Mobile Accessories Market Share, Size, Trends, Industry Analysis Report

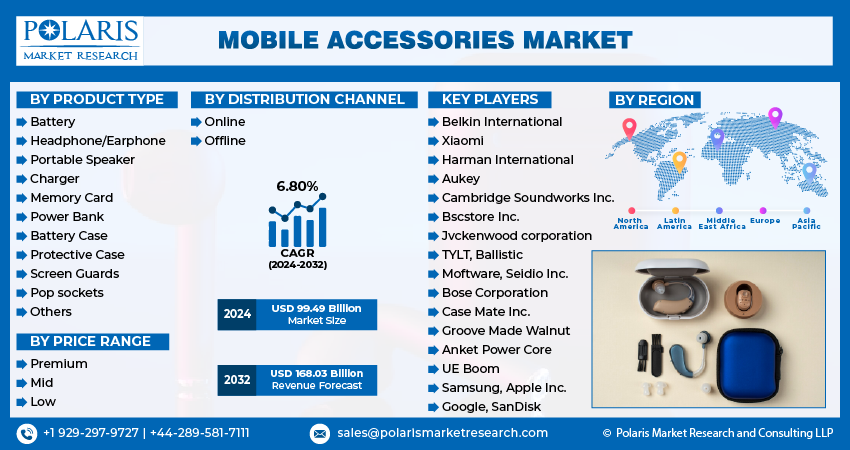

By Product Type (Battery, Headphone, Earphone, Portable Speaker, Charger, Memory Card, Protective Case, Power Bank, Battery Case, Screen guards, Pop sockets, and Others), By Distribution Channel, By Price Range, By Region; Segment others Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM3150

- Base Year: 2023

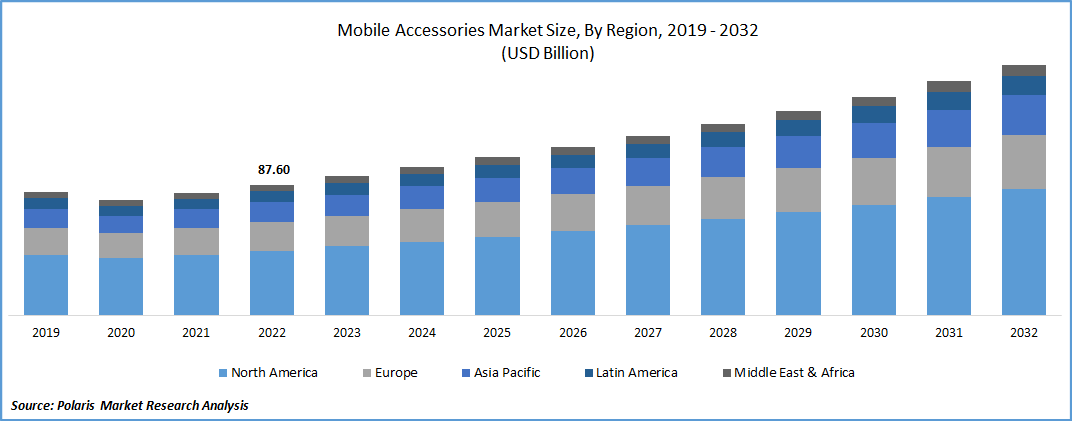

- Historical Data: 2019-2022

Report Outlook

The global mobile accessories market was estimated at USD 93.34 billion in 2023 and is projected to grow at a CAGR of 6.80% during the forecast period. The important drivers driving market expansion are the proliferation of low-cost smartphones, cutting-edge functionalities in smartphones, and the rising preference for wireless mobile phone accessories. However, problems, including the expanding market for duplicate mobile accessories and the short product life of smartphones, could restrain market expansion.

Know more about this report: Request for sample pages

Mobile phone accessories are things that provide the smartphone with additional functionality. Such accessories, which entice customers by making access to their cell phones more practical and usable, are offered in various product forms on the mobile accessories market. These include chargers, screen protectors, cases, power banks, cables, headphones, batteries, pop sockets, mounts and stands, memory cards, speakers, etc.

To stop the spread of the virus, COVID-19 required stringent lockdowns and social isolation, which hurt the market for mobile phone accessories. Economic unpredictability, a partial company shutdown, and poor consumer hinder the market for mobile phone accessories. However, with the limits being loosened, the post-pandemic mobile phone accessory business is anticipated to pick up speed. Economic uncertainty, a partial corporate shutdown, and poor consumer confidence influenced the demand for mobile phone accessories. The pandemic hindered the supply chain, and there were logistical difficulties. The market for mobile phone accessories is anticipated to pick up speed again after the epidemic due to the loosening of restrictions.

Industry Dynamics

Growth Drivers

Incorporating cutting-edge functionalities is one of the main factors fueling market expansion in the mobile phone accessory industry. Competition in the global smartphone market has increased because smartphone makers concentrate on integrating cutting-edge features and technology to stay competitive. For instance, Apple Inc., a multinational technology company based in the United States specializing in creating high-end consumer electronics products, planned to release the iPhone 14 Pro and iPhone 14 Pro Max in October 2022.

These devices would include LiDAR sensors, primarily to improve the device's implementation of augmented reality (AR). Due to recent technological advancements, users can utilize their devices for various purposes, including playing high-definition games, capturing high-definition selfies and videos, and instantly accessing mobile applications. This will accelerate market expansion throughout the forecast period.

Increased attention paid to enhancing telecommunications network infrastructure is one of the most noticeable market trends in the mobile phone accessory market. Smartphone manufacturers, governmental agencies, and telecom service providers work together to upgrade the communications network infrastructure to enable high bandwidth capacity. This accelerates the development of 4G/5G compatible gadgets and investments in 4G/5G networks. This will increase the demand for mobile phone accessories as more people use their phones to access the internet and audio and video content.

Report Segmentation

The market is primarily segmented based on product type, distribution channel, price range, and region.

|

By Product Type |

By Distribution Channel |

By Price Range |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The Earphone/ headphone segment is expected to witness the fastest growth in 2022

In 2022, the Earphone/ headphone segment was anticipated to increase. Most of the market during the historical and forecast periods belonged to earphones and headphones. This is due to headphones' ability to block sound so that only the wearer may hear it. This is for privacy or to avoid bothering others, such as when listening in a public library. Additionally, they can deliver sound fidelity superior to loudspeakers at comparable prices.

The protection cases and screen protectors segment is growing rapidly since they shield your phone from harm. People expect their expensive smartphones to last when they purchase them. This toughness can be increased by using sturdy phone cases, and a screen protector will shield your smartphone from daily damage, like scratches from keys in your pocket.

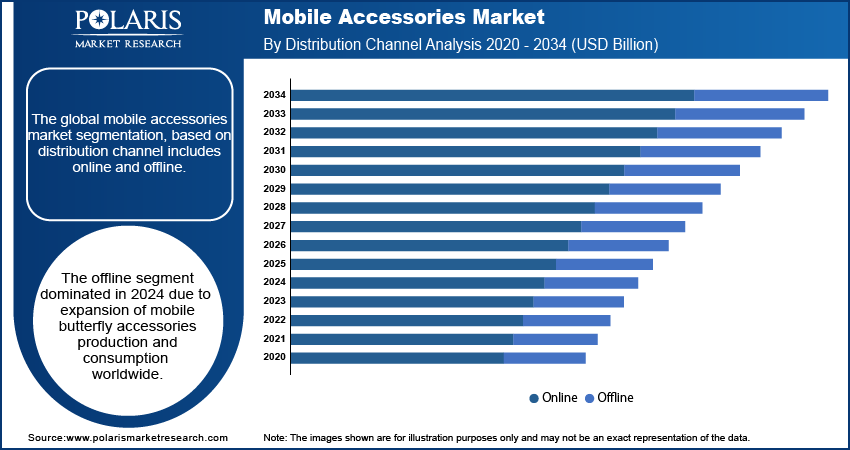

Offline accounted for the largest market share in 2022

The offline segment garnered the largest revenue share in the market. This was attributable to the expansion of mobile butterfly accessories production and consumption worldwide. Mobile Accessories with a butterfly shape are widely available. The higher percentage is correlated with the growing habit of purchasing mobile phone accessories from brick-and-mortar retailers, primarily to assess product quality. Most customers enjoy testing the audio output of headphones and the sharpness of camera lenses. They also want to try a protective case to determine if it looks fashionable.

