RF Interconnect Market Size, Share, Trends, Industry Analysis Report

By Type (RF Cable, RF Cable Assembly), By Frequency, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6233

- Base Year: 2024

- Historical Data: 2020-2023

Overview

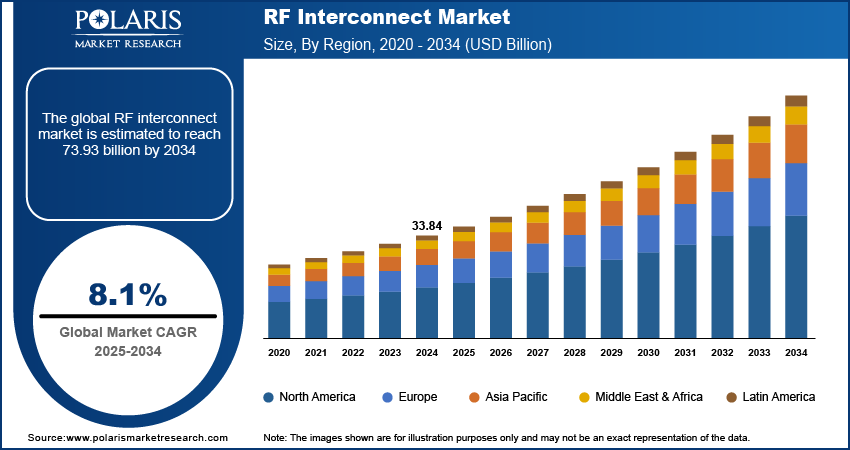

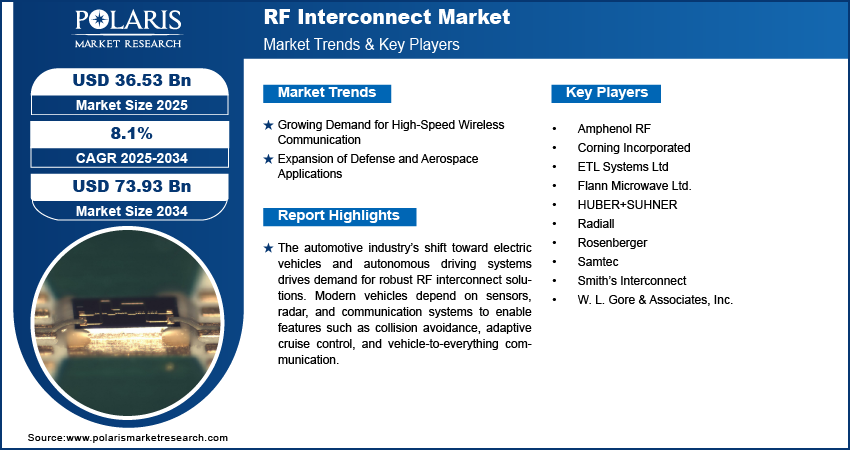

The global RF interconnect market size was valued at USD 33.84 billion in 2024, growing at a CAGR of 8.1% from 2025 to 2034. The market growth is driven by growing demand for high-speed wireless communication and expansion of defense and aerospace applications.

Key Insights

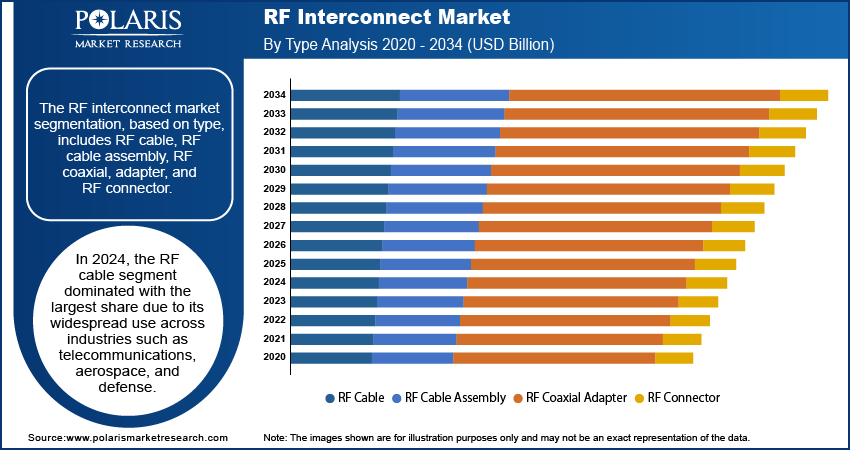

- In 2024, the RF cable segment dominated with the largest share due to its widespread use across various industries such as telecommunications, aerospace, and defense.

- The medical segment is expected to experience significant growth during the forecast period as healthcare systems increasingly rely on wireless communication for diagnostics, monitoring, and treatment delivery.

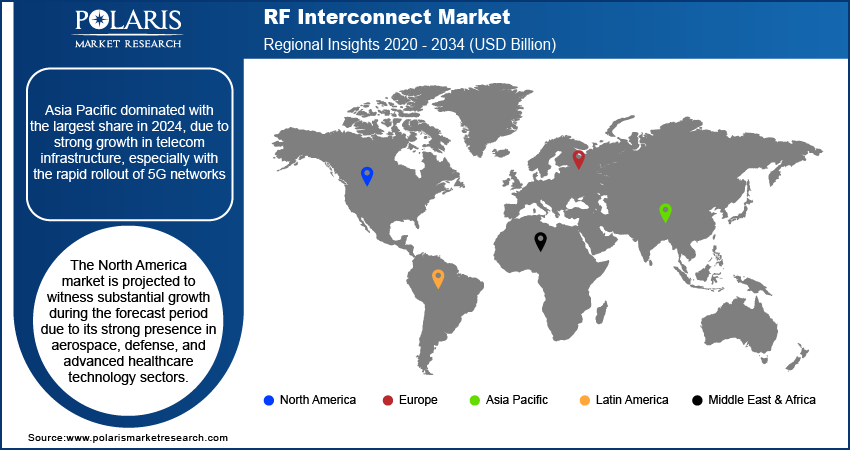

- Asia Pacific dominated the global market with the largest share in 2024, due to strong growth in telecom infrastructure, especially with the rapid rollout of 5G networks.

- The North America market is projected to witness substantial growth during the forecast period due to its strong presence in the aerospace, defense, and advanced healthcare technology sectors.

- The U.S. industry is projected to witness substantial growth during the forecast period, driven by advanced aerospace and defense projects requiring high-frequency, durable connectors.

Industry Dynamics

- Growing Demand for high-speed wireless communication drives the adoption of these connectors.

- Expansion of defense and aerospace applications is fueling the industry growth.

- The automotive industry’s shift toward electric vehicles and autonomous driving systems drives demand for robust RF interconnect solutions.

- High cost of advanced RF interconnect components and testing equipment restrains widespread adoption across cost-sensitive applications.

Market Statistics

- 2024 Market Size: USD 33.84 billion

- 2034 Projected Market Size: USD 73.93 billion

- CAGR (2025–2034): 8.1%

- Asia Pacific: Largest market in 2024

AI Impact on RF Interconnect Market

- AI algorithms simulate the behavior of RF signals to optimize impedance matching, connector geometry, and shielding for minimal signal loss.

- AI-based inspection systems are used to detect micro-defects in cables, connectors, and assemblies, which improves product reliability.

- AI-enabled monitoring in deployed systems are adopted to track signal degradation and recommend replacements and maintenance proactively.

- AI configuration tools are used for rapid development of tailored RF interconnect solutions for specific environmental conditions and frequency bands.

- AI assists in material selection as it helps in predicting electromagnetic compatibility and durability under harsh conditions.

RF interconnects are specialized connectors, cables, and components designed to transmit high-frequency radio signals with minimal loss and distortion. They play a critical role in ensuring reliable communication between devices in wireless, aerospace, and defense systems. These interconnects must maintain signal integrity across a wide frequency range while withstanding environmental stresses.

Electronic devices continue to become smaller and more compact, requiring components, including RF interconnects, to shrink while maintaining performance. Miniaturization trends in smartphones, wearables, medical devices, and aerospace equipment demand tiny RF connectors and cables capable of handling high-frequency signals with low loss. This challenge leads manufacturers to develop new materials and designs that balance size reduction with durability and signal quality. The increasing demand for smaller, lighter, and more efficient electronic products drives growth in the RF interconnect industry.

The automotive industry’s shift toward electric vehicles and autonomous driving systems drives demand for robust RF interconnect solutions. Modern vehicles depend on sensors, radar, and communication systems to enable features such as collision avoidance, adaptive cruise control, and vehicle-to-everything communication. RF interconnects must provide reliable, high-frequency signal transmission despite constant vibration and temperature changes. Growing incorporation of electronic components in vehicles creates a strong demand for specialized RF connectors that ensure safety and efficiency, thereby driving the growth.

Drivers & Opportunities

Growing Demand for High-Speed Wireless Communication: The adoption of 5G and development of 6G technologies are significantly boosting the RF interconnect demand. According to Huawei, China alone has installed more than 1.4 million 5G base stations. These advanced networks require faster data transfer rates and support for higher frequency signals, increasing the need for high-quality RF connectors and cables. RF interconnects ensure efficient signal transmission with minimal loss or interference, which is critical for wireless infrastructure performance. Increasing consumer and industry demand for seamless connectivity drives telecom providers and equipment manufacturers to invest in improved RF interconnect technologies to meet evolving standards, thereby fueling the growth.

