Industrial Control & Factory Automation Market Share, Size, Trends, Industry Analysis Report

By Component; By Solution (SCADA, PLC, DCS, MES, PAM, Industrial Safety); By Industry; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 118

- Format: PDF

- Report ID: PM2839

- Base Year: 2024

- Historical Data: 2020-2024

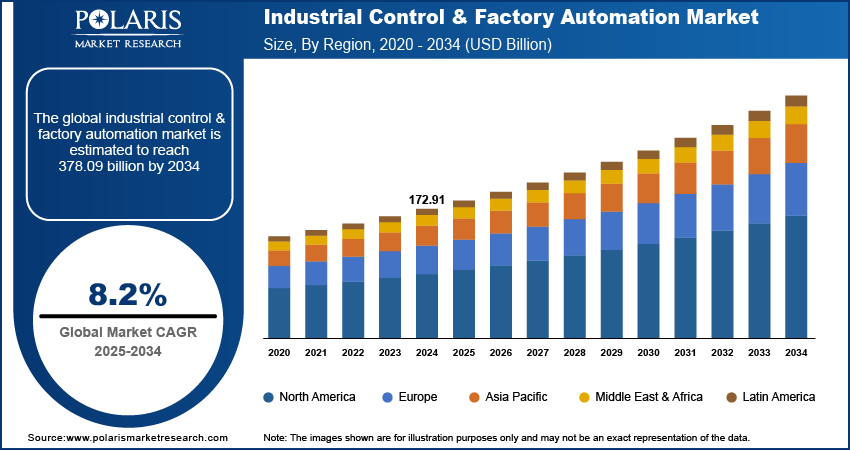

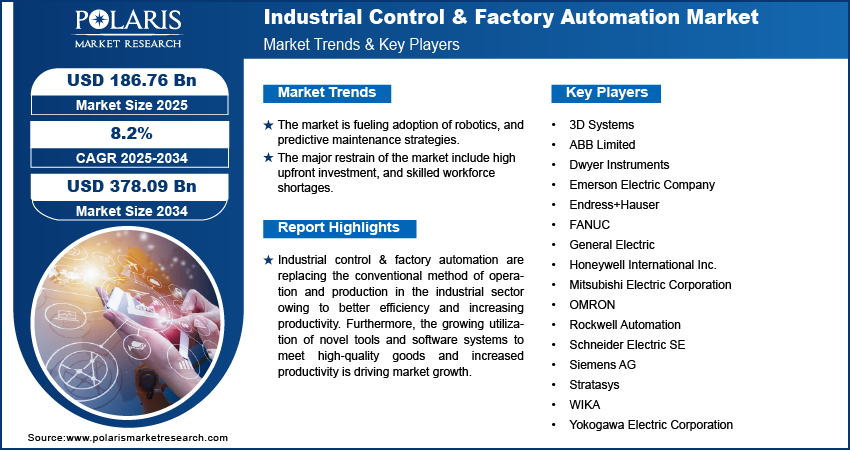

The global industrial control & factory automation market was valued at USD 172.91 billion in 2024 and is expected to grow at a CAGR of 8.2% during the forecast period. The growing demand for industrial control & factory automation is expected to be driven by rapid digitization, the adoption of IoT and AI-equipped tools in the industrial sector, and a revolution in industry 4.0.

Key Insights

- Industrial 3D printing accounted for the largest share in 2024. This is driven by demand for customization, and rapid prototyping in manufacturing.

