Palm Oil Market Share, Size, Trends, Industry Analysis Report, By Nature (Organic, Conventional); By Product (CPO, Palm Kernel Oil, RBD Palm Oil, Fractionated Palm Oil); By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 113

- Format: PDF

- Report ID: PM1118

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

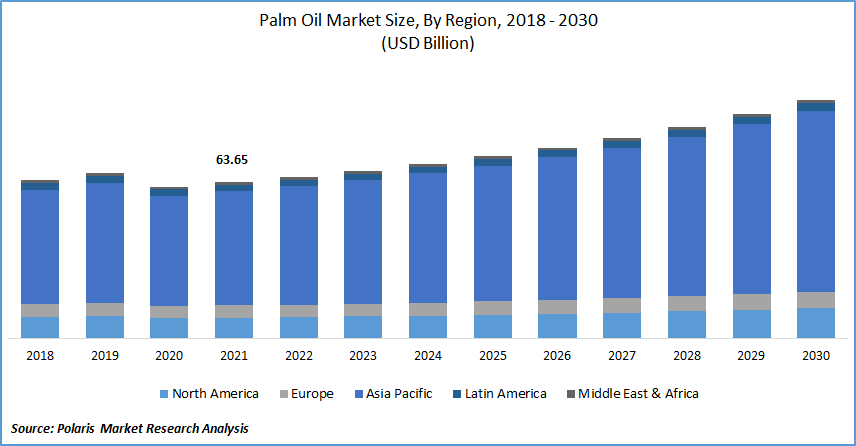

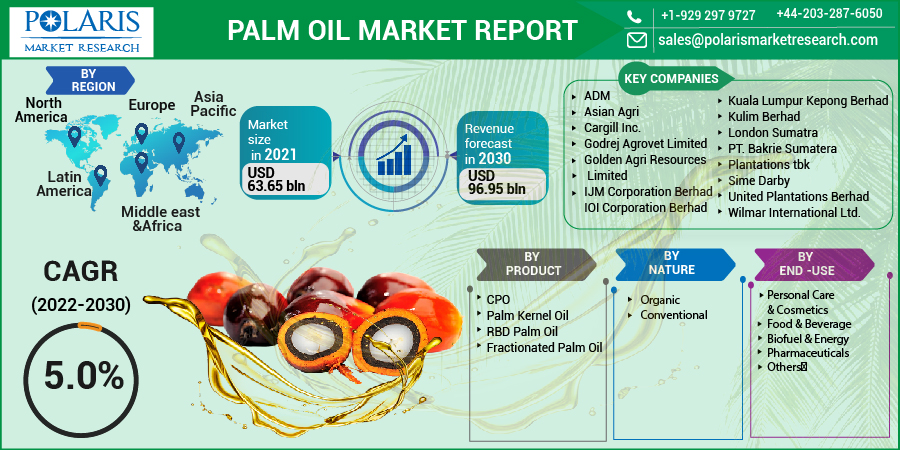

The global palm oil market was valued at USD 63.65 billion in 2021 and is expected to grow at a CAGR of 5.0% during the forecast period. Increasing demand from end-use industries such as personal care & cosmetics, food & beverage, biofuel & energy, pharmaceuticals, and others is expected to propel market growth over the forecast period.

Know more about this report: Request for sample pages

Palm oil is an essential component of everyday products such as fats, shortening, sweets, confectionery, and prepackaged fast meals. The key benefit of the product is its inexpensive and usefulness characteristics compared to its counterparts. It's also used to make commodities like cosmetics, detergents and soaps, lubricants, and printing ink. The product may also be used to make biodiesel, which is becoming increasingly essential due to the significance of conventional energy in greenhouse gas (GHG) pollution.

Industry Dynamics

Growth Drivers

The rising demand for this precious commodity as a nutrition and fuel supply has been reflected in significant growth in production. Furthermore, eliminating GMOs, gluten, and milk in edible fats, including palm oil, is piquing customer attention worldwide. Furthermore, with increased public understanding of these health advantages, the product has an extended storage life as well as being less expensive than alternative vegetable oils, which is expected to drive the market expansion.

The product has grown in popularity as an edible and economical product with uses in a variety of home and commercial activities. Despite the fact that numerous companies are active in the sector's r&d., the palm oil market is predicted to flourish. As the food industry grows, consumption of palm-related fat, as well as the business, is expected to rise over the projected period.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on product, nature, end-use, and region.

|

By Product |

By Nature |

By End-Use |

By Region |

· |

|

|

|

Know more about this report: Request for sample pages

Insight by Nature

The conventional segment is expected to hold a significant share in the global palm oil market. Traditional palm oil is grown using fertilizers and pesticides, which can cause soil damage and the buildup of pesticide impurities. Increasing cultivation with the help of chemical pesticides by small and medium market players is expected to contribute to the segment growth.

Insight by End-Use

The food & beverage segment is expected to dominate the market during the forecast period due to the increasing application of these product derivatives as raw material in food & beverages. Moreover, rising population growth is also expected to increase food consumption worldwide, which in turn is expected to propel product demand over the forecast period.

The biofuel and energy segment is expected to grow at a considerable pace throughout the projected period. In the mobility and power sectors, palm oil increasingly overtakes petroleum-based goods as a viable substitute. It is also used as a natural alternative in power plants for energy generation. Further, increasing desire for renewable and environmentally friendly resources is also expected to increase the demand for segment growth, boosting market demand.

Geographic Overview

Asia Pacific dominated the global market in 2021 and is anticipated to maintain its dominance throughout the projected period. The region's industrial development is linked to rising discretionary income and substituting healthy and nutritious cuisine for traditional meals. Furthermore, the presence of important industry participants in the area propels the market growth.

The market demand in North America is expected to grow at a considerable pace throughout the forecast period due to shifting eating habits and increasing demand for the food & beverage sector. Furthermore, increasing penetration of biodiesel is also expected to contribute to the growing demand.

Competitive Insight

Major market players operating in the global market include ADM, Asian Agri, Cargill Inc., Godrej Agrovet Limited, Golden Agri Resources Limited, IJM Corporation Berhad, IOI Corporation Berhad, Kuala Lumpur Kepong Berhad, Kulim Berhad, London Sumatra, PT. Bakrie Sumatera Plantations Tbk, Sime Darby, United Plantations Berhad, Univanich Palm Oil Public Company Ltd., and Wilmar International Ltd.

These players are adopting marketing strategies such as long-term agreements, product launches, up-gradation, partnerships, and agreements along with mergers & acquisitions in order to increase their market presence and boost their revenue. For instance, in June 2021, Cargill is constructing a new $200 million coconut oil refinery in Lampung, Indonesia, which will speed the company's efforts to establish a sustainable palm supply chain and offer clients verified deforestation-free goods.

Palm Oil Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 63.65 Billion |

|

Revenue forecast in 2030 |

USD 96.95 Billion |

|

CAGR |

5.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Nature, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ADM, Asian Agri, Cargill Inc., Godrej Agrovet Limited, Golden Agri Resources Limited, IJM Corporation Berhad, IOI Corporation Berhad, Kuala Lumpur Kepong Berhad, Kulim Berhad, London Sumatra, PT. Bakrie Sumatera Plantations tbk, Sime Darby, United Plantations Berhad, and Wilmar International Ltd. |