Hydrogen Fluoride Gas Detection Market Share, Size, Trends, Industry Analysis Report

By Form (Gas, Liquid); By Type (Fixed Devices, Portable Devices): By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:May-2022

- Pages: 112

- Format: PDF

- Report ID: PM2387

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

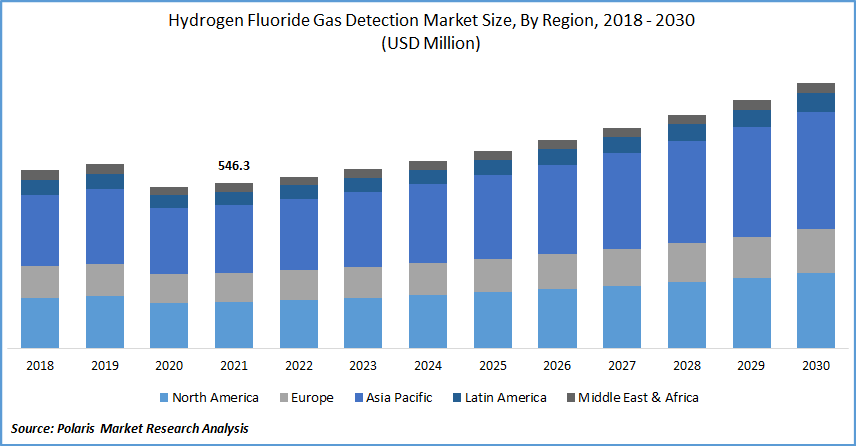

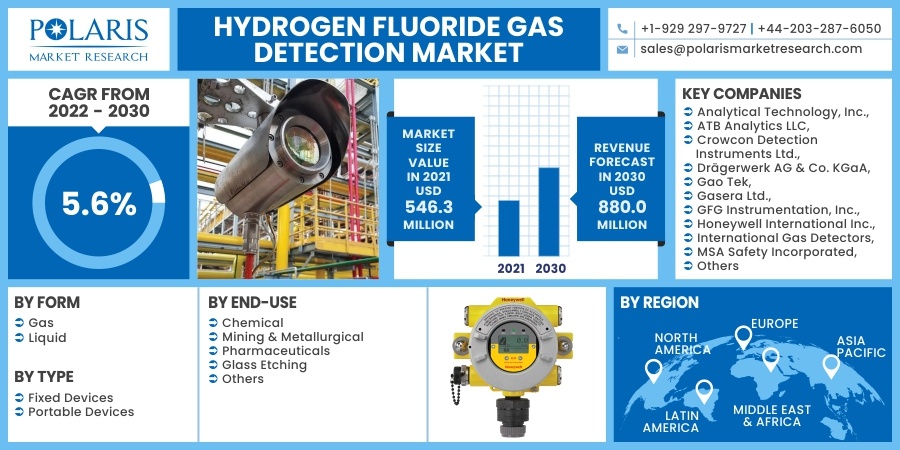

The global hydrogen fluoride gas detection market was valued at USD 546.3 million in 2021 and is expected to grow at a CAGR of 5.6% during the forecast period. Factors such as strict regulations for human and environmental safety and the rising adoption of IoT by end-use industries are driving the hydrogen fluoride gas detection market growth during the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Government regulations heavily influence the expansion of the hydrogen fluoride gas detection industry. Even though hydrogen fluoride is extremely corrosive, it is hazardous to human health and the environment. To preserve human lives and the environment, various governing bodies, such as the Occupational Safety and Health Administration (OSHA) and the Environmental Protection Agency (EPA), have established guidelines that regulate the manufacture and usage of hydrogen fluoride and its sensor systems.

