Polyglycerates Market Share, Size, Trends, Industry Analysis Report

By Form (Solid, Liquid); By Product Type; By Application; By End User; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4107

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

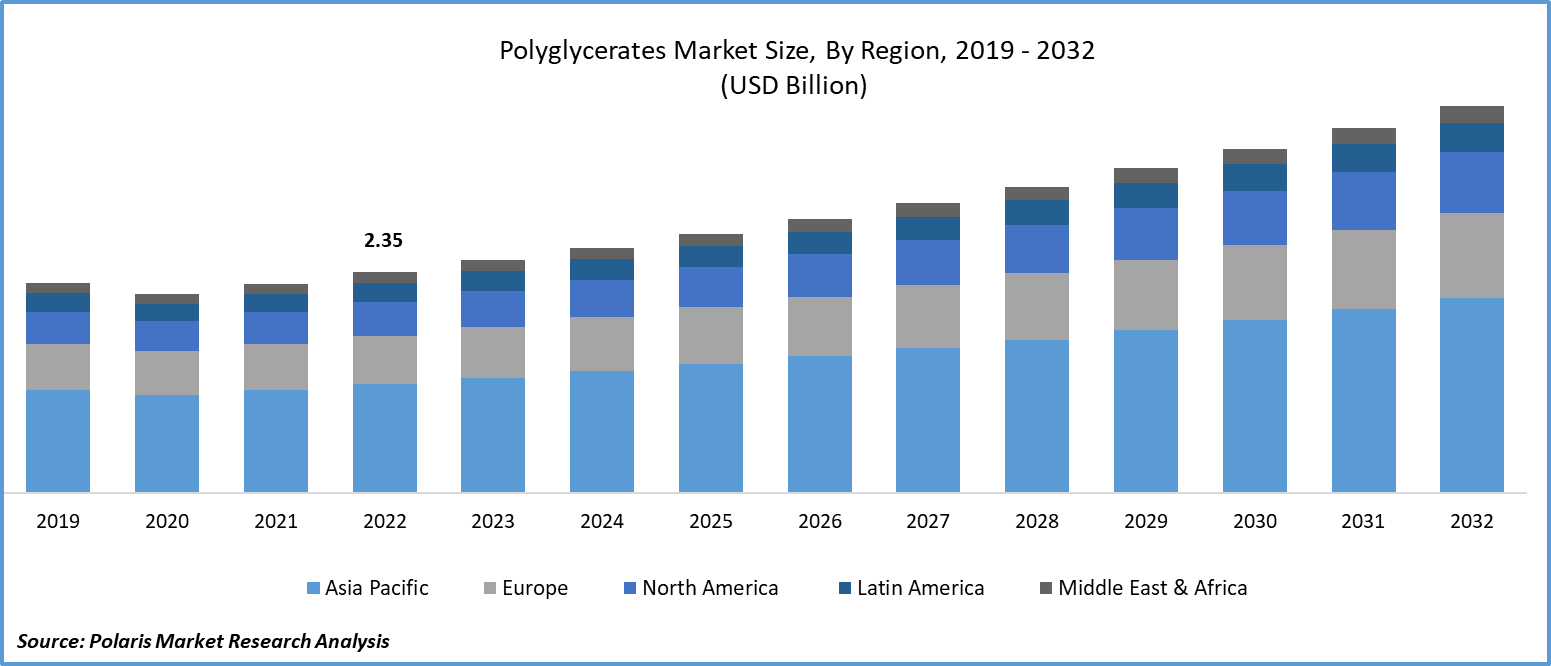

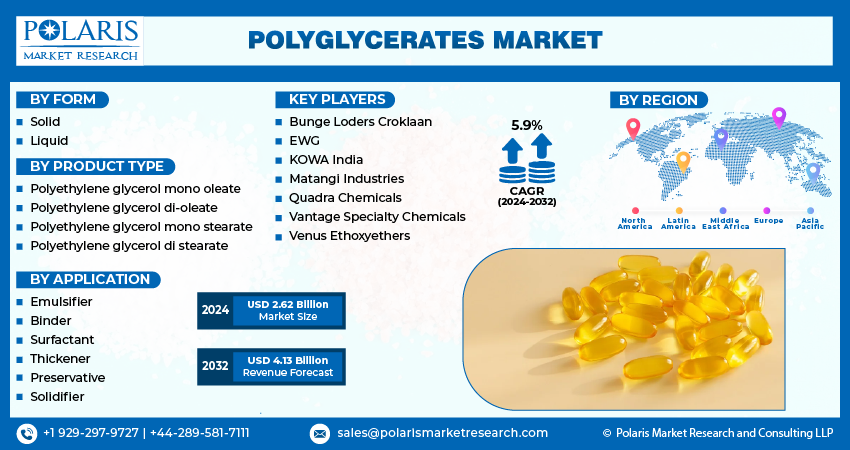

The global polyglycerates market was valued at USD 2.48 billion in 2023 and is expected to grow at a CAGR of 5.9% during the forecast period.

Polyglycerates are known to be used as food additives due to their effective emulsifying properties. This is one of the components of glycerol and is used in the food and pharmaceutical industries. Polyglycerates are made up of esterifying glycerol through the combination of fatty acids and glycerol itself. This acts as an emulsion stabilizer as it is capable of ensuring a mixture of oil-based ingredients blends properly. Furthermore, its moisturizing and conditioning properties on skin and hair are driving its use as an alternative to lanolin, which is an animal-derived product. Growing research activities on emulsion technology are widening the scope of polyglycerates and may reveal new growth opportunities in the coming years.

It is a polyglycerate acquired from sunflower oil by ensuing the green chemistry concepts. Oil usually has a chemical framework accommodating one glycerol to which three fatty acids are connected. But this is a reshaped variety of oil; the fatty acids connected to glycerol have been transformed or repositioned. This solution of poly glycerate behaves as a sizeable relief for animal lanolin because of its water-irrevocable, skin-plumping, and palliative trait. It is utilized in personal care commodities for its alloy endowing, emollient, and governing venture.

Polyglycerates have several advantages, such as encouraging skin and scalp hydration. Its fatty acid material plays an important part in keeping the skin and scalp hydrated. It also behaves as an emulsion counterbalance. The polyglycerates market demand is on the rise as its emulsion chartering trait is advantageous in offering steadiness to the commodity formula. It has aging attributes. It offers anti-oxidant safeguarding, keeps moisture, and renders the skin plumper, lessening wrinkles and fine lines. It prohibits the early aging of hair.

To Understand More About this Research: Request a Free Sample Report

- For instance, in 2022, a study published in IOPScience focused on reviewing the literature on nono emulsion technology in food, cosmetics, medicine, agriculture, and more with the intention of improving further research activities in this field.

Moreover, the growing demand for cleanly labelled products in the marketplace is driving new growth potential for the polyglycerates market as they are derived from natural resources, making them a superior option for food and cosmetic product formulations, primarily for the vegan population.

However, the prevalence of lower awareness or understanding about polyglycerates among the various industries is hampering the growth of the global market. The presence of cost-effective substitutes for polyglycerates is, in a way, restraining the demand for the market.

Growth Drivers

- The rising expansion of the food processing industry is stimulating the need for efficient emulsifiers

The growing food processing industry is creating new growth opportunities for the polyglycerates market in the coming years, attributable to the rising use of emulsifying agents, primarily homogeneous mixtures of oil and water, in a wide range of food products. It assists organisations in improving the shelf life, appearance, and texture of food formulations.

Developing countries like India are witnessing a rapid surge in the expansion of the food processing industry, driven by government initiatives to promote food production as a part of schemes like Atma Nirbhar Bharat and Vocal for Local, as well as growing foreign direct investment in the country. According to the article published in the Times of India, the food processing sector in India is expected to be US$322 billion, and it is projected to witness US$543 billion by 2025 with a CAGR of 14.6%. The rising expansion may further necessitate the need for various food ingredients, including emulsifiers, which will enhance the growth and demand for the product in the next few years.

Report Segmentation

The market is primarily segmented based on form, product type, application, end user and region.

|

By Form |

By Product Type |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Form Analysis

- Liquid segment is expected to witness the highest growth during the forecast period

The liquid segment is projected to grow at a CAGR during the projected period, mainly driven by its ease of incorporation in various disciplines, including pharmaceuticals, cosmetics, and food formulations. The improved dispersion of polyglycerates in liquid form, primarily in salads, dressings, and creams, is enhancing the demand for the global market in the coming years. Emulsification is becoming the primary concern in hair and beauty care industry product innovations due to its ability to promote texture and appearance of products, which is expanding the growth of the global market.

The solid segment led the industry market with a substantial revenue share in 2022, largely attributable to its applications in pharmaceutical formulations. This form is highly incorporated in pharmaceuticals as it is effective in promoting shelf life, primarily for the products for which moisture control is important. Furthermore, these forms are preferred in extreme weather conditions where liquid products may freeze during the transportation and storage of polyglycerates in liquid form.

By Product Type Analysis

- Polyethylene glycerol di-oleate segment accounted for the largest market share in 2022

The polyethylene glycerol di-oleate segment accounted for the largest market share. This is known to be one of the most effective emulsifiers, making it a suitable option for food and pharmaceutical use. These are effectively incorporated as dispersing agents, lotions, bath oils, and creams. Furthermore, in cosmetics, it is utilised as a surfactant, humectant, emulsifier, and skin conditioner. As industrialists understand the benefits associated with polyethylene glycerol di-oleate, there will be a huge demand for the global market.

The polyethylene glycerol distearate segment is expected to grow at the fastest rate over the next few years on account of the expanding cosmetics industry. The rising disposable income among the population is witnessing a huge demand for luxury products, primarily cosmetics, which may provide demand for emulsifier agents like polyethylene glycerol distearate in the next few years.

By Application Analysis

- Emulsifier segment held the significant market revenue share in 2022

The emulsifier segment held a significant market share in revenue in 2022, which is highly accelerated due to its effectiveness in promoting stable emulsions, driving their use in oil- and water-based ingredients in product innovations including medications, salads, and more. Furthermore, the increasing consumer preferences for the quality and texture of the products are stimulating the growth of the polyglycerate market in the coming years.

By End User Analysis

- Food and Beverage segment held the significant growth in 2022

The food and beverage segment held a significant market share in revenue in 2022, which is highly influenced by the rising consumer preference towards convenience and processed food items. The increasing working population at the global level is driving the demand for ready-to-eat foods at restaurants, fueling the need for food additives, emulsifiers, surfactants, and preservatives in the marketplace, which necessitates the demand for polyglycerates during the study period, driven by its capabilities to fulfil the above tasks.

Regional Insights

- Asia Pacific region registered the largest share in the global market in 2022

The Asia Pacific region dominated the market. Countries in this region are witnessing higher growth in the pharmaceutical industry driven by government policies as a part of the self-reliance motive, primarily in India. According to Asian Lite, the Indian pharmaceutical industry is expected to reach 13% growth in the global market. It is exporting generic medicine to around 200 countries from developed and emerging markets. This rising production of medicines facilitates the need for key ingredients, including polyglycerates, driving its demand in the coming years.

The North American region is expected to be the fastest-growing region with a healthy CAGR during the projected period, owing to the growing food industry in this region. According to the US Department of Agriculture, in the gross domestic product of the United States, the food industry constitutes more than $1 trillion. This demonstrates that the ongoing expansion of the food industry will further facilitate the need for polyglycerates, as they are used as emulsifiers, thickeners, and preservatives in product formulations. As the region witnesses the growth of the food processing industry, there will be a huge surge for natural food ingredients, boosting demand for polyglycerates in the coming years.

Key Market Players & Competitive Insights

The polyglycerate market is witnessing higher competition driven by government initiatives to promote the evolution of companies to cater to ongoing consumer needs. The increasing collaborations, partnerships, mergers, and acquisitions among the key market players are expanding the availability of products and driving product innovations in the marketplace.

Some of the major players operating in the global market include:

- Bunge Loders Croklaan

- EWG

- KOWA India

- Matangi Industries

- Quadra Chemicals

- Vantage Specialty Chemicals

- Venus Ethoxyethers

Recent Developments

- In August 2023, Vantage Food introduced its new SIMPLY CAKE emulsifier, which is a patent-pending alternative to conventional baking aids to assist food manufacturers with clean-label initiatives with taller, lighter, more evenly baked cakes and sweet products.

Polyglycerates Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.62 billion |

|

Revenue forecast in 2032 |

USD 4.13 billion |

|

CAGR |

5.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Form, By Product Type, By Application, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |