Intensity Modulated Radiotherapy Market Share, Size, Trends, Industry Analysis Report

By Radiation Type (Proton radiation, Electron radiation, Photon radiation, Carbon-ion radiation); By Application; By End User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 119

- Format: PDF

- Report ID: PM4628

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

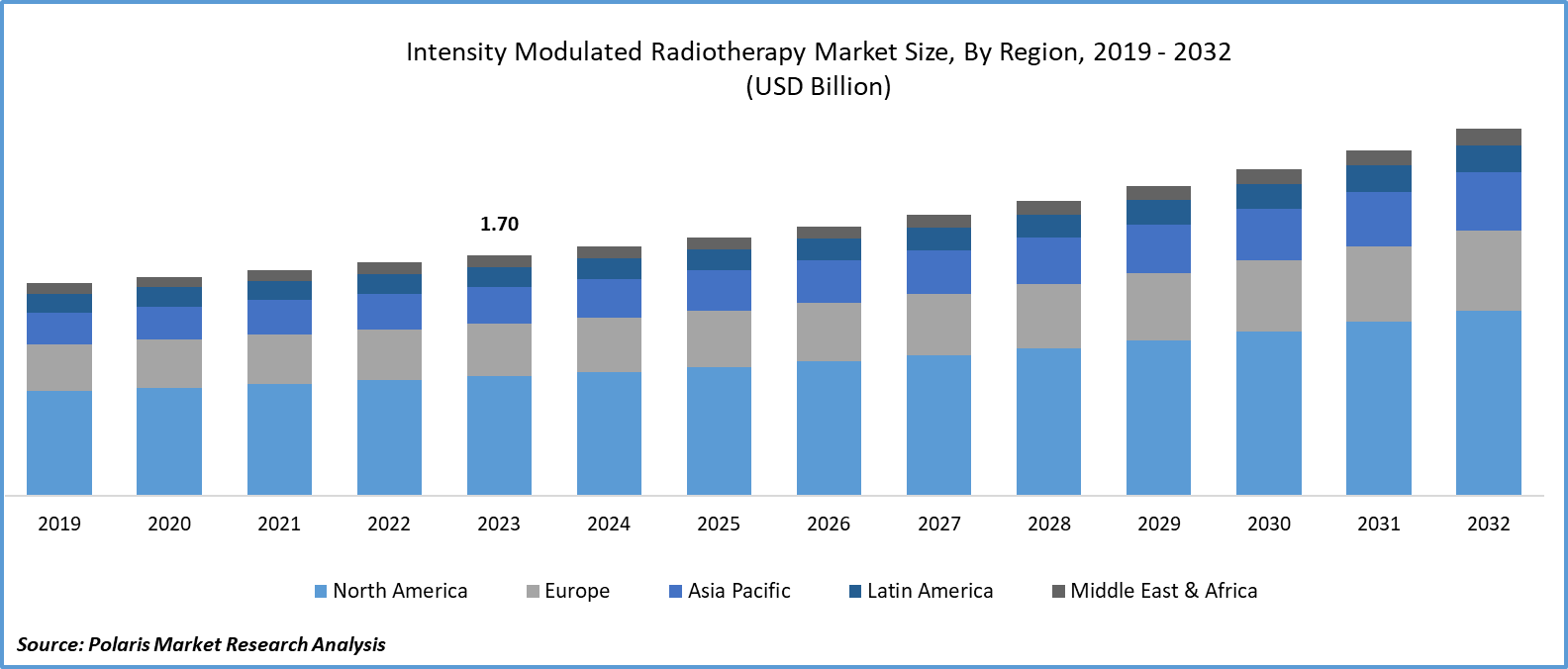

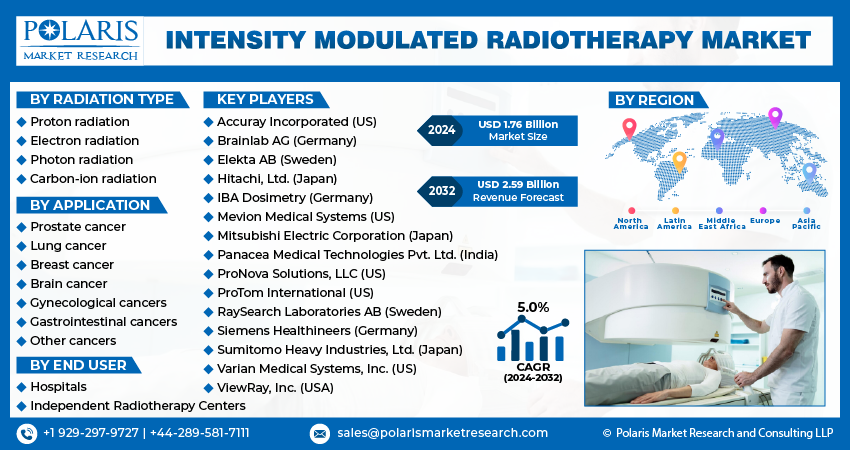

Intensity Modulated Radiotherapy Market size was valued at USD 1.70 billion in 2023. The market is anticipated to grow from USD 1.76 billion in 2024 to USD 2.59 billion by 2032, exhibiting the CAGR of 5.0% during the forecast period.

Market Overview

Intensity-modulated radiotherapy (IMRT) is one of the most prominent developments in oncology. This therapy is gaining adoption with the rising number of benign tumors and cancers in the world. The propensity to give required amount of dosage to the cancer cells in the human body is creating new growth opportunities for intensity-modulated radiotherapy in the global market. The ongoing research studies delving into the potential benefits associated with the IMRT are likely to promote its demand in the oncology segment.

- For instance, a 2023 study presented at the 2023 World Conference on Lung Cancer revealed that the people treated with the IMRT witnessed a more than double reduction in pneumonitis compared to the patients who received 3D-conformal radiotherapy.

To Understand More About this Research: Request a Free Sample Report

Moreover, the emergence of numerous cancer types, such as brain cancer, breast cancer, lung cancer, and more, is anticipated to boost the use of IMRT during the forecast period. According to a research study, intensity-modulated radiotherapy was more widely employed in treating breast, prostate, and lung cancers in 2018. Moreover, as per Lancet Commission on Prostate Cancer Report 2024, prostate cancer incidence is expected to double between 2020 to 2040.

However, the higher initial costs associated with the radiation machines and the lack of proficient professionals in handling intensity-modulated radiotherapy are expected to hamper market growth.

Growth Drivers

Rising use of intensity-modulated radiotherapy

The growing adoption of radiotherapy in cancer treatment is showcasing room for growth in the marketplace. According to the available data, there has been 18% growth in the use of intensity-modulated radiotherapy from 1,921 patients in 2011 to 34,759 in 2018. This trend is showcasing the positive rate of IMRT adoption in cancer treatment. There will be a huge demand for intensity-modulated radiotherapy in the coming years, driven by its higher potential for the elimination of cancer cells.

The increasing investments in the development of healthcare infrastructure

Governments are stepping forward to take significant measures to control and promote cancer treatment availability with increasing incidence of cancer. The enhanced accessibility of healthcare facilities in metropolitan areas is demonstrating a positive outlook for market growth. Based on the research study, around 70% of the patients received IMRT in the metropolitan areas, such as Incheon, Gyeonggi Province, and Seoul, in 2018. This is a sign of the demand potential for intensity-modulated radiotherapy in metropolitan areas.

Restraining Factors

The development of alternative therapies is likely to impede market growth

The ongoing research activities and clinical studies exploring other potential treatments for cancer are expected to restrain market growth. For instance, a 2023 clinical study funded by the National Cancer Institute revealed that people with locally advanced rectal cancer, which means the spread of cancer within the rectal rather than other organs, may not be required to have radiation before surgery. These developments are anticipated to restrain the intensity-modulated radiotherapy market in the long run.

Report Segmentation

The market is primarily segmented based on radiation type, application, end user and region.

|

By Radiation Type |

By Application |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Radiation Type Analysis

Proton radiation segment is expected to witness the highest growth during the forecast period

The proton radiation segment is projected to grow at a healthy CAGR during the projected period. This is mainly driven by its capabilities in driving the safety of healthy tissues while eliminating cancer-infected cells. The rising emphasis on long-term side effects of radiation treatment for healthy organs is enabling doctors and other healthcare professionals to adopt intensity-modulated radiotherapy around the world.

The photon radiation segment led the market with a substantial revenue share in 2023, largely attributable to its ability to offer customized radiotherapy, particularly focusing on the target area. The familiarity of photon radiation in intensity-modulated radiotherapy and its efficiency in treating cancer cells is likely to propel IMRT market growth in the coming years.

By Application Analysis

Brain cancer segment acquired the largest market share in 2023

The brain cancer segment registered the largest market share in 2023. The ongoing patient interest in non-invasive cancer treatment is contributing to the higher segmental growth over other IMRT applications. Moreover, the rising incidence of brain cancer and the established radiotherapy equipment in the world are expected to drive new demand in the study period.

The prostate cancer segment is expected to witness significant growth in the coming years, driven by the growing number of people suffering from prostate cancer. As per the cancer statistics published by the American Cancer Society, there was a rise of 3% in the number of prostate cancer cases annually from 2014 to 2019. As this trend continues further, there will be a significant demand for advanced cancer therapies, including radiation therapy, in the projected timeframe

By End User Analysis

Hospitals segment held the significant market revenue share in 2023

The hospitals segment held a significant market share in revenue in 2023. This due to the continuous rise in healthcare infrastructure, including x-rays and radiotherapy adoption by hospitals, driven by the growing number of cancer cases. The improved availability of proficient professionals and advanced equipment is forcing patients to get appointments in the hospital, facilitating the potential demand for intensity-modulated radiotherapy.

The independent radiotherapy centers segment is anticipated to witness substantial growth in the coming years, driven by the growing number of hospitals referring to independent radiotherapy centers rather than establishing them in their hospitals due to cost-effectiveness.

Regional Insights

North America region registered the largest share of the global market in 2023

The North America region held the dominant share in 2023. The growth of the market can be largely influenced by the presence of healthcare providers with rigid infrastructure in the region. The growing investments by the major players are positively influencing market growth. For instance, in November 2023, St. Joseph's Hospital unveiled its strategy to open initial proton radiation therapy in Tampa, Florida.

Additionally, the growing cancer cases in the region, particularly in the United States and Canada are expected to drive its demand for intensity modulated radiotherapy. According to the Pan American Health Organization, around 30 million cancer cases are expected to register by 2045 globally, while the number of people with cancer is projected to grow by 59.3%, reaching 6.7 million in America.

The Asia Pacific region is expected to be the fastest-growing region with a healthy CAGR during the projected period, owing to the growing concerns about promoting health infrastructure, primarily cancer care, driven by the rising number of cancer patients in the region.

The developing countries in the region, primarily India, are focusing more on enhancing the accessibility of cancer care to the public. For instance, in May 2023, the Indian government inaugurated an initial public proton beam therapy facility on the Kharagpur Tata Memorial campus.

Furthermore, according to the experts, India is witnessing a rise in brain tumour cases, constituting 20% of the total among children. This tendency is expected to drive demand for intensity-modulated radiotherapy during the forecast period.

Key Market Players & Competitive Insights

Strategic partnerships to drive the competition

The intensity modulated radiotherapy market is considered to be fragmented with the presence of several market players and is anticipated to witness competition driven by strategic expansion activities by the major players.

Some of the major players operating in the global market include:

- Accuray Incorporated (US)

- Brainlab AG (Germany)

- Elekta AB (Sweden)

- Hitachi, Ltd. (Japan)

- IBA Dosimetry (Germany)

- Mevion Medical Systems (US)

- Mitsubishi Electric Corporation (Japan)

- Panacea Medical Technologies Pvt. Ltd. (India)

- ProNova Solutions, LLC (US)

- ProTom International (US)

- RaySearch Laboratories AB (Sweden)

- Siemens Healthineers (Germany)

- Sumitomo Heavy Industries, Ltd. (Japan)

- Varian Medical Systems, Inc. (US)

- ViewRay, Inc. (USA)

Recent Developments in the Industry

- In July 2023, RaySearch Laboratories AB entered a strategic collaboration with a Japanese medical company, B dot Medical Inc. This collaboration is aiming to drive advancements in the development of proton therapy.

- In July 2023, Apollo Hospitals announced its plan to develop two more proton cancer centers in India

Report Coverage

The intensity modulated radiotherapy market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, radiation type, application, end user, and their futuristic growth opportunities.

Intensity Modulated Radiotherapy Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.76 billion |

|

Revenue forecast in 2032 |

USD 2.59 billion |

|

CAGR |

5.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Intensity Modulated Radiotherapy Market report covering key segments are radiation type, application, end user and region.

Intensity Modulated Radiotherapy Market Size Worth $2.59 Billion

Intensity Modulated Radiotherapy Market exhibiting a CAGR of 5.2% during the forecast period.

North America is leading the global market

key driving factors in Intensity Modulated Radiotherapy Market are rising application of intensity-modulated radiotherapy