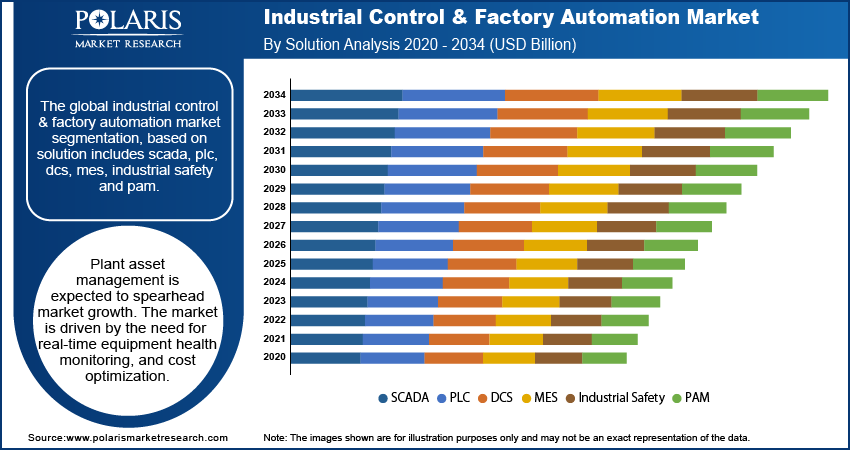

- Plant asset management is expected to spearhead market growth. The market is driven by the need for real‑time equipment health monitoring, and cost optimization.

- Discrete industry is expected to witness faster growth during the forecast period. This is driven by demand for flexible, and rapid automation deployment.

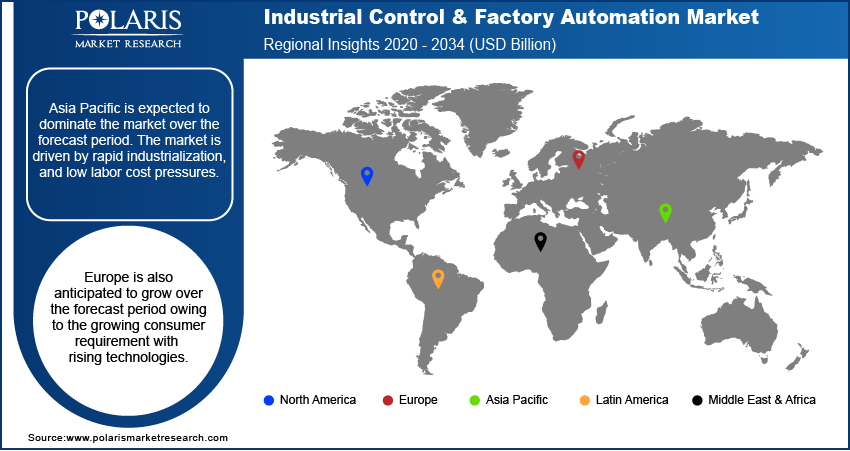

- Asia Pacific is expected to dominate the market over the forecast period. The market is driven by rapid industrialization, and low labor cost pressures.

Industry Dynamics

- The market is growing due to rising demand to improve productivity, uptime, and precision under Industry 4.0 automation trends.

- The market is fueling adoption of robotics, and predictive maintenance strategies.

- Advancements in edge computing, and seamless system integration create opportunities in the market.

- The major restrain of the market include high upfront investment, and skilled workforce shortages.

Market Statistics

- 2024 Market Size: USD 172.91 Billion

- 2034 Projected Market Size: USD 378.09 Billion

- CAGR (2025–2034): 8.2%

- Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Industrial control & factory automation are replacing the conventional method of operation and production in the industrial sector owing to better efficiency and increasing productivity. Furthermore, the growing utilization of novel tools and software systems to meet high-quality goods and increased productivity is driving market growth.

The COVID-19 pandemic had a negative impact on the growth of the industrial control & factory automation market. Many manufacturing facilities were shut down due to the global lockdown, resulting in supply chain disruption. The declining expenditure on industrial automation and activity severely impacted the market.

The replacement of traditional techniques with smart automation and advanced technology requires a high cost for installation, which is anticipated to restrict market growth. In addition, the advanced technology has high manufacturing and maintenance costs, eventually increasing the price of automation and restraining market growth.

Industry Dynamics

Growth Drivers

The global industrial control & factory automation is due to the expansion of automation in process and discrete industries across emerging nations. Additionally, the rising government investment in developing industrial infrastructure has led to the frequent adoption of robotic and automation technologies. For instance, Minister for heavy industries Mahendra Nath Pandey announced that India would adopt digital manufacturing processes and promote automation and innovation, which involves the implementation of data analytics, advanced robotics, ad IoT; such factors support the market growth.

