Mining Drills and Breakers Market Share, Size, Trends & Industry Analysis Report

By Product Type (Drills, Breakers); By Sales; By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 118

- Format: PDF

- Report ID: PM1633

- Base Year: 2024

- Historical Data: 2020-2023

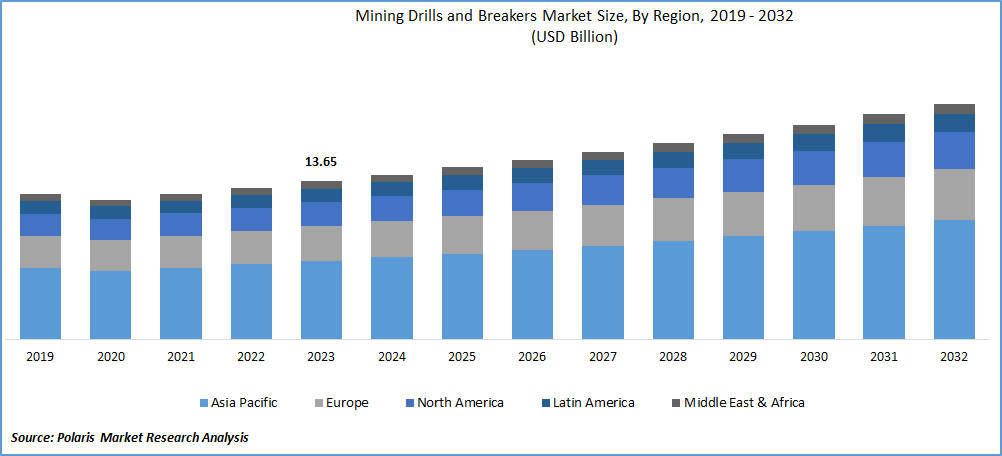

The global mining drills and breakers market was valued at USD 15.4 billion in 2024 and is forecasted to grow at a CAGR of 5.80% from 2025 to 2034. The market is driven by increasing mining activities and demand for high-performance equipment.

Mining drills are a type of equipment widely used to drill the surface of the earth for mining purposes. Breakers are used to break rocks or stones during mining operations. Mining equipment is used to extract minerals or organic elements from beneath the soil, such as coal, gold, crude oil, and various types of metals. There are two types of drilling equipment: crawler and rotary. On the other hand, breakers come in two types that are rock and hydraulic. Manufacturers benefit from breakers as they provide an option for selecting specific breakers tailored to the application.

The expansion of underground and surface exploration sites across the world has increased the demand for a variety of drills and breakers. Additionally, the increase in sales of underground mining equipment stimulates the mining drills and breakers market. For metal and mineral mining, the surface is dug up, and debris is removed; rocks are broken into small pieces and then crushed further. Such excavation tasks require breakers for primary rock mining processes, thereby driving the demand for breakers in the mining industry. Moreover, the increase in mining activities for coal and metals is a significant driver for the market worldwide.

To Understand More About this Research: Request a Free Sample Report

The mining drills and breakers market faces some challenges that are holding it back from growing. Mining operations are affected by changes in government regulations and environmental concerns. Sometimes, stricter rules can make it harder or more expensive for mining companies to operate. Another problem is that the initial cost of buying and maintaining mining drills and breakers is quite high. This acts as a barrier for smaller mining companies with limited budgets.

Growth Drivers

- The expansion of mining operations drives the market growth for mining drills and breakers.

The market for mining drills and breakers is getting a boost because mining operations are expanding. As more places around the world look for valuable resources like coal, minerals, and metals, mining companies need more equipment to dig and break through rocks. Mining drills, breakers, and heavy-duty tools help miners to get the stuff they need. With the demand for these resources going up, mining companies are investing more in equipment to make their operations efficient and productive.

This expansion of mining activities is driving the market of mining drills and breakers because companies need these powerful tools to keep their mining operations running smoothly. Also, as technology improves, new and advanced mining drills and breakers are being developed, making the mining process even more effective. These innovations are attracting mining companies to upgrade their equipment, further contributing to the growth of the market.

