North America Facades Market Share, Size, Trends, Industry Analysis Report

By Product Type (Ventilated, Non-Ventilated, Others); By Material; By Application Type; By Country; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4253

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

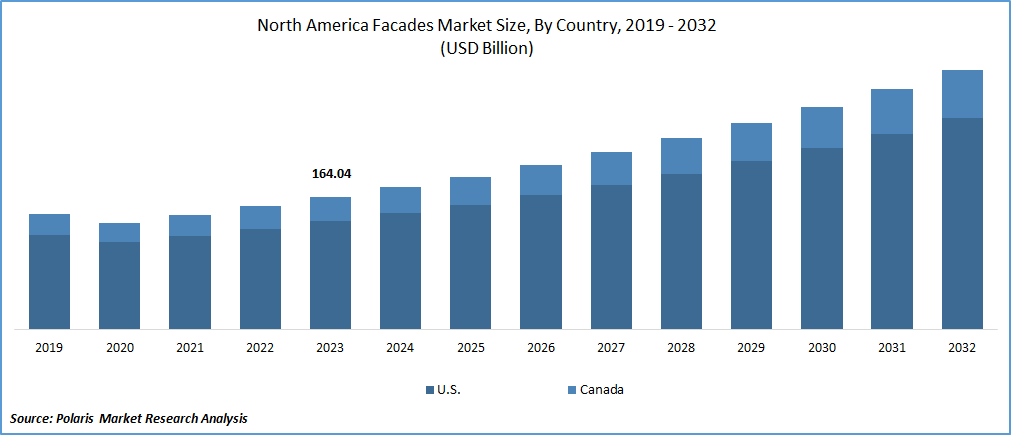

The North American facades market was valued at USD 164.04 Billion in 2023 and is expected to grow at a CAGR of 7.8% during the forecast period.

The adoption of facades in the North American region is growing due to the increasing demand for energy-efficient buildings, as well as a desire for pleasing architectural designs. The market in North America has seen lucrative growth in recent years, focusing on innovative materials and technologies that offer improved performance and efficiency.

The market is experiencing increased popularity due to the high-performance glazing systems. These systems provide better insulation, reduce energy consumption, and offer superior visual clarity compared to traditional glass products. Also, there is a growing preference for unitized curtain wall systems, which are designed to provide faster installation, reduced labor costs, and improved weather tightness. Another notable factor in the North American facades market is the rising demand for green building practices. Architects and builders are increasingly opting for eco-friendly materials and design solutions that minimize environmental impact while providing cost savings and improving occupant comfort. This has led to an increased adoption of natural ventilation strategies, passive solar design, and vegetated roofs and walls.

To Understand More About this Research: Request a Free Sample Report

Several factors are hindering the growth of the market since the high cost of installing advanced facade systems, which can be a significant barrier for many building owners and developers who are working with limited budgets. Also, the need for more understanding among architects, engineers, and builders about the benefits of modern facade systems is hampering the adoption of these systems in the region. The availability of cheaper alternatives, such as traditional brick-and-mortar facades, is another factor that is limiting the demand for advanced facades in North America.

Growth Drivers

New innovative types and designs fuel the sales of the facades market

The North American market is witnessing significant growth due to increasing demand for attractive building practices. One innovative type of façade that has gained popularity in recent years is the "living wall" or "green wall." This type of facade features a vertical garden or greenery integrated into the exterior walls of a building, providing numerous benefits such as reducing energy consumption, improving air quality, and enhancing aesthetic appeal.

- For instance, the Amazon Spheres, located in Seattle, Washington, features a unique living wall system that covers over 65,000 square feet of exterior surface area. The spherical structure is covered in over 40,000 plants, creating a natural oasis in the heart of the city.

This vertical garden not only helps in insulation and minimizes energy expenses, but it also serves as a shelter for nearby fauna, which underlines Amazon's dedication to environmentalism. Such inventive designs not only promote a more sustainable future but also produce a pleasing architectural declaration, establishing a novel benchmark for modern towers in North America.

Report Segmentation

The market is primarily segmented based on product type, material, application type, and country.

|

By Product Type |

By Material |

By Application Type |

By Country |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Analysis

The ventilated facades dominated the North American market in 2023.

The ventilated facades market in North America experienced significant growth in 2023, with a dominant share of the overall facades market. This was largely driven by increasing demand for eye-catching and stunning building solutions, as well as growing awareness among architects, builders, and homeowners about the benefits of ventilated facades. These benefits include improved indoor air quality, reduced energy consumption, and enhanced thermal performance.

Also, ventilated facades offer aesthetic appeal and design flexibility, making them an attractive option for both new construction and retrofitting projects. As a result, leading manufacturers of ventilated facades expanded their product portfolios and distribution networks to meet the rising demand, further solidifying their position in the North American market.

By Application Type Analysis

The commercial use of facades led the North American market in 2023

The commercial sector was the leading application type segment in the North American market in 2023, accounting for a significant share of the total revenue. This dominance is attributed to the growing demand for fetching and desirable buildings, as well as the increasing focus on creating visually appealing and functional spaces. Facades played an important role in achieving these goals by providing insulation, natural lighting, ventilation, and weather protection while also contributing to the building's visual appearance. Also, advancements in technology have enabled the development of high-performance facades that offer improved thermal efficiency, air tightness, and solar control, making them an attractive option for commercial properties.

Country Insights

The U.S. dominated the North American market in terms of revenue share in 2023

The United States dominated the North American facade market in terms of revenue share in 2023 owing to the country's large construction industry, increasing demand for unique building solutions, and the presence of prominent architectural companies that promote innovative facade designs. The U.S. has a well-established supply chain network for facade materials and components, ensuring easy accessibility and availability of high-quality products.

Furthermore, government initiatives and policies like the Green Building Initiative (GBI) supporting green building practices and energy efficiency have led to an increased adoption of advanced facade systems in the country. Overall, these factors have contributed to the U.S. emerging as a leading player in the North American facades market.

Key Market Players & Competitive Insights

In North America, manufacturers are continuously innovating and introducing new products and technologies to meet the increasing demand for innovative building solutions. Manufacturers are investing heavily in research and development to create advanced materials and systems that can provide better thermal performance. Also, many manufacturers are adopting digital technologies such as Building Information Modeling (BIM) and computer-aided design (CAD) to enhance their product offerings and improve collaboration with architects, engineers, and contractors.

Some of the major players operating in the North American market include:

- Enclos Corp.

- Axis Facades

- GAMCO CORPORATION

- TAKTL

- SADEV USA

- Valmont Industries, Inc

- BAMCO Inc.

- Thornton Tomasetti

- APA Façade Systems

- Envel Facade, Inc.

Recent Developments

- In August 2023, The Wells Companies, which provides prefabricated building solutions, announced the promotion of Dan Stenzel to Vice President of Facades. In his new role, he is responsible for collaborating with industry partners to implement new facade designs that are revolutionizing the way building envelopes are designed and constructed.

- In July 2021, Lerch Bates Inc., a multidisciplinary technical consultancy company, announced the acquisition of AXIS Facades which is a well-known expert in facades, and curtain wall designs based in San Diego, California.

North America Facades Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 176.26 Billion |

|

Revenue Forecast in 2032 |

USD 321.68 Billion |

|

CAGR |

7.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product Type, By Material, By Application Type, By Country |

|

Country scope |

U.S., Canada |

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

FAQ's

The North American facades market size is expected to reach USD 321.68 Billion by 2032

Enclos Corp., Axis Facades, GAMCO CORPORATION, TAKTL, SADEV USA, Valmont Industries are the top market players in the market.

U.S region contribute notably towards the global North America Facades Market.

The North American facades market is expected to grow at a CAGR of 7.8% during the forecast period.

Type, material, application type, and country are the key segments in the North America Facades Market.