Oral Solid Dosage Contract Manufacturing Market Share, Size, Trends, Industry Analysis Report

By Product (Tablets, Capsules, Granules Powder, Others); By Mechanism; By End-User; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 117

- Format: PDF

- Report ID: PM4612

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

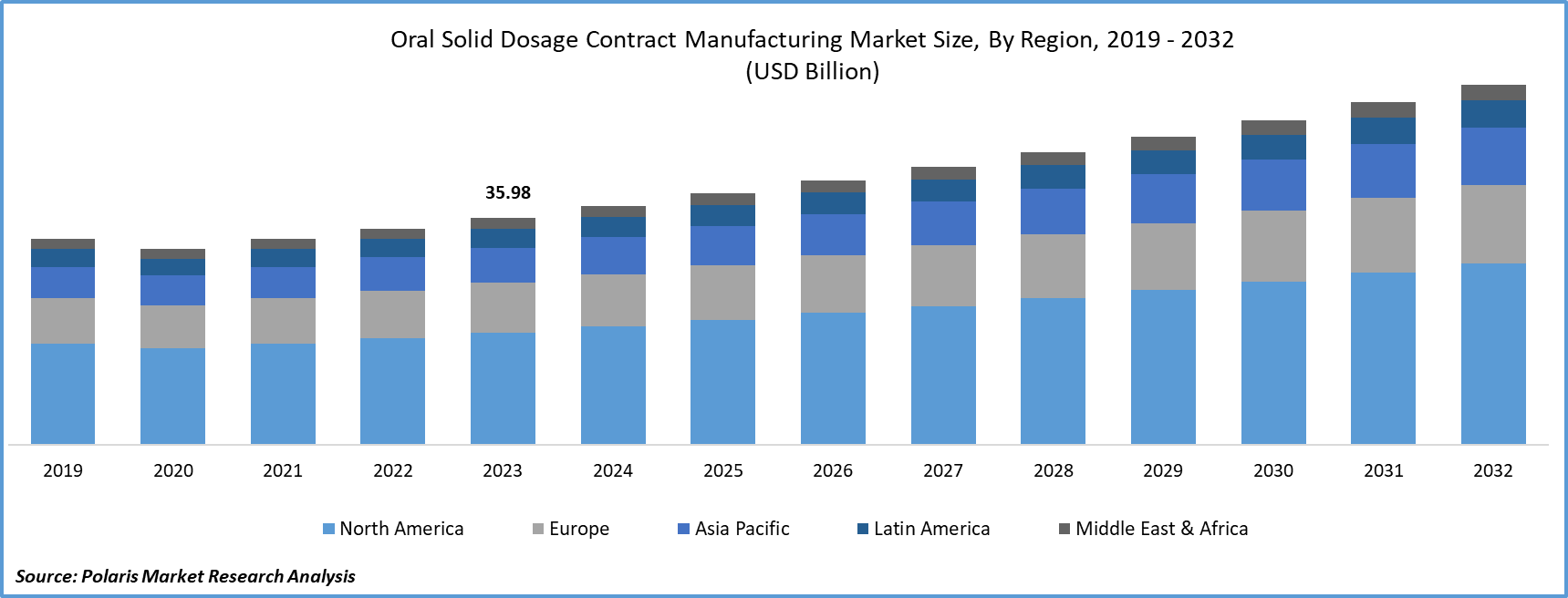

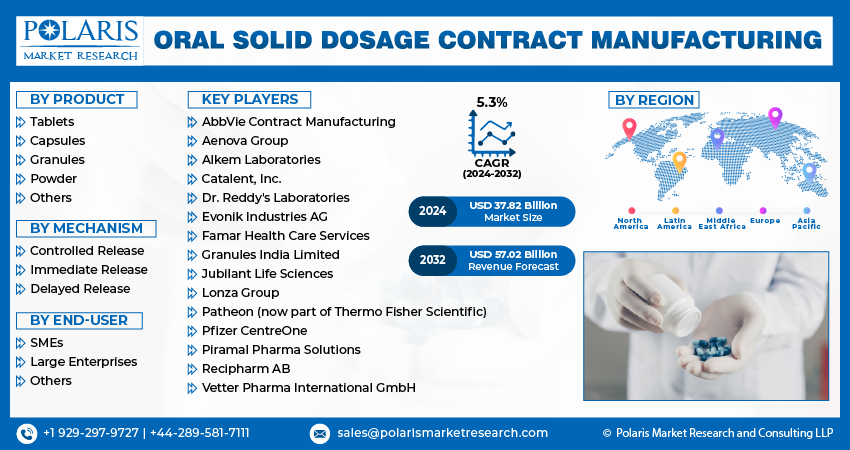

- Oral Solid Dosage Contract Manufacturing Market size was valued at USD 35.98 billion in 2023.

- The market is anticipated to grow from USD 37.82 billion in 2024 to USD 57.02 billion by 2032, exhibiting the CAGR of 5.3% during the forecast period.

Market Introduction

Active pharmaceutical ingredients (APIs) have become more complex over time, leading to a number of creative formulations that help carry drugs to their target sites of action efficiently. Even with these developments, there is still an unmatched need for oral solid dose (OSD) forms like tablets and capsules. It has been noted that almost two-thirds of prescription medications worldwide are given as oral solids. In addition to being more affordable and having more stability than their bigger molecule equivalents, these tiny molecules that are taken orally put the needs of the patient first and are essential in helping to overcome problems with drug adherence.

As a result of the increased emphasis on regulatory compliance, there are opportunities in the Oral Solid Dosage (OSD) Contract Manufacturing market. Companies are searching for contract manufacturers with a track record of compliance as the pharmaceutical industry struggles with complex regulatory environments. OSD contract manufacturers now have the chance to set themselves apart by making investments in quality management systems, putting in place reliable documentation procedures, and abiding by global regulatory norms.

To Understand More About this Research: Request a Free Sample Report

- For instance, in May 2023, Lighthouse Instruments, LLC, a global frontrunner in laser test and measurement systems for monitoring pharmaceutical processes, officially unveiled its interactive laboratory. The interactive laboratory offers a distinctive opportunity to explore all the solutions provided by the company to ensure the safety of products entering the market.

The oral solid dosage contract manufacturing market growth can be credited to advancements in drug delivery technology, encompassing targeted drug delivery and sustained-release dosage forms. Additionally, investments by contract development manufacturing organizations to broaden oral solid dosage development and the rising demand for innovative therapies contribute to this trend.

Industry Growth Drivers

Advancements in drug delivery technology is projected to spur the product demand.

The continuous evolution of drug delivery technology, particularly in the realm of oral solid dosage forms, serves as a significant driver. Innovations such as targeted drug delivery and sustained-release dosage forms enhance the efficacy of pharmaceutical products, driving pharmaceutical companies to seek specialized oral solid dosage contract manufacturing services.

Increased investments by Contract Development Manufacturing Organizations (CDMOs) is expected to drive oral solid dosage contract manufacturing market size.

Contract development manufacturing organizations play a pivotal role in expanding the OSD market. Increased investments by CDMOs to enhance their capabilities and infrastructure for oral solid dosage development create a favorable environment for market growth. Pharmaceutical companies often turn to these specialized providers to streamline their manufacturing processes and benefit from their expertise.

Industry Challenges

Stringent regulatory compliance is likely to impede the market oral solid dosage contract manufacturing growth opportunities.

Stringent regulatory compliance stands as a prominent factor hindering the growth of the oral solid dosage contract manufacturing market study. The oral solid dosage contract manufacturing market opportunities encounter obstacles linked to rigorous regulatory demands. Navigating through diverse and intricate regulatory frameworks proves to be time-consuming and demands substantial resources, serving as a constraint on market growth. Manufacturers must make substantial investments to ensure adherence to international standards, influencing both time-to-market and operational efficiency.

Report Segmentation

The market is primarily segmented based on product, mechanism, end-user, and region.

|

By Product |

By Mechanism |

By End-User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Capsules segment is expected to witness highest growth during forecast period

The capsules segment is projected to grow at a CAGR during the projected period in the oral solid dosage contract manufacturing market growth. The increasing benefits associated with capsules, including ease of swallowing, rapid disintegration, and absorption, are anticipated to propel the market forward. These capsules exhibit faster disintegration, facilitating the swift release and absorption of medication. Additionally, the market is expected to experience growth driven by technological advancements and the widespread adoption of such innovations to enhance capsule-filling capabilities.

By Mechanism Analysis

Controlled release segment is expected to dominate the oral solid dosage contract manufacturing market during forecast period

In 2023, the oral solid dosage contract manufacturing market share was predominantly influenced by controlled release, commanding a significant market share. This drug delivery mechanism sustains a steady drug concentration in tissues and the bloodstream for an extended period. Recent progress in oral controlled-release (CR) delivery systems, encompassing innovations like intestinal patches, polymer nanosystems, dome tablets, dual drug tablets, and bioinspired delivery methods such as exosomes, has brought about a transformative shift in the field.

By End-User Analysis

Large enterprises segment is expected to dominate the market during forecast period

Large enterprises emerged as the dominant players in the end-user segment. Prominent pharmaceutical corporations opt to subcontract the formulation and manufacturing of oral solid dose medications, citing quality and reliability as their foremost considerations. However, beyond these priorities, their preferences diverge. Established pharmaceutical entities prioritize productivity as the second most crucial factor, succeeded by considerations for affordability, innovation, and adherence to regulatory standards. In contrast, Contract Manufacturing Organizations (CMOs) that specialize in oral solid dosage offer numerous advantages to large pharmaceutical companies, contributing to a growing trend of adoption.

Regional Insights

Asia-Pacific region dominated the global oral solid dosage contract manufacturing market study in 2023

Asia-Pacific dominated the global market size in 2023 and is expected to continue to do so. The surge in growth can be attributed to various factors, including enhanced social insurance schemes and continually improving economic conditions in the region. These improvements enable patients to bear pharmaceutical costs out-of-pocket. Notably, countries such as India, China, and Singapore have emerged as significant players in the pharmaceutical industry due to their expanding capabilities in the oral solid dosage contract manufacturing process. Over the past decade, there has been a notable trend of outsourcing the manufacturing of pharmaceutical products to Asian countries, particularly India and China.

In the meanwhile, North America is expected to be the most lucrative region in the market growth. The need for oral solid dosage contract manufacturing is being driven by pharmaceutical companies' growing investments in the research and development of new medications. One important element driving the market's growth is the expansion of the pharmaceutical business in the U.S. and Canada. Further driving market expansion is anticipated to come from the current clinical trials as well as the active involvement of major market participants.

Key Market Players & Competitive Insights

The oral solid dosage contract manufacturing market players is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- AbbVie Contract Manufacturing

- Aenova Group

- Alkem Laboratories

- Catalent, Inc.

- Dr. Reddy's Laboratories

- Evonik Industries AG

- Famar Health Care Services

- Granules India Limited

- Jubilant Life Sciences

- Lonza Group

- Patheon (now part of Thermo Fisher Scientific)

- Pfizer CentreOne

- Piramal Pharma Solutions

- Recipharm AB

- Vetter Pharma International GmbH

Recent Developments

- In May 2023, Lonza successfully concluded the establishment of its clinical and commercial drug product manufacturing line in Visp. This expansion was poised to enhance the company's capabilities in providing drug product services. The manufacturing unit was an integral part of Lonza's Ibex Biopark, encompassing mammalian manufacturing, bioconjugation, and microbial development.

- In January 2023, the Contract Development and Manufacturing Organization (CDMO) declared the initiation of its inaugural continuous manufacturing line for oral solids, situated in Wuxi City, China.

Report Coverage

The oral solid dosage contract manufacturing market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, mechanism, end-user, and their futuristic growth opportunities.

Oral Solid Dosage Contract Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 37.82 billion |

|

Revenue forecast in 2032 |

USD 57.02 billion |

|

CAGR |

5.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in Oral Solid Dosage Contract Manufacturing Market are Alkem Laboratories, Catalent, Inc., Dr. Reddy's Laboratories, Evonik Industries AG

Oral Solid Dosage Contract Manufacturing Market exhibiting the CAGR of 5.3% during the forecast period.

The Oral Solid Dosage Contract Manufacturing Market report covering key segments are product, mechanism, end-user, and region.

key driving factors in Oral Solid Dosage Contract Manufacturing Market are Advancements in drug delivery technology is projected to spur the product demand

The global oral solid dosage contract manufacturing market size is expected to reach USD 57.02 billion by 2032