Report Segmentation

The market is primarily segmented based on product type, sales, application, and region.

|

By Product Type |

By Sales |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Analysis

- The rock breakers segment is expected to hold a significant market share in 2024

The rock breakers segment is expected to hold a significant market share because these are specialized attachments for heavy machinery used in mining, designed to break down large rocks into smaller pieces. The rock breaker segment plays an important role in enhancing the efficiency of mining operations. In various mining activities, particularly those involving hard and compacted rock formations, the use of rock breakers is essential for performing excavation and extraction processes. As mining companies increasingly campaign into locations with challenging rock structures, the need for powerful rock-breaking equipment becomes more important. This demand is further propelled by the growing focus on optimizing mining operations for increased productivity.

By Application Analysis

- The metal mining segment accounted for the dominating revenue share in 2024

The metal mining segment has emerged as a dominant segment since the extensive use of mining drills and breakers in extracting metals from the Earth's crust. Metal mining involves the extraction of various valuable metals like gold, copper, and iron, and these processes often require powerful tools to break through the hard rock formations. Mining drills and breakers play a crucial role in metal mining operations by performing the excavation of challenging geological formations. The efficiency offered by these tools is particularly essential in metal mining, where the quality and size of extracted materials directly impact the economic conditions of the operation. The demand for metals continues to rise globally because of industrialization, infrastructure development, and technological advancements. As a result, metal mining activities have expanded, leading to a similar increase in the requirement for advanced drilling and breaking equipment and accounting for a dominating market share in terms of application.

Regional Insights

- Asia Pacific is estimated to dominate the market over the forecast period.

Asia Pacific is estimated to dominate the mining drills and breakers market because of the mining activities and economic trends in the region. Asia Pacific has become a focal point for mining operations, driven by the region's reserves of minerals and metals. The dominance of the Asia Pacific market is due to infrastructure development and construction projects across countries like China, India, and Southeast Asian nations. As these nations undergo the developmental phase, there is an increased need for raw materials extracted through mining, thereby driving the demand for advanced drilling and breaking equipment. Moreover, the economic growth in the Asia Pacific region has led to increased investments in mining exploration and extraction.

The North American region is expected to grow at a significant growth rate because of the restoration of mining activities in response to the increasing demand for minerals and metals. North America, with its heavy deposits of various resources, is witnessing renewed exploration and extraction activities, driving the need for advanced drilling and breaking equipment. Strategic investments in infrastructure projects and the development of mining sites are further boosting the demand for these specialized tools.

Key Market Players & Competitive Insights

In the global market, mining drills and breakers manufacturers are actively engaged in a range of activities aimed at meeting the evolving demands of the mining industry. These manufacturers play an important role in innovation, introducing cutting-edge technologies, and enhancing the efficiency of mining operations. Key activities include research and development initiatives focused on creating advanced drilling and breaking equipment capable of handling diverse geological challenges. Manufacturers strive to design tools that not only improve operational productivity but also adhere to stringent safety and environmental standards.

Some of the major players operating in the global market include:

- Boart Longyear

- Cabo Drilling Corp.

- Caterpillar, Inc

- Doosan Corporation

- Energold Drilling Corp.

- Epiroc AB

- FLSmidth & Co. A/S

- Furukawa Co., Ltd

- Geodrill Limited

- Hitachi Construction Machinery Co. Ltd.

- Komatsu Ltd

- Metso Corporation

- Sandvik AB

- SANYHE International Holdings Co., Ltd.

Recent Developments

- In January 2025, Gainwell Engineering delivered India's first indigenous Room and Pillar Mining Equipment Package to Eastern Coalfields Limited, featuring a Continuous Miner (GCM345) and Feeder Breaker (GFB110). The milestone advances India’s self-reliance in high-end mining equipment under the 'Make in India' initiative.

- In October 2023, Sandvik Mining and Rock Solutions introduced a performance upgrade package for its 2700 series underground drills. The 2700 series, which includes a top hammer production drill, single-boom jumbo, and rock bolter for mining development, was designed and manufactured in collaboration with the company's operations in Finland, France, and China.

Mining Drills and Breakers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 16.29 Billion |

|

Revenue Forecast in 2034 |

USD 27.1 Billion |

|

CAGR |

5.80% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Product Type, By Sales, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

FAQ's

Key segments in the Mining Drills and Breakers Market are product type, sales, application, and region

Mining Drills and Breakers Market Size Worth USD 27.1 Billion By 2034

Market predicted expected to grow at a CAGR of 5.80% during the forecast period (2025-2034)

Asia Pacific is leading the global market.

key driving factors in Mining Drills and Breakers Market are expansion of mining operations drives the market growth for mining drills and breakers