Rubber Coated Fabric Market Share, Size, Trends, Industry Analysis Report

By Type (Natural, Synthetic); By Application; By End-Use (Protective Clothing, Industrial, Transportation & Watercraft, Recreation & Leisure, Others); By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3976

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

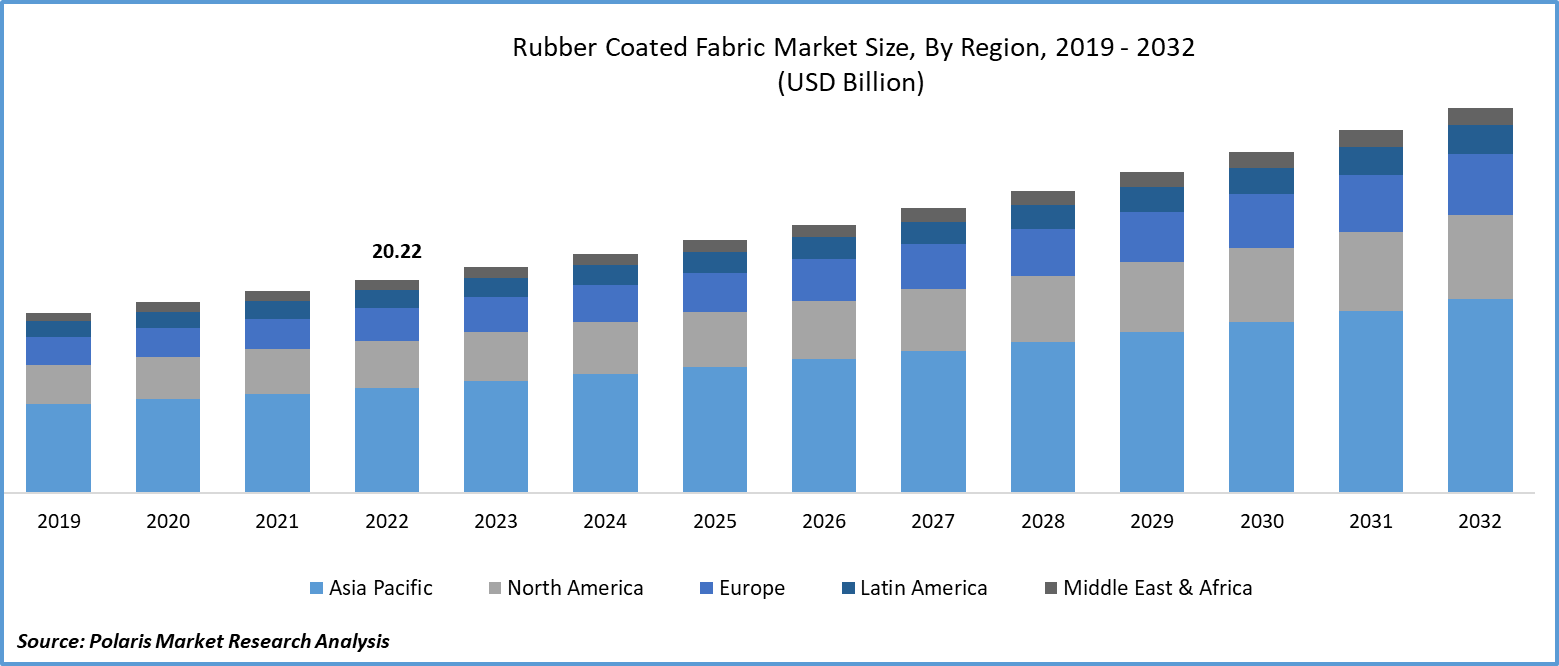

The global rubber coated fabric market was valued at USD 21.4 billion in 2023 and is expected to grow at a CAGR of 6.10% during the forecast period.

Rubber-coated fabric is gaining traction nowadays due to its resistance to water and ability to conserve products from dramatic weather conditions. The growing cargo is fueling the demand for rubber-coated fabric as it enables higher protection for the cargo in the manufacturing of cargo tarps, covers, and liners. Increasing partnerships in the marketplace are expanding the firm’s ability to innovate new rubber-coated fabrics and distribution channels.

To Understand More About this Research: Request a Free Sample Report

For instance, in April 2023, the Trelleborg Engineered Coated Fabrics unit signed a distribution agreement with MMI Textiles for the TACTWEARTM High Abrasion Neoprene Kevlar (HANK).

Moreover, specially designed fabrics are required to ensure dependable performance in difficult situations. Elements, including UV light, moisture, chemicals, and abrasion in a short amount of time can severely harm regular fabrics. Due to their resistance to these difficulties, polymer-coated fabrics like rubber-coated fabrics are crucial to numerous sectors.

However, rubber-coated fabric requires specialized workers in the manufacturing process along with huge machinery, driving higher costs for the companies, primarily those who want to enter this field, driven by a higher average cost for the company until it reaches economies of scale. This may result in lower competition in the market, leading to higher prices for the rubber-coated fabrics, hampering the demand from industrialists, as they show preferences to cut product costs by incorporating substitutes like laminates in the product formulations.

