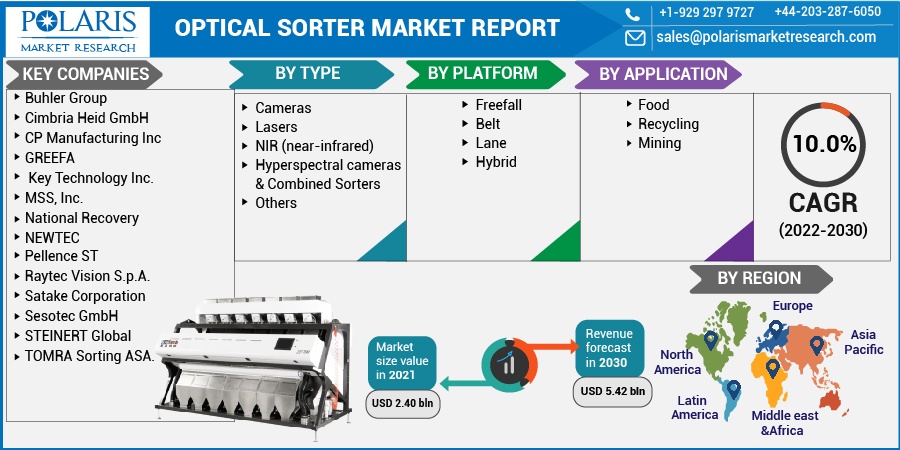

Optical Sorter Market, By Type (Cameras, Lasers, NIR, Hyperspectral cameras & Combined Sorters, Others); By Platform (Freefall, Belt, Lane, Hybrid); By Application (Food, Recycling, Mining) By Region; Segment Forecast, 2022 - 2030

- Published Date:Jul-2022

- Pages: 119

- Format: PDF

- Report ID: PM2494

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

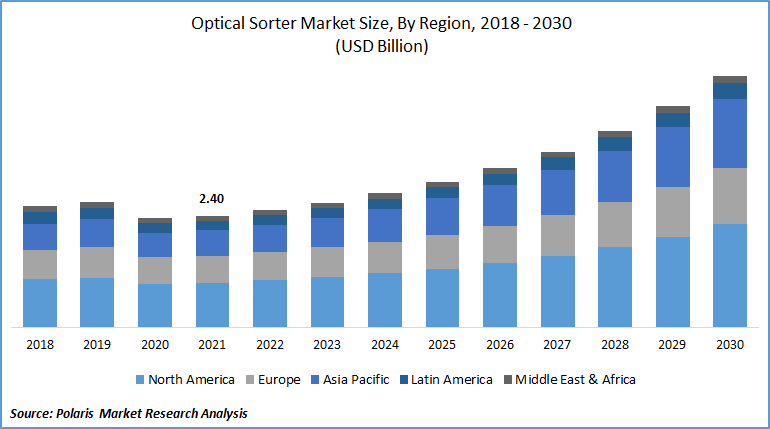

The global optical sorter market was valued at USD 2.40 billion in 2021 and is expected to grow at a CAGR of 10.0% during the forecast period. A growing focus on automation is driving the market for optical sorters to boost productivity in various industries. The rising adoption in the food sector for food processing operations, reduced process and delivery time, increases in the wages of manual workers in multiple nations, and stringent government rules surrounding food safety all contribute to the market's growth.

Know more about this report: Request for sample pages

Optical sorters separate products that do not match the standards defined in the database based on color, shape, size, and chemical makeup. Alcoholic drinks, food fortification, advertising and claims, packaging, pesticide residues, antibiotic tolerance limits, and pharmacologically active chemicals are only a few of the significant restrictions.

Another critical aspect driving industry demand is the increased desire to reduce delivery and processing times. Optical sorting improves product quality, maximizes throughput, and increases yields while lowering labor costs compared to manual sorting, which is subjective and unreliable. However, the worldwide optical sorter market is constrained by expensive capital investment and continually rising operations and maintenance expenses.

Industry Dynamics

Growth Drivers

For monitoring system performance, sophisticated statistics and data analysis techniques are readily available. For example, TOMRA (Norway) offers a Sort to Spec feature in its machines that allows concerned sorter to categorize food items like French fries for color faults and size. The intelligent system uses algorithms and measurements to examine the incoming product stream in real-time, making piece-by-piece decisions and determining what is approved and what is rejected. Furthermore, practical usage of these modern systems can increase yield and reduce waste. As a result, technological advancements are expected to drive demand for optical in several end-user applications.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on type, platform, application, and region.

|

By Type |

By Platform |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Insight by Application

Food segment is anticipated to be the most significant revenue grosser. Optical sorters aid the food business in reducing the danger of contamination from any foreign material, hence improving food safety on the manufacturing line among food processors and manufacturers. The increased desire to increase production capacity by reducing delivery and processing time drives demand for optical sorters in the food market. Sensor-based optical can continuously detect and eliminate foreign material, undesirable rot, greening faults, blemishes, and damage. These technologies contribute to an increased usage of optical sorters in the food market by helping to improve food quality and safety.

Insight by Type

Based on the type market segment, the hyperspectral cameras and combined sorter segment is expected to hold the most significant revenue. This technology improves the removal of foreign material and EVM extraneous vegetable matter, often with meager false reject rates. Detection of the rock minerals and detecting foreign substances in food processing are the two most employed hyperspectral imaging techniques.

Geographic Overview

In terms of geography, North America had the largest market share. Optical sorting solutions developed by North American companies such as Key Technology, Machinex, National Recovery Technologies, and CP Global drive the market. Companies in the region are focusing on adopting new-age technologies in optical sorters, hyperspectral cameras, and metal detectors.

For instance, in June 2021, Satake announced the launch of its latest and largest optical sorter in size and capacity: "NIRAMI series." NIRAMI is built with an open frame that enables easy cleaning and maintenance while preventing cross-contamination. Its huge LED operating indication helps operators quickly assess the machine's status. Further, the food market and the presence of severe food safety laws are primarily responsible for North America's massive share of the optical sorter market.

Competitive Insight

Some of the major market players operating in the global optical sorter market include Buhler Group, Cimbria Heid GmbH, CP Manufacturing Inc, GREEFA, Hefei Meyer Optoelectronic Technology Inc., Key Technology Inc. (Duravant Company), MSS, Inc. (CP Manufacturing, Inc.), National Recovery, NEWTEC, Pellence ST, Raytec Vision S.p.A., Satake Corporation, Sesotec GmbH, STEINERT Global, and TOMRA Sorting ASA.

Optical Sorter Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 2.40 billion |

|

Revenue forecast in 2030 |

USD 5.42 billion |

|

CAGR |

10.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Platform, By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Buhler Group, Cimbria Heid GmbH, CP Manufacturing Inc, GREEFA, Hefei Meyer Optoelectronic Technology Inc., Key Technology Inc. (Duravant Company), MSS, Inc. (CP Manufacturing, Inc.), National Recovery, NEWTEC, Pellence ST, Raytec Vision S.p.A., Satake Corporation, Sesotec GmbH, STEINERT Global, and TOMRA Sorting ASA. |