The growing adoption of automation in the automotive sector is anticipated to drive market growth over the forecast period. It is observed that many manufacturers and production facilities are focusing on factory automation with the emerging trend of self-automation vehicles. Furthermore, this advanced technology offers high accuracy and efficiency, increasing its demand across the verticals. Moreover, replacing conventional vehicles with electric ones is driving the market growth.

What are the key innovations in the Industrial Control & Factory Automation Market?

The industrial control and factory automation industry is witnessing rapid transformation. Technologies such as AI, IIoT, and edge computing enable smarter, more connected, and energy-efficient production environments. They reduce downtime, optimize performance, and improve quality. Collaborative robots and 5G connectivity enhance flexibility and real-time responsiveness across manufacturing operations. These advancements are paving the way for Industry 4.0. In Industry 4.0, data-driven, intelligent systems redefine productivity and operational resilience in industrial ecosystems.

|

Innovation |

Description |

Benefits |

Key Drivers and Notes |

|

IIoT & connected sensors |

Machines, sensors, and systems are networked for real-time data collection and communication. |

Condition monitoring and reduced manual interventions |

Rising demand for transparency, operational efficiency, and data-driven manufacturing. |

|

Edge computing & real-time processing |

Processing data closer to machines rather than sending everything to the cloud. |

Lower latency, more resilient operations, and faster decision-making. It is important for robotics and control loops. |

Increasing penetration of 5G, large volumes of data locally, and growing need for quicker control responses. |

|

AI/ML in automation & control systems |

Predictive maintenance, adaptive control, and quality inspection |

Higher throughput, improved quality, and reduced downtime. |

Data availability and connected systems enabling “smart” factories. |

|

Collaborative robots (“cobots”) & advanced robotics |

Robots work safely alongside humans and faster re-configurable robotics. |

Greater flexibility, enhanced improved safety, and lower barrier to automation (especially for smaller firms). |

Labor cost pressures, need for agility, and modular production. |

|

Digital twins & simulation |

Virtual replicas of physical systems, including machines and production lines, are used for simulation, monitoring, and optimization. |

Optimize flows without halting production and reduce trial-and-error. |

Advancements in modelling, need for flexible production, and availability of real-time data. |

|

5G/Advanced connectivity |

High-bandwidth and low-latency communication networks enable real-time control, remote supervision, and mobile robotics. |

Allows mobile robots, decentralized control, remote operations, and seamless data flow across large plants. |

Sensor proliferation, requirement for remote and automated operations, and push for Industry 4.0. |

Report Segmentation

The market is primarily segmented based on component, solution, industry, and region.

|

By Component |

By Solution |

By Industry |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Industrial 3D Printing Accounted For the Largest Share in 2024

The industrial 3D printing segment accounted for the highest revenue share in 2024 owing to the ease of development of customized products, design flexibility, and minimal wastage. The printing device is useful to print any part depending on the industry, which minimizes the cost of material and saves time and production costs; these factors are supposed to complement the market growth.

Additionally, industrial tools with complex designs can be easily manufactured, so OEMs' rising adoption of 3D printing to stay agile and innovative with the emerging trends. Furthermore, the ongoing digitization has resulted in printing complex designs with maintaining operational agility and reducing cost, which is expected to drive the segment over the forecast period.

The increasing demand for 3D printing in the automotive, defense, aerospace, and robotic industries also supports market growth. Many key players are also collaborating to develop printers for various end-use industries. For instance, Ozo & Rob Pvt Ltd has developed a 3D printer named Anant Pro XL, which solves issues for material shortage, compatibility, and high-precision quality design.

Plant Asset Management Are Expected to Spearhead the Market Growth

The demand for the PAM is driven by the rising demand for real-time tracking of many end-use industries to maximize their returns and improve efficiency and productivity. Additionally, the growing adoption of novel technologies such as IoT and automation across various sectors is also complementing the market growth.

Furthermore, these sectors produce a large amount of data which helps businesses look for a better approach to maintain the requirements of the enterprises and deliver safety & longevity in design, construction, and operations; such factors support market growth. Moreover, the ability to provide a high degree of accuracy to improve operations and deliver high performance has resulted in the adoption of PAM in the oil & gas and energy & power industry, boosting the market growth.