Expansion of Defense and Aerospace Applications: The defense and aerospace sectors worldwide are expanding. According to the Aerospace Industry Association, in the U.S. alone, the commercial aerospace industry employs 2.2. million people, with 53% employed in defense and national security. The defense and aerospace sectors strongly influence the RF interconnect due to their need for reliable, high-performance communication systems. Radar, satellite, and military communication systems operate in demanding environments where precision and durability are essential, driving the demand for these devices. Additionally, increased defense spending and expanded space exploration efforts worldwide push the demand for specialized RF interconnects tailored to these critical applications, fostering innovation and further driving the growth.

Segmental Insights

Type Analysis

The segmentation, based on type, includes RF cable, RF cable assembly, RF coaxial, adapter, and RF connector. In 2024, the RF cable segment dominated with the largest share due to their widespread use across industries such as telecommunications, aerospace, and defense. These assemblies ensure minimal signal loss and high performance, which are essential for applications requiring long-distance or high-frequency signal transmission. Their flexibility, durability, and compatibility with various connectors make them a preferred choice. The growing deployment of 5G infrastructure, satellite systems, and automated machinery drives demand. Moreover, strong reliance on reliable data transmission in critical systems further fuels the growth of the segment.

Frequency Output Analysis

The segmentation, based on frequency output, includes upto 6GHz, upto 50GHz, and above 50GHz. The upto 6GHz segment reported significant growth in 2024 due to their applicability in mainstream consumer electronics, IoT devices, and wireless communication systems. Devices such as smartphones, smart home gadgets, and Wi-Fi routers commonly function within this frequency range. This segment benefits from rising connectivity demands in both residential and industrial settings. Additionally, the rollout of 5G networks increases the need for components that perform efficiently in this frequency band. Moreover, growing adoption of connected devices across all age groups and business types fuels the demand for up to 6 GHz RF interconnect solutions, thereby driving the segment growth.

End Use Analysis

The segmentation, based on end use, includes aerospace & defense, medical, industrial, and others. The industrial segment dominated with the largest share in 2024 due to widespread use in automation, robotics, and smart manufacturing. Factories and production units require highly reliable signal transmission for real-time monitoring, machine communication, and control systems. RF interconnects support seamless data flow in harsh and noisy environments where signal integrity is crucial. Additionally, the push for Industry 4.0 and digital transformation across manufacturing processes drives the demand. Moreover, rising investments in factory automation and industrial IoT further boost the growth.

The medical segment is expected to experience significant growth during the forecast period as healthcare systems increasingly rely on wireless communication for diagnostics, monitoring, and treatment delivery. RF interconnects are essential in devices such as MRI machines, patient monitors, and wearable health tech, where accuracy and reliability are critical. Additionally, advancements in telemedicine and remote patient care are further increasing the need for robust connectivity. Rising health awareness, aging populations, and expansion of healthcare infrastructure globally are boosting demand for high-frequency and miniaturized RF interconnects.

Regional Analysis

Asia Pacific RF Interconnect Market Trends

Asia Pacific dominated the global market with the largest share in 2024, due to strong growth in telecom infrastructure, especially with the rapid rollout of 5G networks. Expanding consumer electronics manufacturing and increased demand for connected devices across countries such as India, South Korea, and Japan are accelerating adoption. Large-scale investments in industrial automation and smart city projects are driving RF component usage. The region further benefits from a robust supply chain of electronic components and skilled labor. High mobile penetration, growing data consumption, and government-backed digital initiatives make Asia Pacific a major growth hub for RF interconnect technologies across diverse applications.

China RF Interconnect Market Insights

The industry in China is expected to witness significant growth during the forecast period, driven by its dominance in electronics manufacturing and 5G infrastructure deployment. Government support for digital transformation and leadership in telecommunications technology fuels strong demand for high-frequency connectors and assemblies. Rising adoption of electric vehicles (EVs) and advanced medical devices is increasing the need for high-performance RF solutions. Growing investment in defense, aerospace, and satellite technologies is further expanding opportunities. The presence of domestic giants in telecom and consumer electronics ensures a consistent pipeline of innovation and large-scale production, thereby fueling the growth of the industry.

North America RF Interconnect Market Analysis

The North America industry is projected to witness substantial growth during the forecast period due to its strong presence in aerospace, defense, and advanced healthcare technology sectors. Rapid adoption of 5G and IoT solutions in smart homes and industrial automation drives the demand. High R&D investment from private companies and government agencies fosters continuous innovation in RF technologies. A mature semiconductor industry and strong demand for high-reliability interconnects in mission-critical systems boost regional growth. Additionally, increased focus on digital infrastructure and robust demand for high-speed data transmission across industries further fuels the expansion of RF interconnect applications across the region.

U.S. RF Interconnect Market Outlook

The U.S. industry is projected to witness substantial growth during the forecast period, driven by advanced aerospace and defense projects requiring high-frequency, durable connectors. Rapid expansion of 5G infrastructure and increased investments in autonomous vehicles are boosting demand for reliable RF components. Medical technology innovation, particularly in diagnostics and patient monitoring further boosts the growth. Strong manufacturing capabilities, strategic partnerships between tech firms, and support from federal programs accelerate product development and adoption. Demand for secure and high-speed data transmission in the military, telecom, and healthcare sectors further drives the growth.

Europe RF Interconnect Market Assessment

The industry in Europe is expected to experience significant growth in the future, driven by its strong focus on aerospace, automotive, and industrial automation. Increasing adoption of electric vehicles and advanced driver-assistance systems (ADAS) fuels demand for high-performance RF connectors. Rapid deployment of 5G infrastructure and smart manufacturing across countries such as France, Italy, and the UK enhances the need for reliable RF connectivity. Investment in space exploration and defense applications further expands the usage of precision interconnect components. The region’s emphasis on technological innovation, combined with strict quality standards and regulatory compliance, ensures strong demand for robust and efficient RF interconnect solutions across diverse sectors.

Germany RF Interconnect Market Outlook

The market in Germany is expected to experience significant growth driven by its leadership in automotive engineering and Industry 4.0 initiatives. High demand for connected vehicles and automation technologies accelerates the use of RF components in critical systems. The country's robust infrastructure in telecommunications and active participation in 5G trials support market expansion. Growth in medical electronics and diagnostic devices further contributes to rising RF connector demand. Germany’s strong export orientation and presence of global manufacturing giants help scale innovation and adoption. Continued investments in smart mobility and industrial connectivity ensures long-term growth for RF interconnect solutions.

Key Players and Competitive Analysis

The RF interconnect market features intense competition among globally recognized players, each striving to enhance product performance, frequency range, and application diversity. Key companies such as Amphenol RF, Rosenberger, and Radiall lead with expansive portfolios and strong distribution networks across telecommunications, defense, and aerospace sectors. Smiths Interconnect and HUBER+SUHNER focus on mission-critical applications, offering high-frequency, rugged interconnects tailored for harsh environments. Corning Incorporated and W. L. Gore & Associates bring material innovation to the market, improving signal integrity and durability. Meanwhile, Flann Microwave Ltd. and ETL Systems Ltd. specialize in niche microwave and waveguide solutions. Samtec emphasizes high-speed, precision RF assemblies, while Rosenberger and Radiall continue investing in miniaturization and higher GHz compatibility. Strategic partnerships, R&D investments, and advancements in 5G, 6G, and IoT technologies are shaping the market, with companies aiming to meet growing demand for low-loss, high-frequency, and compact interconnect solutions across industrial and commercial applications.

Key Players

- Amphenol RF

- Corning Incorporated

- ETL Systems Ltd

- Flann Microwave Ltd.

- HUBER+SUHNER

- Radiall

- Rosenberger

- Samtec

- Smith’s Interconnect

- W. L. Gore & Associates, Inc.

RF Interconnect Industry Developments

In July 2025, the IEEE MTT-S International Microwave Symposium (IMS 2025) showcased the latest RF and microwave interconnects, including 0.6 mm connectors and advanced waveguide technologies, attracting over 9,000 global attendees and highlighting innovations for 5G, 6G, and beyond.

In July 2024, Smiths Interconnect launched the Mini-Lock Connector, a high-frequency component operating up to 110 GHz, designed for mission-critical applications. Its robust locking mechanism ensured reliable connectivity in extreme conditions, enhancing speed and reducing downtime in sectors such as aerospace and defense.

RF Interconnect Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- RF Cable

- RF Cable Assembly

- RF Coaxial Adapter

- RF Connector

By Frequency Output Outlook (Revenue, USD Billion, 2020–2034)

- Upto 6GHz

- Upto 50GHz

- Above 50GHz

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Aerospace & Defense

- Medical

- Industrial

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

RF Interconnect Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 33.84 Billion |

|

Market Size in 2025 |

USD 36.53 Billion |

|

Revenue Forecast by 2034 |

USD 73.93 Billion |

|

CAGR |

8.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 33.84 billion in 2024 and is projected to grow to USD 73.93 billion by 2034.

The global market is projected to register a CAGR of 8.1% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Amphenol RF; Corning Incorporated; ETL Systems Ltd; Flann Microwave Ltd.; HUBER+SUHNER; Radiall; Rosenberger; Samtec; Smith’s Interconnect; and W. L. Gore & Associates, Inc.

The RF cables segment dominated the market share in 2024.

The medical segment is expected to witness the significant growth during the forecast period.