)

- KiranaKart Technologies Private Limited (Zepto)

- Getir

- Flink

- Yemece.

- Quickcommerce Ltd. (Zapp)

- Delivery Hero

- Gopuff.

- Maplebear Inc. (Instacart)

- Zapp

- foodpanda

- Rappi

Recent Developments

- In May 2023, Getir has revealed a collaboration with Uber Eats, intending to extend its instant grocery delivery service to Uber Eats users in the UK.

- In October 2023, Carrefour Polska has revealed plans to expand its collaboration with Glovo in Poland. The company will now offer its services in approximately 69 new locations, including Pszczyna, Tomaszów, Zgorzelec, & Mazowiecki.

Quick Commerce Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4.52 billion |

|

Revenue forecast in 2032 |

USD 11.67 billion |

|

CAGR |

12.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product Category, Payment Mode, Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global quick commerce market size is expected to reach USD 11.67 billion by 2032

Key players in the market are Swiggy, Dunzo, Blink Commerce, Big Basket, Zepto

North America contribute notably towards the global quick commerce market

The global quick commerce market is expected to grow at a CAGR of 12.6% during the forecast period.

The quick commerce market report covering key segments are product category, payment mode, technology, and region.