Discrete Industry Is Expected to Witness Faster Growth During the Forecast Period

The demand for the discrete industry is expected to see a significant surge over the forecast period owing to its ability to manufacture complex products in low volumes. Additionally, the medical device industry is contributing to revenue growth of the market owing to technological advancement and innovation in the healthcare sector.

In addition, the growing preference for innovative industrial and factory automation to improve quality and reduce time is also supporting market growth. Furthermore, manufacturers focusing on automation to improve their competitive edge position to male flexible and agile medical manufacturing systems are increasing the demand. The increasing need is due to the reduction of paperwork and errors, and maintaining high-quality standards increases the throughput of medical manufacturing plants; Such factors are bolstering the market growth.

Asia Pacific Is Expected to Dominate the Market Over the Forecast Period

Asia Pacific is the largest region for industrial control & factory automation and is expected to witness faster growth over the forecast period owing to many industrial verticals emphasizing increasing process effectiveness and lowering their manufacturing costs across China, India, South Korea, and Japan. Furthermore, advancements in robotic technology and the need to produce products in a single batch and connected supply chain to meet the requirement of a growing population.

Moreover, the increase in IoT devices and the growing adoption of smart factory automation across emerging nations has further led to the increasing adoption of industrial automation. For instance, the Japanese government announced its ‘Rebirth of Japan’ plan by investing $ 1.3 trillion, which focused on strengthening the manufacturing sector, and the industrial sector is expected to grow by $490 billion by 2023; such factors are anticipated to drive market growth.

Europe is also anticipated to grow over the forecast period owing to the growing consumer requirement with rising technologies. Additionally, the increasing adoption of novel technologies by the key players to make their business process efficient and productive to evolve with the rising competition is propelling the market growth.

Furthermore, many firms are adopting and launching industrial automation products in the market with rising consumer preferences. For instance, Schneider Electric launched a smart ventilation system named CkimaSys, which is an AI-equipped product used for filtering and managing airflow; such factors are expected to drive the market over the forecast period.

Competitive Insight

Some of the major players operating in the global market include 3D Systems, ABB Limited, Dwyer, Emerson Electric Company, Endress + Hauser, Fanuc, General Electric, Honeywell International Inc., Mitsubishi Electric Corporation, Omron, Rockwell Automation, Schneider Electric SE, Siemens, Stratasys, Wika, and Yokogawa Electric Corporation.

Recent Developments

In July 2024, Nozomi released Arc Embedded, embedding a security sensor inside Mitsubishi PLCs to track process‑level threats and boost resilience.

In September 2022, Mitsubishi electric corporation collaborated with Toshiba Mitsubishi-electric industrial system corporation (TMEIC) to develop an electrical motor-design equipped with AI to shorten the time required for electric motor design.

In April 2021, siemens and google cloud collaborated to optimize factory processes and improve productivity. This cooperation simplifies the deployment of artificial intelligence on the shop floor and improves overall quality.

Industrial Control & Factory Automation Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 172.91 billion |

| Market size value in 2025 | USD 186.76 billion |

|

Revenue forecast in 2034 |

USD 378.09 billion |

|

CAGR |

8.2% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Component, By Solution, By Industry, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

3D Systems, ABB Limited, Dwyer, Emerson Electric Company, Endress + Hauser, Fanuc, General Electric, Honeywell International Inc., Mitsubishi Electric Corporation, Omron, Rockwell Automation, Schneider Electric SE, Siemens, Stratasys, Wika, and Yokogawa Electric Corporation. |

FAQ's

• The global market size was valued at USD 172.91 billion in 2024 and is projected to grow to USD 378.09 billion by 2034.

• The global market is projected to register a CAGR of 8.2% during the forecast period.

• Asia Pacific dominated the industrial control & factory automation market in 2024.

• A few of the key players in the market are 3D Systems, ABB Limited, Dwyer, Emerson Electric Company, Endress + Hauser, Fanuc, General Electric, Honeywell International Inc., Mitsubishi Electric Corporation, Omron, Rockwell Automation, Schneider Electric SE, Siemens, Stratasys, Wika, and Yokogawa Electric Corporation.

• The industrial 3D printing segment dominated the market in 2024.