Growth Drivers

Growing Demand for Protective Garments with Rubber Coatings

Coated textiles are a type of flexible composite material, created by coating one or both sides of a fabric substrate with rubber compounds, depending on the intended use of the fabric. When the coating dries, it forms a solid bond with the fabric, making it stronger, more stable, and washable. Rubber-coated fabrics have a close-textured surface, which makes them resistant to diffusion and permeation, as well as weather, oil, and temperature changes. They also have high electrical conductivity.

Rubber-coated fabrics are used to make a variety of products, including liquid storage tanks, airbags for automobiles, blood pressure cuffs for medical use, and thermal protection systems for spacecraft. They are also used in the production of protective apparel, parachutes, sports and recreational equipment, as well as in industrial, construction, and agricultural processes.

By providing a barrier between workers and dangerous working environments, protective garments made from materials with rubber coatings can help reduce hazards. This is why there is a growing demand for this type of fabric in the coming years.

Report Segmentation

The market is primarily segmented based on type, application, end-use, and region.

|

By Type |

By Application |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Synthetic Segment is Expected to Witness the Highest Growth During the Forecast Period

The synthetic segment is projected to grow at a higher CAGR during the study period, highly influenced by the higher resistance power during drastic temperatures. Synthetic fibers, including nylon and polyester, are known to have longer durability and strength compared to natural fibers like cotton. Furthermore, synthetic fibers are used in protective clothing, car seat covers, floor mats, and parachutes, fueling their demand in the study period.

The natural segment witnessed a substantial revenue share in the global rubber coated fabric market in 2022, largely imputable to its sustainability for the environment. The growth of environmental consciousness among consumers is driving demand for products with sustainable fabrics. Furthermore, in the healthcare sector, where safety is the primary concern, use natural rubber for medical equipment like gloves. The demand for water-proof rubber coatings in the healthcare industry will create new growth opportunities for the natural rubber segment in the coming years.

By Application Analysis

Protective Suits & Gloves Segment Accounted for the Largest Market Share in 2022

The protective suits & gloves segment accounted for the largest market share. Protective functional textiles are designed with a focus on more complex requirements, such as protection from risks or hazards that could endanger the worker's life or cause physical harm. The rising importance of worker safety by international labor organizations is supporting the use of protective suits and gloves at the workplace.

The outdoor gear & rainwear segment will grow at a rapid pace, owing to the rising number of working-class people, as they are likely to consume rainwear products like raincoats in the rainy season, which assists them to continue their way to work in higher rainfall days, which will drive the demand for rain-ware, fueling the production by companies and, in a way, driving the need for rubber-coated fabric in the marketplace.

By End-Use Analysis

Protective Clothing Segment Held the Significant Market Revenue Share in 2022

The protective clothing segment held a significant market share in revenue share in 2022, which is highly growing due to the rising concerns about workplace safety among the industrials to follow government regulations. With the advent of the Industrial Revolution, it has been observed that the use of protective garments against workplace dangers such as heat, fire, blast, impact, wounds, chemical splashes, and dirt has increased significantly. The technical textile market is still thriving due to the increased focus on human personal protection and the ongoing implementation of health and safety. Personal defense includes safeguards against extremes in temperature, wind, rain, snow, UV rays, microorganisms, and nuclear, biological, chemical, mechanical, and electrical dangers. All these factors are contributing to the growth of the rubber-coated fabric market during the study period.

Regional Insights

Asia Pacific Region Dominated the Global Market in 2022

The Asia Pacific region dominated the global market. The growing automotive industry is creating new growth potential for rubber-coated fabric as it is highly used in the vehicle manufacturing process, including in the covering of seats, floor mats, and more. This region is witnessing rapid expansion of the automotive industry, highly influenced by the presence of developing countries. According to Moody’s Investor Service, India is the fourth-largest automotive industry at the global level. The ongoing initiatives like Atma Nirbhar Bharat may further fuel the production of automobiles, driving demand for rubber-coated fabric in the future.

The Europe region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the growing infrastructure development projects in the region. Infrastructure development projects, including buildings, bridges, and roadways, all require the use of strong materials that can withstand weather disasters. Synthetic rubber-coated fabric is used in waterproofing goods, safety coverings, and roofing membranes. The ongoing infrastructure development activities may create a new demand for rubber-coated fabric in the study period.

Key Market Players & Competitive Insights

The rubber coated fabric market is expected to witness rapid expansion fueled by growing research studies focusing on innovating new technologies, which may develop novel applications of them soon. The growth in mergers and acquisitions, partnerships, collaborations, and product launches are increasing the global presence of key market players and fueling product availability in the marketplace.

Some of the major players operating in the global market include:

- Arville Textiles

- Auburn Manufacturing

- Bobet Company

- Caodetex S.A.

- Colmant Coated Fabrics

- Continental AG

- Fothergill Group

- Saint-Gobain S.A.

- The Rubber Company

- Trelleborg AB

- White Cross Rubber Products

- Zenith Rubber

Recent Developments

- In June 2023, Borflex, acquired Bobet Group to expand its portfolio of offerings into elastomer-based fabrics.

Rubber Coated Fabric Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 22.65 billion |

|

Revenue forecast in 2032 |

USD 36.52 billion |

|

CAGR |

6.10% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |