Military Antennas Market Share, Size, Trends, Industry Analysis Report

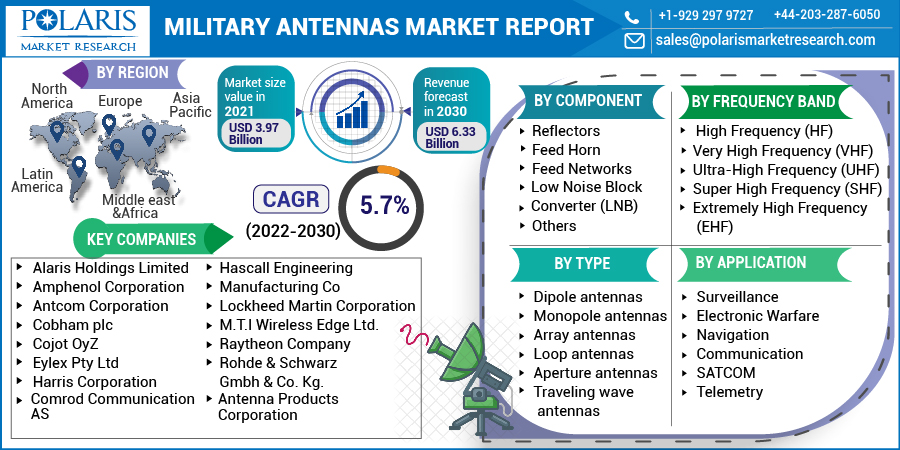

By Component; By Frequency Band; By Type; By Application (Surveillance, Electronic Warfare, Navigation, Communication, SATCOM, Telemetry); By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 114

- Format: PDF

- Report ID: PM2441

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

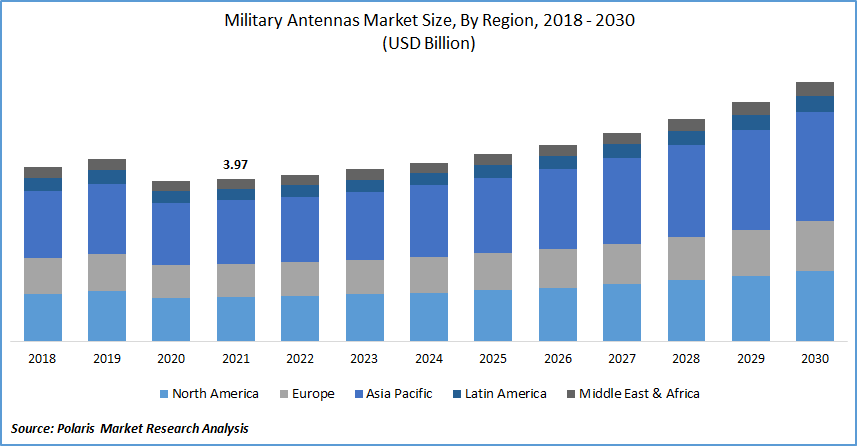

The global military antennas market was valued at USD 3.97 billion in 2021 and is expected to grow at a CAGR of 5.7% during the forecast period. A rise in market demand for electronically phased array antennas, a surge in military spending, and an increasing installation of the military antenna are boosting the military antennas market growth during the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Advancements in communication-on-the-move (COTM) services for such platforms for the commercial and military vehicles and trains. An antenna terminal's steering is critical for establishing a satellite link, and an ESPA eradicates mechanical motion. Furthermore, the factors driving the global military antennas market are a rise in armed spending and a boost in the adoption of multifunctional radar systems. Moreover, advancements in drone technology and innovations in microstrip, meta-material, and plasma antennas have opened up new opportunities. However, the high costs of developing and maintaining infrastructure that supports military antennas are expected to restrain the market growth during the forecast period.

Industry Dynamics

Growth Drivers

Rising market demand from maritime application and various governments funding and awards to the significant players for providing satellite services across the globe. Communication satellites with a tiny aperture terminal (VSAT) on the moving objects in the sea. If a ship at sea moves with the water, the antenna must be stabilized concerning the horizon and True north, so the antenna always points at the satellite from which it transmits and receives signals. The shipborne antenna is typically regarded as one of a maritime satellite communication shipborne terminal (MARSAT). A high gain auto-track antenna has been developed to be treated in a similar system.