A lack of trust in buying mobile phone accessories is also a result of the sale of fake and subpar goods on well-known e-commerce platforms. Customers need help seeing how the protective cover will appear on their smartphone, particularly when purchasing a protective case. These elements have increased the business the industry receives through offline distribution channels. Demand for this specific distribution channel will rise throughout the projected period. This is due to the availability of accessories in offline channels at prices that are comparable to those found online.

The Mid-range segment is expected to witness the fastest growth during forecast period

The mid-range segment dominated the market and is expected to dominate throughout the forecast period. Since mid-range mobile accessories typically offer the best balance of price and performance, mild-range mobile accessory products historically held the largest market share. Due to compatibility concerns and improved quality, branded mobile phone accessories have seen a surge in sales associated with higher growth.

Customers who typically purchase accessories want to improve their user experience and increase the functionality of their current cell phones. They want to ensure high reliability, usability, and quality, which has increased demand for high-end mobile phone accessories. The enhanced features and durability of the exceptional range of goods will also boost the mobile phone accessories market during the anticipated timeframe.

North America holds the largest share over the study period

During the forecast period, North America holds the largest global market share. Due to the presence of high-end smartphone manufacturers like Apple, Moto, and Samsung, the region has experienced significant growth. To solve compatibility problems and give their users better quality, they have also introduced their line of mobile phone accessories. Apple, the smartphone market leader, has developed an ecosystem to improve the user experience. This ecosystem includes wireless AirPods, wireless chargers, power cords, protective cases, and a leather MagSafe pocket.

However, the Asia Pacific registered the highest growth rate over the study period. They are rising disposable incomes & ever-increasing young populations in emerging nations seeking aesthetic value in their gadgets likely to contribute to the market. South Asian has a huge population base for both high & low-end mobile accessories and a high level of customization. Competition is fierce due to many un-organized players and medium-sized catering to the booming young generation residing in tier II and III cities.

Competitive Insight

There are various significant players in the global market, such as Belkin International, Xiaomi, Harman International, Aukey, Cambridge Soundworks Inc., Bscstore Inc., Jvckenwood corporation, TYLT, Ballistic, Moftware, Seidio Inc., Bose Corporation, Case Mate Inc., Groove Made Walnut, Anket Power Core, UE Boom, Samsung, Apple Inc.,Google, SanDisk, and others.

Recent Developments

- In August 2022, in addition to Bluetooth 5.3, a dual driver configuration, six microphones, active noise cancellation, speech detection, and an IPX7 rating, Samsung unveiled the Galaxy Buds 2 Pro.

- In April 2022, Samsung Electronics partnered with the plant-based designer “Sean Wotherspoon to launch its eco-friendly smartphone cases & watch accessories. All are sourced sustainably using 100 percent recycled materials, and the cases & watch bands are bio-degradable.

Mobile Accessories Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 99.49 billion |

|

Revenue forecast in 2032 |

USD 168.03 billion |

|

CAGR |

6.80% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product Type, By Distribution Channel, By Price Range, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Belkin International Inc., Xiaomi, Harman International Industries, Aukey, Cambridge Soundworks Inc., Bscstore Inc., Jvckenwood corporation, TYLT, Ballistic, Moftware Inc., Seidio Inc., Bose Corporation, Case Mate Inc., Groove Made Walnut, Anket Power Core, UE Boom, Samsung, Apple Inc., Google, SanDisk, and others. |

FAQ's

Key companies in the mobile accessories market Belkin International, Xiaomi, Harman International, Aukey, Cambridge Soundworks Inc., Bscstore Inc., Jvckenwood corporation, TYLT, Ballistic, Moftware, Seidio Inc.

The global mobile accessories market projected to grow at a CAGR of 6.7% during the forecast period.

The mobile accessories market report covering key segments are product type, distribution channel, price range, and region.

Key driving factors in mobile accessories market are increasing demand for wireless devices and technological advancements.

The global mobile accessories market size is expected to reach USD 168.03 billion by 2032.