Sorting Machine Market Share, Size, Trends, Industry Analysis Report

By Product (Optical Sorter, Weight/Gravity Sorter, Others), By End-User (Food & Beverage Industry, Pharmaceutical, Waste Recycling, Mining, Others); By Region; Segment Forecast, 2022 - 2030

- Published Date:Mar-2022

- Pages: 118

- Format: PDF

- Report ID: PM2335

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

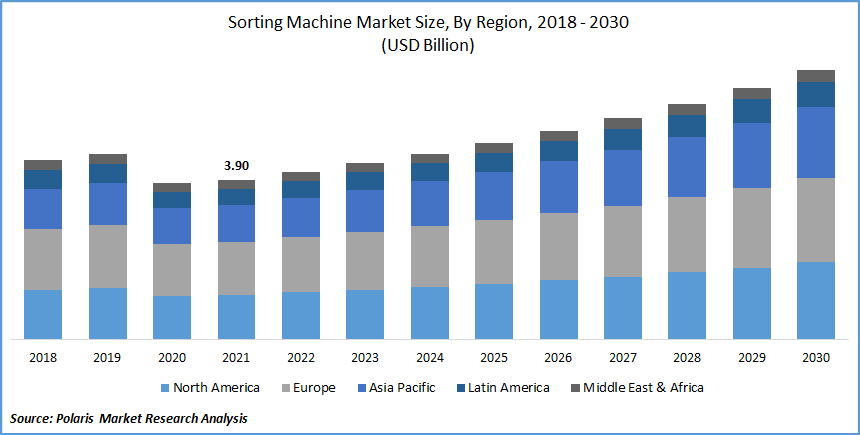

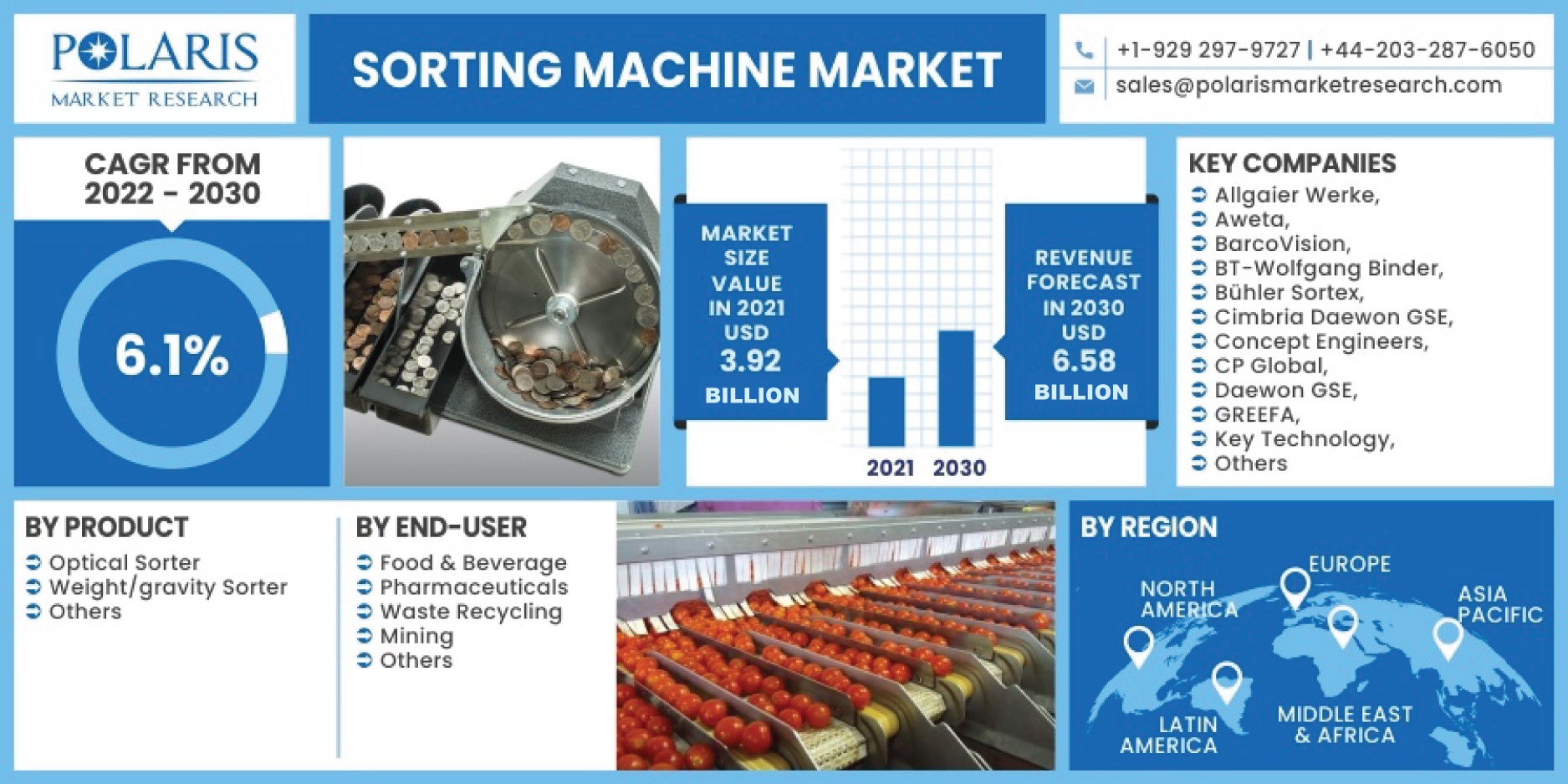

The global sorting machine market was valued at USD 3.90 billion in 2021 and is expected to grow at a CAGR of 6.1% during the forecast period. The increasing adoption of automation technology and the rising demand for sorting machines from end-user industries such as the pharmaceutical and food & beverage industries, among others, are the chief factors that may propel the sorting machine market demand.

Know more about this report: Request for sample pages

In addition, the rising developments by key industry players are further anticipated to boost the industry growth. Sorting machines are utilized to arrange OR group things in predetermined ways systematically. The primary functions of sorting machines include aligning, packaging, collecting, defect removal, and others.

For instance, in October 2020, Key Technologies, based in the U.S., introduced VERYX BioPrint Digital Sorter. This sorter combines color cameras with NIR (Near Infrared) hyperspectral detection. Further, the machine removes the unwanted products with discoloration, irregular shape defects, and foreign materials. Moreover, the implementation of stringent government rules & regulations regarding food safety & security is anticipated to boost the adoption of sorting machines.

The onset of the COVID-19 reflects the downfall of the sorting machine market growth owing to the unprecedented restrictions on movement and disruptions in business activities. The disruption in the supply chain, lockdown measures, and limited corporate spending will hamper the industry growth. The impact of the COVID-19 outbreak is far-reaching, having adverse effects on communities, individuals, and societies globally.

The negative impact of COVID-19 outbreaks on the major end-user industries such as food & beverage, mining, and others is anticipated to hinder the industry's growth. However, the increasing focus of various sectors on automation is expected to present huge industry growth opportunities. On the positive hand, the threat of COVID-19 has prompted various pharmaceutical companies to invest more in developing vaccines that can prevent the further spread of the virus, boosting the demand for sorting machines.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The growing emphasis of various end-use industries towards automation in order to enhance their production capacity while reducing the risks is the significant factor that may accelerate the sorting machine market growth. Automation enables companies to increase their performance by reducing the number of errors and better efficiency. Different industries such as food & beverage, pharmaceutical, and others are shifting their focus towards automation to boost productivity while maintaining product quality. This approach speeds up the production process, reduces manual labor, and improves product safety.

Furthermore, the increasing labor costs and the growing implementation of stringent rules and regulations by governments across nations for food safety & security are anticipated to present huge sorting machine market growth opportunities. For instance, in January 2019, FSSAI (Food Safety & Standard Authority of India) announced the enforcement of 27 new food quality standards set in 2018. Some of the principal regulations are packaging, food fortification, and others. Therefore, these factors act as catalyzing factors for the global industry development in the future scenario.

Report Segmentation

The market is primarily segmented on the basis of product, end-user, and region.

|

By Product |

By End-User |

By Region |

|

|

|

Know more about this report: Request for sample pages

Insight by End User

The food & beverage segment holds the largest revenue share in 2021 and is expected to lead the industry in the forecasting years. The considerable share of the segment can be attributed to the increasing production across the food & beverage industry globally. Furthermore, the increasing adoption of automated equipment in the food industry is anticipated to boost the segment's growth. The use of sorting equipment improves food safety, quality, production outputs, delivery cycles and reduces the losses in production. For instance, optical food sorters are used to identify & remove under-developed coffee beans.

The pharmaceutical segment is projected to have the highest CAGR over the forecasting years 2021-2028. The exponential growth of the pharmaceutical industry across the emerging nations is anticipated to boost the development of the segment. Weight/gravity sorters are utilized in the pharmaceutical industry to sort capsules & tablets on the precise weight measurement.

Geographic Overview

Geographically, North America garnered the largest share in the global sorting machine market. The increasing demand for processed & nutritional food in the U.S. and Canada is anticipated to drive the industry's growth. Furthermore, the growing adoption of automation in the end-user industries such as pharmaceutical and food & beverage is expected to present huge market growth opportunities. The high demand for better quality food products within shorter delivery cycles in the U.S. is anticipated to drive the market's growth. Additionally, the increasing labor rates in the manufacturing industry are expected to boost the adoption of sorting machines.

Moreover, the Asia Pacific market is anticipated to exhibit the highest CAGR over the forecasting years. The rapid industrialization in the Asia Pacific is boosting the growth of various end-user industries of sorting machines such as mining, food & beverage, pharmaceutical, and others. The increasing production in these industries is anticipated to drive the market's growth. Various global pharmaceutical companies are setting up their production facilities in the Asia Pacific, presenting huge market growth opportunities.

Competitive Insight

Some of the major players operating in the global market include Allgaier Werke, Aweta, BarcoVision, BT-Wolfgang Binder, Bühler Sortex, Cimbria Daewon GSE, Concept Engineers, CP Global, Daewon GSE, GREEFA, Key Technology, National Recovery Technologies, Raytec Vision, Satake Corporation, Sesotec, and TOMRA.

Sorting Machine Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 3.92 billion |

|

Revenue forecast in 2030 |

USD 6.58 billion |

|

CAGR |

6.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Allgaier Werke, Aweta, BarcoVision, BT-Wolfgang Binder, Bühler Sortex, Cimbria Daewon GSE, Concept Engineers, CP Global, Daewon GSE, GREEFA, Key Technology, National Recovery Technologies, Raytec Vision, Satake Corporation, Sesotec, and TOMRA. |