Signals Intelligence Market Share, Size, Trends, Industry Analysis Report

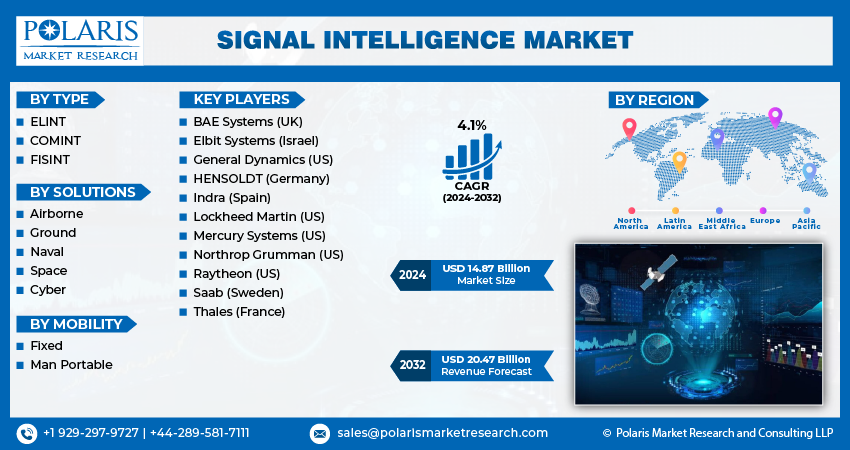

By Type (ELINT, COMINT, FISINT); By Solutions; By Mobility; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 116

- Format: PDF

- Report ID: PM4962

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

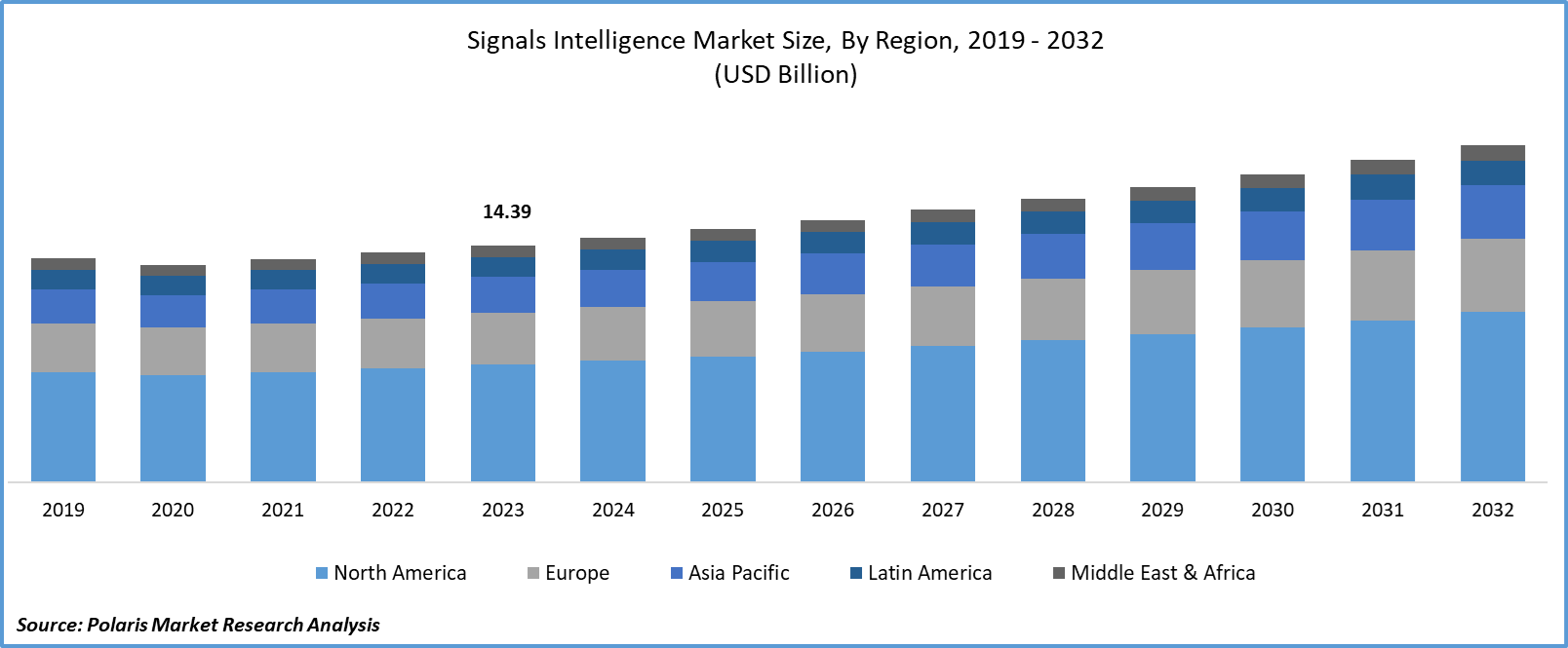

Signals Intelligence Market size was valued at USD 14.39 billion in 2023. The market is anticipated to grow from USD 14.87 billion in 2024 to USD 20.47 billion by 2032, exhibiting the CAGR of 4.1% during the forecast period.

Market Overview

Growing terrorism activities in the world market are promptly driving the demand for the adoption of superior performing defense machinery and technology around the world. This is showcasing significant opportunities for signal intelligence systems. Nations are purchasing unmanned aerial vehicles and patrol aircraft, driving high-speed message tracking and data analyzing systems, showing tremendous growth potential for global signal intelligence solutions. Additionally, rising product launches in the defense sector utilizing signal intelligence technology are expected to propel Signals Intelligence Market growth in the coming years.

To Understand More About this Research: Request a Free Sample Report

For instance, in May 2023, HENSOLDT, a defense electronics and sensor solutions provider, announced the launch of a signal intelligence system, SAS2000S, at the Association of Old Crows (AOC) Conference Europe.

Moreover, increasing cybercrime and other criminal activities are requiring governments and defense organizations to equip advanced communication networks. The ongoing political conflicts are expected to fuel defense expenditure, which will stimulate the consumption of defense equipment and other technologies. The ability to monitor enemy movements in real-time will essentially drive its integration into aircraft and naval systems over the forecast period.

Growth Drivers

Rising Adoption of Signal Intelligence Navy Systems

The growing consumption of signal intelligence solutions around the world is significantly driving the production of these systems by manufacturers. The rising war in the navy is encouraging countries to equip advanced information and communication systems to increase their defense strength and promote protection for their nations. For instance, in November 2023, the Swedish Defence Materiel Administration announced that it had supplied its signal intelligence ship, HMS Artemis, to its Swedish Armed Forces. It started production of a second ship for the Polish Navy in Gdansk. As more countries consume signal intelligence solutions, there will be a huge demand for the global Signals Intelligence Market over the forecast period.

Increasing Advancements in the Signal Intelligence Software

Companies are stepping forward with new technologies to enhance signal intelligence software performance globally, driven by the growing emergence of new technologies in the marketplace, particularly artificial intelligence, machine learning, deep learning, and more. These are playing a significant role in improving the functionality of traditional information technology communication systems. For instance, in March 2023, as per the post published in the South China Morning News Agency, Chinese researchers announced the development of an artificial intelligence-based signal intelligence system that has the potential to track and monitor enemies's signals with faster speed.

Restraining Factors

Higher Cost of Development Is Likely to Impede Market Growth

The huge costs of investment in designing and manufacturing signal intelligence systems are likely to limit new entrants to the market, leading to an increase in an increase in the cost of signal intelligence solutions. This is expected to reduce demand for signal intelligence software among low-income countries. However, growing development activities by the producers to develop cost-effective and efficient signal intelligence systems are anticipated to drive their adoption in the foreseeable future.