Furthermore, the government organization awarded significant players for developing military antenna, which drives the market growth. For instance, in October 2021, L3Harris was awarded a USD 5.7 million contract by the United States Air Force Research Laboratory to incorporate a Low-Earth orbit port into a rotary-wing airplane to expand aerial communications abilities.

In March 2021, Eutelsat, one of the world's leading satellite operators, has chosen Airbus to build EUTELSAT 36D, a younger iteration multi-mission geostationary telecommunications satellite. Thus, the contracts among public and private players and the increasing market demand from the maritime industry are driving the military antennas market growth during the forecast period.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on component, frequency band, type, application, and region.

|

By Component |

By Frequency Band |

By Type |

By Application |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Component

Based on the component, the reflectors segment is expected to be the most significant revenue contributor due to advancements in reflector design that have reduced assembly time. Reflectors are incorporated into antenna assemblies to change the antenna's radiation characteristics to improve signal strength. Major manufacturers are working to strengthen reflector design to reduce assembly time. For instance, in April 2021, Airbus chose Ariane as the provider of the satellite antenna reflectors from the OneSat.

Based on the frequency band, the super-high frequency (SHF) held the largest share. This segment is primarily driven by the increasing market demand for reliable military satellite communication. This frequency band is used for point-to-point satellite communication and data links. In airborne radar, the SHF band is used for airborne floor mapping. This frequency range is used for point-to-point communications and information links. Most radar transmitters, wireless LANs, satellite interaction, microwave radio relay links, and various short terrestrial data links operate in this frequency range.

Geographic Overview

In terms of geography, Asia Pacific had the largest revenue share. Asia's rapid and sustained economic growth and the increase of sophisticated military technology are reshaping the global defense landscape. Rapid improvements in defense infrastructure across the region generate high demand for military-technical capabilities. Due to an increase in the number of terror attacks in the Asia Pacific region, countries have increased their surveillance and anti-terrorism capabilities.

Furthermore, rising defense spending in India and China, among others, and the development of defence commands in emerging economies, have speeded up demand for military equipments in the Asia Pacific region. In January 2021, China launched the Tiantong 1-03 communications satellite, which will provide mobile telecommunications services in the S-band frequency band. The China Aerospace Science and Technology Corporation (CASC), the Country's leading space construction company, affirmed that the satellite had successfully entered geosynchronous transfer orbit. The satellite was connected with the Tiantong 1-01 and 1-02 satellite communications once in orbit to enhance resource productivity and system service offerings.

Moreover, North America is expected to witness a high CAGR in the global military antennas market. The growing trend of innovative technologies in business facilities, premises, homes, and other settings to improve communication boosts regional growth. Advances in antenna design and structure enable improved connectivity, improving business connectivity while maintaining safety. Due to digital transformation, the growing adoption of wireless connectivity solutions in businesses propels the market forward.

Competitive Insight

Some of the major players operating in the global military antennas market include Alaris Holdings Limited, Amphenol Corporation, Antcom Corporation, Antenna Products Corporation, Cobham plc, Cojot Oy, Comrod Communication AS, Eylex Pty Ltd, Harris Corporation, Hascall Engineering and Manufacturing Co, Lockheed Martin Corporation, M.T.I Wireless Edge Ltd., Raytheon Company, and Rohde & Schwarz Gmbh & Co. Kg.

Military Antennas Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 3.97 Billion |

|

Revenue forecast in 2030 |

USD 6.33 Billion |

|

CAGR |

5.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Frequency Band, By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Alaris Holdings Limited, Amphenol Corporation, Antcom Corporation, Antenna Products Corporation, Cobham plc, Cojot Oy, Comrod Communication AS, Eylex Pty Ltd, Harris Corporation, Hascall Engineering and Manufacturing Co, Lockheed Martin Corporation, M.T.I Wireless Edge Ltd., Raytheon Company, and Rohde & Schwarz Gmbh & Co. Kg. |