Mycoplasma Testing Market Share, Size, Trends & Industry Analysis Report

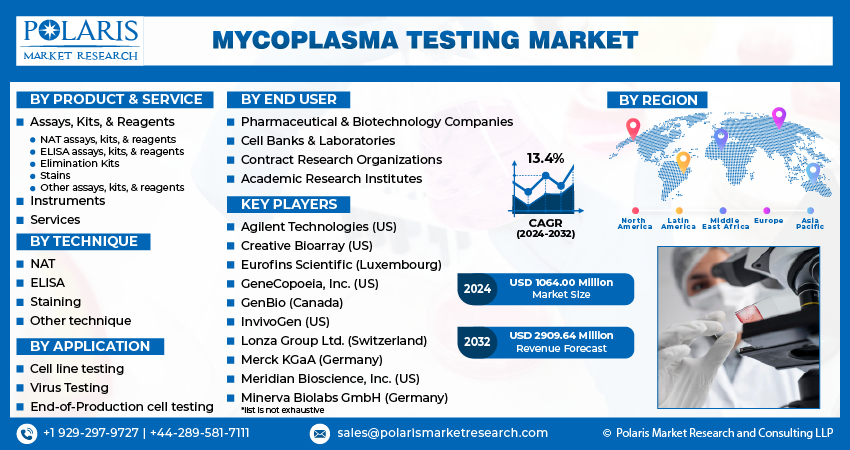

By Product & Service (Assays, Kits, & Reagents, Instruments, Services); By Technique; By Application; By End User; By Region; Segment Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 118

- Format: PDF

- Report ID: PM1785

- Base Year: 2024

- Historical Data: 2020-2023

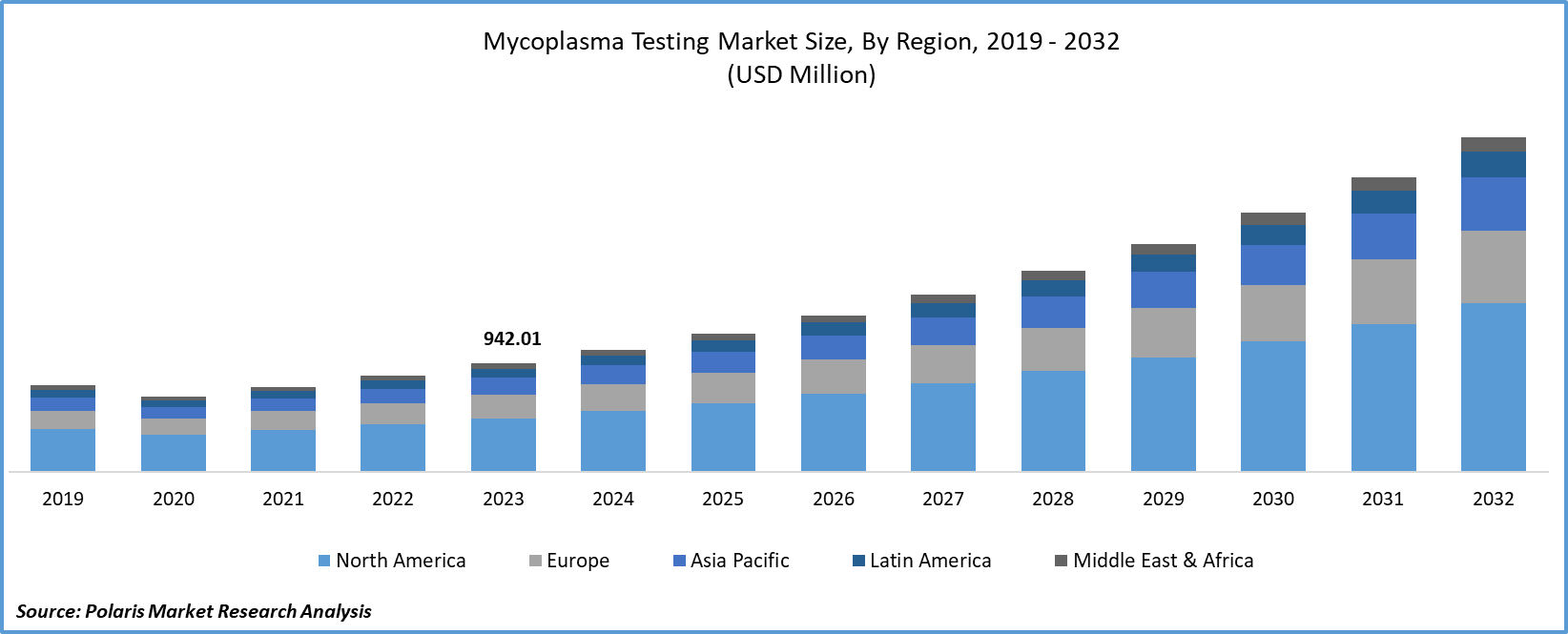

The global mycoplasma testing market was valued at USD 1.2 billion in 2024 and is expected to grow at a CAGR of 13.50% from 2025 to 2034. The market is growing due to heightened biopharmaceutical production and stringent contamination control standards.

Market Overview

Mycoplasma is a microorganism that is known for causing respiratory tract infections and sexually transmitted diseases among human beings. The increasing respiratory and sexually transmitted disease cases is unraveling the importance of utilizing mycoplasma testing in the pharmaceutical, and food manufacturing settings. The ongoing research activities focusing on designing compatible mycoplasma testing tools are optimally influencing the market growth.

For instance, in January 2023, a study published in the Journal of Clinical Microbiology conducted a comparative study of five commercial molecular assays aiming to develop mycoplasma testing for cellular therapy products.

To Understand More About this Research: Request a Free Sample Report

Moreover, as per a 2022 study published in Cytotechnology Journal, mycoplasma is expected to present in nearly 35% of cell cultures incorporated in research and therapeutics development. It is capable of changing cell physiology in cell cultures, and is unable to identify through a microscope. This is making the researchers undergo mycoplasma testing in their research procedures, driven by their potential to alter research findings.

Growth Drivers

Rising Research Studies Exploring Mycoplasma Detection

The growing knowledge about the effect of certain microorganisms in disrupting body functions is showcasing the importance of ensuring the contaminant-free laboratory environment at the time of therapeutics development. Moreover, the increasing studies working on creation of effective mycoplasma detection tools are anticipated to showcase significant growth opportunities in the coming years. For instance, a 2023 study published in MDPI focused on exploring the development and evaluation of qPCR assays for mycoplasma detection in cell cultures.

The Growing Incidence of Mycoplasma-Related Health Issues

Food and healthcare sectors showing emphasis on promoting consumer safety. This shift is significantly supporting the demand for mycoplasma testing, driven by growing prevalence of health problems driven by the intake of mycoplasma-contaminated medicine, therapies, and food products. According to the National Health Commission, in November 2023, China registered a significant rise in hospital admissions and outpatient consultations due to Mycoplasma pneumoniae. This trend is expected to drive new potential opportunities for mycoplasma testing in the forecast timeframe.

Restraining Factors

The Unwillingness to Adopt New Technological Solutions

The higher costs of deploying testing infrastructure, along with the need to adopt new technological innovations, are expected to restrain mycoplasma testing market growth. Academicians and researchers are anticipated to show reluctance to embrace the latest innovations, due to the familiarity and convenience of traditional methods, embarking on a significant obstacle to the expansion of the mycoplasma testing market.

Report Segmentation

The market is primarily segmented based on product & service, technique, application, end user, and region.

|

By Product & Service |

By Technique |

By Application |

By End User |

By Region |

|

|

|

|

|

By Products & Services Analysis

Assays, Kits, & Reagents Segment Poised to Witness the Highest Growth During the Forecast Period

The assays, kits, and reagents segment are expected to grow at a reasonable CAGR during the anticipated period. This is attributable to the rising new development of therapeutics, primarily cell and gene, contributing to the need for kits, reagents, and assays to test the presence of mycoplasma, as it can mislead the therapeutic results.

The instruments segment led the market with a substantial revenue share in 2023, largely attributable to the increasing demand for accurate, fast, and cost-effective testing solutions in the marketplace. The potential of instruments in efficiently determining the presence of harmful bacteria in medicines is gaining attention in the pharmaceutical space, as it plays a major role in promoting the safety and efficacy of cell-based therapies.

By Technique Analysis

Nat Segment Witnessed the Largest Market Share in 2024

The NAT (nucleic acid amplification) segment registered for the largest market share in 2023 and is expected to continue its market position throughout the study period. The multiple advantages of NAT, including robustness, sensitivity, and faster results, are contributing to the increased adoption of this technology in mycoplasma testing.

The ELISA (enzyme-linked immunosorbent assay) segment is expected to grow at the fastest rate over the next few years. This is due to the rapid increase in demand for cell banks. It is widely used in laboratory tests to identify antibodies in blood against mycoplasma pneumoniae.

By Application Analysis

Cell Line Testing Segment Held the Significant Market Revenue Share in 2024

The cell line testing segment held a significant market share in revenue in 2023, which was highly accelerated due to the continuous rise in the use of cell cultures. The growing research and development activities in the production and manufacturing of medicines necessitate the need to employ mycoplasma testing, driving substantial investments in cell line testing.

The end-of-production cell testing segment is expected to register significant growth over the study period. This is primarily driven by its ability to check for bacterial contamination in the production of medicines, thereby, creating effective and safe pharmaceutical solutions to the patients.

By End User Analysis

Pharmaceutical & Biotechnology Companies Segment Registered a Dominant Share in 2024

The Pharmaceutical & Biotechnology Companies segment witnessed a dominant share in 2023. This is highly attributable to the growing investments in the development of cell and gene therapies, for the multiple health problems. The growing focus on new therapeutics development is likely to fuel the demand for bacteria testing tools, including mycoplasma.The contract research organizations segment is expected to register significant growth in the next few years, driven by the rising establishment of contract research organizations. They are specialized in offering services in the development, production, and testing of biopharmaceutical products, which will significantly boost the demand for mycoplasma testing tools in the long run.

Regional Insights

North America Region Registered the Largest Share of the Global Market in 2024

The North America region held the dominant share in 2023. This is due to the existence of robust infrastructure with larger government agencies, particularly the United States Food and Drug Administration (FDA).

The Asia Pacific region is poised to be the fastest growing region with a higher CAGR during the forecast timeframe, owing to the presence of major players focusing on the production of reliable medicines and therapies. For instance, in May 2023, HiMedia Laboratories announced the new initiative to offer customized testing services for mycoplasma cell line detection, drug screening, cell line authentication, and bioproduction platforms. This trend is expected to create mycoplasma testing opportunities in the region.

Key Market Players & Competitive Insights

Rising Product Innovations Will Drive Advancements in the Marketplace

The mycoplasma testing market is a mixture of consolidation and fragmentation. It is anticipated to witness significant competition with the growing research activities on developing early detection mycoplasma tools. For instance, in February 2023, SwiftDx unveiled a mycoplasma detection kit with the capability to offer a faster and more convenient solution.

Some of the major players operating in the global market include:

- Agilent Technologies (US)

- American Type Culture Collection (US)

- Biological Industries Israel Beit Haemek Ltd. (Israel)

- Bionique Testing Laboratories, Inc. (US)

- Biotools B & M Labs, S.A. (Spain)

- Charles River Laboratories International, Inc. (US)

- Creative Bioarray (US)

- Eurofins Scientific (Luxembourg)

- GeneCopoeia, Inc. (US)

- GenBio (Canada)

- InvivoGen (US)

- Lonza Group Ltd. (Switzerland)

- Merck KGaA (Germany)

- Meridian Bioscience, Inc. (US)

- Minerva Biolabs GmbH (Germany)

Recent Developments in the Industry

- In April 2023, Agathos Biologics launched advanced analytical services featuring high-content imaging and digital PCR, including precise mycoplasma testing. Using QIAcuity instruments from QIAGEN, Agathos delivered unmatched accuracy in nucleic acid analysis, supporting regional and global life science researchers with cutting-edge technology.

- In May 2023, a study published in Science Direct focused on the development of mycoplasma testing that can detect 90% of the presence of mycoplasma with the PCR standard protocol.

Report Coverage

The mycoplasma testing market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product & service, technique, application, end user and their futuristic growth opportunities.

Mycoplasma Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 1.36 Billion |

|

Revenue forecast in 2034 |

USD 4.3 Billion |

|

CAGR |

13.50% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global mycoplasma testing market size is expected to reach USD 4.3 Billion by 2034

Key players in the market are Agilent Technologies, American Type Culture Collection, Biological Industries Israel Beit Haemek Ltd

North America contribute notably towards the global Mycoplasma Testing Market

Mycoplasma Testing Market exhibiting the CAGR of 13.50% during the forecast period.

The Mycoplasma Testing Market report covering key segments are product & service, technique, application, end user and region.