Report Segmentation

The market is primarily segmented based on type, solutions, mobility, and region.

|

By Type |

By Solutions |

By Mobility |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Communication Intelligence (Comint) Segment Is Expected to Witness the Highest Growth during the Forecast Period

The communication intelligence segment is projected to grow at a CAGR during the projected period, mainly driven by its capabilities to assist military professionals in taking data-informed decisions accurately, leading to efficient military operations with strategic planning. The enormous potential to gather data on opponents, including messages, voice calls, and others, and the ability to decode encrypted messages are some of the factors widely driving the use of signal intelligence systems globally.

By Solutions Analysis

Airborne Segment Accounted For the Largest Market Share in 2023

The airborne segment accounted for the largest market share in 2023 and is likely to retain its market position throughout the forecast period. This is mainly driven by the increasing conflicts through air as a medium, necessitating army agencies to equip communication intelligence systems due to the rising information transmission in wireless networks. The adoption of signal intelligence systems enables the army to identify potential threats earlier, which can help in safeguarding common people and army forces on time.

By Mobility Analysis

Man Portable Segment Held the Significant Market Revenue Share in 2023

The man portable segment held a significant market share in revenue in 2023, which was highly accelerated due to the continuous rise in conflicts at multiple locations. The convenience of handling and replacing signal intelligence systems from one place to another and the cost of installation and maintenance are anticipated to propel market growth during the forecast timeframe.

Regional Insights

North America Region Registered the Largest Share of the Global Market in 2023

The North America region held the dominant share in 2023. This is due to the growing defense sector investments in the region, particularly in the United States and Canada. The US defense expenditure had grown by 2.3% in 2023, reaching USD 916 billion. Additionally, the presence of companies developing satellites for effective communication is fueling research innovations in signal intelligence systems. For instance, in April 2024, SpaceX, a US-based company, announced that it is expected to reach its weekend triple header by completing the launch of Bandwagon-1, a project to install 11 aircraft to monitor earth with the integration of the internet of things and signal intelligence in the interests of the United States, South Korea, Japan, Australia, and India.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the growing consumption of advanced communication systems in the region. The increasing conflicts among neighboring nations are encouraging governments to promote their defense strength by integrating advanced technologies, including signal intelligence. Furthermore, monitoring opponents' actions is vital in military, naval, and cyber operations. China invested USD 296 billion in the military in 2023, which has increased by 6% from 2022. It is the second-largest military expenditure in the world and accounts for half of the total defense expenditure in Asia and Oceania. Growing research activities are optimally influencing the global market. For instance, in July 2023, China announced its plan to launch two flat spy satellites, which are expected to be equipped with signal intelligence from the Xichang Satellite Launch Center.

Key Market Players & Competitive Insights

Strategic Collaborations to Drive the Competition

The signals intelligence market is fragmented and registering significant competition with the growing research and development activities to develop high-performing signal intelligence systems in the world. The rising number of new entrants to boost their defense capability is expected to bolster market expansion in the coming years. For instance, in March 2024, Brussels entered into a collaboration agreement with Aerospace Labs, aiming to enter the satellite radio frequency and geo-spatial intelligence domains.

Some of the major players operating in the global Signals Intelligence Market include:

- BAE Systems (UK)

- Elbit Systems (Israel)

- General Dynamics (US)

- HENSOLDT (Germany)

- Indra (Spain)

- Lockheed Martin (US)

- Mercury Systems (US)

- Northrop Grumman (US)

- Raytheon (US)

- Saab (Sweden)

- Thales (France)

Recent Developments in the Industry

- In October 2023, Invoca announced the launch of cutting-edge artificial intelligence-based conversation technology, Signal AI, to alter online marketing and call center operations. In addition, as part of Invoca Labs, it also unveiled GPT call analysis features in line with the other developments.

Report Coverage

The signals intelligence market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, solutions, mobility, and their futuristic growth opportunities.

Signals Intelligence Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 14.87 billion |

|

Revenue forecast in 2032 |

USD 20.47 billion |

|

CAGR |

4.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |