Monkeypox Testing Market Share, Size, Trends, Industry Analysis Report

By Technology (PCR, LFA, Others); By End Use; By Region; Segment Forecast, 2022 – 2030

- Published Date:Dec-2022

- Pages: 118

- Format: PDF

- Report ID: PM2922

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

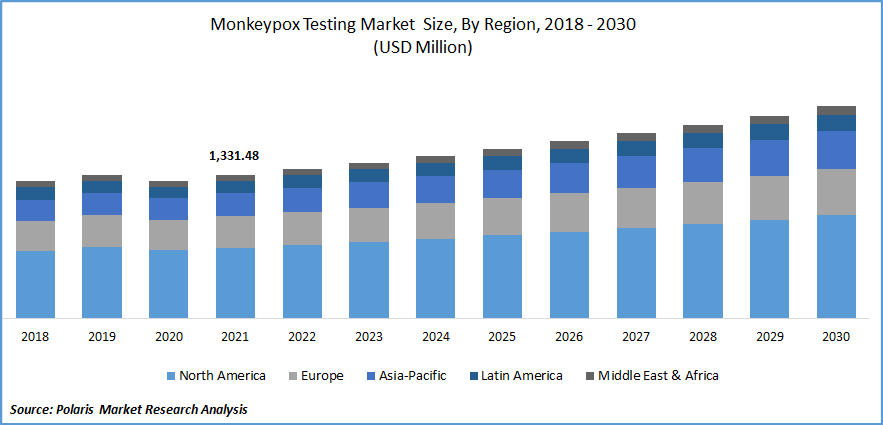

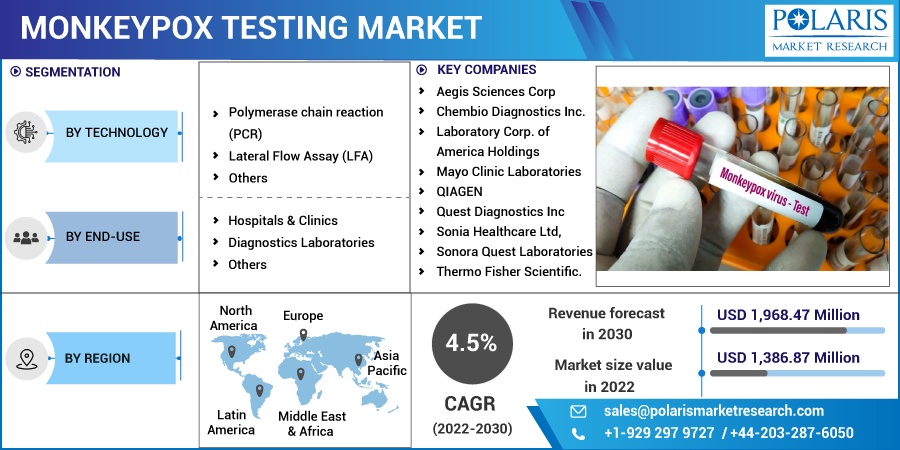

The global monkeypox testing market was valued at USD 1,331.48 million in 2021 and is expected to grow at a CAGR of 4.5% during the forecast period.

The increase in monkeypox cases worldwide and the declaration of a "Public Health Emergency" are predicted to contribute to the market's growth. With the formation of a new research consortium, the UK's efforts to combat the monkeypox outbreak will experience a significant boost. The consortium will collaborate to create better diagnostic tools, identify potential treatments, examine the effectiveness of vaccines, and track the spread of the virus. Creating sensitive PoC tests, to expedite diagnosis.

Know more about this report: Request for sample pages

Development of the LFT will be carried out in conjunction with the “Global Access Diagnostics” to create products that might afterward be mass-produced & utilized therapeutically all over the world, especially in low- and middle-income nations.

The rise in monkeypox cases and worries about another global pandemic due to population growth are both cited as reasons for the industry's expansion. According to the CDC, as of August 2022, 94,385 laboratory tests had been completed with a cumulative positivity rate of 29.7%. There were 56,609 cases worldwide, with 21,504 of those cases coming from the U.S. To stop the virus from spreading, it is necessary to establish precise diagnosis tools, treatment plans, and testing capabilities.

To detect the disease, a variety of testing kits are being created; nevertheless, an accurate method to comprehend the spread is still being investigated. In addition, government programs to promote testing are accelerating the market's expansion. For instance, as part of its ongoing commitment to address ongoing outbreaks, the U.S. FDA announced initiatives and significant actions in September 2022 to expand the diagnostics capacity and accessibility. The introduction of novel diagnostic tests using PCR technology is being facilitated by the pandemic's increased laboratory capacity, allowing for easier test uptake.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The sector is expanding quickly as a result of variables including the rising incidence of illness conditions globally and the difficulties in determining the primary cause of the onsite disease. Government efforts to stop the virus's spread and prevent the emergence of another pandemic are also contributing to the industry's expansion.

The introduction of novel diagnostic tests using PCR technology is being facilitated by the pandemic's increased laboratory capacity, allowing for easier test uptake. Being rapid and cost-effective PCR testing systems have been implemented in monkeypox diagnosis to facilitate effective results with more accuracy. In the market PCR testing system is only a single diagnostic kit with is cost-effective, rapid, accurate, and feasible.

Report Segmentation

The market has segmentations based on technology, end-use, and region.

|

By Technology |

By End-use |

By Region |

|

|

|

Know more about this report: Request for sample pages

The polymerase chain reaction segment is expected to witness as a primary testing unit

In 2022, the PCR technology category led the global market and was responsible for significant revenue. Over the course of the projection period, the segment will continue to grow at a constant CAGR. Due to the quick and accurate results provided by the PCR technique, the growth of this market can be attributed to the growing use of PCR technology for testing. Additionally, most of the test kits on the market use PCR-based analysis.

For instance, in August 2022 Fulgent Genetics unveiled PCR-based diagnostics for the recognition of monkeypox. In July 2022, LabCorp introduced a PCR-based monkeypox detection test due to the CDC partnership. With the rising need for quick tests and cutting-edge detection kits, the lateral flow assay technique segment is anticipated to grow at a profitable CAGR over the forecast period. The technology used in diagnostics is improving as a result of research and technical developments. For instance, JOYSBIO released two monkeypox test kits in August 2022 that both provide findings in under 15 minutes.

The hospitals and clinics segment has its dominance in the global market

In 2022, the hospitals and clinics end-use category led the global market and was responsible for the highest revenue share and expected to register the highest growth rate over the study period. Due to the growing adoption of testing in these healthcare institutions and the rising incidence of infection in the general population, this market sector has experienced growth. After the pandemic, people are much more aware of how viruses propagate.

This has then encouraged early detection and treatment of these viruses to prevent the occurrence of another pandemic on a global scale. On the other hand, the diagnostic laboratories’ end-use segment is anticipated to increase at the fastest rate during the projection period. Due to growing concerns about the virus's quick global transmission, there has been an acceleration in R&D, which has contributed to the segment's rapid rise. For instance, the FDA released guidelines in September 2022 to promote the creation of assays for monkeypox testing. In consequence, it is predicted that this will make developing laboratory-developed tests easier.

North America is most likely to dominate the global industry

The North American region market dominated the industry globally in 2022. The prevalence of the area is ascribed to an increase in monkeypox cases in the area. Out of a total of 56,026 cases recorded worldwide, the CDC reports that 21,274 cases are from the United States. After the WHO declared monkeypox a worldwide health emergency due to the virus’s fast spread in many regions, China's test kit manufacturers, the largest contributors to testing items for COVID-19, are managing what may be a new and hectic production, but with complete preparation and confidence.

Around, 30 Chinese in vitro diagnostics businesses have gained CE certification from the EU or market access for monkeypox virus nucleic acid detection reagent products as a result of increased demand worldwide. Additionally, a rapidly growing US outbreak is increasing the demand for testing. The nation's Monkeypox outbreak is being considered by the Biden administration as a potential public health emergency.

Over the course of the projection period, the Europe area is also anticipated to experience significant growth. The existence of nations with the greatest prevalence and dissemination of the virus is a reason for the expansion.

Competitive Insight

Some of the major players operating in the global market include Aegis Sciences Corp, BD, Chembio Diagnostics, Laboratory Corp, Mayo Clinic Laboratories, QIAGEN, Quest Diagnostics, Sonia Healthcare, Sonora Quest Laboratories, and Thermo Fisher Scientific.

Recent Developments

- In June 2022, CerTest Biotech & BD worked together to form a molecular diagnostic test for the monkeypox virus.

- In September 2022, Quest Diagnostics introduced new tests to detect Monkey Pox testing through FDA’s emergency use authorization.

Monkeypox Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 1,386.87 million |

|

Revenue forecast in 2030 |

USD 1,968.47 million |

|

CAGR |

4.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Technology, By End-use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Aegis Sciences Corp, BD, Chembio Diagnostics Inc., Laboratory Corp. of America Holdings, Mayo Clinic Laboratories, QIAGEN, Quest Diagnostics Inc, Sonia Healthcare Ltd, Sonora Quest Laboratories, Thermo Fisher Scientific. |