Greenhouse Film Market Size, Share, Trends, Industry Analysis Report

: By Resin Type (LDPE, LLDPE, EVA, and Others), Thickness, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 118

- Format: PDF

- Report ID: PM1601

- Base Year: 2024

- Historical Data: 2020-2023

Greenhouse Film Market Overview

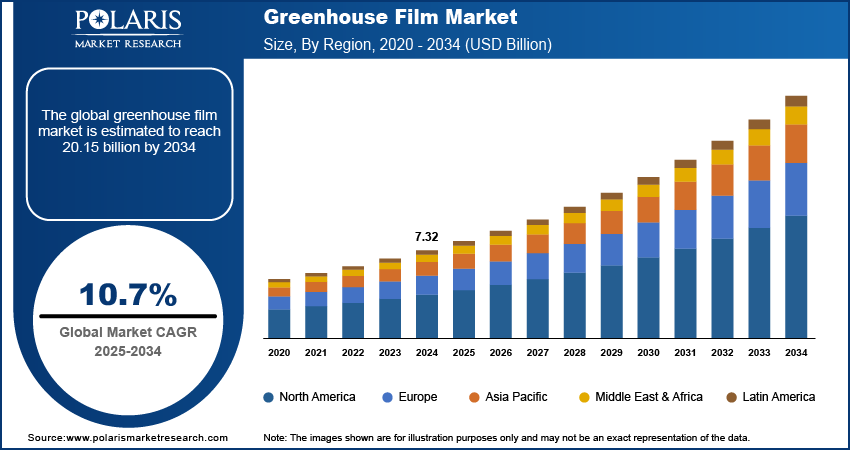

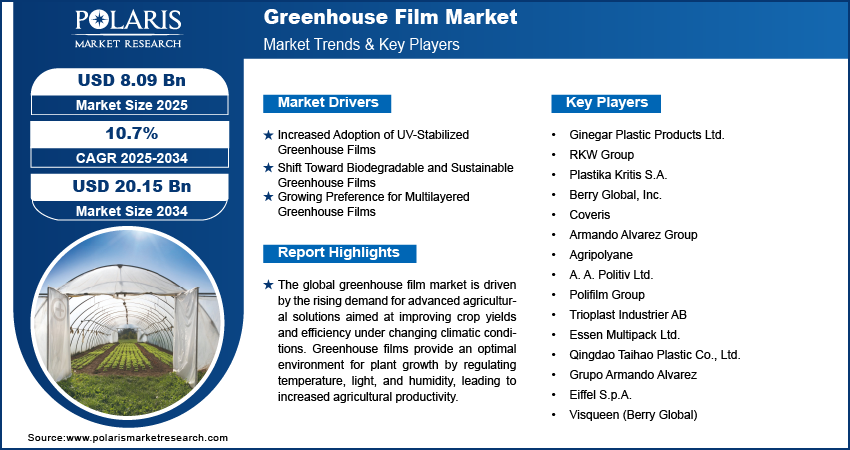

The global greenhouse film market size was valued at USD 7.32 billion in 2024. The market is projected to grow from USD 8.09 billion in 2025 to USD 20.15 billion by 2034, exhibiting a CAGR of 10.7% during 2025–2034.

The global greenhouse film market growth is driven by the rising demand for advanced agricultural solutions aimed at improving crop yields and efficiency under changing climatic conditions. Greenhouse films provide an optimal environment for plant growth by regulating temperature, light, and humidity, leading to increased agricultural productivity. Key drivers include rising population pressures on food supply, advancements in agricultural technologies, and the shift toward greenhouse farming for improved control over cultivation. The adoption of biodegradable and UV-stabilized films and innovations in multilayered films that enhance durability and light diffusion are key greenhouse film market trends. Additionally, government support for sustainable farming practices further contributes to the market expansion.

To Understand More About this Research: Request a Free Sample Report

Greenhouse Film Market Drivers and Trends

Increased Adoption of UV-Stabilized Greenhouse Films

The UV-stabilized films can prolong film lifespan and enhance plant health by managing light exposure. UV-stabilized films filter harmful UV rays while allowing essential sunlight to pass through, which supports crop growth without risking damage from excessive radiation. According to Agricultural Sciences Research Journal, UV-stabilized films can increase crop yields by ∼10–15% under specific conditions by balancing light levels effectively. This trend is being driven by growers looking to maximize efficiency and extend film durability, reducing replacement costs over time. Thus, the rising adoption of UV-stabilized greenhouse films will become a key greenhouse film market trend in the coming years.

Shift Toward Biodegradable and Sustainable Greenhouse Films

As environmental concerns intensify, there is a marked shift toward biodegradable greenhouse films made from eco-friendly materials, which decompose naturally and reduce plastic waste. According to Environmental Science & Technology Journal, traditional plastic greenhouse films contribute significantly to environmental pollution, with estimates indicating that agricultural plastics account for nearly 3% of global plastic waste annually. In response, manufacturers are innovating with biodegradable materials such as polylactic acid (PLA), which breaks down in natural environments. The shift to sustainable film options aligns with regulations in the European Union countries and North America aimed at minimizing agricultural plastic waste. Therefore, the rising shift toward biodegradable and sustainable greenhouse films boosts the greenhouse film market growth.

Growing Preference for Multilayered Greenhouse Films

Multilayered greenhouse films combine two or more polymer layers. Their preference is growing due to their improved durability and enhanced control over environmental factors such as humidity, light diffusion, and heat retention. Compared to single-layer films, multilayered options offer better insulation, helping to lower energy requirements for temperature control by up to 20%, according to the Journal of Applied Polymer Science. The multilayered structure also allows manufacturers to incorporate different properties into each layer, customizing the film for specific crops or climatic needs. This trend is particularly strong in regions with extreme temperature fluctuations, where crop protection and energy efficiency are priorities. It is further expected to fuel the growth of the greenhouse films market in the coming years.

Greenhouse Film Market Segment Insights

Greenhouse Film Market Outlook – by Resin Type-Based Insights

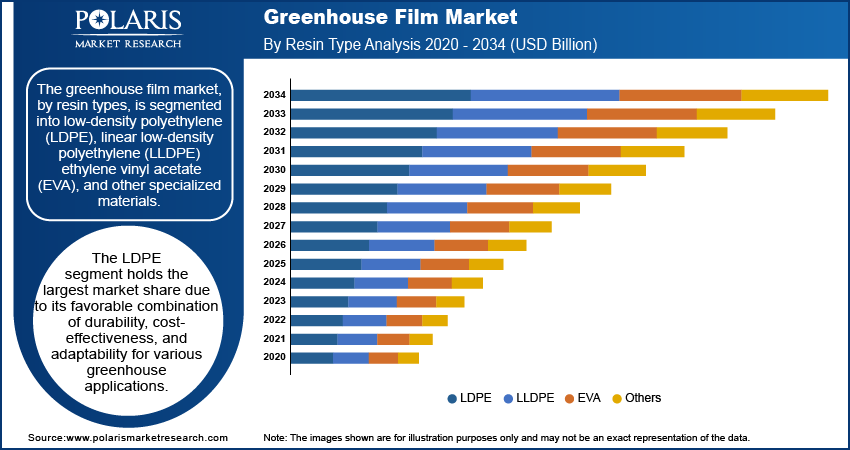

By resin types, the greenhouse film market is segmented into low-density polyethylene (LDPE), linear low-density polyethylene (LLDPE), ethylene vinyl acetate (EVA), and other specialized materials. The LDPE segment holds the largest market share due to its favorable combination of durability, cost-effectiveness, and adaptability for various greenhouse applications. LDPE films are widely preferred as they offer excellent tensile strength and resistance to environmental stress, making them suitable for diverse climates and crop requirements. Additionally, LDPE is often treated with UV stabilizers, which enhances its longevity and provides additional light control, further driving its popularity among large-scale growers aiming for cost efficiency and reduced replacement rates.

The EVA segment is emerging as the fastest-growing segment due to its superior properties in light transmission, elasticity, and thermal insulation. These features make EVA films particularly advantageous in regions with low temperatures or fluctuating climatic conditions, where consistent temperature and light management are crucial for optimal crop yields. EVA films can also be manufactured with anti-fog and anti-drip properties, which help maintain a stable environment by reducing condensation that could otherwise impact plant health. The growth of the EVA segment is supported by increased investments in controlled-environment agriculture, where advanced film properties directly contribute to yield improvement and quality control in high-value crops.

Greenhouse Film Market Outlook – by Thickness-Based Insights

The greenhouse film market, by thickness, is segmented into <200 microns, 200 microns, and >200 microns. The 200 microns segment holds the largest market share, as they provide an optimal balance between durability, flexibility, and cost. Films with a thickness of 200-micron are widely used for general-purpose greenhouse applications as they effectively protect crops from environmental stressors while being cost-effective for growers. Their thickness provides sufficient insulation to maintain controlled temperatures, making them suitable for a wide range of climates and crop types, from vegetables to floriculture. This segment is particularly favored in large-scale agricultural projects, where durability and protection against tear and puncture are critical.

The >200 microns segment is experiencing the highest growth rate due to the enhanced strength and longevity of these films, which are crucial for permanent or semi-permanent greenhouse structures. These thicker films are typically preferred in regions with harsher weather conditions, as they offer improved resistance to wind, UV exposure, and heavy rain, thus reducing the need for frequent replacements. Growers investing in high-value crops, such as berries or exotic plants, are increasingly opting for films above 200 microns for their superior protective qualities and cost-efficiency over the long term. The rising adoption of durable greenhouse structures in controlled-environment agriculture further supports the growth of this segment, as it aligns with the industry’s shift toward sustainable and resilient farming practices.

Greenhouse Film Market Outlook – by Application-Based Insights

The greenhouse film market, in terms of application, is segmented into manufacturing, construction, mining, oil and gas, and others. The manufacturing segment holds the largest market share, and include the manufacturing of products such as crops. The segment growth is driven by the broad utilization of greenhouse films for crop protection in industrial-scale agricultural operations. Within manufacturing, greenhouse films are widely implemented for crop-specific needs, ensuring a controlled environment that boosts productivity and quality. As countries increasingly focus on improving agricultural productivity through protected farming methods, the demand for greenhouse films in this segment continues to expand.

The construction segment is registering the highest growth in the greenhouse film market, owing to the rising adoption of greenhouse films in temporary structures and protective coverings for materials and site areas. These films provide critical benefits in protecting construction materials from weather exposure, reducing risks of delays caused by adverse conditions, and ensuring efficient project management. Additionally, in construction, greenhouse films are gaining popularity for their use in scaffolding covers, site enclosures, and other temporary barriers that enhance worker safety and environmental compliance. As urbanization accelerates globally and construction projects increase in scale, the demand for versatile and durable greenhouse films in this segment is expected to grow robustly in the coming years.

Greenhouse Film Market Regional Insights

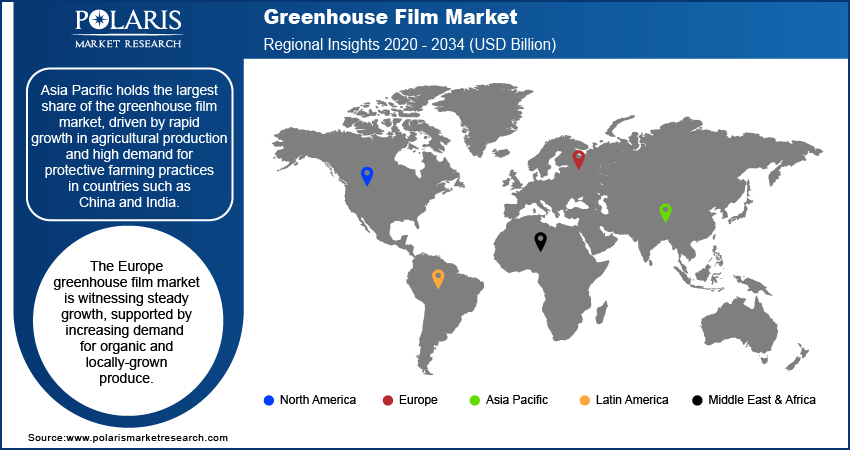

By region, the study provides greenhouse film market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific holds the largest share of the market, driven by rapid growth in agricultural production and high demand for protective farming practices in countries such as China and India. The region’s large population and increasing food demand have spurred investments in greenhouse farming, as it offers greater control over crop yields amid varying climatic conditions. Government initiatives promoting sustainable agriculture and the adoption of advanced farming technologies further fuel market growth in Asia Pacific. Additionally, the region’s favorable climatic diversity makes greenhouse cultivation more viable, especially for high-value crops. Meanwhile, North America and Europe show steady growth due to the rise in organic farming practices and demand for high-quality produce, whereas Latin America and the Middle East & Africa are emerging markets with increasing interest in greenhouse farming techniques to address food security challenges.

The Europe greenhouse film market is witnessing steady growth, supported by increasing demand for organic and locally-grown produce. The region’s emphasis on sustainable agricultural practices and strict environmental regulations are encouraging the use of greenhouse films for controlled-environment farming. Countries such as the Netherlands and Spain are at the forefront of greenhouse film adoption in Europe, focusing on high-value crops and innovative farming methods. Moreover, ongoing R&D investments in advanced film materials, such as UV-resistant and biodegradable films, are supporting market growth in Europe, aligning with its focus on environmentally friendly solutions.

Greenhouse Film Market – Key Players and Competitive Insights

Key players in the greenhouse film market are prominent manufacturers and suppliers such as Ginegar Plastic Products Ltd.; RKW Group; Plastika Kritis S.A.; Berry Global, Inc.; Coveris; Armando Alvarez Group; Agripolyane; A. A. Politiv Ltd.; and Polifilm Group. Other active companies are Trioplast Industrier AB; Essen Multipack Ltd.; Qingdao Taihao Plastic Co., Ltd.; Grupo Armando Alvarez; and Eiffel S.p.A. These companies have established themselves with comprehensive greenhouse film portfolios that cater to a variety of applications, such as light control, UV stabilization, and thermal insulation. Many of these firms have developed extensive distribution networks to support demand from both local and international markets.

The competitive landscape in this market is defined by each company's focus on innovation, product quality, and cost efficiency. Companies such as Ginegar Plastic Products Ltd. and Plastika Kritis S.A. have invested significantly in research and development to produce high-performance films that meet specific agricultural needs, such as UV resistance and anti-drip properties. Berry Global, Inc. and RKW Group, on the other hand, emphasize environmentally sustainable materials, including biodegradable films, to align with rising environmental standards in regions such as Europe and North America. The competitive strategies among these companies often involve partnerships and collaborations with local agricultural agencies and growers to tailor products to regional farming requirements.

Insights into this competitive landscape reveal that market players are increasingly focused on advanced materials to differentiate their offerings. The introduction of multilayer films, films with additives for improved light diffusion, and eco-friendly options has become common as companies respond to growing market demands for both quality and sustainability. In addition, the rising focus on building global distribution channels and collaborating with local agricultural communities underscores how competition is product-based and service-oriented. As the greenhouse farming sector expands globally, players in this market are adapting to diverse regulatory landscapes and sustainability standards, which influences their production practices and product innovation strategies.

Ginegar Plastic Products Ltd., based in Israel, is a key player in the greenhouse film market, well-known for its focus on advanced agricultural films that support crop growth in varied environmental conditions. The company offers a range of products such as UV-resistant and anti-condensation films, designed to enhance crop quality and yield.

RKW Group, headquartered in Germany, is another prominent company in the greenhouse film industry, providing a wide range of film products with features such as UV stability and thermal control. The company is particularly active in producing environmentally friendly films that reduce the environmental impact of agricultural practices.

Key Companies in Greenhouse Film Market

- Ginegar Plastic Products Ltd.

- RKW Group

- Plastika Kritis S.A.

- Berry Global, Inc.

- Coveris

- Armando Alvarez Group

- Agripolyane

- A. A. Politiv Ltd.

- Polifilm Group

- Trioplast Industrier AB

- Essen Multipack Ltd.

- Qingdao Taihao Plastic Co., Ltd.

- Grupo Armando Alvarez

- Eiffel S.p.A.

- Visqueen (Berry Global)

Greenhouse Film Industry Developments

- In June 2023, Ginegar announced the expansion of its production facilities to meet the increasing demand for high-performance greenhouse films in Asia Pacific, demonstrating its commitment to addressing the needs of diverse agricultural regions.

- In May 2023, RKW Group introduced a new line of sustainable, high-durability greenhouse films designed to offer improved performance while reducing waste, catering to the growing preference for eco-conscious farming materials across Europe and North America.

Greenhouse Film Market Segmentation

By Resin Type Outlook

- LDPE

- LLDPE

- EVA

- Others

By Thickness Outlook

- <200 Microns

- 200 Microns

- >200 Microns

By Application Outlook

- Manufacturing

- Construction

- Mining

- Oil and Gas

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Greenhouse Film Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.32 billion |

|

Market Size Value in 2025 |

USD 8.09 billion |

|

Revenue Forecast by 2034 |

USD 20.15 billion |

|

CAGR |

10.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global greenhouse film market value reached USD 7.32 billion in 2024 and is projected to grow to USD 20.15 billion by 2034.

The global market is projected to register a CAGR of 10.7% during 2025–2034

North America held the largest share of the global market in 2024.

A few key players in the greenhouse film market include prominent manufacturers and suppliers such as Ginegar Plastic Products Ltd.; RKW Group; Plastika Kritis S.A.; Berry Global, Inc.; Coveris; Armando Alvarez Group; Agripolyane; A. A. Politiv Ltd.; and Polifilm Group.

The LDPE segment accounted for the largest share of the global market in 2024.

The 200 microns segment accounted for the largest share of the global greenhouse film market in 2024.

Greenhouse film is a specialized type of plastic film used to cover greenhouses, providing a controlled environment for plant growth. It serves multiple purposes, including protecting crops from extreme weather conditions, optimizing sunlight exposure, and maintaining temperature and humidity levels. Made from materials such as polyethylene (PE), ethylene-vinyl acetate (EVA), or polyvinyl chloride (PVC), greenhouse films are designed to be durable, UV-resistant, and often equipped with features such as anti-drip, anti-fog, and light diffusion properties.

A few key trends in the greenhouse film market are described below: Adoption of UV-Stabilized Films: Increased use of UV-resistant films to enhance durability and improve crop yield. Shift Toward Biodegradable Films: Growing demand for eco-friendly, biodegradable films as sustainable options becomes a priority. Multilayered Films: Rising preference for multilayered films that offer better insulation, light diffusion, and protection from harsh weather. Integration of Smart Technologies: Incorporation of smart sensors and automated systems in greenhouse films for better climate control.

A new company entering the greenhouse film market must focus on developing eco-friendly, biodegradable films that cater to the growing demand for sustainability, aligning with global trends toward reducing plastic waste. Additionally, investing in advanced technology, such as smart films embedded with sensors for climate control and precision agriculture, could provide a competitive edge. Customizing films for specific crop types, offering improved UV resistance, and enhancing thermal insulation properties would further attract growers seeking optimized solutions for varying climates. Expanding into emerging markets with tailored products and establishing partnerships with local agricultural communities would also help secure a strong foothold.

Companies producing and utilizing greenhouse films and related products, and other consulting firms must buy the report.