Hemato Oncology Testing Market Share, Size, Trends, Industry Analysis Report

By Product & Service (Assay Kits and Services); By Cancer Type; By Technology; By End-User; Region; Segment Forecast, 2022-2030

- Published Date:Dec-2022

- Pages: 118

- Format: PDF

- Report ID: PM2906

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

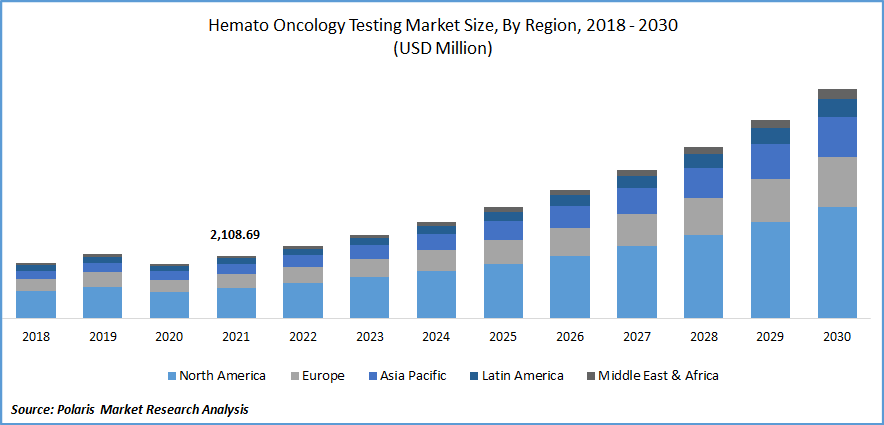

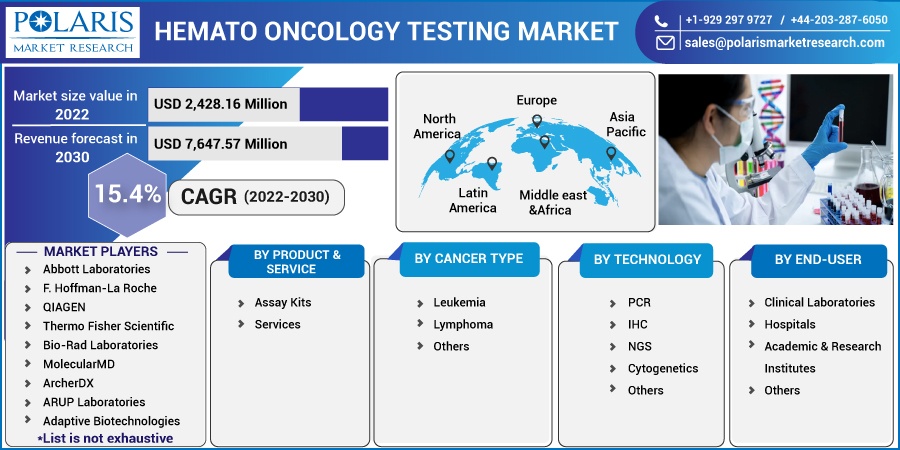

The global hemato oncology testing market was valued at USD 2,108.69 million in 2021 and is expected to grow at a CAGR of 15.4% during the forecast period.

The growing proliferation of sequencing technologies like NGS due to rising development costs and sequencing of the Human Genome Project in the field of Genomics drives the market. Increasing investment in research & development activities by major companies in the precision medicine sector is a key factor boosting the growth of the global market. In addition, the rising prevalence of various types of cancer such as lymphoma and myeloma around the world is projected to fuel the growth of the market over the next coming years.

Know more about this report: Request for sample pages

For instance, according to the American Cancer Society, an estimated total of 186,400 people were diagnosed with lymphoma, leukemia, and myeloma in 2021, in the United States. And, lymphoma, myeloma, and leukemia are estimated to cause nearly 57,750 deaths in the US in 2021, and in every 3 minutes, 1 person is diagnosed with these diseases.

Moreover, a rapid rise in the availability of advanced & innovative molecular techniques for the diagnosis of hematoma technology and growing introduction to newly developed advanced techniques to recognise blood cancer prognosis, treatment course, and diagnosis are likely to have a positive impact on the market growth and contribute significantly to the global market share. For instance, in June 2022, Burning Rock Biotech received CE marking for the “OverC Multi-Cancer Detection Blood Test”, NGS-based diagnostic device. It is mainly intended for earlier detection and localization of various types of cancer in adults.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the hemato-oncology testing market. The emergence of the deadly coronavirus has resulted in a shortage of well-trained staff, financial and social work support, blood components, antibiotics, antifungals, and chemotherapy owing to imposed lockdowns in many countries across the globe to get control of the spread of the pandemic. Also, the lack of hospitality beds in most health facilities leads to a decline in the number of admission delays and increasing rates of infection.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Increasing technological advancements & developments in sequencing techniques and a growing number of molecular decision support systems, which helps to combine genomic and clinical data to reduce the gaps between precision medicine are major factors projected to drive the growth of the global market over the course of the anticipated period. Major companies operating in the market are typically involved in various investment programs to enhance precision medicine, which is influencing market growth.

Furthermore, the rising geriatric population, which results in an increased incidence of hematologic cancer, as this portion of the population is more prone to several types of chronic disorders is also driving the market for hemato oncology testing. These patients require continuous monitoring due to which, physicians basically prefer drugs combined with companion diagnostics for the prevention of adverse reactions in patients and also to reduce mortality rates.