The EPA is an independent executive agency of the United States federal government charged with environmental protection. The AGEL-1 for hydrofluoric acid is 1.0 ppm as an 8-hour TWA, the AGEL-2 for hydrofluoric acid is 12.0 ppm as an 8-hour TWA, and the AGEL-3 for hydrofluoric acid is 22.0 ppm as an 8-hour TWA, according to their guidelines. In addition, several end-use industries, including chemical, refinery, and pharmaceuticals, are required to submit data to the EPA regarding their safety practices and so on.

Industry Dynamics

Growth Drivers

Key players have used a variety of business expansions, including agreements, acquisitions, partnerships, expansions, and product launches. Agreements have been the most dominant strategy used by key players to expand their customer base. For instance, in September 2021, MSA Safety Incorporated established a global center of excellence for exploration technology by opening a new 20,000 square-foot production facility in Cranberry Township, New Jersey.

Further, in July 2021, Bacharach, Inc. was acquired by MSA Safety Corporation. MSA's access to its markets around the globe was speed-up the acquisition process. Also, in June 2021, Drägerwerk AG & Co. KGaA collaborated with AWC, Inc., a global technology distribution company of control and instrumentation equipment. AWC, Inc. reflects and encourages Dräger's fixed flame and hydrogen fluoride gas detection system portfolio revenues in Louisiana, Tennessee, and Alabama. In May 2021, Drägerwerk AG & Co. KGaA introduced the new Polytron 6100 EC WL, a Bluetooth gas discovery solution for adaptable and cost-effective industrial plant monitoring.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented based on form, type, end-use, and region.

|

By Form |

By Type |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by End-Use

The chemical market segment is expected to be the most significant revenue contributor in the global hydrogen fluoride gas detection market. It is used to produce chemical groups, particularly refrigerants used in refrigerators and air conditioners. It could also be used as a motivator in producing alkanes from smaller alkenes.

More accurate hydrogen fluoride gas monitoring and detection devices are needed to avoid any potentially hazardous accidents on the field in this segment. Thus, there is a rise in demand for highly accurate, dependable hydrogen fluoride gas detection systems in the chemical industry. So, the chemical industry's hydrogen fluoride gas detection industry is expected to grow at the fastest CAGR during the forecast period.

Geographic Overview

Asia Pacific had the largest revenue share in the global market. Technological advancement and a strong emphasis on energy harvesting in China, India, and South Korea are major contributors to this growth. China and Japan are industrial powerhouses with a wide range of electronic equipment, instruments, materials, automotive, and other industries that rely heavily on silicon chips.

Furthermore, the industrial transition toward digitization is anticipated to convert manual processes in the manufacturing industries into digital processes. This is expected to boost demand for advanced and miniaturized electronic products and materials.

Moreover, North America is anticipated to witness a high CAGR in the global hydrogen fluoride gas detection market. The North American oil and gas and chemical industries have seen significant growth in the market in recent years. This increase can be attributed to the growing need for the security and safety of workers who work in environments in which they are directly exposed to toxic gases.

Competitive Insight

Some of the major players operating in the global market include Analytical Technology, Inc., ATB Analytics LLC, Crowcon Detection Instruments Ltd., Drägerwerk AG & Co. KGaA, Gao Tek, Gasera Ltd., GFG Instrumentation, Inc., Honeywell International Inc., International Gas Detectors, MSA Safety Incorporated, New Cosmos Electric Co., Ltd., R.C. Systems, RKI Instruments, Sensidyne, LP, and Teledyne Technologies Incorporated.

Hydrogen Fluoride Gas Detection Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 546.3 Million |

|

Revenue forecast in 2030 |

USD 880.0 Million |

|

CAGR |

5.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Form, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Analytical Technology, Inc., ATB Analytics LLC, Crowcon Detection Instruments Ltd., Drägerwerk AG & Co. KGaA, Gao Tek, Gasera Ltd., GFG Instrumentation, Inc., Honeywell International Inc., International Gas Detectors, MSA Safety Incorporated, New Cosmos Electric Co., Ltd., R.C. Systems, RKI Instruments, Sensidyne, LP, and Teledyne Technologies Incorporated |