According to the World Health Organization, people aged 60 years & above were around 1 Bn, in 2021 & will increase to 1.4 Bn, by 2030. And, by 2050, the world’s population aged 60 years or above is expected to double (2.1 billion) and people aged 80 years or older are estimated to triple during the period.

Report Segmentation

The market is primarily segmented based on product & service, cancer type, technology, end-user, and region.

|

By Product & Service |

By Cancer Type |

By Technology |

By End-User |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The services segment accounted for the largest market share

The services segment is expected to grow moderately in 2021 owing to the rapidly growing incidence of non-Hodgkin lymphoma, myeloma, and leukemia and the rise in the development of various new and advanced tests for the diagnosis of these diseases. In addition, increasing awareness towards the availability of various innovative treatment therapies including personalized medicines is further expected to boost the growth of the segment market in the next coming years.

Moreover, the assay kits segment is anticipated to register significant growth during the forecast period due to the factors such as increasing demand for drug discovery, the need for research in biotechnology, and the high prevalence of infectious diseases across the globe. Additionally, the ability of assay kits to cut down ambiguity by offering reliable outcomes in diagnostics is propelling the growth of the market.

The lymphoma segment dominated the global market in 2021

The lymphoma segment dominated the global market with a holding of significant market share in 2021. The growth of the segment market can be attributed to the rising prevalence of Non-Hodgkin and Hodgkin Lymphoma worldwide along with the rapid surge in the global geriatric population. Factors such as immune system deficiency, lower immunity, and growing cases of autoimmune diseases are key reasons causing lymphoma cancer among the aged population, which results in a growing need for oncology testing and rising the segment growth forward.

Furthermore, the myeloma segment is expected to grow at a considerable growth rate over the anticipated period on account of the rise in the availability of technologically advanced products for better diagnosis of myeloma. Moreover, growing efforts and focus by service providers to develop a test that aid in the early detection of various types of cancer is also fueling the market growth.

NGS technology is projected to witness the fastest growth

The NGS technology segment is expected to grow at a significant CAGR over the projected period, which is mainly driven by various advantages offered by this technology like specificity and more sensitivity. The PCR segment accounted for the highest market share in 2021 and is likely to grow at a significant growth rate in the coming years. The growth of the segment market can be attributed to its ease of use, high accuracy, easy availability, affordability, and ease of use. Moreover, rapid growth in the launch of PCR-based tests by various key market players is also propelling the adoption and growth of the segment.

The hospital segment held the largest market revenue share in 2021

The hospital segment led the global market with considerable revenue share in 2021. The rise in the incidence of blood cancers, the availability of specialized laboratory settings, and the large presence of healthcare professionals for conducting diagnostic tests are key factors driving the growth of the segment market. In addition, growing investment in the development of healthcare infrastructure especially in emerging economies like India and China is likely to contribute positively to market growth over the coming years.

Moreover, the academic & research institutes are also anticipated to account for a considerable share due to the large presence of academic and research groups that conduct various types of studies to enhance the field of hemato oncology and innovate more advanced and innovative technology and products.

North America is expected to dominate the global market in 2021

North America region dominated the global market in 2021 and accounted for a healthy market share, which is accelerated by a various number of supportive initiatives undertaken by key market players and various research organizations in the region. In addition, increased penetration of using artificial intelligence for the accurate detection of myeloid leukemia with higher reliability is driving the regional market growth significantly.

Asia Pacific is anticipated to emerge as the fastest-growing region in the market during the projected period on account of the increasing prevalence of blood cancer and related problems along with the growing number of research & development activities conducted by research institutes in the regio n. Additionally, increasing healthcare expenditure and rising consumer awareness towards the availability of advanced diagnostic techniques is fueling the growth of the market.

Competitive Insight

Some of the major players operating in the global market include Abbott Laboratories, F. Hoffman-La Roche, QIAGEN, Thermo Fisher Scientific, Bio-Rad Laboratories, MolecularMD, ArcherDX, ARUP Laboratories, Adaptive Biotechnologies, Amoy Diagnostics, Vela Diagnostics, SAGA Diagnostics, Olink, Gentronix, Asuragen, and Illumina Inc.

Recent Developments

In August 2022, Thermo Fisher Scientific, announced the launch of its new next-generation sequencing test and analysis software named CE-IVD (IVDD) for the purpose to provide easy access to biomarker testing.

In May 2022, Thermo Fisher & Qatar Genome Program entered into a strategic partnership to focus on the development of an Axion customized genotyping array for the pan-Arab population, by using whole sequencing data of 19 different Arab countries.

Hemato Oncology Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 2,428.16 million |

|

Revenue forecast in 2030 |

USD 7,647.57 million |

|

CAGR |

15.4% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Product & Service, By Cancer Type, By Technology, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Abbott Laboratories, F. Hoffman-La Roche, QIAGEN, Thermo Fisher Scientific, Bio-Rad Laboratories, MolecularMD, ArcherDX, ARUP Laboratories, Adaptive Biotechnologies, Amoy Diagnostics, Vela Diagnostics, SAGA Diagnostics, Olink, Gentronix, Asuragen, and Illumina Inc. |